Beste Buchhaltung und Wirtschaftsprüfung Anwälte in Österreich

Teilen Sie uns Ihre Anforderungen mit, Kanzleien werden Sie kontaktieren.

Kostenlos. Dauert 2 Min.

Oder verfeinern Sie Ihre Suche durch Auswahl einer Stadt:

Liste der besten Anwälte in Österreich

1. Über Buchhaltung und Wirtschaftsprüfung-Recht in Österreich

In Österreich regeln das Handelsrecht und das Unternehmensgesetzbuch (UGB) die Buchführung, Bilanzierung und Offenlegung von Jahresabschlüssen. Die Abschlussprüfung ist für bestimmte Unternehmen gesetzlich vorgeschrieben und wird von registrierten Wirtschaftsprüferinnen und Wirtschaftsprüfern durchgeführt. Berufsrechtliche Grundlagen stammen aus dem Wirtschaftsprüfergesetz und der dazugehörigen Prüfungsordnung.

IFRS standards provide transparent and comparable information in financial statements, helping investors compare across borders.

IFRS Foundation

2. Warum Sie möglicherweise einen Anwalt benötigen

Pflichtprüfung aufgrund Größe oder Rechtsform: Wenn Sie eine GmbH oder AG führen, kann eine gesetzliche Abschlussprüfung erforderlich sein. Ein Rechtsbeistand hilft bei der korrekten Abgrenzung von Pflicht- und freiwilliger Prüfung und bei der Koordination mit dem Prüfer.

Konzernabschluss und konzernweite Prüfungsfragen: Bei Tochtergesellschaften kann eine Konzernabschlussprüfung nötig werden. Hierfür braucht es oft eine juristische Prüfung der Verrechnungspreise, Konsolidierungsmethoden und Reporting-Verpflichtungen.

Vorbereitung auf Börsengang oder Kapitalerhöhung: Für börsennotierte oder gemeldete Unternehmen gelten spezielle Prüfungs- und Offenlegungspflichten. Rechtsberatung unterstützt bei der Strukturierung des Prüfungsumfangs und der Kommunikationsstrategie mit Aufsichtsbehörden.

Rechtsstreitigkeiten oder Haftung wegen falscher Angaben: Bei Anfechtungen durch Gesellschafter oder Dritte können Haftungsfragen auftreten. Ein Rechtsbeistand klärt Haftungsrisiken, Verteidigungsstrategien und mögliche Berichtigungen.

Behördenprüfungen und Streitigkeiten mit der FMA oder dem Finanzamt: In Fällen von Prüfung durch Behörden benötigen Sie Rechtsberatung zu Einsprüchen, Fristen und Verfahrensrechten.

Interne Kontrollsysteme und Compliance-Projekte: Bei Prüfung interner Kontrollen (ICFR) oder Compliance-Anforderungen unterstützen spezialisierte Berater bei der Umsetzung und Dokumentation.

3. Überblick über lokale Gesetze

Unternehmensgesetzbuch (UGB) regelt Buchführung, Jahresabschluss, Offenlegung und Prüfungspflichten. Es definiert, wer welche Form von Abschlussprüfung benötigt und welche Formen der Offenlegung vorgesehen sind.

Wirtschaftsprüfergesetz (WPrG) legt den Berufsrahmen, die Zulassungsvoraussetzungen, die Unabhängigkeitspflichten und das Berufsrecht der Wirtschaftsprüfer fest. Es regelt auch Verfahren bei Beanstandungen und Haftungsfragen.

Abgabenordnung (BAO) bestimmt steuerliche Prüfungsabläufe, Fristen und Rechtsmittel im Rahmen von Betriebsprüfungen und Steuerberichten. Sie ist maßgeblich für die Zusammenarbeit von Unternehmen mit dem Finanzamt.

Hinweis: Die aktuellen Fassungen dieser Gesetze unterliegen regelmäßigen Anpassungen durch nationale Änderungen und EU-Richtlinien. Prüfen Sie die jeweils geltende Fassung auf offiziellen Quellen, bevor Sie Verträge abschließen oder Rechtswege antreten.

Independent audits improve the reliability of financial reporting and bolster investor confidence.

OECD

4. Häufig gestellte Fragen

Was bedeutet eine gesetzliche Abschlussprüfung laut UGB für kleine Unternehmen?

Die gesetzlichen Anforderungen hängen von Rechtsform, Größe und Bilanzkennzahlen ab. Oft sind kleine Unternehmen freiwillig prüfbar, doch bestimmte Schwellenwerte lösen eine Pflichtprüfung aus. Ein Rechtsbeistand hilft, die genauen Pflichten zu klären und Fehler zu vermeiden.

Wie finde ich einen passenden Rechtsbeistand für Buchhaltung in Österreich?

Nutzen Sie Portale der Wirtschaftskammer und Anwalts- bzw. Wirtschaftsprüferkammern, um Fachkompetenz in Buchhaltung und Prüfung zu prüfen. Vergleichen Sie Spezialisierungen, regionale Verfügbarkeit und Transparenz bei Honoraren. Vereinbaren Sie ein unverbindliches Erstgespräch, um den Arbeitsumfang abzustecken.

Wann ist eine externe Wirtschaftsprüfung in Österreich gesetzlich vorgeschrieben?

In der Regel besteht eine Prüfungspflicht für bestimmte Rechtsformen und Unternehmensgrößen, insbesondere bei großen Kapitalgesellschaften oder Konzernabschlüssen. Für andere Unternehmen kann die Prüfung freiwillig erfolgen, um Vertrauen bei Gesellschaftern und Finanzpartnern zu stärken.

Wo finde ich offizielle Fristen und Pflichten für Buchführung in Österreich?

Offizielle Fristen und Pflichten ergeben sich aus UGB, BAO und den jeweiligen Prüfungsmerkmalen. Die Informationen finden Sie auf den Webseiten der Kammern und Behörden. Ein Rechtsberater hilft, individuelle Fristen zu ermitteln und Fristversäumnisse zu vermeiden.

Warum braucht ein Unternehmen eine Rechtsberatung bei fehlerhaften Jahresabschlüssen?

Bei Fehlern im Jahresabschluss drohen Haftungsfragen gegenüber Gesellschaftern, Gläubigern und dem Finanzamt. Ein Rechtsberater klärt Haftungsrisiken, initiiert notwendige Berichtigungen und unterstützt bei der Kommunikation mit Prüfungsstellen.

Kann ich die Kosten einer Abschlussprüfung steuerlich absetzen?

Beratungskosten für Abschlussprüfungen können unter bestimmten Voraussetzungen als Betriebsausgaben abzugsfähig sein. Klären Sie dies mit Ihrem Steuerberater, da die Absetzbarkeit von der Rechtsform und dem Verwendungszweck abhängt. Eine genaue Dokumentation unterstützt die Nachweisführung.

Sollte ich bei einer Revision einen Anwalt hinzuziehen und warum?

Ja, insbesondere bei Unklarheiten über Rechtsfolgen, Haftung oder Fristwahrungen. Ein Anwalt hilft bei der Rechtsverteidigung, der Prüfung von Fristen und der Einlegung von Rechtsmitteln. Dies minimiert das Risiko kostspieliger Fehler.

Was ist der Unterschied zwischen Buchführung und Bilanzierung nach UGB?

Die Buchführung erfasst laufend Geschäftsvorfälle, während die Bilanzierung eine systematische Zusammenstellung von Vermögen, Schulden und Eigenkapital in einer Bilanz ist. Beide sind eng miteinander verknüpft und richten sich nach UGB. Die Bilanz bildet die Grundlage für den Jahresabschluss.

Wie lange dauert typischerweise eine Jahresabschlussprüfung in Österreich?

Die Dauer hängt von Unternehmensgröße, Komplexität und dem Umfang der Prüfung ab. Für kleine Unternehmen kann eine Prüfung innerhalb weniger Wochen abgeschlossen sein, bei großen Konzernen verlängert sich der Prozess. Ein detaillierter Zeitplan ergibt sich nach dem ersten Abstimmungsgespräch.

Wie viel kostet eine Wirtschaftsprüfung in Österreich durchschnittlich?

Die Kosten variieren stark nach Umfang, Branche und Prüfungsdauer. Typischerweise entstehen Honorare aus einem Grundhonorar plus Zuschläge für zusätzlichen Aufwand. Bitten Sie um mehrere Kostenvoranschläge und vergleichen Sie Leistungsumfang, nicht nur den Preis.

Brauche ich einen Wirtschaftsprüfer, wenn mein Unternehmen klein ist?

Bei kleineren Unternehmen besteht oft keine Pflichtprüfung. Dennoch kann eine freiwillige Prüfung sinnvoll sein, um Investoren, Banken oder Partner zu überzeugen. Erwägen Sie eine Beratung, um Vorteile und Kosten abzuwägen.

Welche Unterlagen bereiten Prüfer normalerweise vor der Prüfung vor?

Prüfer benötigen Jahresabschlüsse, Konto- und Belegunterlagen, Offene-Posten-Listen, Inventare, Verträge sowie Nachweise zu Bilanzpositionen. Eine gut vorbereitete Dokumentation reduziert den Prüfungsaufwand und beschleunigt den Prozess.

5. Zusätzliche Ressourcen

IFRS Foundation - offizielle Quelle zu international anerkannten Rechnungslegungsstandards, die auch in vielen europäischen Ländern Anwendung finden. IFRS Foundation

OECD - bietet Richtlinien zu Unternehmensführung, Prüfungen und Transparenz in der Unternehmensberichterstattung. OECD

IFAC - Internationale Föderation der Wirtschaftsprüfer und Revisoren, Leitlinien zu Berufsstandards und Ethik. IFAC

6. Nächste Schritte

Definieren Sie Ihren konkreten Beratungsbedarf. Entscheiden Sie, ob eine Prüfung, eine Beratung zu Buchführung oder ein juristischer Beistand nötig ist. Erstellen Sie eine kurze Aufgabenbeschreibung.

Erstellen Sie eine Shortlist potenzieller Berater aus Kammern, Fachverbänden und Branchenempfehlungen. Berücksichtigen Sie regionale Verfügbarkeit und Branchenfokus. Planen Sie 1-2 Wochen für die Recherche ein.

Prüfen Sie Qualifikationen, Registrierung und Referenzen. Bitten Sie um zwei Referenzgespräche und prüfen Sie frühere Mandate in ähnlicher Branche. Rechnen Sie mit 1-2 Wochen Vorbereitungszeit.

Holen Sie drei bis vier Angebot ein und vergleichen Sie Leistungen, Honorarraster, No-Call-Fees und Kosten für Zusatzleistungen. Halten Sie Fristen und Zahlungsbedingungen schriftlich fest. Planen Sie 2-3 Wochen für Angebotsvergleiche ein.

Vereinbaren Sie eine Erstberatung, idealerweise persönlich oder per Video. Klären Sie Umfang, Zeitplan, Ansprechpartner und Datenschutz. Rechnen Sie mit 0,5-1 Stunde pro Beratungsgespräch.

Schließen Sie einen Mandatsvertrag ab, der Aufgaben, Haftung, Vertraulichkeit, Fristen und Berichtsformate regelt. Klären Sie auch Vorleistungen und Abrechnungsmodalitäten. Beschluss erfolgt innerhalb von 1-2 Wochen nach dem Gespräch.

Starten Sie das Mandat und setzen Sie klare Meilensteine samt Lieferterminen. Bitten Sie um regelmäßige Statusberichte und eine transparente Kommunikation. Planen Sie den offiziellen Kick-off innerhalb von 2-4 Wochen nach Vertragsabschluss.

Lawzana hilft Ihnen, die besten Anwälte und Kanzleien in Österreich durch eine kuratierte und vorab geprüfte Liste qualifizierter Rechtsexperten zu finden. Unsere Plattform bietet Rankings und detaillierte Profile von Anwälten und Kanzleien, sodass Sie nach Rechtsgebieten, einschließlich Buchhaltung und Wirtschaftsprüfung, Erfahrung und Kundenbewertungen vergleichen können.

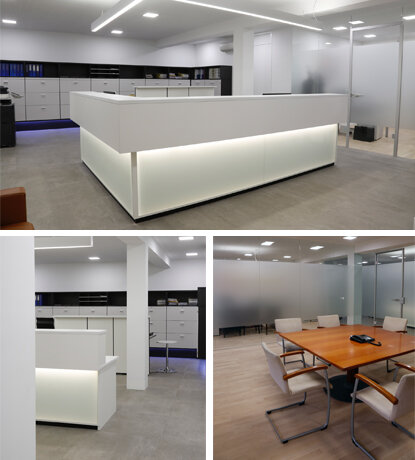

Jedes Profil enthält eine Beschreibung der Tätigkeitsbereiche der Kanzlei, Kundenbewertungen, Teammitglieder und Partner, Gründungsjahr, gesprochene Sprachen, Standorte, Kontaktinformationen, Social-Media-Präsenz sowie veröffentlichte Artikel oder Ressourcen. Die meisten Kanzleien auf unserer Plattform sprechen Deutsch und haben Erfahrung in lokalen und internationalen Rechtsangelegenheiten.

Erhalten Sie ein Angebot von erstklassigen Kanzleien in Österreich — schnell, sicher und ohne unnötigen Aufwand.

Haftungsausschluss:

Die Informationen auf dieser Seite dienen nur allgemeinen Informationszwecken und stellen keine Rechtsberatung dar. Obwohl wir uns bemühen, die Richtigkeit und Relevanz des Inhalts sicherzustellen, können sich rechtliche Informationen im Laufe der Zeit ändern, und die Auslegung des Gesetzes kann variieren. Sie sollten immer einen qualifizierten Rechtsexperten für eine auf Ihre Situation zugeschnittene Beratung konsultieren.

Wir lehnen jede Haftung für Handlungen ab, die auf Grundlage des Inhalts dieser Seite vorgenommen oder unterlassen werden. Wenn Sie glauben, dass Informationen falsch oder veraltet sind, contact us, und wir werden sie überprüfen und gegebenenfalls aktualisieren.

für buchhaltung und wirtschaftsprüfung Kanzleien nach Stadt in Österreich durchsuchen

Verfeinern Sie Ihre Suche durch Auswahl einer Stadt.