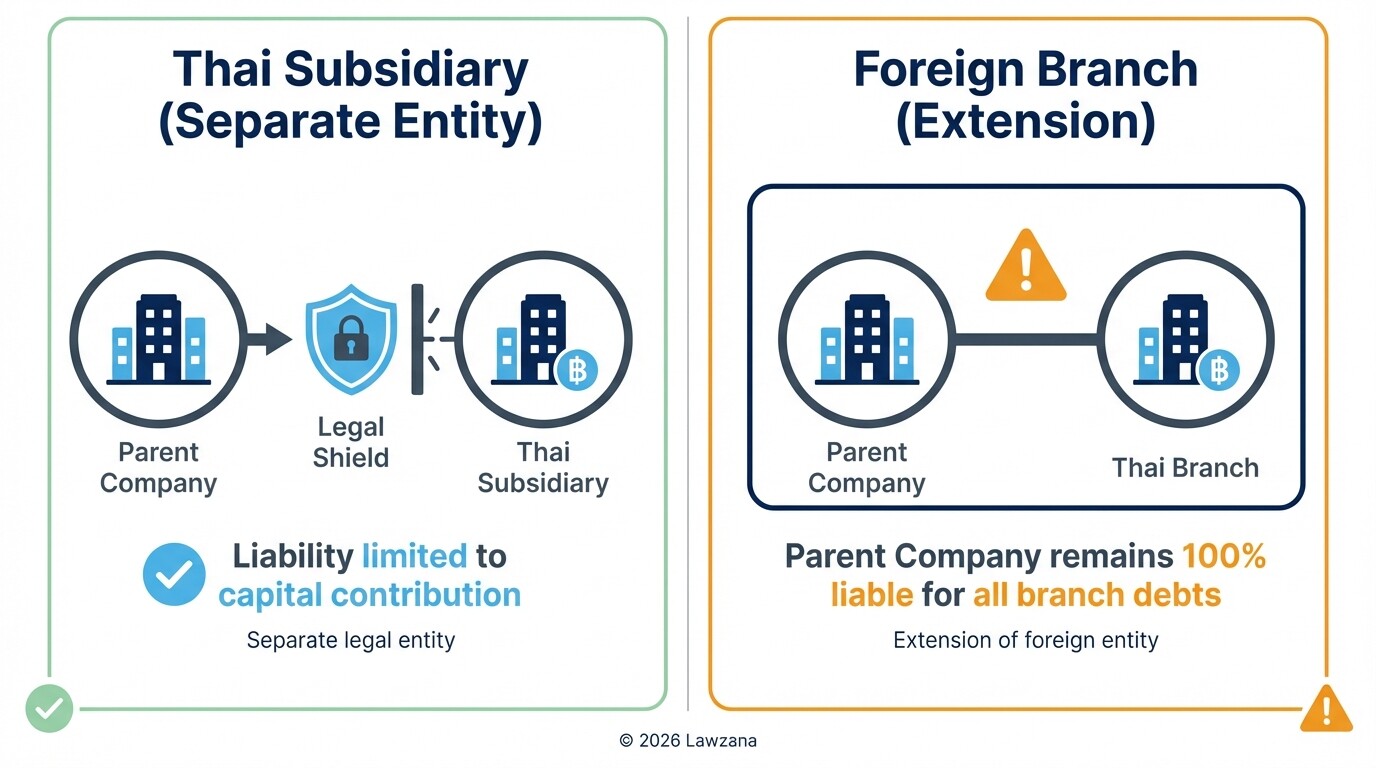

- A foreign branch is not a separate legal entity; the parent company remains 100% liable for all obligations and debts incurred by the Thai branch.

- Most foreign branches require a Foreign Business License (FBL) before starting operations, which involves a rigorous approval process by the Ministry of Commerce.

- The minimum capital requirement for a foreign branch is 3 million THB, which must be brought into Thailand according to a specific schedule.

- Foreign branches are only taxed on income derived from sources within Thailand, unlike Thai subsidiaries which are taxed on global income.

- You must appoint at least one branch manager residing in Thailand to oversee operations and ensure legal compliance.

What is the difference between a branch, a representative office, and a subsidiary?

Choosing the right structure depends on whether you intend to generate revenue and how much liability the parent company is willing to assume. A branch office acts as a direct extension of the parent company, whereas a subsidiary is a locally incorporated company with its own legal identity.

A representative office is the most restricted form, as it is strictly prohibited from earning income and may only perform non-trading activities like market research or quality control. Because a branch is not a separate entity, the parent company's assets are at risk if the Thai branch faces litigation or debt.

| Feature | Foreign Branch | Representative Office | Regional Office | Thai Subsidiary (Limited Co.) |

| Legal Status | Extension of Parent | Extension of Parent | Extension of Parent | Separate Legal Entity |

| Income Generation | Permitted | Strictly Prohibited | Prohibited (Support only) | Permitted |

| Key Activity | Trading / Services | Market Research / QC | Coordination / Training | Any (Subject to FBA) |

| Liability | Parent is 100% liable | Parent is 100% liable | Parent is 100% liable | Limited to unpaid shares |

| Foreign Ownership | 100% | 100% | 100% | Restricted (often 49% limit) |

| Min. Capital | 3 Million THB* | 2 Million THB | 2 Million THB | 0 - 2 Million THB (typical) |

How do you register a foreign branch with Thai authorities?

Registering a foreign branch requires obtaining a Foreign Business License (FBL) or a Foreign Business Certificate (FBC) from the Department of Business Development (DBD). This process confirms that your business activities are permitted under the Foreign Business Act (FBA), which restricts many service and retail sectors to Thai nationals unless a specific waiver is granted.

Is Your Business Restricted? Understanding the 3 Lists

To obtain a license, you must determine which "List" of the Foreign Business Act (FBA) your activities fall under. Most foreign branches fall under List 3.

-

List 1 (Strictly Prohibited): Activities reserved exclusively for Thai nationals. Foreign branches cannot obtain a license for these.

-

Examples: Newspaper/media businesses, rice farming, land trading, and forestry.

-

-

List 2 (National Security & Culture): Activities related to national safety, arts, culture, or natural resources. These require Cabinet approval, which is rarely granted.

-

Examples: Domestic transportation (land/water/air), production of Thai silk or drums, and mining.

-

-

List 3 (Restricted but Permissible): Activities where Thai nationals are not yet ready to compete. You can operate these with a Foreign Business License (FBL) approved by the Director-General of the DBD.

-

Examples: Accounting, legal services, engineering, advertising, and—most commonly—"Other Services" (which covers most branch office activities).

-

The application involves submitting a detailed business plan, an organizational chart, and evidence of the parent company's financial health. If your company is from a country with a bilateral treaty with Thailand, such as the United States under the Treaty of Amity, you may qualify for an expedited certificate rather than a full license.

Required Documentation

- Corporate Documents: Notarized and legalized copies of the parent company's Certificate of Incorporation, Bylaws, and Memorandum of Association.

- Power of Attorney: A document appointing a representative in Thailand to act on the company's behalf during the registration.

- Passport Copies: Of the parent company's directors and the appointed branch manager.

- Financial Statements: Audited reports from the parent company for the past three years.

- Business Plan & Technology Transfer: A comprehensive description of the branch's proposed activities and 3-year financial forecast. Crucially, this must include a Technology Transfer Plan detailing how the branch will transfer unique know-how, innovation, or skills to Thai staff. The Ministry of Commerce rarely approves branches that do not demonstrate a clear benefit to the Thai economy beyond simple employment.

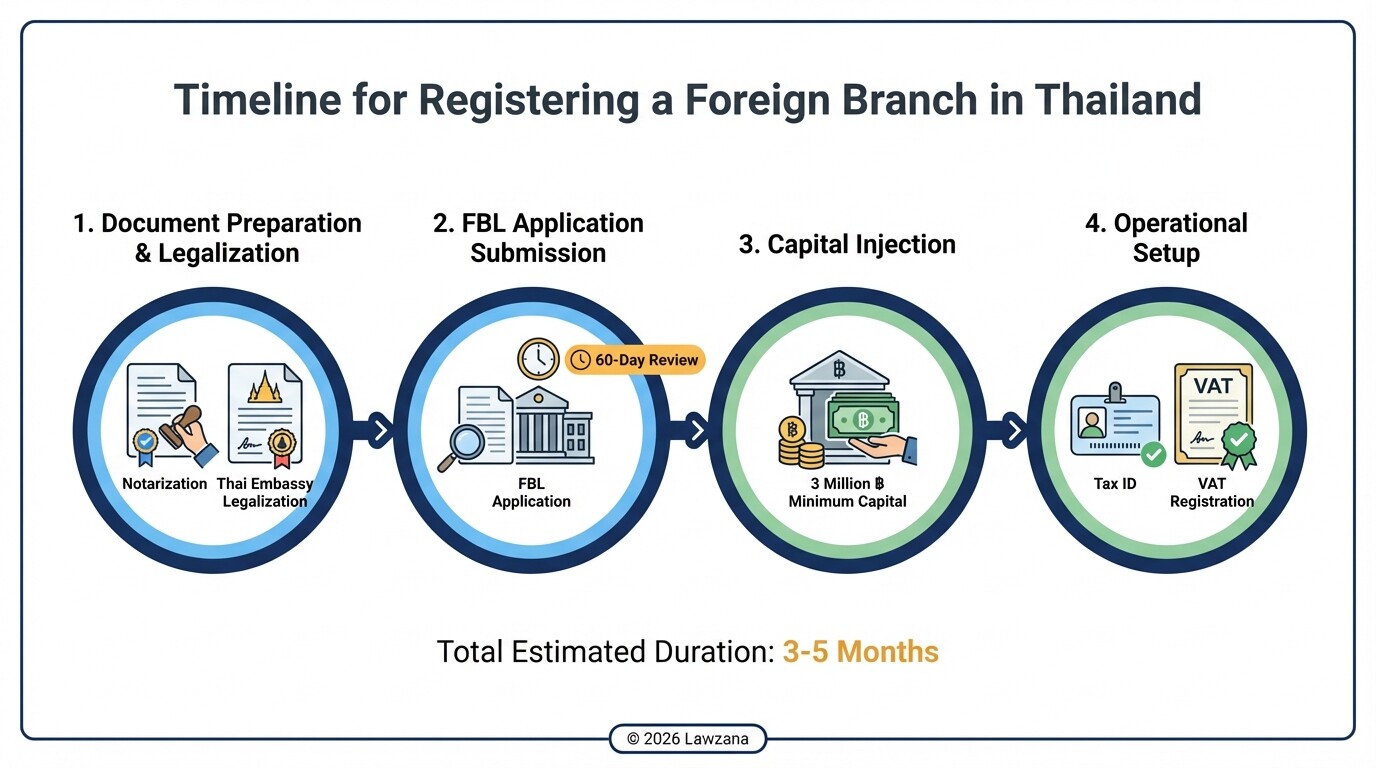

Step-by-Step Process

- Document Legalization: All foreign documents must be notarized in the home country and legalized by the Thai Embassy or Consulate.

- FBL Application: Submit the application to the Ministry of Commerce. The Foreign Business Committee typically reviews these applications within 60 days.

- Capital Injection: Once approved, you must remit the 3 million THB minimum capital into a Thai bank account.

- Tax Registration: Apply for a Tax ID and VAT certificate (if applicable) with the Revenue Department.

What are the tax and VAT considerations for a foreign branch?

Foreign branches are subject to Thai Corporate Income Tax (CIT) only on profits generated from business carried out within Thailand. The standard CIT rate is 20% of net profits, though small and medium enterprises (SMEs) may benefit from progressive lower rates if they meet specific capital and income thresholds.

If the branch's annual turnover exceeds 1.8 million THB, it must register for Value Added Tax (VAT), which is currently set at 7%. Additionally, when a branch remits profits back to the parent company abroad, a 10% profit remittance tax applies, which must be filed and paid within seven days of the end of the month in which the remittance occurred.

Withholding Tax Obligations

The branch is responsible for withholding tax on certain payments made to service providers and employees.

- Wages/Salaries: Calculated on a sliding scale for Personal Income Tax.

- Service Fees: Usually 3% for local companies.

- Rent: 5% if paid to a local landlord.

- International Payments: 15% for technical fees or royalties (subject to Double Tax Treaties).

What are the local agent and compliance reporting requirements?

Every foreign branch must appoint at least one individual residing in Thailand to be the "Branch Manager" responsible for the branch's operations and legal compliance. This individual does not have to be a Thai national, but if they are a foreigner, they must hold a valid Non-Immigrant "B" Visa and a Work Permit.

Manager Qualifications (Section 16) When appointing a Branch Manager, ensure they do not have any "prohibited attributes" under Section 16 of the Foreign Business Act. The appointee must not:

-

Have a history of incompetency or quasi-incompetency.

-

Be bankrupt.

-

Have been imprisoned for fraud, cheating creditors, or embezzlement.

-

Have had a Foreign Business License revoked in the last five years.

Ongoing compliance is strict in Thailand. The branch must maintain proper books of account and undergo an annual audit by an independent Thai Certified Public Accountant (CPA). These audited financial statements, along with the annual tax return (PND 50) and half-year return (PND 51), must be submitted to the Revenue Department and the DBD.

Annual Compliance Checklist

- Audited Financial Statements: Must be filed within five months of the fiscal year-end.

- Annual General Meeting (AGM): While technically an extension of the parent, the branch must still document its annual approval of accounts.

- Social Security: If the branch has employees, it must register with the Social Security Office and make monthly contributions.

- Visa/Work Permit Renewals: Ongoing maintenance for any foreign staff stationed at the branch.

Common Misconceptions About Foreign Branches

Misconception 1: A branch is easier to set up than a Thai company.

In reality, obtaining a Foreign Business License for a branch is often more difficult and time-consuming than incorporating a Thai Limited Company. The Thai government scrutinizes branch applications heavily to ensure the business provides a unique benefit to the country that a local company cannot provide.

Misconception 2: Branches do not need to bring in capital.

Many investors believe that since the parent company is already funded, the branch does not need its own capital. However, the law requires a minimum of 3 million THB. Usually, 25% must be brought in during the first three months, and the remainder within three years.

Misconception 3: A branch protects the parent company's assets.

This is the most dangerous myth. Because a branch is the "same person" as the parent company in the eyes of the law, a lawsuit against the Thai branch is effectively a lawsuit against the parent company. If you need to ring-fence liability, a subsidiary is the appropriate choice.

FAQs

Can a foreign branch own land in Thailand?

No. Foreign branches and companies with majority foreign ownership are prohibited from owning land in Thailand unless they have specific promotion from the Board of Investment (BOI) or are located in an industrial estate.

How long does the registration process take?

The entire process, from document legalization to receiving the Foreign Business License, typically takes 3 to 5 months. Using an expedited treaty-based application (like the US-Thai Amity Treaty) can reduce this to 4-6 weeks.

Is a branch required to have a Thai partner?

No. One of the primary advantages of a branch is that it can be 100% foreign-owned. You do not need a Thai shareholder, though you must still comply with the Foreign Business Act's licensing requirements.

When to Hire a Lawyer

Navigating the Foreign Business Act is complex, and errors in the application process can lead to immediate rejection by the Ministry of Commerce. You should retain a Thai corporate lawyer if:

- Your business activities fall under the restricted lists of the Foreign Business Act.

- You are applying for protection under a bilateral treaty (e.g., US, Australian, or Japanese treaties).

- You need assistance with the legalization and notarization of international corporate documents.

- You require a local representative to handle interactions with the Department of Business Development and the Revenue Department.

- You are unsure whether a branch, representative office, or subsidiary is the most tax-efficient structure for your specific goals.

Next Steps

- Assess Your Activities: Determine if your business activities are "restricted" under the Thai Foreign Business Act.

- Gather Parent Company Documents: Begin the process of notarizing and legalizing your Certificate of Incorporation and Bylaws at the nearest Thai Embassy.

- Draft a Business Plan: Prepare a detailed 3-5 year forecast and operational plan for the Thai branch.

- Appoint a Manager: Identify a resident manager who will be responsible for the branch's local filings.

- Consult Legal Counsel: Schedule a consultation to review your business plan and begin the FBL application process.