- Startups registered as Private Limited Companies must file annual financial statements (AOC-4) and annual returns (MGT-7) with the Registrar of Companies (RoC).

- Failure to comply with the Companies Act, 2013, can lead to penalties ranging from ₹100 per day to director disqualification for up to five years.

- Employee Stock Option Plans (ESOPs) require a special resolution and a formal valuation report from a Registered Valuer to be legally valid.

- Missing the mandatory four annual Board Meetings is a serious breach that can result in personal liability for the startup's directors.

- Sweat equity is capped at 15% of the existing paid-up share capital per year, whereas Founder's Shares are typically issued at the time of incorporation.

What are the required annual filings and documentation for Indian private limited companies?

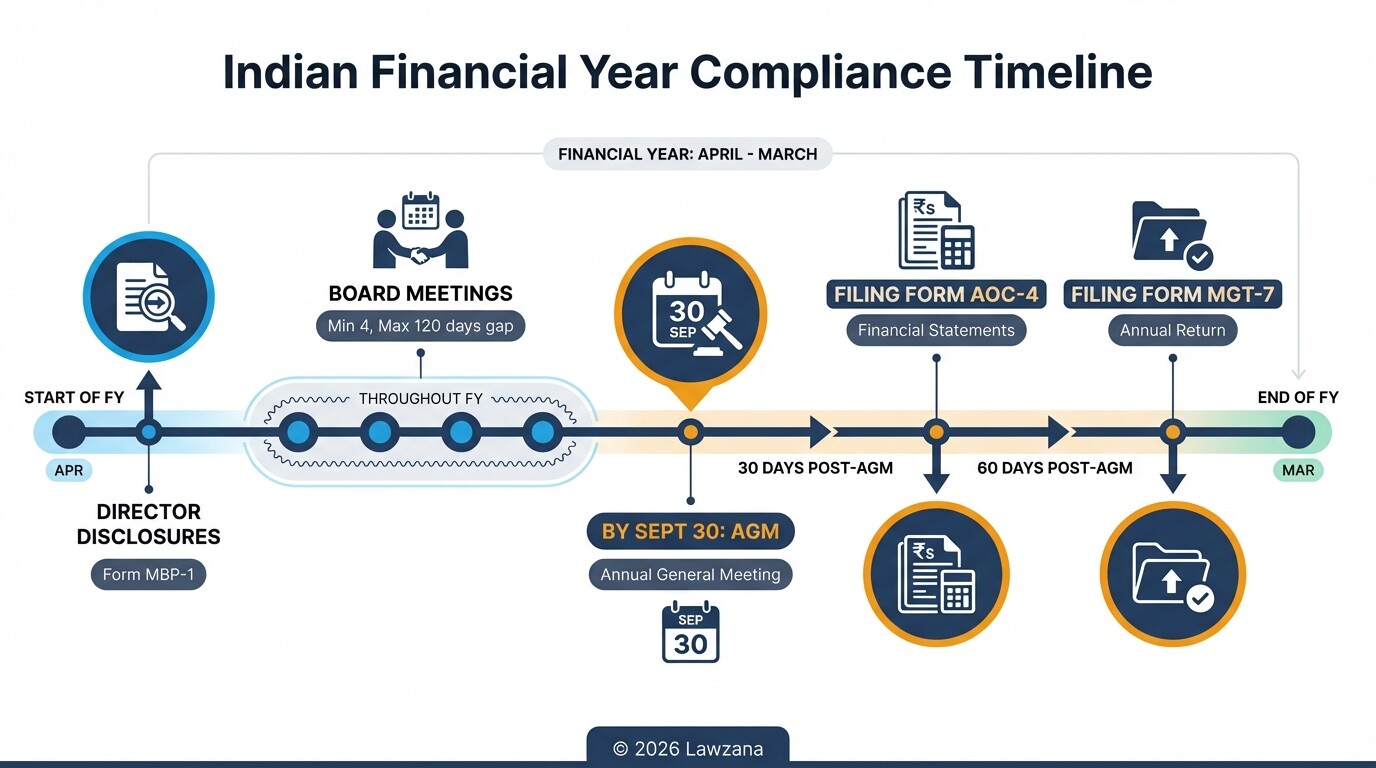

Every private limited company in India must complete annual compliance filings with the Ministry of Corporate Affairs (MCA) to maintain its "active" status. The primary filings include Form AOC-4 for financial statements and Form MGT-7 for the annual return, both of which must be submitted following the company's Annual General Meeting (AGM).

To stay compliant, startups should follow this annual checklist:

- Financial Statements (Form AOC-4): This includes the Balance Sheet, Profit and Loss Account, and the Director's Report. It must be filed within 30 days of the AGM.

- Annual Return (Form MGT-7): This document contains details of the registered office, shares, indebtedness, and changes in management. It must be filed within 60 days of the AGM.

- Director's Disclosure (Form MBP-1): Every director must disclose their interest in other entities in the first board meeting of every financial year.

- Director KYC (Form DIR-3 KYC): Directors must update their Know Your Customer (KYC) details annually with the MCA to keep their Director Identification Number (DIN) active.

- Audit Requirements: Regardless of turnover, every company must appoint a statutory auditor and have its accounts audited annually.

Failure to meet these deadlines results in an additional fee of ₹100 per day per form. If a company fails to file for two consecutive years, it may be struck off the register, and its directors may be barred from joining other boards.

What are common mistakes when issuing ESOPs to employees?

The most frequent mistake Indian startups make with Employee Stock Option Plans (ESOPs) is failing to comply with the procedural requirements of the Companies Act, 2013. Many founders treat ESOPs as informal promises rather than legal instruments, leading to disputes during funding rounds or exits when investors find the "cap table" is not legally sound.

Common pitfalls to avoid include:

- Missing Special Resolutions: Issuing ESOPs requires the approval of shareholders through a special resolution (75% majority). An ordinary board resolution is insufficient.

- Incorrect Valuation: Options must be granted based on a fair market value determined by a SEBI-registered Merchant Banker (for listed companies) or a Registered Valuer (for unlisted startups).

- Vesting and Exercise Confusion: Startups often fail to clearly define the "Vesting Period" (minimum 1 year) and the "Exercise Period." Without a written ESOP Scheme document, the grant is legally unenforceable.

- Tax Oversight: Founders often forget that ESOPs are taxed as a perquisite (part of salary) when the employee exercises the options, which can lead to unexpected tax burdens for the staff.

How do Sweat Equity and Founder's Shares compare under Indian law?

Founder's Shares are the initial equity issued to the creators of the company at the time of incorporation, usually at a nominal price. In contrast, Sweat Equity is issued to directors or employees at a discount or for consideration other than cash as a reward for providing technical know-how or intellectual property rights.

The following table highlights the key legal differences:

| Feature | Founder's Shares | Sweat Equity Shares |

|---|---|---|

| Eligibility | Original subscribers to the MoA | Directors or permanent employees |

| Pricing | Nominal value (e.g., ₹1 or ₹10) | Based on a Registered Valuer's report |

| Approval | Board resolution at incorporation | Special resolution by shareholders |

| Lock-in Period | Generally no statutory lock-in | Mandatory 3-year lock-in period |

| Maximum Limit | No limit (up to authorized capital) | Capped at 15% of total capital or ₹5 crores |

For startups, sweat equity is an excellent way to reward "non-founding" early hires who bring massive value, but it requires much stricter regulatory documentation than the original founder's allotment.

What is the legal impact of missing Board Meeting deadlines?

Missing the deadlines for Board Meetings is a violation of Section 173 of the Companies Act, 2013, which stipulates that every company must hold its first board meeting within 30 days of incorporation and at least four meetings every year. The interval between two consecutive board meetings must not exceed 120 days.

The legal and operational impacts of missing these deadlines include:

- Director Liability: Every "Officer in Default" (which includes all directors) can be fined ₹25,000 for each instance of non-compliance.

- Vacation of Office: If a director absents themselves from all meetings of the Board held during a period of 12 months, with or without seeking leave of absence, they automatically vacate their office under Section 167.

- Invalidation of Decisions: Decisions made "on the fly" without a formal meeting may be challenged by minority shareholders or investors during due diligence.

- Compounding of Offenses: To rectify the skip, the company may need to apply for "compounding" with the Regional Director or the National Company Law Tribunal (NCLT), which involves a legal process and additional fines.

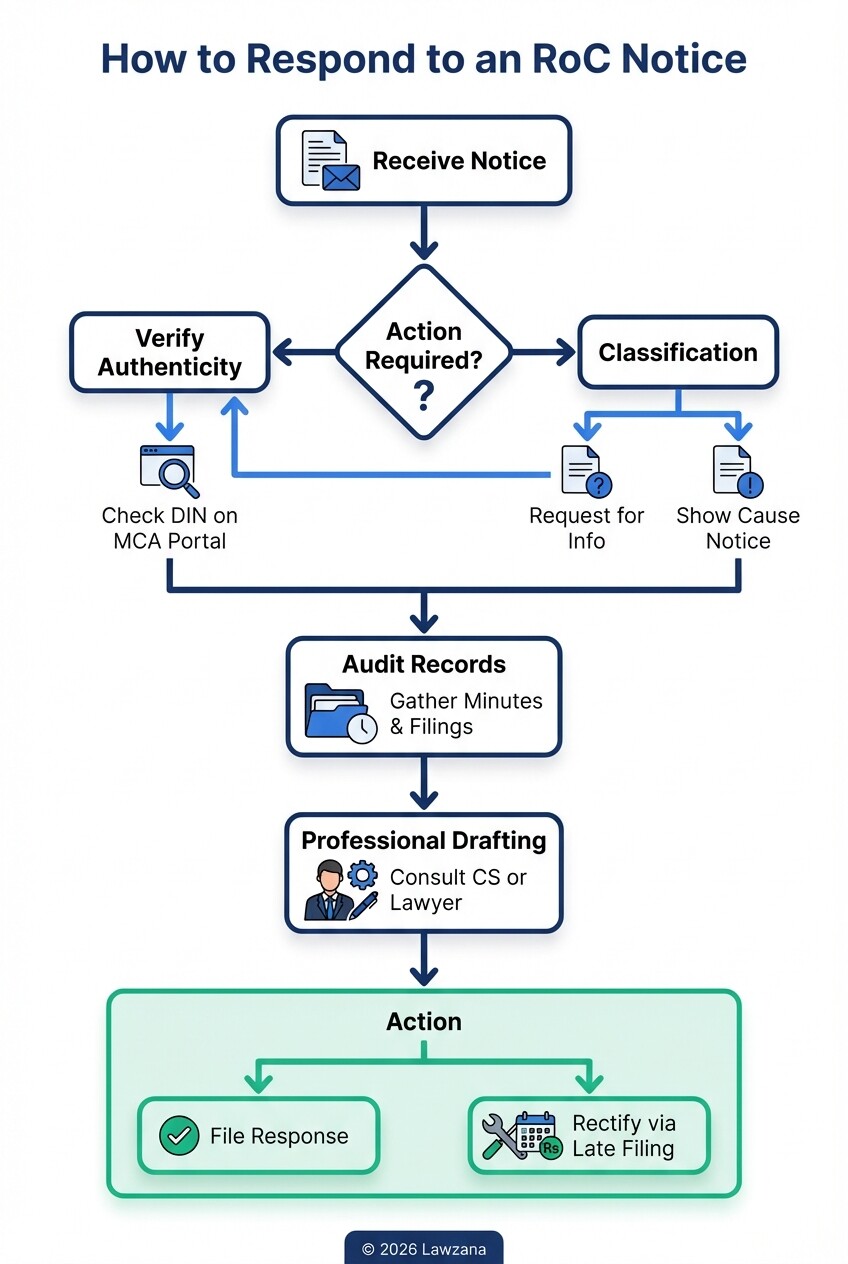

What steps should a startup take when receiving a notice from the Registrar of Companies (RoC)?

A notice from the RoC is a formal inquiry or order regarding a perceived non-compliance, such as an unfiled form, a discrepancy in financial statements, or a complaint from a shareholder. Ignoring an RoC notice is a "red flag" that can lead to a full-scale inspection or an order for the winding up of the company.

If your startup receives a notice, follow these steps immediately:

- Verify the Notice: Confirm the authenticity of the notice by checking the Document Identification Number (DIN) on the Ministry of Corporate Affairs portal.

- Analyze the Allegation: Identify the specific section of the Companies Act cited. It could range from a simple "Notice for Information" to a more serious "Show Cause Notice."

- Gather Evidence: Collect all relevant records, such as minutes books, share certificates, and bank statements, that prove your compliance.

- Draft a Professional Response: The reply should be formal, addressing each point in the notice. It must be signed by a director or an authorized Company Secretary (CS).

- Admit and Rectify (If Applicable): If the notice is for a missed filing, the best course of action is often to file the missing document with the late fee and inform the RoC of the rectification in your response.

Common Misconceptions About Indian Corporate Compliance

Misconception 1: "We are a small startup, so we don't need a formal audit."

In India, every Private Limited Company must have its accounts audited by a Chartered Accountant, regardless of its turnover or profit status. There is no "startup exemption" for the annual statutory audit.

Misconception 2: "If we aren't doing any business, we don't need to file anything."

Even if a company has zero transactions, it must still file annual returns and financial statements. If you truly wish to stop operations, you must formally apply for "Dormant Status" or "Strike Off" the company via Form STK-2; otherwise, penalties will continue to accrue.

Misconception 3: "Board meetings must always be held in person."

Under current Indian law, startups can hold board meetings via video conferencing, provided the proceedings are recorded and the quorum is met. This is a vital tool for founders with international directors.

FAQ

What is the minimum number of directors required for an Indian startup?

A Private Limited Company must have at least two directors. At least one of these directors must be a resident of India (someone who has stayed in India for at least 182 days in the previous financial year).

Can a startup issue shares to a foreign investor immediately?

Yes, but the company must comply with Foreign Direct Investment (FDI) guidelines set by the Reserve Bank of India. This involves filing the Foreign Collaboration-General Permission Route (FC-GPR) form within 30 days of issuing the shares.

What happens if I miss the AGM deadline?

The Annual General Meeting must be held within six months of the closing of the financial year (usually by September 30th). If missed, you must apply to the RoC for an extension or face a penalty of up to ₹1 lakh, with additional daily fines for continued default.

When to Hire a Lawyer

While a Company Secretary (CS) handles most routine filings, you should consult a corporate lawyer in the following scenarios:

- Drafting or amending the Articles of Association (AoA) for a new funding round.

- Receiving a "Show Cause Notice" from the RoC or an investigation notice from the Serious Fraud Investigation Office (SFIO).

- Structuring complex ESOP schemes or cross-border share transfers.

- Resolving disputes between founders or with minority shareholders.

- Navigating the legalities of a merger, acquisition, or liquidation.

Next Steps

- Conduct a Compliance Audit: Review your MCA dashboard to ensure all AOC-4 and MGT-7 filings for previous years are marked "Approved."

- Set a Compliance Calendar: Mark your 120-day deadlines for Board Meetings and your September 30th AGM deadline.

- Review Share Allotments: Ensure every share issued to founders or employees is backed by a valuation report and a formal board resolution.

- Consult an Expert: If you have received a notice or realized you have missed multiple filings, contact a corporate lawyer to discuss "suo motu" compounding of offenses to avoid higher penalties later.