- Mandatory Approval: Most foreign entities must obtain written approval from the Treasurer via FIRB before acquiring interests in Australian commercial real estate or sensitive businesses.

- National Interest Test: Decisions are based on whether an investment aligns with Australia's national security, competition, tax integrity, and community impact.

- Conditionality is Critical: Never sign an unconditional contract for an Australian asset; all agreements must include a "Subject to FIRB Approval" clause to avoid massive penalties.

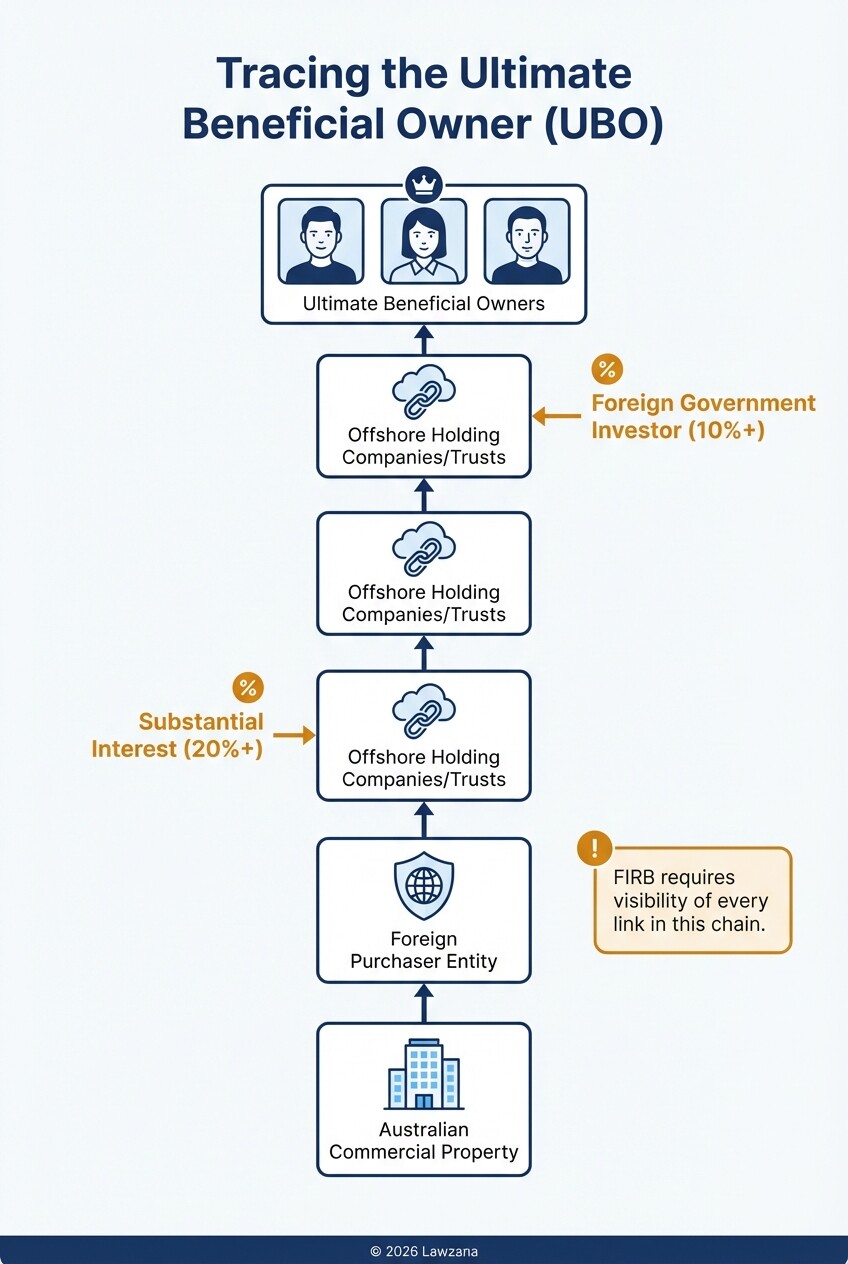

- Strict Documentation: Investors must disclose the entire ownership chain, identifying Ultimate Beneficial Owners (UBOs) who hold as little as 10% to 20% interest.

- 2026 Compliance Standards: Increased scrutiny now applies to "national security businesses," including data centers, telecommunications, and critical infrastructure, often with a $0 monetary threshold.

Understanding the Foreign Investment Review Board (FIRB)

The Foreign Investment Review Board (FIRB) is a non-statutory advisory body that examines foreign investment proposals to ensure they are not contrary to Australia's national interest. While the Treasurer makes the final decision, FIRB provides the essential framework and recommendations based on the Foreign Acquisitions and Takeovers Act 1975.

In 2026, the FIRB process has become increasingly rigorous, focusing on the protection of critical technology and data. The "national interest" test remains the primary benchmark, evaluating the investor's character, the impact on competition, and the transparency of the transaction. For commercial buyers, this means every acquisition-from a small warehouse to a major office tower-must be vetted against evolving geopolitical and economic standards.

FIRB Compliance Checklist and Sample Clause

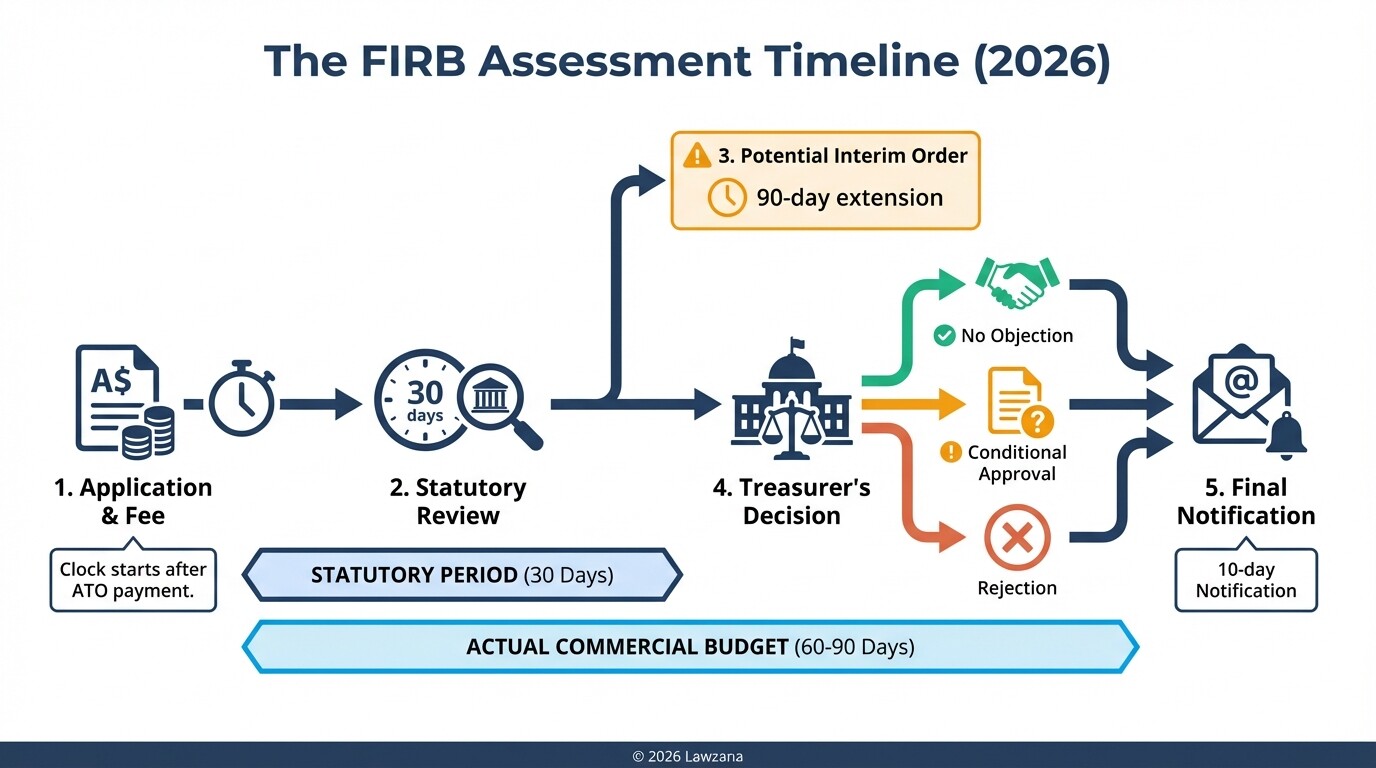

To secure approval, investors must provide a comprehensive "suitability" package to the Treasury. Missing even a single document can result in an "Interim Order," which legally pauses the clock for up to 90 days, potentially killing the deal.

Essential Documentation Checklist

- Entity Structure Chart: A visual diagram showing every entity between the Australian target and the individual Ultimate Beneficial Owners.

- Ultimate Beneficial Owner (UBO) Disclosures: Full names, citizenship, and residential addresses of individuals holding a "substantial interest" (usually 20% or more, or 10% for sensitive sectors).

- Financial Capability Evidence: Audited financial statements for the past two years or proof of funds from a recognized financial institution.

- Tax Compliance History: Declarations regarding the investor's global tax standing and commitment to comply with Australian Tax Office (ATO) requirements.

- Investment Rationale: A detailed statement explaining the commercial purpose of the acquisition and how it benefits the Australian economy (e.g., job creation, capital infusion).

Sample "Subject to FIRB Approval" Clause

Use the following language as a baseline for your Sale of Land or Asset Purchase Agreement. This ensures you are not in breach of Australian law if the Treasurer rejects the application.

"This Agreement is conditional upon the Purchaser obtaining a written statement of no objection (the 'FIRB Approval') from the Treasurer of the Commonwealth of Australia under the Foreign Acquisitions and Takeovers Act 1975 (Cth) in relation to the proposed acquisition. The Purchaser shall apply for FIRB Approval within [Number] business days of the Execution Date. If FIRB Approval is refused or granted subject to conditions that are not acceptable to the Purchaser (acting reasonably), either party may terminate this Agreement by written notice, and all deposit monies shall be refunded to the Purchaser."

Mandatory Notification Thresholds for 2026

The requirement to notify FIRB depends on the type of asset and the investor's origin. Australia grants higher thresholds to "Agreement Country Investors" (those from nations with specific free trade agreements, such as the U.S., NZ, or Japan) compared to general foreign investors.

| Asset Type | General Investor Threshold (AUD) | Agreement Country Threshold (AUD) |

|---|---|---|

| Sensitive Commercial Land | $0 (Always required) | $0 (Always required) |

| Non-Sensitive Commercial Land | $310 Million | $1,427 Million |

| National Security Business | $0 (Always required) | $0 (Always required) |

| Agribusiness | $71 Million | $1,427 Million |

| Critical Infrastructure | $0 (Always required) | $0 (Always required) |

Note: Thresholds are indexed annually on January 1. "Sensitive" commercial land includes property leased to government agencies or sites near military installations.

Disclosing Ownership and the 'Ultimate Beneficial Owner'

The Australian government requires total transparency regarding who truly controls the capital entering the country. You must look past shell companies and offshore trusts to identify the individuals at the end of the chain.

The FIRB application requires a deep dive into your corporate registry. If a foreign government or a "foreign government investor" (FGI) holds a stake of 10% or more in your organization, you may be subject to a $0 threshold for all investments, regardless of the asset type. Failing to disclose an FGI stake is considered a major breach, often leading to the rejection of the application and potential criminal prosecution.

Common Mistake: Entering Binding Contracts Without Protections

The most frequent error commercial buyers make is signing a binding contract before receiving FIRB clearance without a specific contingency clause. In Australia, a contract is legally binding the moment it is "exchanged."

If you sign an unconditional contract and the Treasurer later denies your application, you are legally obligated to complete a purchase that is now a criminal offense to finalize. This puts the buyer in an impossible position: face massive fines and forced divestment (selling at a loss) or breach the contract and lose the deposit (usually 10% of the purchase price). Always ensure your legal counsel inserts a "Subject to FIRB" clause before any money changes hands.

Timeline for Assessment and Handling Conditions

The statutory period for a FIRB decision is 30 days, followed by a 10-day notification period. However, in practice, commercial buyers should budget for 60 to 90 days for complex applications.

The Treasurer rarely issues an outright "no." Instead, they often issue a "No Objection Notification" with specific conditions. These may include:

- Tax Conditions: Requiring the investor to provide annual reports to the ATO.

- Governance Conditions: Mandating that a certain number of board members be Australian citizens.

- Data Security: Restricting where sensitive Australian data can be stored or accessed.

If the conditions are too burdensome, the investor has the right to withdraw the application, but they cannot proceed with the purchase without accepting them.

Penalties for Non-Compliance

The Australian government significantly increased penalties for foreign investment breaches to ensure the system's integrity. Non-compliance is monitored through the Register of Foreign Ownership of Australian Assets.

- Civil Penalties: Fines can exceed $500 million for major corporations or three times the "benefit gained" from the transaction.

- Criminal Penalties: For serious, intentional breaches, individuals can face up to 10 years in prison.

- Divestment Orders: The Treasurer has the power to force the sale of an asset if it was acquired without approval or if the national security landscape changes (the "Call-in Power").

Common Misconceptions

"We are a private company, so we don't need to disclose our investors."

FIRB regulations override standard corporate privacy. If you refuse to disclose your UBOs, your application will be rejected. The Australian government treats lack of transparency as a red flag for national security risks.

"If the threshold is $310 million and we buy for $300 million, we are safe."

Not necessarily. If the land is "sensitive" (e.g., it contains a telecommunications tower or is used by a defense contractor), the threshold drops to $0. You must perform "land use" due diligence before assuming you are below the threshold.

"FIRB approval is just a rubber stamp for commercial deals."

In 2026, the rejection rate for sensitive sectors is at a historic high. The government actively blocks deals that could give foreign powers influence over Australian supply chains or critical data.

FAQ

How much does a FIRB application cost in 2026?

Fees are tiered based on the value of the asset. For a commercial property valued between $50 million and $100 million, the fee is approximately $111,000 AUD. Fees must be paid upfront before the assessment begins.

Can I apply for FIRB approval after I buy the property?

No. You must receive a "No Objection Notification" before you "take an action" (settle the property). You can apply while the property is under a conditional contract, but you cannot complete the transfer of title.

Does FIRB apply to leasing commercial space?

Yes, if the lease term (including any options to renew) is likely to exceed five years. Foreign entities must seek approval for long-term commercial leases just as they would for a freehold purchase.

When to Hire a Lawyer

Navigating FIRB is a high-stakes legal requirement, not a mere administrative task. You should engage an Australian commercial lawyer if:

- You are unsure if your target asset falls under the "National Security Business" definition.

- Your ownership structure involves offshore trusts or foreign government entities.

- You are participating in a competitive bid and need to draft a "FIRB-proof" offer.

- You have received a "Notice of Interim Order" or a request for further information from the Treasury.

Next Steps

- Verify Your Status: Determine if your organization qualifies as a "Foreign Government Investor" or an "Agreement Country Investor."

- Conduct Land Due Diligence: Identify if the commercial property is "sensitive" by checking for government tenants or proximity to restricted sites.

- Draft the Clause: Ensure your solicitor includes a robust "Subject to FIRB" clause in the initial Heads of Agreement (HOA).

- Prepare the Fee: Allocate the necessary capital for the application fee, as the 30-day clock does not start until the payment is cleared by the Australian Taxation Office.