- Superannuation is not automatically part of your estate and requires a Binding Death Benefit Nomination (BDBN) to ensure it reaches your intended heirs.

- Digital or "informal" wills are legally risky in Australia and often lead to significant delays and thousands of dollars in additional Supreme Court costs.

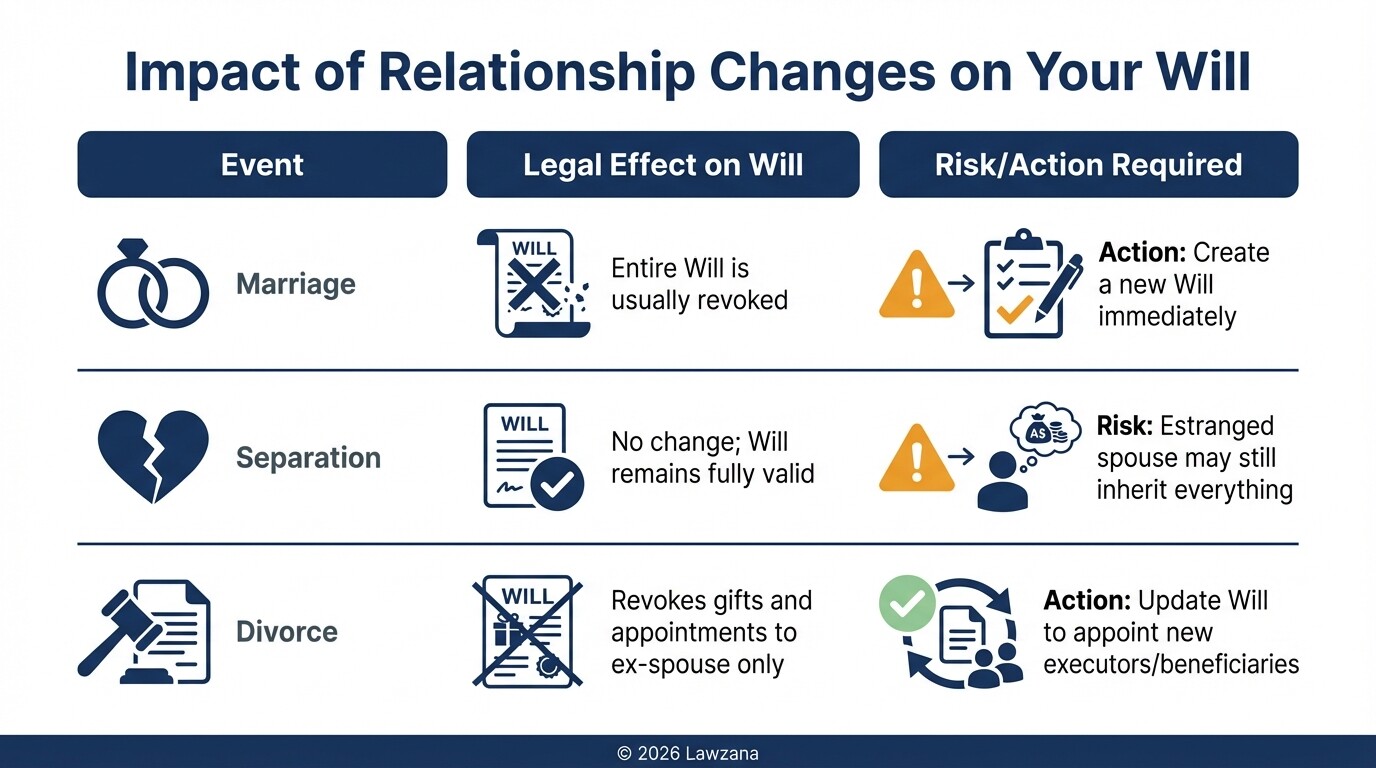

- Marriage typically revokes an existing will entirely, while divorce revokes only the sections pertaining to your former spouse.

- Family provision claims allow certain relatives to contest a will if they feel they were not adequately provided for, making precise drafting essential.

- Testamentary trusts can offer significant tax advantages and asset protection, particularly for minor children or beneficiaries at risk of bankruptcy.

Can a digital or video will be used for probate in Australia?

A digital or video will can be accepted by Australian courts, but it is highly discouraged because it does not meet the formal requirements of a valid will. Under state laws like the Succession Act, an "informal document" must clearly demonstrate the deceased's intent, which often requires a costly and lengthy Supreme Court application to prove.

While technology is evolving, the risks of relying on a digital file include:

- Probate Delays: A standard probate application takes a few weeks, but an informal digital will can delay the process by six to twelve months as the court investigates its validity.

- Increased Legal Costs: Executors may need to spend $5,000 to $15,000 in additional legal fees to prove the digital document was intended to be the final will.

- Strict Evidence Requirements: The court requires proof that the digital file was not tampered with and that the person had the mental capacity to create it at that specific moment.

- Vulnerability to Challenges: Informal wills are much easier for disgruntled relatives to contest compared to traditional, witnessed paper documents.

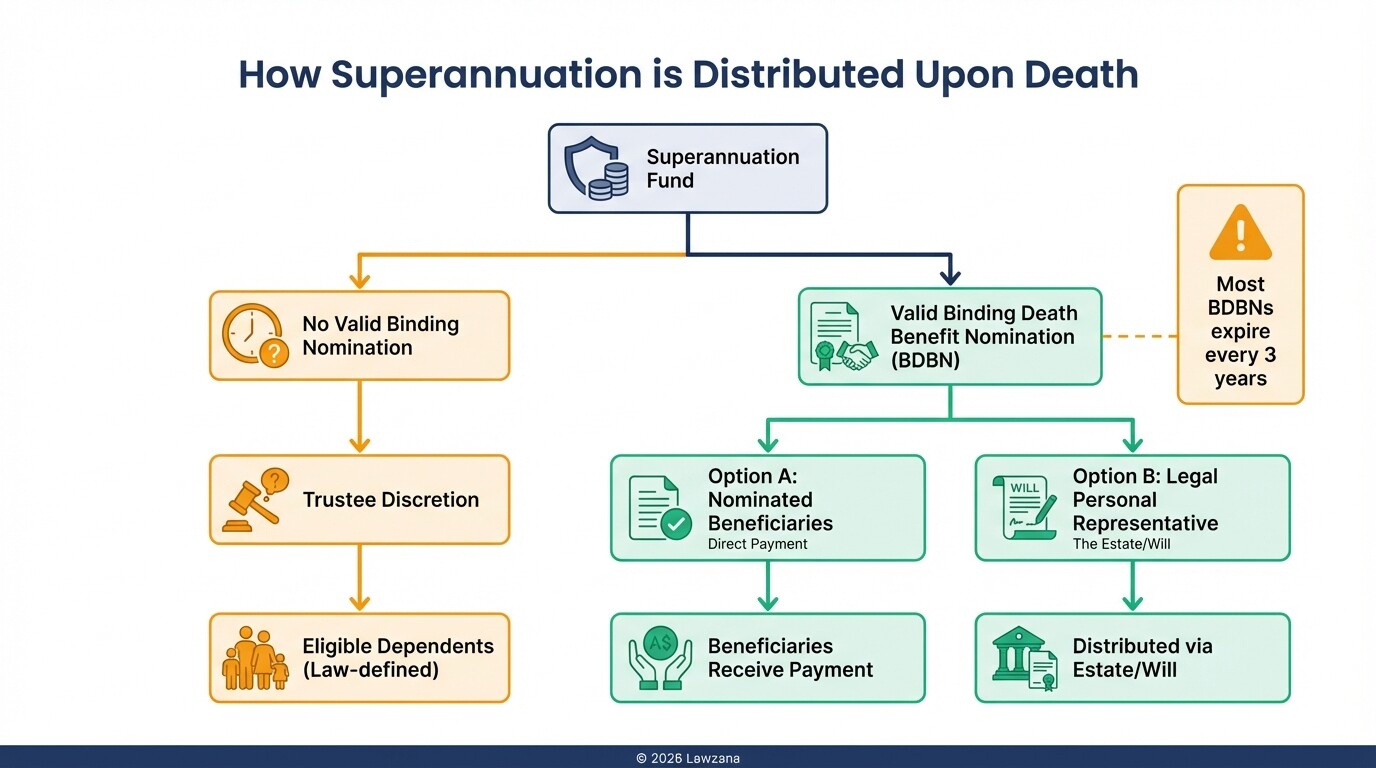

Why is my superannuation not automatically included in my will?

Your superannuation is held in a trust by the fund's trustee, meaning it is not an asset you personally own at the time of your death. To direct where these funds go, you must complete a Binding Death Benefit Nomination (BDBN) through your super fund; otherwise, the trustee has the discretion to decide who receives the payout.

To ensure your superannuation reaches your heirs, follow this checklist:

- Check the Nomination Type: Confirm if your nomination is "Binding" or "Non-Binding." Only a Binding nomination legally forces the trustee to follow your instructions.

- Review Lapsing Dates: Most BDBNs expire every three years. If yours lapses, it becomes non-binding, giving the trustee the power to choose your beneficiaries.

- Identify Eligible Dependents: You can only nominate "dependents" under superannuation law, which includes your spouse, children, or someone in an interdependent relationship with you.

- Coordinate with Your Will: If you want your super to be distributed according to your will, you must nominate your "Legal Personal Representative" (your estate) as the beneficiary on your BDBN form.

| Feature | Will Provision | Binding Death Benefit Nomination |

|---|---|---|

| Governing Law | State Succession Acts | Commonwealth Superannuation Law |

| Assets Covered | Real estate, bank accounts, personal items | Super balance and life insurance inside super |

| Control | Controlled by your Executor | Controlled by the Super Fund Trustee |

| Expiration | Valid until revoked or replaced | Usually expires every 3 years |

What drafting errors lead to family provision claims?

Common drafting errors include failing to explain why a close relative was excluded or using vague language that does not clearly define "adequate provision" for a dependent. In Australia, the court can override your will if an "eligible person" (such as a spouse, child, or former spouse) proves they have been left with insufficient financial support.

To minimize the risk of a claim, avoid these three mistakes:

- Silence on Disinheritance: If you are excluding a child or spouse, do not simply leave them out. Instead, have a lawyer draft a separate "Statement of Wishes" explaining the objective reasons for the exclusion, such as a long-term estrangement or prior financial gifts.

- Using Generic Templates: DIY will kits often lack the specific clauses needed to address complex family structures, such as blended families or adult children with disabilities.

- Inconsistent Asset Valuation: If you grant a specific asset (like a house) to one person and a cash sum to another, significant changes in the value of that house before you die can create an unintended imbalance that triggers a claim of unfairness.

How do marriage and divorce affect my estate plan in 2026?

In 2026, the legal standard in Australia remains that marriage automatically revokes any existing will unless that will was specifically drafted "in contemplation of" that marriage. Conversely, a divorce decree generally revokes any gift or appointment (like being named an executor) related to the former spouse, but it does not cancel the entire will.

Managing these timelines is critical for protecting your assets:

- Pre-Marriage Planning: If you are engaged, update your will now to include a "contemplation of marriage" clause to ensure it remains valid after your wedding day.

- The Separation Gap: Legal divorce can take over a year. During the separation period before the divorce is finalized, your old will is still fully valid. If you die while separated but not divorced, your estranged spouse may still inherit everything.

- De Facto Relationships: Australia recognizes de facto partnerships as having similar rights to marriage. If you enter a new relationship, your new partner may be entitled to a portion of your estate even if they are not mentioned in your will.

- Executor Appointments: Check who you have named as your executor. If your former spouse was the sole executor, your estate might be left without a leader if you do not update the document.

How does a testamentary trust protect my beneficiaries?

A testamentary trust is a trust created within your will that only comes into existence upon your death, offering a layer of protection that a simple will cannot provide. Instead of giving assets directly to a beneficiary, the assets are held by a trustee for the beneficiary's benefit, which keeps the assets out of the beneficiary's personal name.

Key advantages of this structure include:

- Asset Protection: Because the beneficiary does not legally own the assets, those assets are generally protected from creditors if the beneficiary faces bankruptcy or from an ex-partner during a divorce settlement.

- Tax Efficiency for Minors: In a standard trust, minors are taxed at high penalty rates on unearned income. However, through a testamentary trust, children are taxed at adult marginal rates, allowing them to use the $18,200 tax-free threshold.

- Control for Vulnerable Heirs: If a beneficiary struggles with addiction, gambling, or mental health issues, the trustee can manage the funds and provide for their needs without giving them a lump sum they might mismanage.

Common Misconceptions About Australian Wills

Myth: "I don't need a will because my family will just split everything anyway." Reality: If you die without a will (intestate), your assets are distributed according to a rigid government formula. This often results in your spouse and children receiving portions you didn't intend, or distant relatives inheriting over close friends. It also significantly increases the time it takes to settle your estate.

Myth: "Once I write a will, it's set in stone forever." Reality: A will is a living document. You should review it every three to five years or after any "life event," such as a birth, death, marriage, divorce, or a significant change in your financial position (like buying a house or starting a business).

Myth: "My Executor can do whatever they want with my money." Reality: Executors have a strict fiduciary duty to follow the will and act in the best interests of the beneficiaries. They can be held personally and financially liable by the Supreme Court if they mismanage the estate.

FAQ

What happens if I die without a will in Australia?

You are considered to have died "intestate." Each state has specific laws that dictate who inherits your assets, usually starting with your spouse and children. If no close relatives are found, your entire estate could go to the state government.

How much does it cost to make a will with a lawyer?

A simple will typically costs between $400 and $1,000. Complex estate plans involving testamentary trusts or business succession can range from $2,000 to $5,000+. While more expensive than a DIY kit, it prevents much higher costs associated with litigation later.

Can I witness my own will?

No. For a will to be valid, it must be signed by you in the presence of two adult witnesses who are not beneficiaries of the will. If a beneficiary witnesses the will, their gift may be voided by the court.

Do I need to register my will with the government?

Australia does not have a national or state-based mandatory will register. It is your responsibility to keep the original document in a safe place (like a solicitor's vault or a bank safety deposit box) and ensure your executor knows where it is.

When to Hire a Lawyer

While DIY kits are available, you should consult an estate planning lawyer if:

- You own a business or have a self-managed super fund (SMSF).

- You have a blended family or wish to exclude a biological child.

- You have assets located outside of Australia.

- You want to set up a testamentary trust for tax or protection purposes.

- You are concerned about your will being contested by a family member.

Next Steps

- Audit Your Assets: List all your bank accounts, properties, superannuation funds, and digital assets (like cryptocurrency).

- Check Your Super: Log in to your superannuation portal and confirm you have a current, valid Binding Death Benefit Nomination.

- Choose Your Executor: Select a trusted person who is organized and capable of handling administrative tasks.

- Consult a Professional: Schedule a meeting with an estate lawyer to discuss the best structure for your specific family needs.

- Secure Your Documents: Store your original will in a fireproof safe or with your lawyer and provide a copy to your executor.

For more information on tax implications of inherited assets, visit the Australian Taxation Office.