- Free Zone companies must register for Corporate Tax regardless of whether they expect to pay the 0% or 9% rate.

- To maintain "Qualifying Free Zone Person" (QFZP) status, entities must fulfill strict requirements regarding substance, audited financials, and income types.

- A 9% tax rate applies to any income derived from "Excluded Activities" or income from sources outside the Free Zone that does not meet specific criteria.

- Documentation for Transfer Pricing is mandatory for transactions with related parties to prove they meet the "Arm's Length Principle."

- Failure to register by the deadline determined by your license issuance month results in an administrative penalty of AED 10,000.

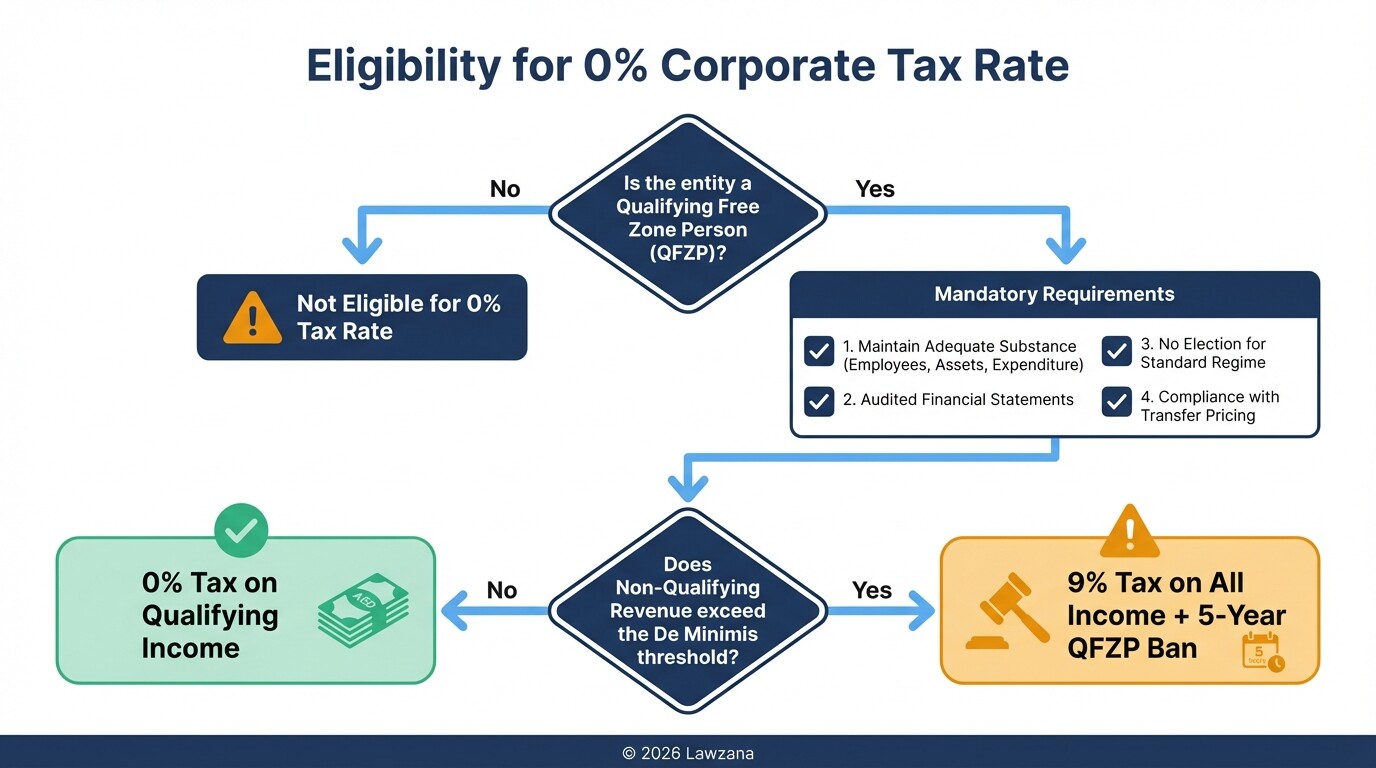

What are the requirements for the 0% Corporate Tax rate in UAE Free Zones?

To qualify for the 0% Corporate Tax rate, a company must be designated as a "Qualifying Free Zone Person" (QFZP). This status requires the entity to maintain adequate substance in the UAE, derive "Qualifying Income," comply with Transfer Pricing rules, and have its financial statements audited by a certified firm.

If a company fails to meet any of these conditions at any point during a tax period, it loses its QFZP status for that year and the following four years. During this period, all taxable income will be subject to the standard 9% rate.

Mandatory Conditions for QFZP Status:

- Adequate Substance: The company must perform its core income-generating activities within a Free Zone. This includes having sufficient qualified employees, physical assets, and an adequate level of operating expenditure.

- Qualifying Income: The entity must ensure its revenue primarily comes from transactions with other Free Zone persons or from specific "Qualifying Activities."

- Non-Election: The company must not have elected to be subject to the standard 9% Corporate Tax regime voluntarily.

- Audited Financials: The UAE Ministry of Finance requires all QFZPs to prepare and maintain audited financial statements for every tax period.

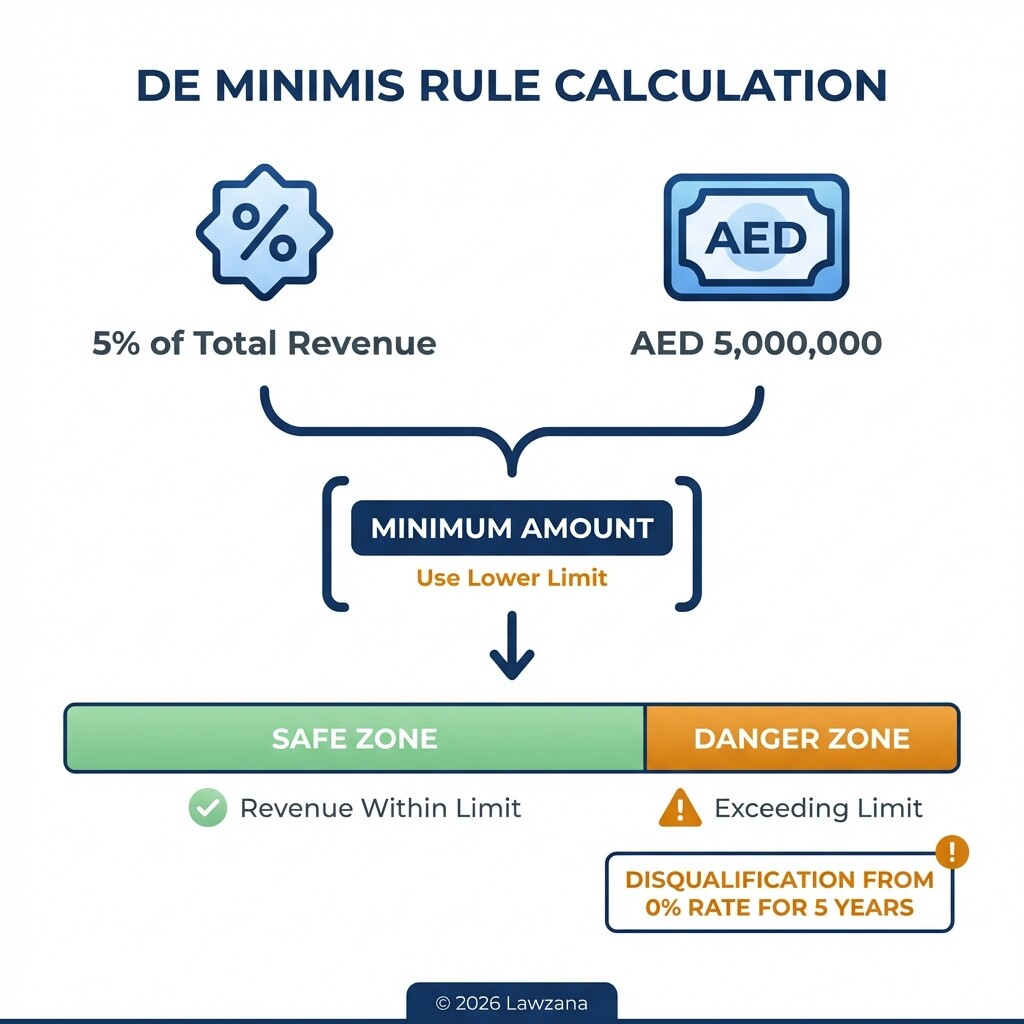

- De Minimis Requirement: Non-qualifying revenue must not exceed 5% of total revenue or AED 5 million, whichever is lower.

What types of income qualify for the 0% tax rate?

Qualifying Income includes revenue derived from transactions with other Free Zone persons, provided the income is not from "Excluded Activities." Additionally, income from "Qualifying Activities" performed for any person (including those outside the UAE) can benefit from the 0% rate if the business operates within a designated zone.

The UAE government distinguishes between activities that promote the local economy and those that could erode the tax base. "Excluded Activities" are specifically listed to prevent businesses from gaining an unfair advantage over mainland companies.

| Qualifying Activities (0% Potential) | Excluded Activities (9% Standard Rate) |

|---|---|

| Manufacturing and processing of goods | Banking, insurance, and finance activities |

| Holding of shares and other securities | Ownership or management of intellectual property |

| Reinsurance and fund management services | Sales to UAE mainland consumers (Retail) |

| Logistics services and aircraft leasing | Real estate transactions with non-Free Zone persons |

| Distribution in designated zones | Provision of services to mainland businesses (unless specified) |

Understanding Qualifying Intellectual Property (IP)

Income from "Qualifying Intellectual Property" (such as patents or copyrighted software) may also qualify for the 0% rate. However, this is calculated using a specific "nexus approach," which links the tax benefit to the actual Research and Development (R&D) expenditures incurred by the company in the UAE. Marketing-related IP, such as trademarks, is generally excluded from the 0% benefit.

How do Transfer Pricing rules affect Free Zone companies?

Transfer Pricing rules require that all transactions between "Related Parties" or "Connected Persons" be conducted at "Arm's Length," meaning the prices must be identical to what two independent companies would agree upon. This prevents companies from shifting profits between high-tax and low-tax entities to reduce their overall tax burden.

Even if a Free Zone company is subject to a 0% tax rate, it must document its related-party transactions. This transparency ensures the Federal Tax Authority (FTA) can verify that the 0% rate is not being abused.

Documentation Requirements:

- Disclosure Form: Submitted alongside the tax return, summarizing related-party transactions.

- Local File: A detailed report describing the local entity's business and specific intercompany transactions.

- Master File: A high-level overview of the global business operations and transfer pricing policies of the entire group.

Note: The requirement to maintain a Master File and Local File generally applies only if the company's annual revenue exceeds AED 200 million or if it is part of a Multinational Enterprise (MNE) group with a total consolidated revenue of AED 3.15 billion.

Are audited financial statements mandatory for Free Zone companies?

Yes, maintaining audited financial statements is a strictly enforced requirement for any Free Zone entity that wishes to claim the 0% "Qualifying Free Zone Person" status. These statements must be prepared in accordance with International Financial Reporting Standards (IFRS) and must be signed off by a licensed auditor registered in the UAE.

While mainland companies may only need audited financials if their revenue exceeds AED 50 million, Free Zone companies do not have a minimum threshold for this specific requirement. Without an audit, the FTA will automatically apply the 9% tax rate to all taxable income above AED 375,000.

Record-Keeping Checklist:

- Keep all financial records and supporting documents for at least 7 years.

- Ensure all invoices, contracts, and receipts are categorized by activity type (Qualifying vs. Excluded).

- Maintain a clear "substance file" documenting employee visas, office lease agreements, and board meeting minutes held within the Free Zone.

When must Free Zone companies register for UAE Corporate Tax?

Every taxable person, including Free Zone companies, must register with the Federal Tax Authority (FTA) based on the month their trade license was originally issued. The FTA released a specific timeline in 2024 to manage the influx of registrations, and missing these deadlines results in an immediate AED 10,000 administrative fine.

The registration process is completed through the Emaratax Portal.

| License Issuance Month | Registration Deadline (2024) |

|---|---|

| January - February | May 31, 2024 |

| March - April | June 30, 2024 |

| May | July 31, 2024 |

| June | August 31, 2024 |

| July | September 30, 2024 |

| August - September | October 31, 2024 |

| October - November | November 30, 2024 |

| December | December 31, 2024 |

Common Misconceptions About Free Zone Corporate Tax

"My Free Zone has a 50-year tax holiday, so I am exempt."

While many Free Zones promised tax holidays, the new Federal Decree-Law No. 47 of 2022 supersedes those local incentives. The "holiday" is now honored through the "Qualifying Free Zone Person" status, but you must still register, file returns, and meet all compliance conditions to benefit from it.

"I don't have to file a tax return if my income is 0%."

This is incorrect. Every registered entity must file an annual Corporate Tax return within nine months of the end of its financial year. The return is the mechanism through which you declare your Qualifying Income and prove you are eligible for the 0% rate.

FAQs

Can a Free Zone company use the Small Business Relief?

No. Qualifying Free Zone Persons are specifically ineligible for Small Business Relief (which allows companies with revenue under AED 3 million to be treated as having no taxable income). You must choose between being a QFZP or opting into the standard regime to use Small Business Relief.

What happens if I make a small amount of non-qualifying income?

You can still maintain your 0% status if your "non-qualifying" revenue stays within the "De Minimis" threshold: less than 5% of your total revenue or AED 5 million, whichever is lower. If you exceed this, you lose your 0% status entirely for five years.

Do I need a physical office to meet the "Substance" requirement?

Generally, yes. You must have "adequate" physical assets. While some Free Zones allow flexi-desks, the FTA looks at the "core income-generating activities." If your business requires physical space to operate, a virtual office may not suffice for QFZP status.

When to Hire a Lawyer

Navigating the UAE's new tax landscape requires more than just accounting; it requires legal certainty. You should consult a legal professional if:

- You are unsure if your specific business activities fall under "Excluded Activities."

- You are restructuring your company to meet "Adequate Substance" requirements.

- You are drafting intercompany agreements that must comply with Transfer Pricing regulations.

- You have received a notice of non-compliance or a penalty from the Federal Tax Authority.

Next Steps

- Check your license: Identify the issuance month of your trade license to determine your registration deadline.

- Register immediately: Access the Emaratax portal and apply for your Corporate Tax Registration Number (TRN).

- Appoint an Auditor: Secure a contract with a UAE-registered auditor to ensure your 2024 financials are compliant.

- Review Contracts: Audit your transactions with related parties to ensure they are backed by Arm's Length documentation.

- Monitor Revenue: Track your income streams to ensure non-qualifying revenue does not breach the De Minimis threshold.