- The Cyprus IP Box regime provides a significant 80% tax exemption on qualifying profits, potentially lowering the effective corporate tax rate to 2.5%.

- Qualifying assets are strictly limited to patents and copyrighted software; trademarks and marketing-related IP are no longer eligible.

- Compliance is determined by the Nexus Approach, which links tax benefits directly to the amount of R&D expenditure incurred by the company in Cyprus.

- Documentation must be meticulous, tracking all R&D costs and local substance to satisfy the Cyprus Tax Department and EU anti-tax avoidance standards.

- Non-compliance risks include the total loss of the tax incentive and potential penalties under the EU Anti-Tax Avoidance Directive (ATAD).

What is the Cyprus IP Box Regime?

The Cyprus Intellectual Property (IP) Box is a tax incentive program designed to encourage technology companies to develop, maintain, and manage intangible assets within the jurisdiction. Under the current "Nexus Approach," companies can deduct 80% of their qualifying profits from their taxable income, resulting in an effective tax rate as low as 2.5%.

This regime is fully compliant with OECD and EU standards, ensuring that tax benefits are only granted to firms with genuine economic substance and localized research activities. For tech firms operating in 2026, the focus remains on proving that the IP was created or enhanced through tangible efforts within Cyprus rather than simply being held there for tax purposes.

2026 Compliance Checklist for Tech Firms

This checklist serves as a roadmap for international software and hardware companies to ensure their intellectual property remains eligible for the 80% exemption under the Nexus Approach.

| Compliance Action Item | Target Date/Frequency | Requirement Status |

|---|---|---|

| Verify IP Asset Eligibility | Prior to tax year start | Must be software or patent-related |

| Separate R&D Cost Centers | Monthly / Ongoing | Distinguish qualifying vs. non-qualifying costs |

| Local Substance Audit | Bi-Annually | Verify physical office and local R&D staff |

| Maintain IP Asset Register | Updated Annually | Track acquisition and development dates |

| Calculate Nexus Ratio | End of Fiscal Year | (Qualifying Exp. + Uplift) / Total Exp. |

| File Tax Form TD1 & TD4 | Per Statutory Deadlines | Professional audit required |

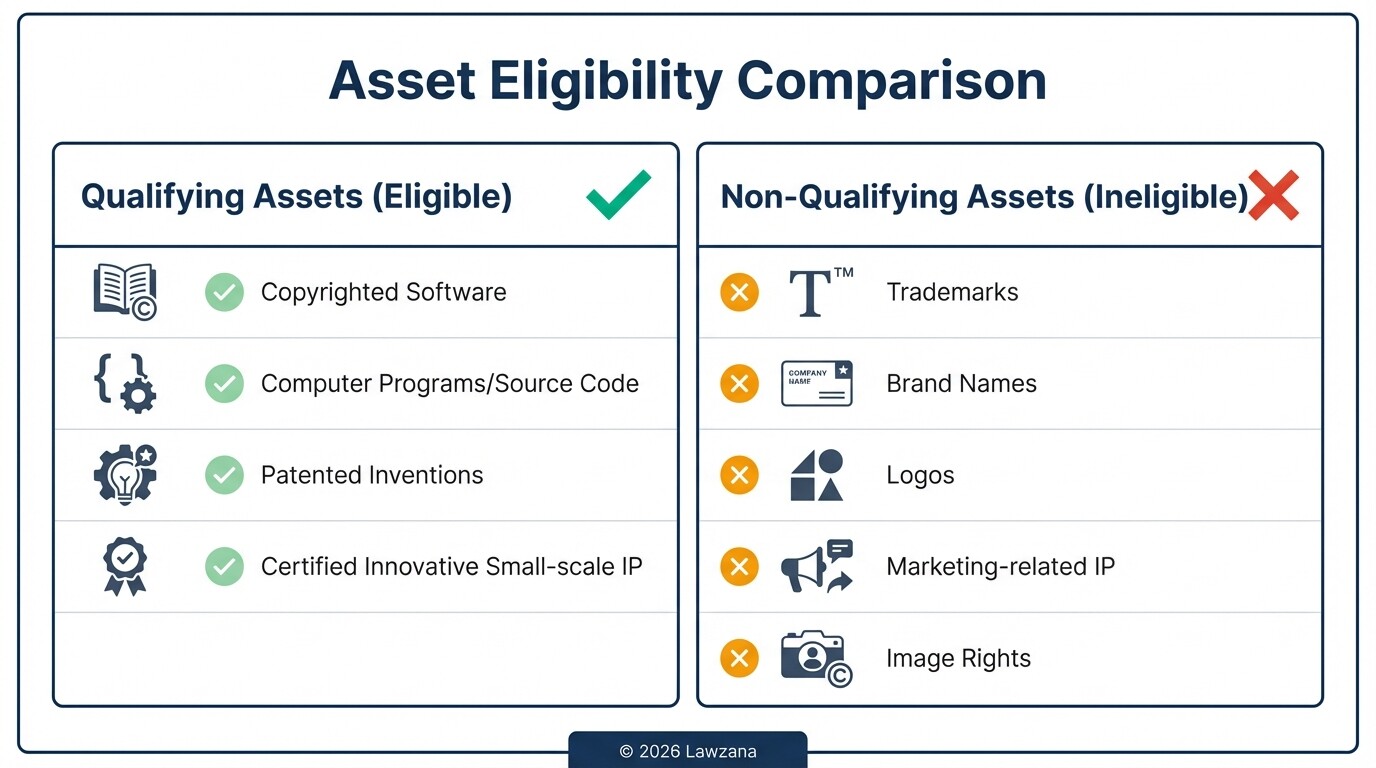

Defining Qualifying Intangible Assets Under the Nexus Approach

Qualifying Intangible Assets (QA) are restricted to assets that are legally protected and result from intensive research and development. Under the current Cyprus legislation (Income Tax Law, Section 9K), the regime excludes marketing-related IP, such as trademarks or brand names, to prevent "shell" company structures from claiming benefits.

To qualify in 2026, an asset must fall into one of these categories:

- Copyrighted Software: This includes computer programs, source code, and original software architectures.

- Patented Inventions: Patents granted under the Patents Law or recognized international patents.

- Other Innovation: Small-scale IP assets (for companies with specific turnover limits) that are certified as innovative by the Cyprus Research and Innovation Foundation.

The core principle is that the asset must be the result of "qualifying expenditure" incurred by the Cyprus entity, ensuring that the tax benefit is proportionate to the level of R&D performed locally.

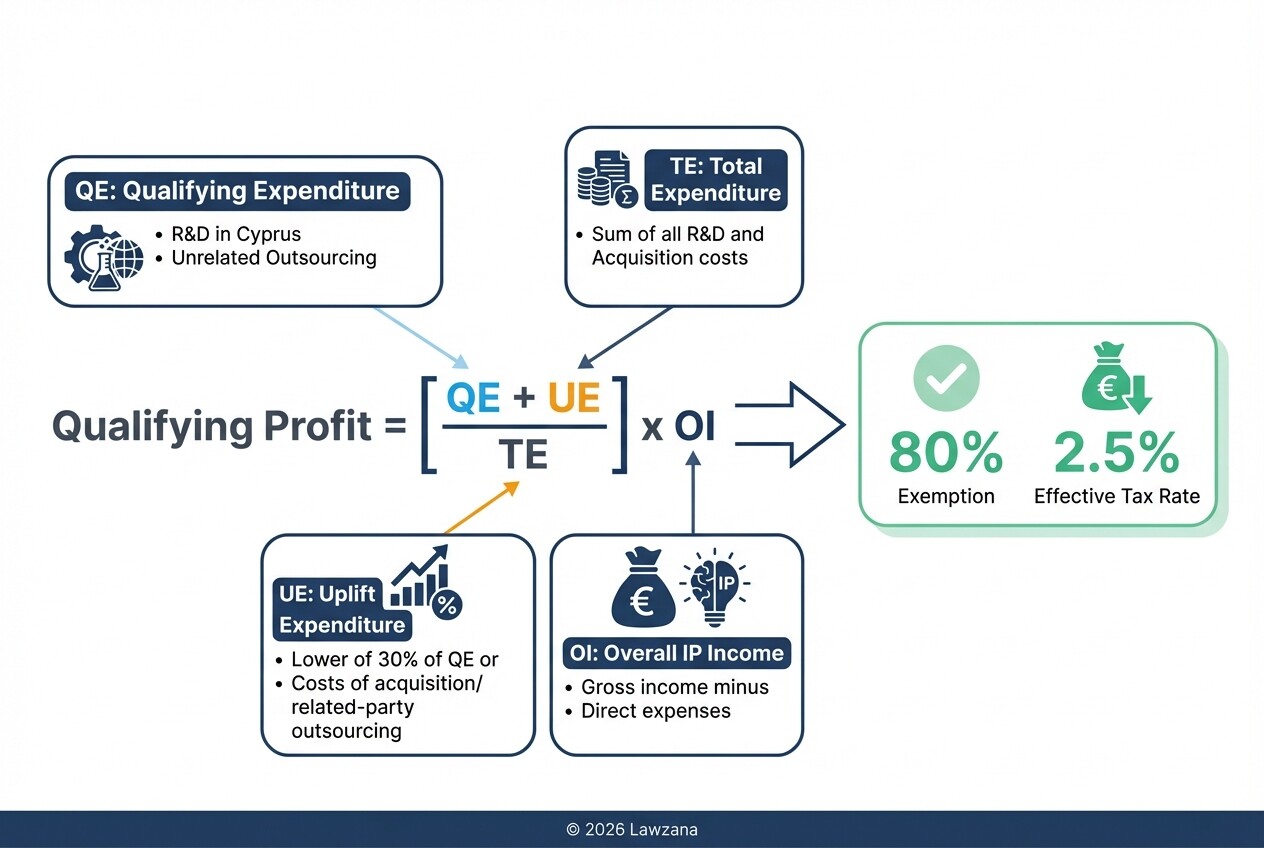

Calculation Methods for the 80% Tax Exemption

The calculation of the IP Box benefit follows a specific mathematical formula mandated by the Nexus Approach. This formula determines the portion of "Overall IP Income" that can benefit from the 80% deduction based on the ratio of "Qualifying Expenditure" to "Total Expenditure."

The formula is expressed as: Qualifying Profits = (QE + UE) / TE x OI

- QE (Qualifying Expenditure): Costs incurred by the Cyprus company for R&D performed in Cyprus or outsourced to unrelated parties.

- UE (Uplift Expenditure): A "buffer" amount equal to the lower of 30% of QE or the total cost of IP acquisition and R&D outsourced to related parties.

- TE (Total Expenditure): The sum of all costs incurred to develop the IP, including acquisition costs and R&D outsourced to related parties.

- OI (Overall IP Income): The gross income derived from the IP, minus direct expenses like amortization and maintenance.

Once the Qualifying Profit is determined, 80% of that figure is deducted from the company's taxable income, leaving only 20% to be taxed at the standard corporate rate of 12.5%.

Mandatory Documentation to Prove R&D Activities

The Cyprus Tax Department requires comprehensive documentation to justify the application of the IP Box regime. In 2026, digital tracking of time and resources is the standard for proving that R&D activities were genuinely carried out within the jurisdiction.

Essential documentation includes:

- Project Specifications: Detailed descriptions of the R&D objectives, technical challenges, and the innovative nature of the software or patent.

- Payroll Records: Evidence of local employees (engineers, developers, data scientists) dedicated to the IP project, including their qualifications and time logs.

- Invoices and Contracts: Clear records of payments made to third-party R&D providers or local subcontractors.

- Asset Register: A chronological history of the IP, from initial conception to the current version or patent grant.

Failure to provide a clear "nexus" between the expenses and the income-generating IP can lead to the Tax Department rejecting the claim during an audit.

Annual Audit Requirements and Tax Filing Timelines

Every Cyprus company claiming the IP Box incentive must undergo an annual audit by a licensed firm and adhere to strict filing timelines. The financial statements must clearly reflect the segregation of IP-related income and expenses from the company's other commercial activities.

Important deadlines and requirements include:

- Audited Financial Statements: Must be prepared in accordance with International Financial Reporting Standards (IFRS) and submitted annually.

- Corporate Tax Return (Form TD4): This form includes specific schedules for the IP Box calculation and must be submitted via the TaxisNet portal.

- Payment of Provisional Tax: Companies must estimate their income and pay provisional tax in two installments (usually July 31 and December 31).

- Final Tax Settlement: Any remaining tax due for a specific year must be paid by August 1 of the following year to avoid interest and penalties.

The Cyprus Tax Department provides updated circulars regarding the electronic submission of these documents, which is mandatory for all corporate entities.

Risks of Non-Compliance with EU Anti-Tax Avoidance Directives

As an EU member state, Cyprus adheres to the Anti-Tax Avoidance Directives (ATAD I and II). These directives are designed to ensure that profits are taxed where the economic activity occurs and where value is created.

The primary risks for tech firms include:

- Substance Challenges: If the Cyprus entity has no physical office or qualified staff, the EU may view it as a "letterbox company," leading to the denial of the 2.5% effective rate.

- Transfer Pricing Risks: Transactions between the Cyprus firm and its parent or sister companies (e.g., license fees) must be at "arm's length." If the Tax Department determines the prices are artificial, they can adjust the taxable income upward.

- Exit Taxes: If a company develops IP in Cyprus and then tries to move it to a low-tax jurisdiction outside the EU without proper valuation, exit taxes may be triggered under ATAD.

Common Misconceptions

Myth 1: Any tech company can claim the 2.5% rate.

Only companies that actively perform R&D and own "qualifying" IP (patents or software) are eligible. Firms that merely resell software or act as distributors do not qualify for the IP Box regime.

Myth 2: Trademarks and brand names are still covered.

This changed several years ago. Under the current Nexus-compliant rules, marketing-related intangibles like trademarks, logos, and brands are strictly excluded from the 80% exemption.

Myth 3: Outsourcing R&D to a parent company does not affect the tax benefit.

Outsourcing to related parties (like a parent company in another country) is considered "non-qualifying expenditure" in the Nexus formula. This directly reduces the portion of profit that qualifies for the 80% exemption.

FAQ

Does the IP Box regime apply to mobile apps?

Yes, as long as the mobile application's source code is copyrighted and the development/R&D was conducted or managed by the Cyprus entity.

Can a company use both the IP Box and the R&D tax credit?

Yes, Cyprus allows for the 80% exemption on IP profits while also permitting companies to deduct 100% (and in some cases up to 120%) of their actual R&D expenses from their taxable income.

What happens if the R&D results in a loss?

If the IP activities result in a tax loss, only 20% of that loss can be carried forward or surrendered for group relief in that specific tax year.

Is there a minimum number of employees required?

There is no "hard number," but the company must demonstrate "adequate" substance. For a tech firm, this typically means having at least one or more qualified developers or managers physically based in Cyprus.

When to Hire a Lawyer

Navigating the Cyprus IP Box regime requires more than just accounting; it requires a structural legal strategy. You should consult a legal professional if you are:

- Structuring the initial acquisition or transfer of IP into a Cyprus entity.

- Drafting inter-company licensing agreements that must comply with Transfer Pricing regulations.

- Facing an audit or challenge from the Tax Department regarding the "qualifying" status of your software.

- Navigating the cross-border legalities of the EU Anti-Tax Avoidance Directive.

Next Steps

- Conduct an IP Audit: Identify which of your current assets qualify as "Copyrighted Software" or "Patents."

- Review Substance: Ensure your Cyprus office has the physical presence and personnel required to support the Nexus Approach.

- Establish Accounting Segregation: Set up your bookkeeping to track R&D expenses separately from general administrative costs.

- Consult with a Specialist: Reach out to a Cyprus-based corporate lawyer or tax advisor to validate your Nexus ratio calculation before the 2026 filing season.