Investing in Thai real estate through a limited company may offer a pathway for foreign investors to legal land ownership in the kingdom. However, this strategy demands a comprehensive understanding of the legal landscape and diligent compliance with Thai corporate laws. In our latest legal guide, we share critical insights and considerations for foreigners venturing into property acquisition through Thai limited companies.

Company Registration Process

When establishing a Thai Limited Company for the purpose of real estate investment, it’s important to understand the registration process. This requires the reservation of a company name, filing a memorandum of association, convening a statutory meeting, obtaining a tax identification card and VAT registration, as well as obtaining any required business licenses in accordance with Thai corporate law.

Shareholder Requirements

To register a Thai Limited Company, you are required to have at least three shareholders. At least fifty percent of the shareholders who attend the incorporation registration must be Thai residents. The requirement for Thai Shareholders illustrates the importance of having local representation in your company’s ownership structure. The right or wrong Thai shareholders can make or break a Thai Limited Company, as the process of choosing the right Thai Shareholders requires careful thought about the roles they will have, the responsibilities they will bear and the interests they will have in the company’s operations.

Corporate Governance

Corporate governance is necessary for a Thai Limited Company to function properly. This means establishing clear authority lines, defining shareholder and director responsibilities and roles, and having strong internal controls. Adopting the best practices for executive conduct allows a body corporate to enhance transparency, accountability and integrity in all of its business activities. This paves the way for increasing the trust of investors and increased compliance with laws and regulations.

Legal Documentation

Incorporating, registering, and achieving ongoing compliance requires a mountain of paperwork. This will include, registration certificates, articles of incorporation outlining business purpose and structure, shareholder agreements outlining responsibilities and rights, and a myriad of other contracts that define the company's relationship with its stakeholders. Given the integral role these documents play in defining a company's legal framework, operational parameters, and financial obligations, it is no surprise that drafting and reviewing these documents is sometimes the foundation of the work of business lawyers in Thailand.

Regulatory Compliance

Operating in Thailand must comply with any number of applicable laws, regulations and licensing requirements. Understanding and navigating regulatory concerns, companies must ensure compliance with a number of ongoing obligations including regular tax filings, financial reporting and industry regulations, among others. By seeking to address their regulatory concerns proactively, companies are able to mitigate legal risks, avoid costly penalties and operate within an environment that is conducive to business.

Investing in Thai Real Estate Through a Thai Company: Mitigating Legal Risks

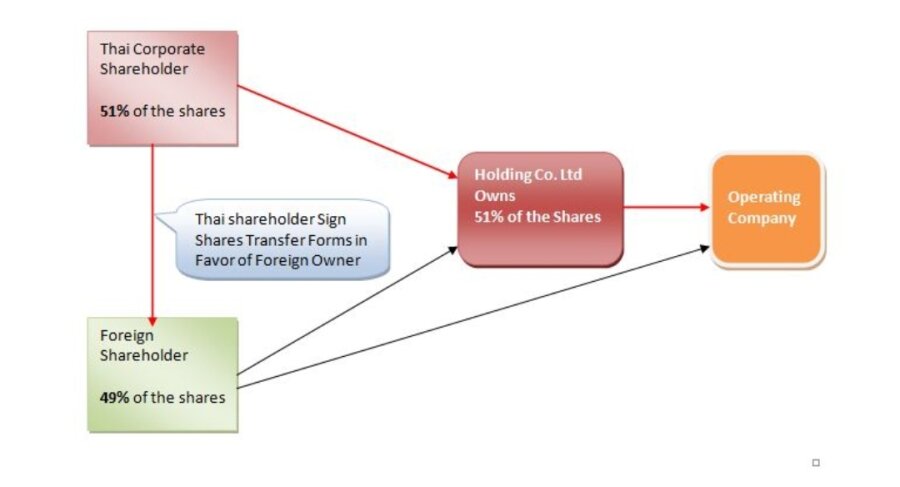

Nominee Shareholders

In many jurisdictions, the use of nominee shareholders is uncontroversial, however, in Thailand, nominee shareholders can present legal risks if their use is not properly structured and employed. Nominees need to actually have a stake in the company and must be actively involved in corporate affairs, and cannot merely serve as figureheads. Where these rules are violated, it can result in regulatory scrutiny, fines, or even dissolution of the company. Consequently, it is important to involve a qualified business lawyer in Thailand to ensure that the Company is operating in compliance with the myriad of laws and regulations with which it must adhere.

Active Business Engagement

Thai authorities may continue to monitor the activities of dormant companies. In order to avoid being classified as an ‘inactive’ or ‘nominee’ company, entities should ideally engage in legitimate business activities beyond the mere ownership of property. This could encompass a variety of activities, including conducting physical commercial operations, actively generating income and being fully compliant with tax obligations. By being able to clearly demonstrate genuine economic substance and operational relevancy, companies can significantly strengthen their stance and appeal as credible, legitimate and sustainable operations in the eyes of stakeholders and regulators.

Due Diligence

When forming partnerships, joint ventures, or other commercial agreements in Thailand, careful due diligence is essential. This involves identifying possible risks, obligations, and conflicts of interest through thorough background investigations, financial evaluations, and legal examinations. Companies may reduce legal risks, protect their interests, and make well-informed, strategic decisions by carefully carrying out due diligence.

Legal Compliance Audits

Maintaining legal integrity and reducing risk requires routine audits of financial operations, corporate governance procedures, and regulatory compliance. Internal and external audits can be used to find non-compliance issues, flaws in operations or procedures, or vulnerabilities that can be fixed right away. Your company will be more likely to comply with legal requirements, gain the trust of investors and other stakeholders, and reduce any potential legal concerns if it has a culture of continuous development and legal compliance.

Corporate Governance Training

Corporate governance training for directors, officers, and key personnel is important. Training can strengthen regulatory compliance and risk management. Programs can teach regulatory compliance and the importance of ethical conduct. They can train on everything from conflict resolution to corporate responsibility. The more employees know and the better they are armed for the complex legal line they walk, the more likely they are to have the knowledge they need to identify, assess, and address legal risks.

Financial Implications and Operational Flexibility

Annual Expenses

In addition to initial registration costs, Thai Limited Companies are subject to various annual expenses associated with corporate governance, tax compliance, and operational overhead. These may include fees for preparing audited accounts, filing tax returns, and maintaining a registered address. By budgeting for these expenses and incorporating them into financial projections, companies can ensure financial sustainability and regulatory compliance.

Stamp Duty Implications

Stamp duty is a significant consideration when purchasing or selling real estate since it is levied on both the initial purchase and any future transfers of property ownership. While stamp duty rates vary according to the type and volume of the transaction, these costs must be taken into consideration when making investment and financial planning decisions. By understanding the stamp duty implications of purchasing real estate through a Thai company, investors may reduce financial risk and increase return on investment.

Tax Obligations

Thai-Limited Businesses must pay a 20% corporate income tax on their net earnings. In addition, they could be responsible for additional taxes including personal income tax for company directors who live in residences held by the firm, property tax, and special business tax. Complying with these tax requirements and managing finances effectively depend on your understanding of them. Businesses may reduce their tax obligations and improve their financial performance by working with licensed tax experts and putting tax-efficient methods into practice.

Property Management Considerations

Maximizing the value and profits of real estate investments requires competent property management. To guarantee operational effectiveness and tenant happiness, businesses need to create thorough plans for property upkeep, tenant interactions, and rent collection. While some businesses could decide to handle their properties in-house, others might decide to contract with other entities to handle their properties. Through a thorough assessment of the advantages and disadvantages of each strategy, businesses can make well-informed decisions that complement their financial and operational objectives.

Strategic Advantages

Among the many strategic benefits of owning real estate through a Thai Limited Company are tax efficiency, asset protection, and operational flexibility. Companies can reduce personal liability concerns, expedite asset transferability, and streamline administrative procedures by combining real estate holdings under a corporate framework. Additionally, individuals could profit from possible depreciation allowances, tax deductions, and other financial incentives that are offered to corporate organizations. Businesses may maximize their real estate investments and improve their long-term financial success by skillfully utilizing these strategic benefits.

Cultural and Regulatory Nuances

Language Barriers

When navigating the Thai real estate market, international investors may face major obstacles due to language limitations. Contracts, legal papers, and regulatory filings are usually written in Thai, necessitating translation and interpreting services. Furthermore, having Thai language proficiency or working with multilingual specialists may be necessary for discussions with local contractors, merchants, and government representatives. Investors may ease communication difficulties and ensure more seamless transactions by proactively addressing language obstacles and enlisting the assistance of skilled language specialists.

Local Customs and Practices

Establishing rapport, cultivating trust, and navigating cultural subtleties in Thailand all depend on having a thorough understanding of local customs, traditions, and business practices. To create fruitful partnerships and meet their investment goals, investors need to adjust to local norms and practices in everything from formal business etiquette to casual social encounters. Furthermore, awareness of cultural differences and honoring Thai traditions show kindness, professionalism, and a dedication to mutual understanding.

Compliance with Legal Requirements

It is crucial for foreign investors participating in Thailand's real estate industry to adhere to legal standards. Adherence to local rules and regulations is necessary for everything from property registration and tax filings to regulatory approvals and licensing. Investment returns and company reputation are at risk when regulatory requirements are broken; there may be fines, penalties, or even legal action. Consequently, in order to handle the intricacies of Thai law and guarantee compliance throughout the whole investment process, investors need to work with a knowledgeable real estate lawyer in Thailand.

Government Policies and Regulations

The dynamics of Thailand's real estate industry are significantly shaped by laws and regulations from the government. Investors need to remain up to date on regulatory changes in order to successfully predict possibilities and manage risks. These changes might range from zoning rules and land use policies to prohibitions on foreign ownership and tax incentives. Moreover, interacting with governmental organizations, trade associations, and legal professionals can yield insightful information about new changes in legislation, market trends, and real estate investment prospects.

Dispute Resolution Mechanisms

Investors need to be aware of the dispute resolution procedures that are available in Thailand in case there are disagreements or conflicts resulting from real estate purchases. Negotiation, mediation, arbitration, or lawsuit are possible options, dependent on the type and intricacy of the disagreement. Investors can proactively handle any disagreements and reduce legal risks by including dispute resolution procedures in contracts and agreements. Retaining commercial connections and facilitating prompt resolution are further benefits of hiring skilled dispute lawyers in Thailand and conflict resolution specialists.

Understanding Thailand Property Market Dynamics

Tourism Influx

The market for real estate in Thailand is greatly influenced by the country's booming tourism sector, especially in well-known travel hubs like Bangkok, Phuket, and Pattaya. By focusing on assets with rental potential, such as holiday rentals, serviced flats, and condominiums, investors may profit from this trend. Furthermore, being close to services, transit hubs, and tourist sites may raise property values and rental yields, making it a profitable investment for astute investors.

Economic Indicators

Thailand's property market is influenced by economic variables such as GDP growth, inflation rates, and unemployment rates. The demand for real estate is often driven by a strong economy that is defined by consistent growth, low inflation, and high consumer confidence. This encourages property development and investment activities. On the other hand, market sentiment may be lowered and variations in real estate values and transaction volumes may result from economic downturns or outside shocks. As a result, in order to assess market circumstances and make wise investment decisions, investors need to keep an eye on important economic indicators.

Thailand GDP Growth

Government Policies and Initiatives

The actions and policies of the government significantly influence the characteristics of the Thai real estate market. Government initiatives may have a big influence on the supply, demand, and price of real estate. These initiatives might range from tax breaks and investment promotion programs to infrastructure projects and urban development plans. Furthermore, legislative changes that strengthen investor protection, advance sustainable development, and improve transparency might open up new business opportunities and alter the competitive environment. Therefore, in order to profit from new trends and efficiently reduce regulatory risks, investors need to remain up to date on government policies and activities.

Market Segmentation

Thailand's real estate market is fast-moving and varied, with distinct segments meeting the demands of the market and the preferences of different investors. Investors have a vast array of alternatives to select from, depending on their investment goals, risk tolerance, and financial limits. These possibilities vary from cheap housing and commercial buildings to luxury condominiums and waterfront villas. Furthermore, new innovations like co-living areas, mixed-use neighborhoods, and sustainable communities present chances for market innovation and uniqueness. To successfully capitalize on new trends and discover high-growth categories, investors need to undertake due diligence and market research.

Investment Strategies

A well-defined plan that takes into account investor goals, market conditions, and risk tolerance is necessary for successful real estate investing. Regardless of whether they prioritize portfolio diversity, rental income, or capital gain, investors need to match their investing strategy to their financial objectives and the state of the market. Furthermore, you may reduce negative risks and increase long-term returns by using a disciplined strategy to asset allocation, risk management, and portfolio rebalancing. As a result, investors need to create a complete investment plan supported by careful thought, wise judgment, and proactive risk management.

Investing in Thai Real Estate: Evaluating Financing Options

Direct Land Ownership

Generally speaking, foreign people and businesses are not allowed to acquire property outright in Thailand, with the exception of a few approved regions and particular situations. On the other hand, they could be allowed to lease land for a maximum of 30 years, with the option to extend the lease. Direct land ownership comes with constraints on land use, transferability, and foreign ownership, all of which need to be carefully examined even if it gives more control and freedom over the property.

Establishing a Thai Limited Company

The formation of a Thai Limited Company is a popular strategy used by international investors to purchase real estate in Thailand. Investors can lawfully buy and keep land for residential, commercial, and industrial uses by creating a company with a majority Thai ownership. Even though this method gives owners more freedom and control over their property, it necessitates adherence to regulatory regulations, shareholder requirements, and Thai company rules. As a result, investors need to work with knowledgeable real estate lawyers in Thailand to handle the intricacies of registering a corporation and guarantee compliance at every turn.

Long-Term Leaseholds

Long-term leaseholds, in which foreign investors rent land or other property from Thai landowners for protracted periods of time, are a further financing alternative. Long-term leases usually have an expiration date of 30 to 90 years and include options for renewal or extension. Although leasehold agreements give investors the ability to use and occupy the property, they do not grant title documents or ownership rights. To properly protect their interests, investors must thus negotiate advantageous lease terms, carry out due diligence on the lessor's title, and guarantee compliance with leasehold legislation.

Financing Arrangements

Investors looking to finance real estate purchases in Thailand have several options to consider besides equity financing. These might include crowdsourcing websites, bank loans, mortgage finance, and seller financing. A thorough assessment of each financing option's terms, conditions, and eligibility requirements should be conducted in light of the investor's financial situation, creditworthiness, and risk tolerance. To choose the most affordable and appropriate financing option for their investment goals, investors must also evaluate the cost of financing, which includes interest rates, fees, and payback periods.

Structuring Considerations

Investors need to weigh several structural factors, including the tax ramifications, regulatory constraints, and operational needs, when assessing financing choices for real estate projects in Thailand. For instance, arranging property ownership through a Thai Limited Company may have tax and asset protection benefits, but it also requires adherence to regulations and corporate governance guidelines. On the other hand, long-term leasehold finance for property acquisitions may offer more flexibility and cheaper upfront expenses, but it necessitates rigorous lease term negotiation and due diligence on the lessor's title. To create a customized financing plan that fits their investment objectives and risk tolerance, investors must thus consider the advantages and disadvantages of each financing option and confer with financial lawyers in Thailand for tailored advice.

Risk Management Strategies

To reduce the financial risks involved with real estate transactions in Thailand, effective risk management is crucial. This might entail hedging against interest rate and currency volatility, diversifying investment portfolios, and keeping sufficient liquidity buffers. Investors must also carry out extensive due diligence on real estate holdings, financial agreements, and legal titles in order to detect any dangers and create backup plans. Long-term financial success may be attained by investors who take a proactive approach to risk management and put strong controls and protections in place to protect their cash and maintain investment returns.

Estimating Rental Income Potential

Location and Accessibility

A property's potential for rental revenue is greatly influenced by its location. Rental returns are often greater for properties located in desirable areas with convenient access to amenities, job hubs, and transportation. Additionally, a property's closeness to retail centers, educational institutions, and tourist destinations helps draw in a consistent tenant base and sustain the demand for rentals. Consequently, in order to properly determine a property's potential for rental revenue, investors need to pay close attention to the properties' accessibility and location.

Property Type and Condition

A property's potential for rental revenue is also influenced by its type and the state of the property. When compared to older or badly kept buildings, newly constructed or renovated residences with contemporary amenities and facilities are likely to command higher rental prices. Furthermore, houses with distinctive qualities, like views of the waterfront, roomy floor plans, or high-end finishes, could fetch higher rentals on the market. Consequently, in order to precisely assess a property's potential for rental revenue, investors need to take into account its kind, attractiveness, and state.

Market Demand and Competition

In Thailand's real estate market, the two main variables influencing prospective rental revenue are market demand and competition. To find out the current rental prices, occupancy percentages, and tenant preferences in their target market segments, investors need to perform market research. In order to determine the likelihood of rental revenue growth and market saturation, they must also evaluate the dynamics of supply and demand as well as the competitive environment. Investors may maximize their prospective rental revenue and make wise investment selections by comprehending market dynamics and tenant preferences.

Rental Market Trends

Seasonal variations, vacancy rates, and rental yield patterns are examples of rental market trends that can give important information about prospective rental revenue. In order to spot new opportunities, modify rental prices, and enhance property performance, investors need to keep a close eye on changes in the rental market. In order to sustain high occupancy rates and rental yields, they also need to adjust to shifting tenant preferences and market conditions. Investors may optimize their rental revenue potential and attain long-term investment success by keeping up with rental market changes and using proactive management measures.

Legal Considerations

Tenancy rules, lease agreements, and rental restrictions are just a few of the legal factors that investors need to take into account when assessing their prospective rental revenue. For instance, in Thailand, the Residential Tenancy Act sets down the rights and responsibilities of both landlords and renters, including provisions for rent control, eviction processes, and dispute resolution methods. In addition, lease agreements need to include all necessary elements including rent amount, payment schedule, security deposit, and termination clauses, in addition to meeting all legal requirements. Thus, in order to guarantee adherence to tenancy rules and regulations, investors should acquaint themselves with pertinent legal aspects and get legal counsel from a real estate lawyer in Thailand.

Property Management Costs

When assessing future rental revenue, property management expenses are a crucial consideration. These might include costs for utilities, insurance, repairs, upkeep, and property management. In order to account for variations in rental revenue, owners also need to estimate vacancy losses, tenant turnover, and marketing costs. Investors can determine the prospective net rental revenue and the viability of their investment goals by precisely evaluating property management expenses and factoring them into financial estimates.

Navigating the Path to Property Ownership in Thailand

Whether you are looking to diversify your holdings, increase your passive income, or take advantage of Thailand's steady economic growth and robust real estate market, you will find some intriguing opportunities by investing in the country's real estate markets. But navigating the maze of legal relations, financial complexity, and implementation logistics of real estate investing calls for meticulous preparation, thorough investigation, and a tried-and-true approach. Property investors stand a better chance of maximizing returns on their assets and securing long-term success in Thailand's burgeoning property market by navigating the legal requirements, minimizing financial risks, assessing the potential for rental incomes, and staying ahead of the market's constantly changing dynamics.