The much admired country of Thailand, where bustling cities intertwine with paradise-esque landscapes, has long captivated global investors with its scintillating real estate prospects. From luxurious coastal villas to chic urban condominiums, property ownership here represents a compelling opportunity to build lasting wealth and secure financial legacies.

However, as any discerning industry professional recognizes, navigating Thailand's intricate legal frameworks surrounding estate planning and inheritance issues requires meticulous strategy. Failure to construct a comprehensive, airtight succession blueprint can cause disruption to even the most lucrative of holdings when generational ownership transitions arise.

So for those committed to preserving their hard-earned real estate empires, knowledge becomes a crucial first line of defense. By developing a deeper understanding of Thailand's estate regulations - and the nuanced strategies available - you equip yourself to safeguard assets, minimize disruptions, and ensure seamless intergenerational transfers of wealth.

In Lawzana’s latest legal guide, we examine the nuances of estate planning within this unique Southeast Asian context. From untangling property ownership complexities to mastering legal instruments like wills and trusts, you'll gain a panoramic view of protecting your prized property investments for decades to come.

The Complexities of Landed Property Ownership in Thailand

Before formulating any overarching estate strategy, real estate owners and legal advisors must first develop a fundamental grasp of Thailand's property classification systems and corresponding ownership rights.

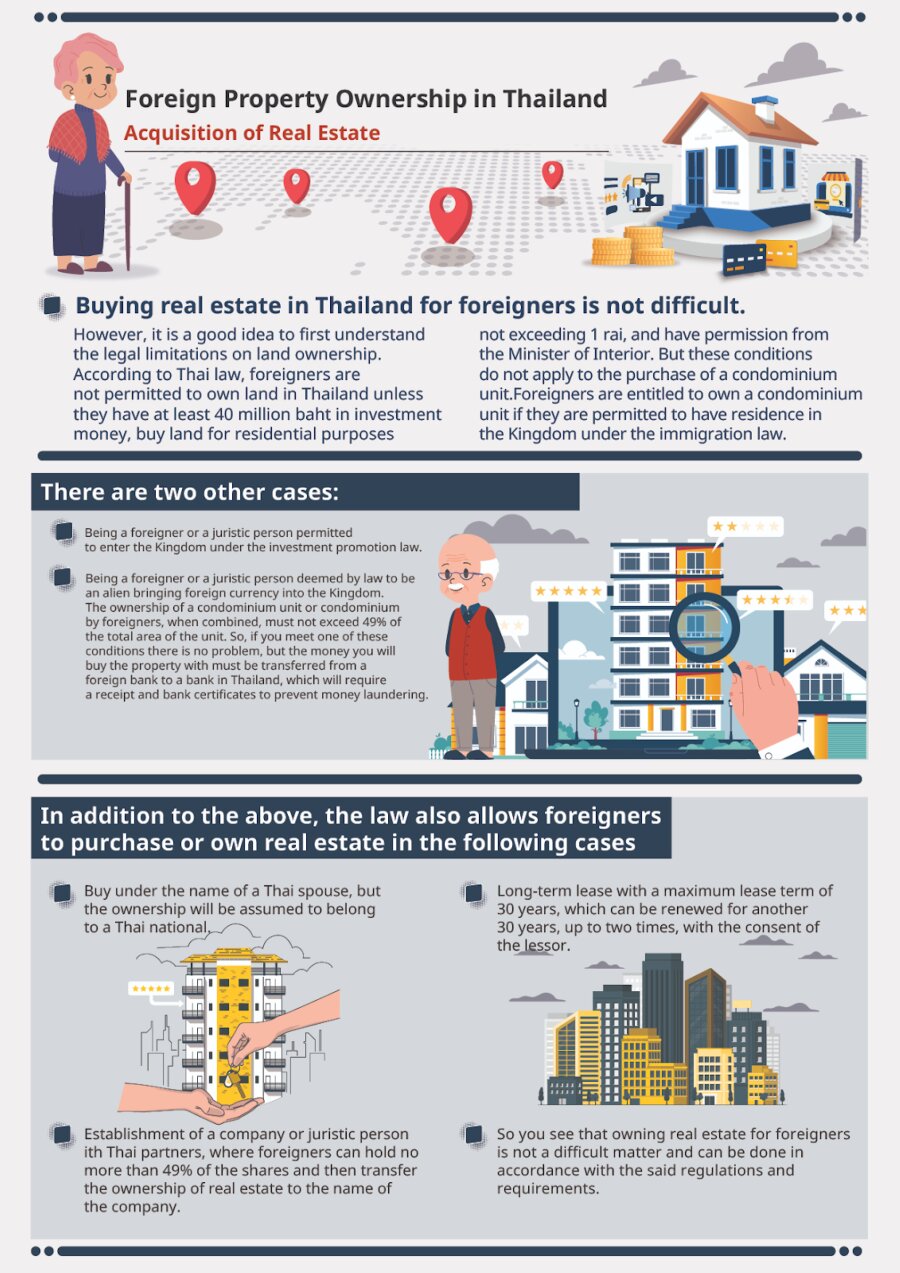

Thai law states that foreigners are not allowed to acquire land in Thailand unless they have an investment of at least 40 million baht, are purchasing land for residential use (up to 1 rai), and have received approval from the Minister of Interior. Nevertheless, this need does not apply when a foreigner purchases a condominium, since they must be able to remain in the Kingdom in accordance with immigration law, or in the following additional circumstances:

- Being a foreign national or a legal entity allowed entry into the Kingdom by virtue of the investment promotion statute;

- Being a foreign national entering the Kingdom using foreign cash, or a legal person recognized by the government as an alien. Foreign ownership of a condominium unit together cannot account for more than 49% of the unit's total area. There won't be any issues if any of these requirements are met, but in order to avoid money laundering, the funds you want to use to purchase the property must be moved from a foreign bank to a Thai bank. This will necessitate the provision of bank certificates and a receipt.

Apart from the aforementioned scenarios, foreign nationals are permitted by law to acquire or possess real estate in the following cases:

- Purchasing it in a Thai spouse's name, yet it will be presumed that the Thai national is the owner;

- Long-term lease having a maximum duration of 30 years, renewable twice for an additional 30 years with the lessor's approval;

- Forming a legal entity or business with Thai partners, in which foreigners are limited to 49% of the shares, and then transferring real estate ownership into the company's name, allowing you to reside as a director but not as the company's owner.

Central to this landscape is the distinction between landed property (that directly on physical land) and condominiums. Outright freehold ownership of landed properties is constitutionally restricted solely to Thai nationals - a long-standing provision designed to safeguard domestic control over sovereign territory and prevent land from falling into permanent foreign hands.

Understandably, this poses complications for global investors and expatriates seeking to acquire residential villas, commercial buildings, and other landed real estate holdings. However, pragmatic legal pathways do exist to bypass these limitations while still facilitating secure, long-term landed property possession:

- Long-Term Leasehold Tenure (Up to 30 Years, Renewable): Foreign nationals and corporations can legally acquire extended leasehold interests from Thai landowners, providing the right to develop and exclusively occupy the property for decades on end through renewable cycles.

- Ownership via Thai-Controlled Company: Setting up a Thai-registered company with appropriate domestic shareholding structures allows foreign-owned businesses to purchase and retain landed properties under a locally derived corporate umbrella.

While these methods provide viable detention alternatives, each requires nuanced estate planning considerations to protect the property's future and your overarching succession objectives.

The added complexities of shareholding entities, multi-generational leaseholds, and other legal nuances beg for meticulous foresight and documentation through comprehensive inheritance frameworks.

Fortunately, Thailand's permissive laws around personal property ownership ease the path for expatriates structuring condominium successions. In most cases, condos purchased freeholds can be inherited conventionally by foreign nationals named in a proper Thai will or trust agreement.

View our How Foreigners Can Own Property in Thailand legal guide for further information.

Property Inheritance Laws: Understanding Your Rights

With landed and condominium classification nuances clarified, we now delve into Thailand's statutory succession frameworks themselves - and the intricacies surrounding inheritance and individual property rights within the context of estates.

Under Thailand's civil laws, there are legally defined forced heirship rules that dictate minimum inheritance allocations for surviving spouses and descendants of the deceased. These mandated reductions from the estate legacy automatically flow to applicable relatives unless expressly defined through advanced legal provisions like Wills.

For in-country real estate investors operating without a recognized Will or Trust, these statutory inheritance rules will apportion all property under probate jurisdiction based on the following hierarchy:

- Descendants: Children receive equal shares, and grandchildren may receive remaining interests if ancestors predecease.

- Parents: In the absence of descendants, parents receive equal shares. If one parent predeceases, their share flows to the surviving spouse.

- Spouses: Surviving spouses attain ownership of remaining assets after parent/child entitlements.

- Siblings: If no closer relatives exist, full sibling heirs subdivide inherited properties equally.

While administratively straightforward on its surface, Thailand's complicated realities of blended families and historical polygamist traditions can significantly alter how these protocols may be applied to any specific case. Furthermore, owning properties via Thai-registered companies and holding minority/majority shares adds exponential degrees of complexity versus individually held assets.

From an estate planning perspective, high-net-worth individuals and legal experts must holistically assess their family dynamics, multi-generational goals, and property portfolios. Then, proactive measures through vehicles like Wills and Trust instruments become essential bulwarks against inadvertent distribution conflicts and dissipation of hard-earned wealth.

Mastering Wills & Testaments in Thailand

For property owners seeking optimal control over how their estates are managed and disbursed post-mortem, professionally drafted Wills represent the gold standard foundation. By explicitly documenting your legacy wishes in a legally recognized document, you effectively override default succession laws while cementing authority over bequeathed assets.

Under current Thai laws, any individual with a mental capacity over 15 years old maintains the right to construct a Will covering personal property and assets located in Thailand. There are no explicit provisions preventing foreign nationals from drafting Wills governing domestic inheritances, provided the documents adhere to Thailand's statutory requirements.

Primary stipulations for legally valid Wills include:

- Clear testamentary intent by the testator/property owner

- Proper document execution witnessed by two capable adults

- Registration with the appointed Thai authority or Court

- Thai translation confirmed by a certified court translator

Once these foundational elements are satisfied, testators obtain wide discretion over constructing inheritance guidelines tailored precisely to their wishes and circumstances. Estate owners can expressly apportion real estate holdings and personal belongings to any named beneficiary, whether family members, non-relatives, organizations, or trusts.

Additionally, Wills enables designating explicit executors responsible for overseeing asset distribution and estate closures according to your defined instructions. This again allows property moguls to circumvent Thailand's default inheritance hierarchy and account for nuances like blended family dynamics or multiple marriages - a crucial advantage over intestate proceedings.

Perhaps most significantly, a Will ensures your legacy will be governed by familiar civil and common law principles rather than sharia precepts should Islamic inheritance laws and female disinheritance risks become an unforeseen issue. Suffice to say, strategic Will preparation provides indispensable inheritance bodyguards for high-net-worth individuals.

Leveraging Trusts for Asset Protection & Tax Efficiency

While a Will establishes clear avenues for articulating final inheritance wishes, trusts represent an oft-underutilized complementary mechanism for facilitating lifetime wealth transfers and circumventing probate administration entirely.

At their core, trust vehicles allow creators (settlors) to formally transfer property ownership to third-party trustees before death while still retaining income distribution rights and control over those assets during their lifetime. Once settlors pass away (a person who establishes a trust by giving their property into trust for the benefit of a beneficiary), the trust assets automatically redistribute to designated beneficiaries per the settlor's defined provisions - bypassing probate court supervision and statutory inheritance laws.

From a legal perspective, Thailand recognizes internationally-established common law trust principles and actively encourages domestic trust formation for both governance and tax incentive purposes. Property secured within a trust structure is considered an independent juristic entity separate from the individual settlor's main estate - effectively ring-fencing assets from claims or distribution challenges that could otherwise disrupt inheritance plans.

Furthermore, Thailand's current tax codes provide compelling reasons for high-net-worth foreigners to make use of trust vehicles when transferring significant assets intergenerationally. Living settlors are eligible for up to 100% remission on transfer fees when re-titling property into trusts while still alive. Upon death, assets distributed from approved trusts correspondingly enjoy generous tax exemptions in contrast to probated inheritances.

For globally-minded estate barons constructing cross-border succession matrices, the advantages of Thai trusts cannot be understated. Not only do they enable iron-clad governance of localized assets, but comprehensive planning can facilitate unified international frameworks protecting entire dynastic empires seamlessly across jurisdictions.

With the proper legal guidance, trust structuring options are virtually unlimited: revocable arrangements allowing settlors to retain control, irrevocable trusts permanently removing assets, incentive/disincentive trusts institutionalizing heirs' positive behavior ... all represent viable pathways for creating enduring legacies tailored to your family ideals and multi-generational vision.

Coordinating Your Estate Planning Portfolio

Of course, this expansive exploration merely skims the immense depth of nuances and possibilities surrounding estate planning within Thailand's property arena. As a universal truth for any high-stakes succession roadmap, the devil lies in the individualized details.

From city-specific regulations and international double-taxation agreements to the complexities of business ownership vehicles, maritime vessel inheritances, tax-exempt minority stakes, and beyond - thriving real estate investors require bespoke advisory support from specialized legal and financial experts to navigate these bespoke complexities elegantly.

Comprehensive estate plans seamlessly harness Wills, Trusts, company structures, and localized property instruments as interwoven puzzle pieces ensuring complete legacy preservation. Inheritance tax efficiency stratification, dissolution protections for closely-held assets, and painstaking tailoring for cross-cultural value alignment represent just a small sampling of other topical considerations for truly global-minded wealth barons.

At the highest levels of dynastic estate orchestration, multi-disciplinary advisory teams collaborate to formulate overarching roadmaps accounting for each family's distinct history, holdings, tax profiles, growth trajectories, and multi-generational aspirations. The best frameworks empower seamless transitions while promoting sustainable enterprise stewardship through future generations.

No matter the scope or complexity, prudent estate planning always begins with commitment. A dedication to preserving not just wealth itself, but the ideals, integrity and relationship fabric underlying that prosperity. Because at its core, legacy solidification represents an invaluable final gift to future lineages - one enabling them to dream further and seize grander opportunities.

So embrace the challenges and craft your tailored inheritance masterplan diligently. With thoughtful guidance and appropriate legal instruments deployed in unison, your hard-earned dynasty will remain immortal - an enduring gemstone adorning Thailand's storied lands indefinitely.

We highly recommend consulting with qualified real estate lawyers and tax lawyers in Thailand to ensure you are following applicable legislation and to optimize your financial objectives.