- Non-residents can legally purchase property in the UK, but they face a 2% Stamp Duty Land Tax (SDLT) surcharge on top of standard rates.

- Property ownership is divided into freehold (owning the building and land) and leasehold (owning the right to the building for a fixed term).

- The "Exchange of Contracts" is the critical legal point where a transaction becomes legally binding; before this, either party can withdraw without penalty.

- Strict Anti-Money Laundering (AML) regulations require foreign buyers to provide extensive proof of the source of their funds and wealth.

- A UK-based conveyancing solicitor is essential to manage legal transfers, title searches, and tax filings.

What is the difference between Freehold and Leasehold property?

Freehold means you own the property and the land it sits on outright and indefinitely. Leasehold means you own the right to occupy the property for a set number of years, often 99, 125, or 999 years, while the land remains owned by a freeholder.

When you buy a freehold house, you are responsible for all maintenance and insurance. In a leasehold arrangement, which is common for apartments or "flats," you typically pay annual ground rent and service charges to the freeholder for the upkeep of common areas and the building's structure.

| Feature | Freehold | Leasehold |

|---|---|---|

| Ownership Duration | Permanent | Fixed term (the "lease") |

| Land Ownership | Included | Retained by the Freeholder |

| Costs | No ground rent | Ground rent and service charges |

| Maintenance | Full responsibility | Often handled by a management company |

| Common Property Type | Detached or semi-detached houses | Apartments and urban flats |

What Anti-Money Laundering (AML) documents do non-residents need?

Non-resident buyers must provide comprehensive documentation to prove their identity and the legitimate origin of their investment capital. UK law requires solicitors and estate agents to perform "Know Your Customer" (KYC) checks to prevent financial crime.

As an international investor, you should prepare the following documentation well in advance:

- Proof of Identity: A valid passport or national ID card, often certified by a local notary or embassy.

- Proof of Address: Recent utility bills, bank statements, or a driver's license from your country of residence (usually dated within the last three months).

- Source of Funds (SOF): Bank statements showing the specific money you intend to use for the purchase.

- Source of Wealth (SOW): A broader explanation of how you accumulated your total net worth, such as inheritance records, employment contracts, or company sale documents.

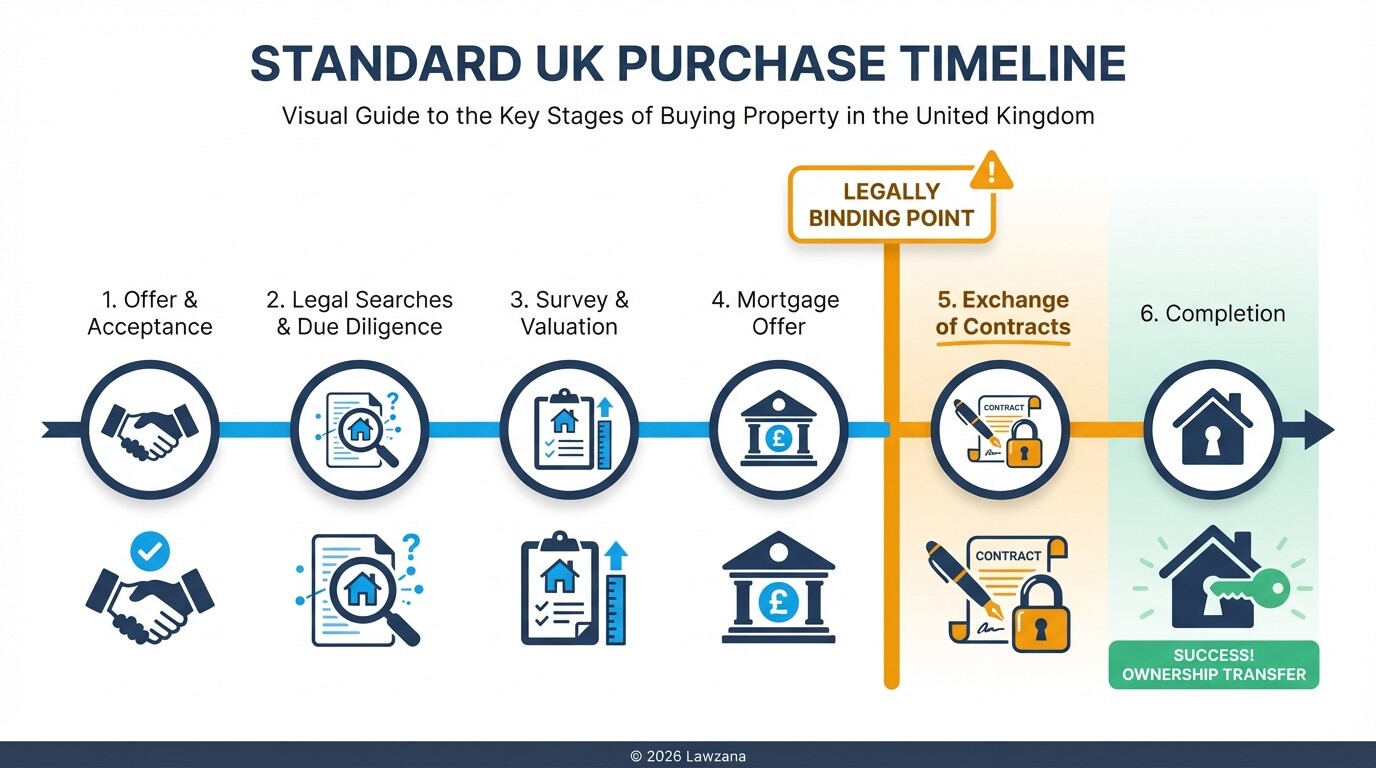

How does the conveyancing process and 'Exchange of Contracts' work?

Conveyancing is the legal transfer of property title from a seller to a buyer, managed by specialized solicitors. The process begins after an offer is accepted and culminates in the "Exchange of Contracts," which is the moment the deal becomes legally enforceable.

Unlike some jurisdictions where a signed offer is binding, in England and Wales, nothing is final until the solicitors for both sides literally exchange signed contracts and the buyer pays a deposit (usually 10%). If you pull out after the exchange, you will lose your deposit and may be sued for breach of contract.

The Standard UK Purchase Timeline

- Offer and Acceptance: The buyer makes an offer, and the seller accepts "subject to contract."

- Legal Searches: Your solicitor checks local authority records for planning issues, environmental risks, and water drainage.

- Survey and Valuation: A professional surveyor inspects the property's physical condition.

- Mortgage Offer: If you are financing the purchase, the lender issues a formal offer after their own valuation.

- Exchange of Contracts: Both parties sign the contract. The buyer pays the deposit. A completion date is set.

- Completion: The remaining balance is transferred. The buyer receives the keys and the solicitor registers the title with the HM Land Registry.

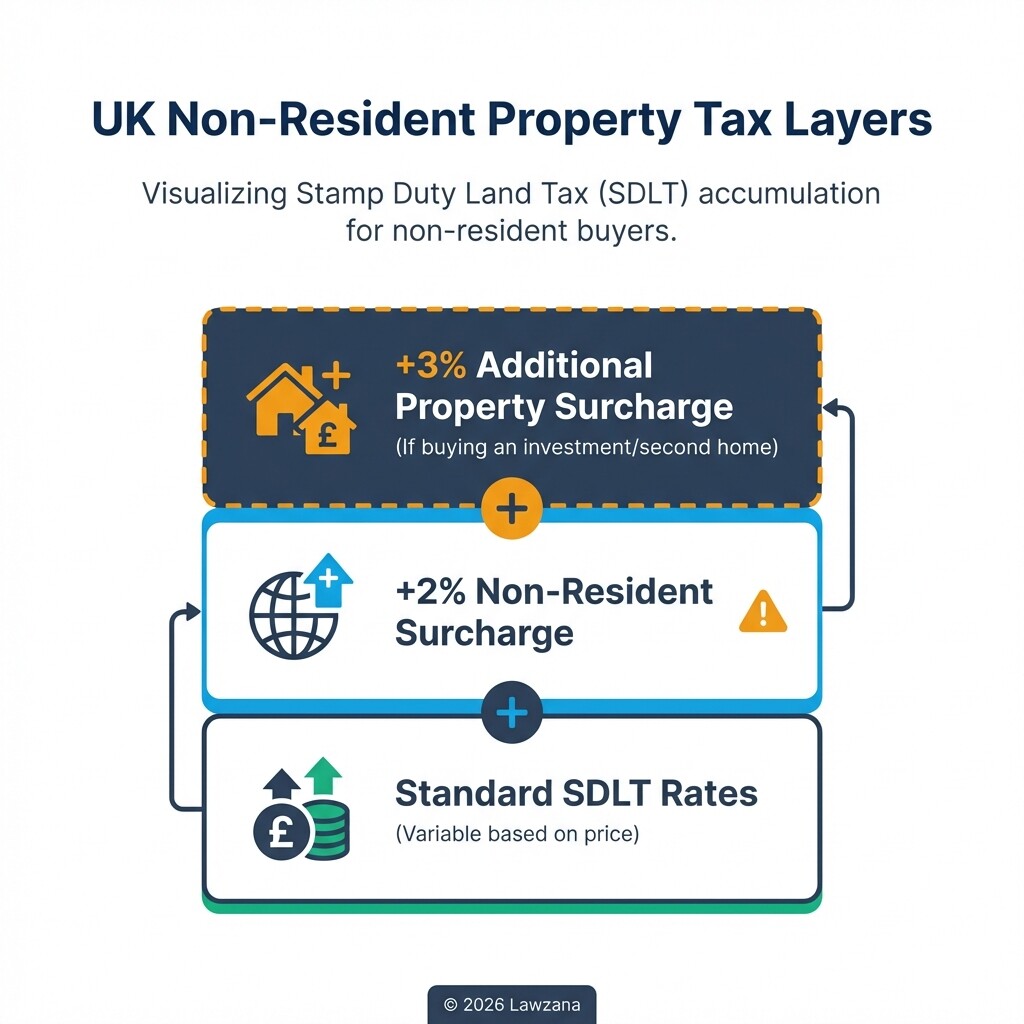

What are the Stamp Duty Land Tax (SDLT) rates for non-residents?

Non-residents purchasing residential property in England or Northern Ireland must pay a 2% surcharge on top of the standard Stamp Duty Land Tax rates. This surcharge applies if you have not been present in the UK for at least 183 days during the 12 months before your purchase.

This tax is calculated in "slices" based on the property price. For example, if you are a non-resident buying an investment property, you will likely pay both the 2% non-resident surcharge and the 3% surcharge for additional properties (second homes).

Residential SDLT Rates for Non-Residents (Including 2% Surcharge)

- Up to £250,000: 2%

- £250,001 to £925,000: 7%

- £925,001 to £1.5 million: 12%

- Over £1.5 million: 14%

Note: If the property is your only residence worldwide but you are a non-UK resident, these rates may vary. Always use the official GOV.UK SDLT calculator for precise figures.

How can buyers resolve disputes over construction defects?

If you purchase a new-build property that has structural defects or delays, you can resolve the issue through Alternative Dispute Resolution (ADR) rather than going to court. Most new-builds come with a 10-year structural warranty (such as NHBC or Premier Guarantee) that provides a specific dispute resolution framework.

For general disputes with estate agents or developers, you can use:

- The Property Ombudsman: An independent service that handles complaints about property professionals.

- Mediation: A voluntary process where a neutral third party helps both sides reach a settlement.

- Adjudication: Often used in construction contracts, where an expert makes a binding decision on technical issues.

Common Misconceptions About Buying UK Property

"Buying property automatically grants me a residency visa."

Purchasing real estate in the UK, regardless of the price, does not provide any immigration status or a right to live in the country. You must still qualify for a visa through standard Home Office routes if you intend to reside in the UK.

"The price on the listing is the final price."

In the UK, the "Asking Price" is a starting point. Properties often sell for significantly more in competitive markets, or less if a survey reveals issues. Additionally, you must budget for "hidden costs" like solicitor fees (typically £1,000 to £3,000), survey fees (£500 to £1,500), and Land Registry fees.

"I don't need a survey if the bank does a valuation."

A mortgage valuation is for the lender's benefit to ensure the property is worth the loan amount. It does not look for dry rot, structural cracks, or roof issues. International buyers should always commission an independent RICS (Royal Institution of Chartered Surveyors) survey to protect their investment.

Frequently Asked Questions

Can I buy property in the UK without visiting in person?

Yes, it is possible to complete the entire transaction remotely. You will need to appoint a UK solicitor and may need to have your identity documents verified by a local notary or through a secure digital verification platform.

How long does the purchase process take?

For a standard residential purchase, it usually takes 12 to 16 weeks from the time your offer is accepted to the day you get the keys. Delays often occur due to "chains" (where sellers are also buying another house) or slow local authority searches.

Is ground rent the same as a mortgage?

No. Ground rent is a fee paid by a leaseholder to the freeholder for the right to occupy the land. It is usually a small annual amount, though you should have your solicitor check for "doubling clauses" that could make the rent expensive over time.

Do I need a UK bank account to buy property?

While not strictly required by law, having a UK bank account makes paying monthly utilities, service charges, and taxes much easier. Most solicitors will accept funds from a verified international bank account if they can satisfy AML checks.

When to Hire a Lawyer

You should hire a conveyancing solicitor as soon as you begin your property search or immediately after your offer is accepted. In the UK, solicitors are not just for paperwork; they perform the "due diligence" that protects you from buying a property with legal "liens" (debts secured against the property), planning violations, or ownership disputes.

If you are an international buyer, seek a firm that specializes in "cross-border transactions." They will be more familiar with the specific AML requirements for foreign funds and the nuances of the 2% non-resident SDLT surcharge.

Next Steps

- Secure Your Financing: Obtain a "Mortgage in Principle" if you are not a cash buyer to prove to sellers you are a serious candidate.

- Appoint a Solicitor: Choose a firm regulated by the Solicitors Regulation Authority (SRA) and request a detailed quote for "disbursements" (third-party costs).

- Prepare Documentation: Organize your certified passport copies and six months of bank statements to satisfy AML requirements.

- Commission a Survey: Once your offer is accepted, hire a RICS-qualified surveyor to check the building's physical health.

- Review the Draft Contract: Work closely with your solicitor to understand any "restrictive covenants" (rules about what you can do with the property).