- Foreign investors must obtain a Greek Tax Identification Number (AFM) before any financial transaction or property reservation can occur.

- Mandatory legal due diligence requires a minimum 20-year title history check to ensure the property is free of liens, encumbrances, or agricultural/forest restrictions.

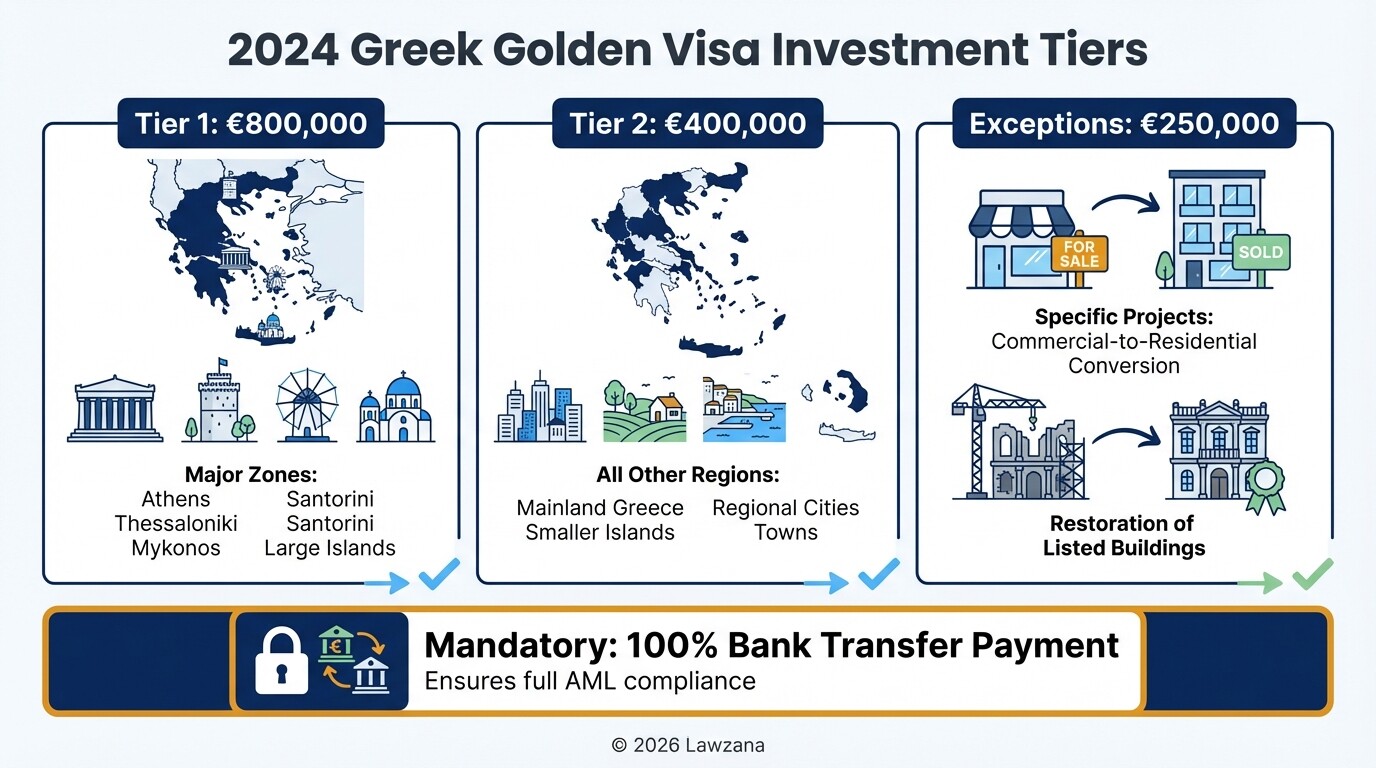

- Greece has recently increased Golden Visa investment thresholds, with certain "Zone A" areas (Athens, Thessaloniki, Mykonos, Santorini) requiring an €800,000 minimum.

- All real estate transactions must be settled via bank transfer; cash payments are strictly prohibited and will result in the immediate nullification of the sale contract.

- Property registration occurs in two parallel systems: the traditional Mortgage Registry (Ypothykofylakeio) and the modern National Land Registry (Ktimatologio).

Foreign Investor Readiness Checklist

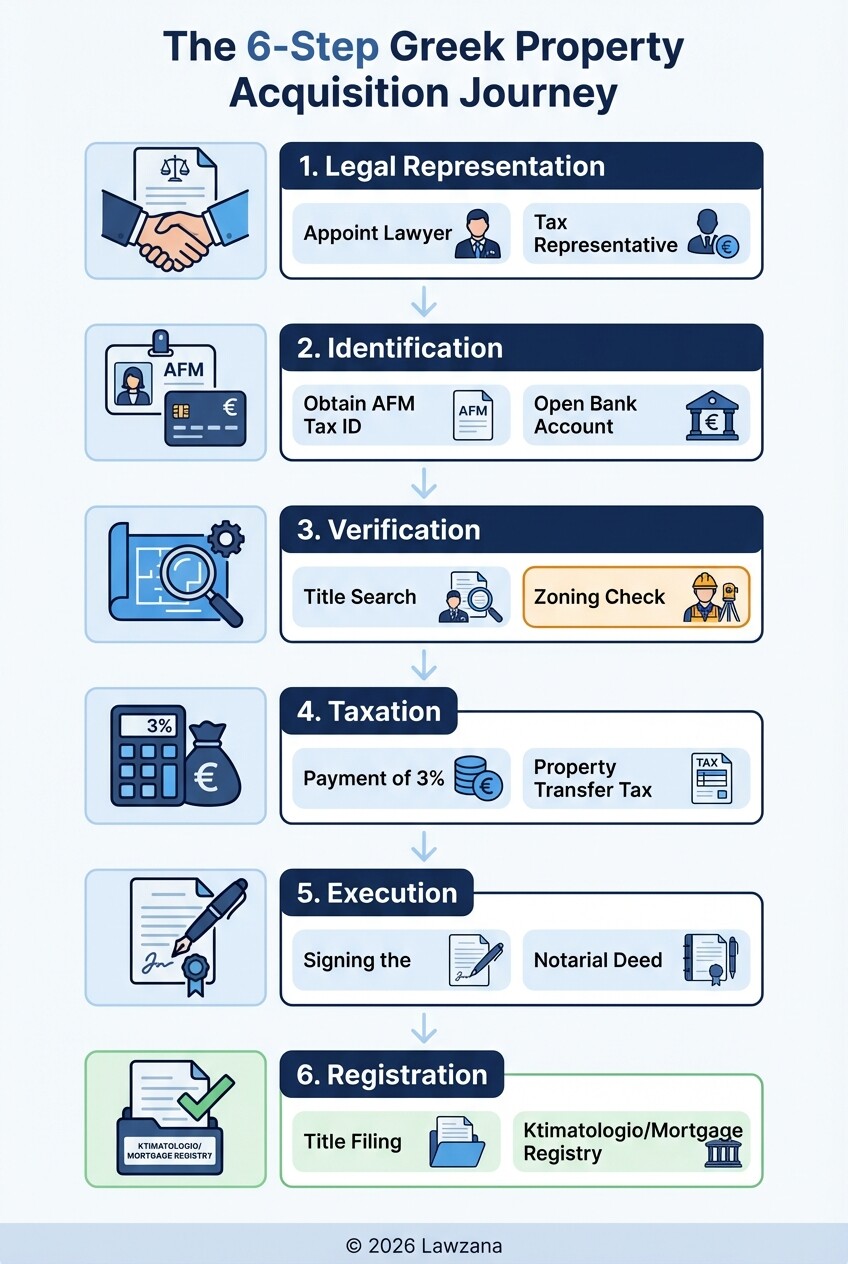

To acquire real estate in Greece, international buyers must navigate a series of administrative and legal hurdles. This checklist outlines the essential milestones from the initial offer to the final registration of the deed.

- Appoint a Greek Tax Representative: Foreign residents must designate a local "antiklitos" to receive official tax communications.

- Obtain a Greek Tax ID (AFM): Issued by the Independent Authority for Public Revenue (AADE), this is required for all buyers, including spouses if the property is jointly owned.

- Open a Local Bank Account: While not strictly mandatory for the purchase itself, it is essential for paying utilities, taxes, and managing the property's future expenses.

- Appoint Legal Counsel: A lawyer is legally required to conduct due diligence and is highly recommended to oversee the signing of the Notarial Deed.

- Secure a Civil Engineer's Certificate: The seller must provide a recent certificate (not older than two months) confirming the property has no illegal constructions or zoning violations.

- Pay the Property Transfer Tax (FMA): This must be paid (usually 3% of the purchase price or objective value) before the final contract is signed.

- Execute the Notarial Deed: The final contract must be signed in the presence of a Greek Notary Public, who acts as a public official to certify the transaction.

- Register the Title: File the deed with the Land Registry (Ktimatologio) or Mortgage Registry to officially transfer ownership.

Required Documentation for Obtaining a Greek Tax ID (AFM)

A Greek Tax Identification Number, or AFM (Arithmos Forologikou Mitrou), is the foundational requirement for any foreign investor entering the Greek market. You cannot sign a reservation agreement, open a bank account, or pay transfer taxes without this nine-digit number.

The process is handled through the local Tax Office (DOY) for foreign residents. While the application is relatively straightforward, it requires specific documentation that must be properly apostilled or legalized if issued outside of Greece.

Necessary Documentation for Individuals:

- Valid Passport: A certified copy of your current passport.

- Proof of Address: A recent utility bill or bank statement from your country of residence.

- Form M1 and M7: These are the specific tax application forms, usually completed by your lawyer or tax representative.

- Power of Attorney (PoA): If you are not physically present, your lawyer needs a notarized PoA to apply on your behalf.

Necessary Documentation for Legal Entities (B2B):

- Articles of Association: Proof of the company's legal existence.

- Certificate of Good Standing: Confirming the entity is active.

- Verification of Beneficial Owners: Documentation identifying the natural persons who control the entity, in line with EU transparency laws.

Legal Due Diligence Process for Greek Property Titles

Legal due diligence is the most critical phase of a Greek real estate transaction, as it uncovers hidden liabilities that could jeopardize your investment. In Greece, the lawyer's primary responsibility is to verify the "continuity of titles" and ensure the property is legally "clean" for transfer.

A thorough title search goes back at least 20 years, as this is the statute of limitations for most third-party claims under Greek Civil Law. Your lawyer will visit the Land Registry to confirm that the seller holds absolute ownership and that there are no pending lawsuits or expropriation orders.

Core Elements of Legal Due Diligence:

- Encumbrance Check: Searching for mortgages, pre-notations of mortgages, seizures, or third-party claims.

- Forest and Coastal Zone Verification: Confirming the property is not located in protected forest lands or restricted shoreline zones where building is prohibited.

- Zoning and Planning Compliance: Working with a civil engineer to ensure the building matches the permits filed with the Urban Planning Office (Poleodomia).

- Tax Clearance: Verifying the seller has paid all "ENFIA" (annual property tax) for the last five years and has no outstanding social security debts.

Timelines for Notary Procedures and Land Registry Filing

The timeline for a Greek real estate transaction typically ranges from 6 to 12 weeks, depending on the complexity of the due diligence and the efficiency of the local registry. Unlike common law jurisdictions, the Notary Public in Greece is a neutral government-appointed official who drafts the final contract and ensures all legal prerequisites are met.

Once the due diligence is complete and the "Technical Folder" is prepared by the seller, the parties meet at the Notary's office. Following the signing, the transfer is not legally binding against third parties until it is recorded in the public registers.

| Stage | Action | Estimated Timeline |

|---|---|---|

| Pre-Contract | Due Diligence & AFM Acquisition | 2 - 4 Weeks |

| Tax Filing | Submission of Transfer Tax Return | 3 - 5 Days |

| Execution | Signing the Notarial Deed | 1 Day |

| Registration | Filing with Land Registry/Mortgage Registry | 1 - 4 Weeks |

| Completion | Issuance of Ownership Certificate | 2 - 8 Weeks (Post-Filing) |

Compliance with 2026 Anti-Money Laundering (AML) Regulations

Greece is currently aligning its domestic laws with the EU's 6th Anti-Money Laundering Directive and the upcoming 2026 AMLA (Anti-Money Laundering Authority) standards. These regulations place a heavy burden of proof on the buyer regarding the "Source of Wealth" and "Source of Funds."

Investors must be prepared for rigorous screening by both the Notary and the Greek banks. All funds used for the purchase must originate from a bank account in the buyer's name and be transferred through the official banking system.

Key AML Compliance Requirements:

- Prohibition of Cash: Since 2024, any contract involving cash payments for real estate is void, and parties face heavy fines.

- Beneficial Ownership Transparency: For corporate buyers, the Greek "Central Registry of Beneficial Owners" must be updated to show the ultimate natural persons behind the investment.

- Enhanced Due Diligence (EDD): Investors from "high-risk" non-EU jurisdictions or Politically Exposed Persons (PEPs) will undergo additional scrutiny regarding their income history and business interests.

Understanding the Role of the Lawyer in the Golden Visa Process

The Greek Golden Visa program offers permanent residency to non-EU citizens who invest in real estate, but the legal requirements have become significantly more complex following the 2024 legislative updates. A lawyer's role is no longer just about the property transfer; they act as the primary liaison between the investor and the Ministry of Migration and Asylum.

Your legal counsel manages the "dual track" of the transaction: ensuring the property meets the specific Golden Visa eligibility criteria while simultaneously preparing the residency application.

Lawyer Responsibilities in the Golden Visa Context:

- Threshold Verification: Ensuring the purchase price meets the €250,000, €400,000, or €800,000 limit applicable to that specific geographic region.

- Contract Clauses: Drafting the Notarial Deed to include specific language required by the Ministry of Migration to prove the investment is "full and unencumbered."

- Application Filing: Submitting the digital residency application and representing the investor during the biometric data appointment.

- Renewal Management: Monitoring the five-year residency cycle to ensure the property remains in the investor's name for renewal purposes.

Common Misconceptions

"A Notary Public represents my interests." In Greece, the Notary is an impartial official of the state. They ensure the document is legal, but they do not perform due diligence for the buyer or negotiate on your behalf. Only your independent lawyer protects your specific interests.

"If the building exists, it must be legal." Greece has a long history of "arbitrary" (illegal) constructions. Never assume a standing structure is fully compliant. A civil engineer must cross-reference the physical building with the official blueprints to avoid massive future fines.

"The Golden Visa threshold is the same across the whole country." As of September 2024, the "Tiered System" is in full effect. Popular areas like Athens and Thessaloniki require €800,000, while other regions may still allow entry at €400,000 or the €250,000 "conversion" route for commercial-to-residential projects.

FAQ

Can I buy property in Greece remotely?

Yes, you can complete the entire purchase remotely by granting a Power of Attorney (PoA) to a Greek lawyer. The PoA must be signed at a Greek Consulate in your country or before a local notary with an Apostille stamp.

What are the closing costs for a property in Greece?

On average, closing costs range from 7% to 10% of the purchase price. This includes the 3% Transfer Tax, approximately 1.5% in Notary fees, 1% to 2% in Legal fees, and 0.5% to 0.8% for Land Registry filing.

Does the Greek Land Registry cover the whole country?

The National Land Registry (Ktimatologio) is still being finalized in some rural areas. In locations where it is not yet active, you must register the property with the local Mortgage Registry (Ypothykofylakeio).

When to Hire a Lawyer

You should hire a lawyer the moment you identify a property you wish to purchase and before signing any "Reservation Agreement" or paying a deposit. In Greece, even a small deposit can be legally binding, and without a lawyer-vetted contract, you may lose those funds if the title is later found to be defective.

A lawyer is also essential if you are an international investor navigating the Golden Visa program, as any mistake in the payment method or contract wording can lead to an immediate rejection of your residency permit.

Next Steps

- Verify Your Budget: Factor in an additional 10% for taxes and professional fees on top of the property price.

- Consult a Tax Specialist: Ensure you understand the tax implications in both Greece and your home country before obtaining your AFM.

- Engage a Greek Lawyer: Provide them with the property details so they can begin the preliminary title search at the relevant registry.

- Appoint a Civil Engineer: Have them inspect the property for structural integrity and zoning compliance before you commit to the purchase.