- Qualifying Free Zone Persons (QFZPs) may maintain a 0% corporate tax rate on qualifying income, whereas mainland entities face a standard 9% rate on profits exceeding 375,000 AED.

- Transitioning requires a full cancellation of MoHRE-regulated labor contracts and the issuance of new residency visas under the specific Free Zone authority.

- Commercial contracts do not automatically transfer; they require legal "novation" agreements to move obligations from the mainland entity to the new Free Zone entity.

- Only "Designated Zones" provide specific VAT exemptions for the movement of goods; not all Free Zones qualify for this status.

- There is no direct "conversion" mechanism in the UAE; you must typically liquidate the mainland entity or restructure it as a branch of the Free Zone company.

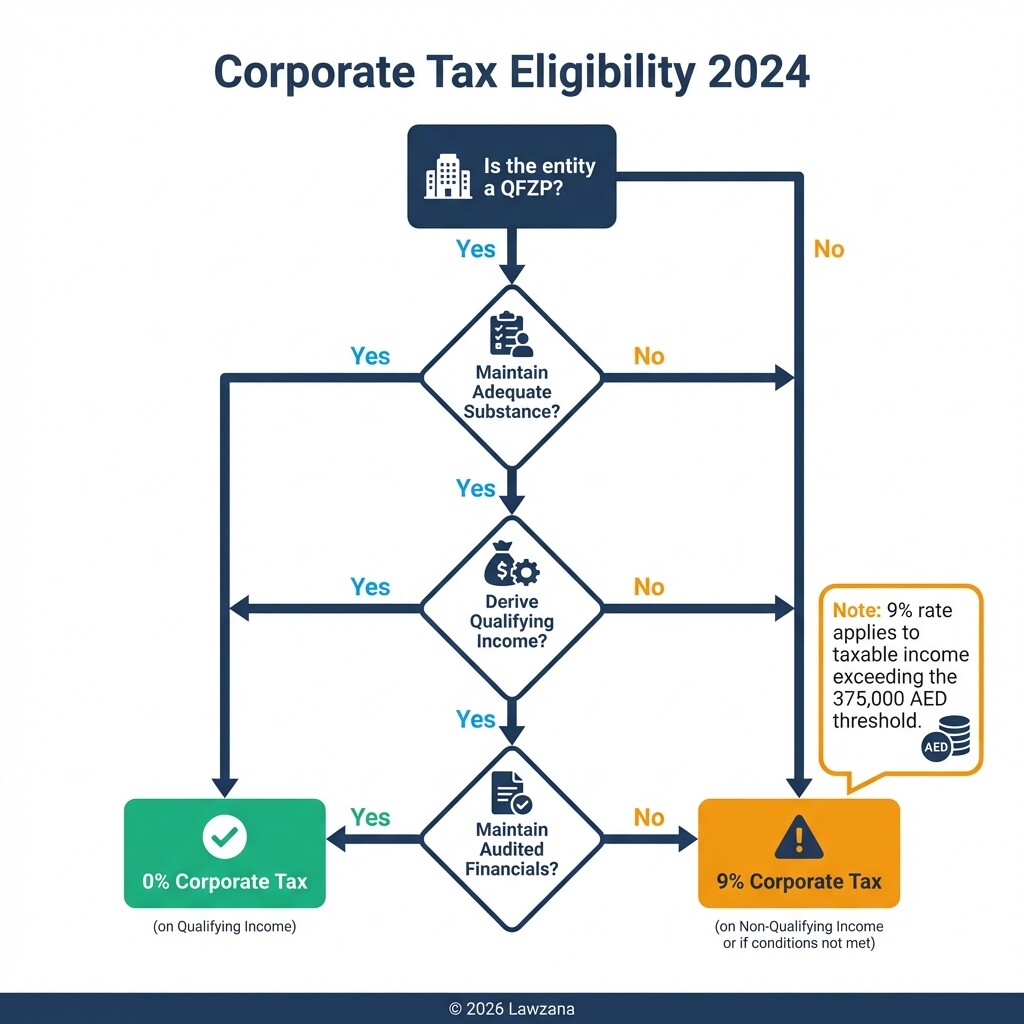

How Does Corporate Tax Differ Between Mainland and Free Zone Status in 2024?

Mainland companies are now subject to a 9% federal corporate tax on all taxable income exceeding 375,000 AED. Free Zone entities can potentially benefit from a 0% corporate tax rate, provided they meet the strict criteria to be a "Qualifying Free Zone Person" (QFZP) under the UAE Corporate Tax Law.

To secure the 0% rate, a business must maintain "adequate substance" in the UAE, which includes having enough employees and physical assets within the Free Zone. The tax implications for 2024 include:

- Qualifying Income: The 0% rate only applies to income derived from transactions with other Free Zone persons or specific "Qualifying Activities" such as manufacturing, fund management, and headquarters services.

- Mainland Sourced Income: If a Free Zone company earns income from mainland UAE customers (outside of specific excepted activities), that portion of income may be taxed at the 9% rate.

- Audited Financials: All Free Zone entities seeking the 0% rate must maintain audited financial statements, regardless of their size.

Detailed guidance on these tax structures can be found through the UAE Ministry of Finance.

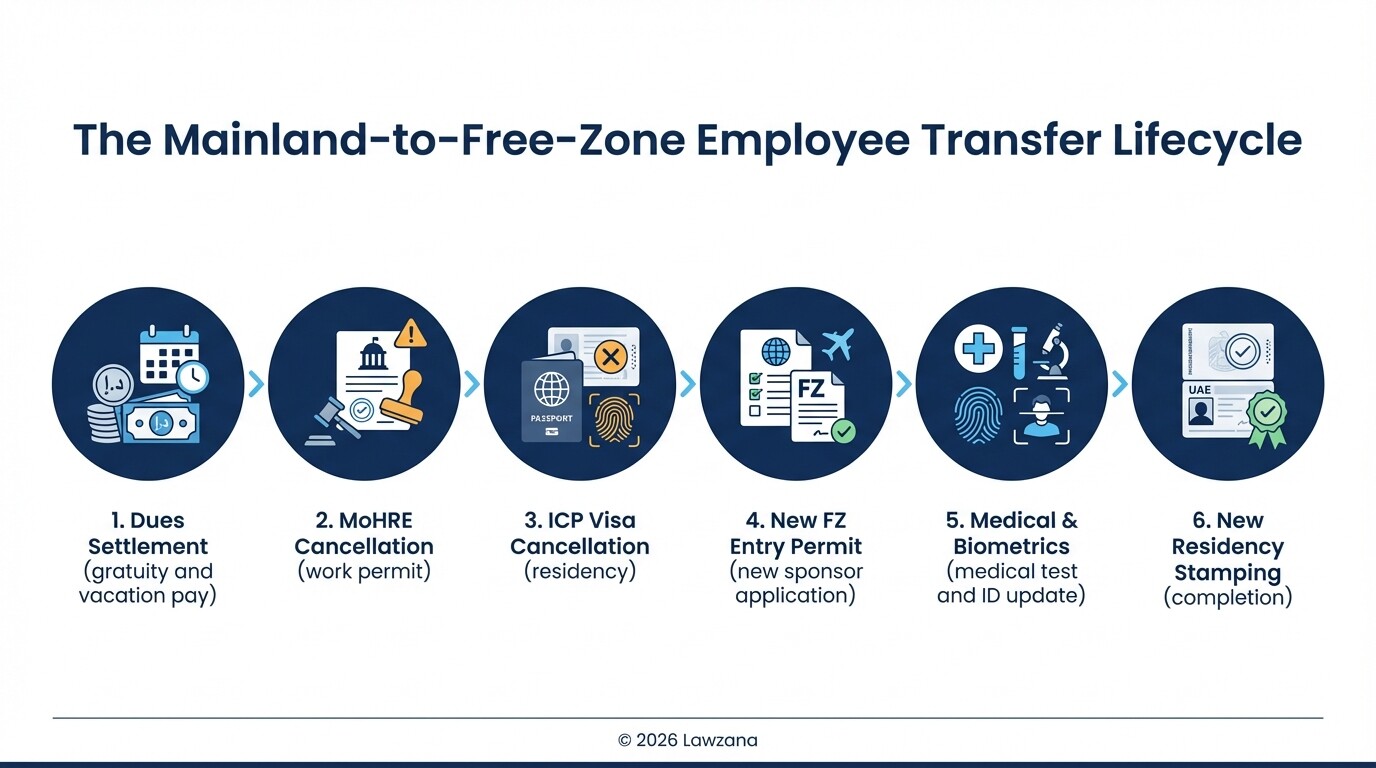

How Do You Transfer Employee Visas and Labor Contracts Through MoHRE?

Moving employees from a mainland company to a Free Zone entity involves a "cancel and re-hire" process because the two jurisdictions fall under different regulatory bodies. Mainland employees are governed by the Ministry of Human Resources and Emiratisation (MoHRE), while Free Zone employees are governed by their respective Free Zone Authorities (e.g., DMCC, DIFC, or JAFZA).

The transition requires several specific steps to ensure legal compliance with the UAE Labor Law:

- Settlement of Dues: The mainland entity must pay out all end-of-service gratuities, accrued vacation pay, and outstanding salaries before cancelling the MoHRE work permit.

- Visa Cancellation: The mainland residency visa must be formally cancelled through the Federal Authority for Identity, Citizenship, Customs & Port Security (ICP).

- New Work Permit Application: The Free Zone entity applies for a new entry permit and work contract under its own quota.

- Medical and Emirates ID: Employees must undergo a new medical fitness test and update their Emirates ID to reflect the new sponsor.

Failure to properly settle mainland labor contracts can lead to "labor bans" or financial penalties that prevent the new Free Zone entity from sponsoring those same employees.

What is Required for Asset Transfer and Novation of Commercial Contracts?

You cannot simply "move" a contract or an asset from a mainland company to a Free Zone entity because they are distinct legal persons. To transfer a contract, you must use a "novation agreement," which is a three-party document where the original mainland entity, the Free Zone entity, and the third-party client all agree to transfer the rights and obligations.

For a smooth operational transition, consider the following checklist:

- Novation Agreements: Essential for long-term service contracts, leases, and vendor agreements. Unlike an assignment, a novation completely releases the mainland entity from future liability.

- Physical Asset Transfer: Vehicles, machinery, and inventory must be sold or transferred via a Bill of Sale. If vehicles are involved, they must be re-registered with the RTA under the new license.

- Intellectual Property (IP): Trademarks and patents must be formally assigned at the Ministry of Economy to ensure the Free Zone entity holds the legal title.

- Bank Account Migration: Most UAE banks will not "transfer" an account. You will need to open a new corporate account for the Free Zone entity and close the mainland one after all checks have cleared.

Should You Choose Liquidation or Branch Conversion?

The UAE does not currently offer a "click-of-a-button" conversion to move a mainland license to a Free Zone; instead, business owners must choose between liquidating the old entity or registering the Free Zone entity as a branch. Liquidation is the most common path for those wishing to fully exit the mainland jurisdiction to save on renewal costs and administrative burdens.

Liquidation of Mainland Entity

This is a formal legal process that involves:

- Appointing a registered liquidator to prepare a final audit report.

- Publishing a notice of liquidation in two local newspapers for 30 days.

- Obtaining "No Objection Certificates" (NOCs) from utility providers, the landlord, and the Federal Tax Authority (FTA).

- Final cancellation of the license by the Department of Economy and Tourism (DET).

Branch Registration

If you wish to keep the mainland presence but centralize management in a Free Zone, you can register the Free Zone company as a "foreign branch" on the mainland. However, this often complicates tax filing and does not provide the same level of tax isolation as a standalone Free Zone company.

How Do You Navigate 'Designated Zone' Status for VAT Purposes?

A "Designated Zone" is a specific category of Free Zone that is considered to be outside the UAE for VAT purposes regarding the supply of goods. If your business involves significant international trading or manufacturing, transitioning to a Designated Zone like JAFZA or KIZAD can offer major cash-flow advantages.

Key VAT implications for Designated Zones include:

- VAT on Goods: Transfers of goods between two Designated Zones are generally tax-free (out of scope).

- VAT on Services: Even in a Designated Zone, almost all services (consulting, legal, accounting) are subject to the standard 5% VAT if performed within the UAE.

- VAT Registration: Moving from mainland to a Free Zone does not automatically cancel your VAT registration. You must update your "Financial Records" and "Business Address" with the Federal Tax Authority within 20 business days of the change to avoid hefty fines.

| Feature | Mainland UAE | Standard Free Zone | Designated Zone |

|---|---|---|---|

| Corporate Tax | 9% (above 375k AED) | 0% (if QFZP) | 0% (if QFZP) |

| VAT on Goods | 5% | 5% | 0% (in specific cases) |

| Labor Law | MoHRE | FZ Authority / MoHRE | FZ Authority |

| Ownership | 100% Foreign (mostly) | 100% Foreign | 100% Foreign |

Common Misconceptions

"Free Zones are always tax-free for all income."

This is a dangerous myth in 2024. While the rate can be 0%, it only applies to "Qualifying Income." If a Free Zone company sells products directly to a consumer in Dubai mainland, that income is generally subject to the 9% corporate tax. Transitioning does not grant a "blanket" tax exemption.

"I can just transfer my mainland license to the Free Zone."

Licenses are issued by specific regulators (DET for mainland vs. specific Free Zone Authorities). They are not portable. You are essentially closing one business and opening a new one, which requires new bank accounts, new visas, and new contracts.

FAQ

Can I keep my mainland office if I move my license to a Free Zone?

No. A Free Zone entity must have a physical office or "flexi-desk" within the boundaries of that specific Free Zone. You cannot operate a Free Zone license from a mainland office space unless you register a mainland branch.

Do I have to pay my employees' gratuity during the move?

Yes. Because the mainland labor contract is being terminated to start a new one in the Free Zone, the "end of service" has legally occurred. You must pay all accrued benefits before the MoHRE will allow the cancellation of the work permit.

How long does the transition from mainland to Free Zone take?

The entire process-including the opening of the new entity, visa transfers, and the start of the mainland liquidation-typically takes 3 to 6 months.

Will my mainland bank account stay active?

Usually, no. Banks tie corporate accounts to the specific trade license and "Know Your Customer" (KYC) documents of the entity. Once the mainland license is cancelled or significantly altered, the bank will require you to open a new account under the Free Zone entity's documents.

When to Hire a Lawyer

Navigating the transition from mainland to a Free Zone is a high-stakes structural change. You should consult a legal professional if:

- You have complex commercial contracts with "Change of Control" clauses that could be triggered by the move.

- You are seeking "Qualifying Free Zone Person" status and need a formal tax substance audit.

- You have a large workforce and need a structured plan to manage the "cancel and re-hire" process without triggering labor disputes.

- You own significant intellectual property or real estate that must be legally transferred between entities.

Next Steps

- Conduct a Tax Impact Study: Determine if your income will actually qualify for the 0% rate before committing to the move.

- Select the Right Jurisdiction: Choose a "Designated Zone" if your business is goods-heavy, or a specialized zone like ADGM or DIFC for financial services.

- Audit Your Contracts: Identify which clients and vendors need to sign novation agreements.

- Initiate the Free Zone Setup: Secure your new license before beginning the cancellation of the mainland entity to ensure business continuity.

- Update the Federal Tax Authority: Ensure your VAT TRN (Tax Registration Number) is correctly linked to your new legal structure to avoid "failure to notify" penalties.