- UK private companies are increasingly expected to follow the Wates Corporate Governance Principles to demonstrate transparency and accountability.

- Section 172 of the Companies Act 2006 requires directors to act in a way that promotes the success of the company for the benefit of its members while considering employees, suppliers, and the environment.

- New internal control reporting requirements under the 2024 UK Corporate Governance Code will become a benchmark for large private entities starting in 2026.

- ESG (Environmental, Social, and Governance) disclosures are no longer optional for large private companies meeting specific size thresholds.

- Rigorous minute-taking is the primary legal defense for directors to prove they have met their fiduciary duties during board deliberations.

UK Corporate Governance Compliance Checklist

Corporate governance in the UK involves a framework of rules and practices by which a company is directed and controlled. For private companies, this ensures long-term sustainability and builds trust with investors, lenders, and regulators.

Use this checklist to evaluate your company's alignment with current UK standards:

| Governance Area | Action Item | Regulatory Reference |

|---|---|---|

| Board Leadership | Establish a clear company purpose and strategy aligned with healthy culture. | Wates Principle 1 |

| Section 172 | Include a "Section 172(1) Statement" in the Strategic Report for large companies. | Companies Act 2006 |

| Board Composition | Ensure a balance of skills, experience, and at least one independent voice. | Wates Principle 3 |

| Risk Management | Implement a robust internal control framework to be reviewed annually by the board. | UK Governance Code 2024 |

| Remuneration | Align executive pay with long-term company performance and employee scales. | Wates Principle 5 |

| Stakeholders | Document how the board engages with the workforce, customers, and suppliers. | The Companies (Miscellaneous Reporting) Regulations 2018 |

Board Composition, Diversity, and Director Independence

Board composition in the UK focuses on creating a "balanced board" where no single individual or small group can dominate decision-making. Effective boards for private companies should prioritize a mix of functional expertise, industry knowledge, and diverse perspectives to avoid "groupthink."

While private companies are not strictly bound by the same quotas as FTSE 350 companies, the trend is moving toward higher transparency. Diversity is not merely about protected characteristics like gender or ethnicity; it encompasses "cognitive diversity," or different ways of approaching problems. For large private companies, appointing at least one Independent Non-Executive Director (NED) is now considered a best practice. An independent director is someone who has no financial or personal ties to the company, providing an objective "critical friend" perspective to the founders or majority shareholders.

- Skills Matrix: Maintain a document that maps the current board's skills against the company's five-year strategy to identify recruitment gaps.

- Succession Planning: Formalize a plan for the orderly replacement of key directors and senior management to ensure business continuity.

- Independence Criteria: Evaluate potential NEDs for conflicts of interest, such as prior employment with the firm or significant shareholdings.

Reporting Duties Under Section 172 of the Companies Act

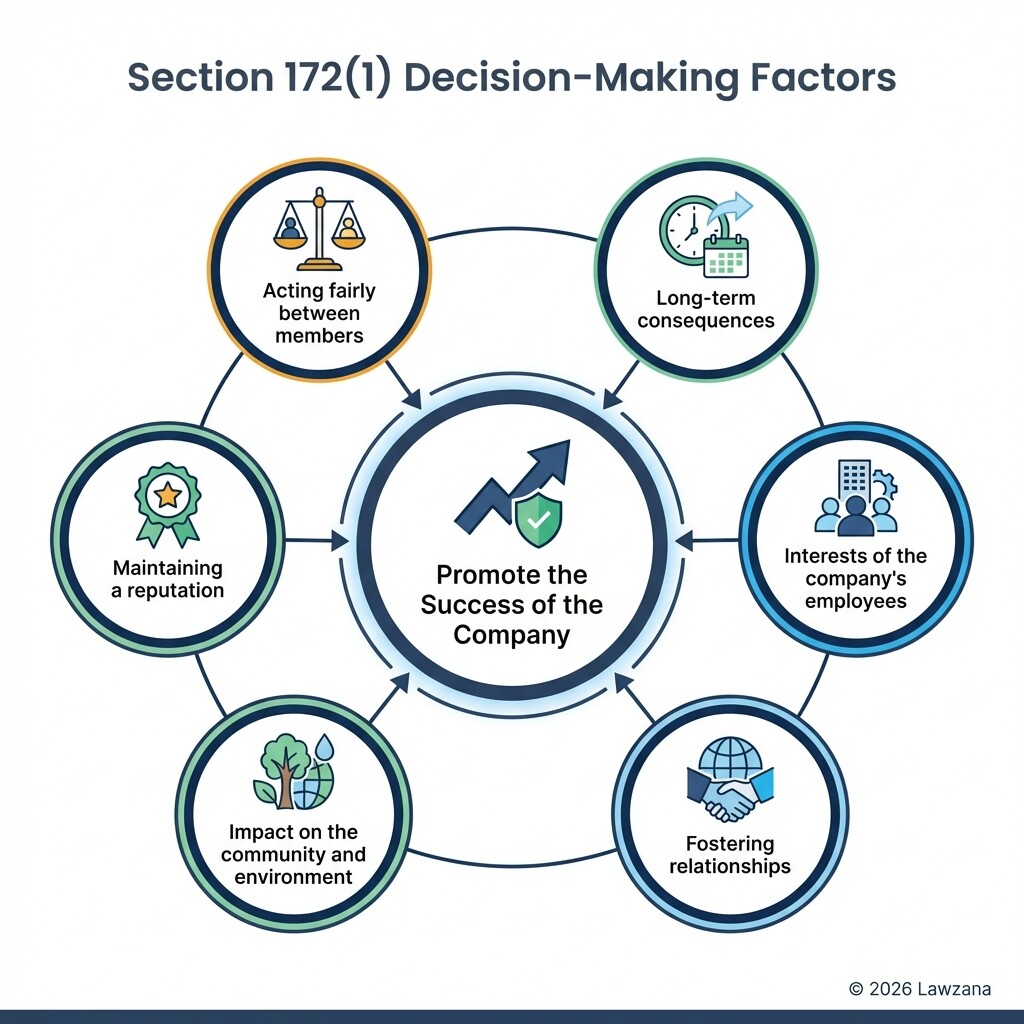

Section 172 of the Companies Act 2006 mandates that a director must act in good faith to promote the success of the company for the benefit of its members as a whole. This "enlightened shareholder value" approach requires directors to consider the long-term consequences of their decisions and the interests of various stakeholders.

Large private companies must include a Section 172 statement in their annual Strategic Report. This statement explains how the directors have had regard to the matters set out in s172(1)(a) to (f), which include the interests of employees, the need to foster business relationships with suppliers and customers, and the impact of operations on the community and environment. It is not enough to simply list these factors; the report must provide specific examples of how stakeholder interests influenced significant board decisions during the year.

- Stakeholder Mapping: Identify who your key stakeholders are and establish formal channels for feedback, such as employee forums or supplier surveys.

- Decision Impact Analysis: When making major board decisions (like an acquisition or a mass redundancy), explicitly record how the s172 factors were weighed in the meeting minutes.

- Annual Review: Ensure the Section 172 statement is accessible on the company website if the company meets the "large" criteria.

ESG Disclosure Expectations for Large Private Companies

ESG disclosure in the UK has transitioned from voluntary "green" marketing to a mandatory regulatory requirement for large private entities. Companies meeting certain thresholds regarding turnover, balance sheet total, or employee count must now report on their environmental impact and social governance.

The Streamlined Energy and Carbon Reporting (SECR) framework requires large companies to disclose their energy use and greenhouse gas emissions in their Directors' Report. Furthermore, for companies with over 500 employees and £500 million in turnover, TCFD-aligned (Task Force on Climate-related Financial Disclosures) reporting is often necessary. Social disclosures are equally critical, focusing on modern slavery statements, gender pay gap reporting, and health and safety records.

- Threshold Check: Confirm if your company exceeds £36 million in turnover or £18 million in balance sheet total, which triggers various reporting obligations.

- Carbon Footprinting: Establish a baseline for Scope 1 (direct) and Scope 2 (indirect energy) emissions to comply with SECR.

- Supply Chain Audit: Implement a code of conduct for suppliers to mitigate risks related to labor exploitation and environmental non-compliance.

Internal Control and Risk Management Frameworks for 2026

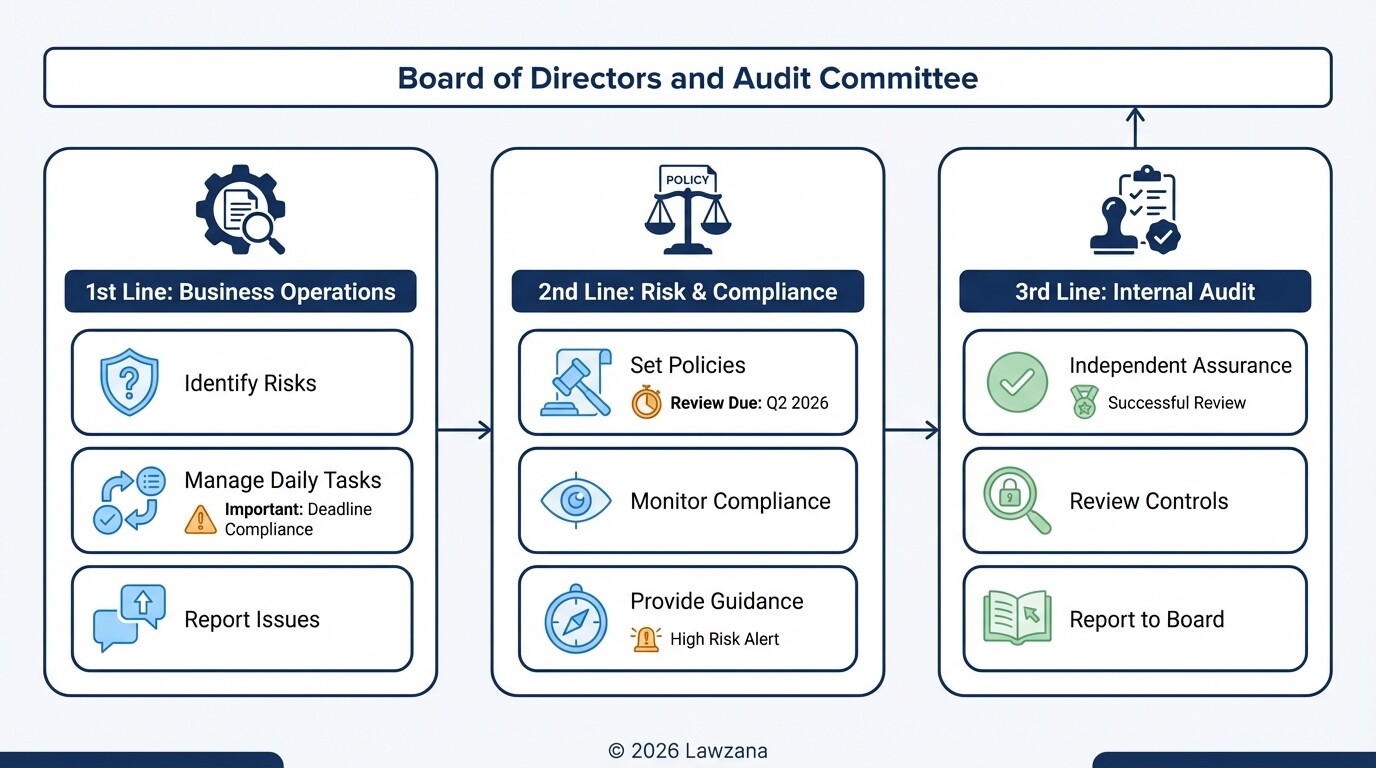

The 2024 update to the UK Corporate Governance Code introduces heightened expectations for internal controls, with the most significant changes taking effect for reporting periods beginning on or after January 1, 2026. Boards will be required to provide a declaration in the annual report regarding the effectiveness of their "material" controls, including financial, operational, and compliance controls.

For private companies, this means moving toward a more formal "Three Lines of Defense" model. The first line is operational management (owning the risk), the second is risk and compliance functions (monitoring the risk), and the third is internal audit (independent assurance). By 2026, boards should be prepared to explain not just what their risks are, but how they have tested the controls meant to mitigate those risks.

- Risk Register: Maintain a living document that identifies "principal risks" and assigns an owner and a mitigation strategy to each.

- Gap Analysis: Conduct a review of current internal controls against the 2024 Code requirements to identify where testing or documentation is lacking.

- Board Oversight: Schedule quarterly deep dives into specific risk areas, such as cybersecurity or regulatory change, rather than a single annual review.

Best Practices for Minute-Taking and Corporate Records

Minute-taking is a statutory requirement under Section 248 of the Companies Act 2006 and serves as the official legal record of board proceedings. Well-drafted minutes demonstrate that directors have exercised "reasonable care, skill, and diligence" in their decision-making process.

Minutes should not be a verbatim transcript of the meeting but a summary of the key "matters considered," the "challenges raised" by directors, and the "conclusions reached." If a director dissents or expresses a specific concern regarding a legal or ethical matter, this must be clearly recorded. In the event of litigation or an insolvency investigation, the minutes are the first place a court will look to see if the board acted reasonably.

- Timely Drafting: Draft minutes within 48 to 72 hours of the meeting while the discussion is fresh in the secretary's mind.

- Action Logs: Attach a separate action log to the minutes to track the implementation of board decisions without cluttering the formal record.

- Confidentiality: Use secure board portals for distributing minutes and supporting papers to protect sensitive commercial data and maintain legal professional privilege where applicable.

Common Misconceptions about UK Governance

"Corporate governance is only for publicly traded companies." While the UK Corporate Governance Code is mandatory for premium-listed companies, the Wates Principles were specifically designed for large private companies. Furthermore, lenders and private equity investors often require high governance standards as a condition for funding.

"Compliance is just a 'tick-box' exercise for the annual report." Regulators and the Financial Reporting Council (FRC) are increasingly looking for "substance over form." Simply copying boilerplate language into a Strategic Report without evidence of actual board engagement can lead to reputational damage and inquiries from authorities.

"The Chairman and the CEO can be the same person in a private company." While legal for private companies, the UK governance framework strongly discourages this. Separating the roles ensures a balance of power between the management of the business (CEO) and the leadership of the board (Chairman).

FAQs

What are the "Wates Principles" for private companies?

The Wates Corporate Governance Principles are a voluntary framework for large private companies to help them comply with reporting requirements. They focus on six key areas: Purpose and Strategy, Board Composition, Director Responsibilities, Opportunity and Risk, Remuneration, and Stakeholder Relationships.

Do small private companies need a governance code?

Small companies are not legally required to follow a specific code, but adopting basic governance structures-such as regular board meetings and clear financial controls-is essential for scaling and attracting future investment.

What is the penalty for not filing a Section 172 statement?

Failure to include a required Section 172 statement in the annual report can result in the report being rejected by Companies House. Directors can also face personal liability for breach of statutory duty if it is proven they did not consider stakeholder interests during a major failure.

How long must we keep board meeting minutes in the UK?

Under the Companies Act 2006, companies must keep minutes of all board meetings for at least ten years from the date of the meeting. These can be stored in hard copy or electronic format, provided they are retrievable.

When to Hire a Lawyer

You should consult a corporate lawyer if your company is undergoing a significant transition, such as preparing for an IPO, navigating a complex merger, or facing an internal dispute between shareholders and the board. Legal counsel is also necessary when drafting bespoke Articles of Association or when a director is concerned about potential personal liability regarding Section 172 duties. If your company meets the "large" thresholds for the first time, a legal audit of your governance framework can prevent costly compliance failures.

Next Steps

- Audit Your Size: Determine if your turnover, assets, or employee count triggers mandatory reporting under the Companies Act or SECR.

- Review Your Board: Assess whether your current board composition provides enough independent oversight to meet 2026 standards.

- Formalize Minutes: Review your last three sets of board minutes to ensure they reflect the "deliberative process" and stakeholder considerations required by Section 172.

- Consult an Expert: Schedule a governance review with a specialist to align your internal controls with the 2024 UK Corporate Governance Code.