- Three-Year Minimum Protection: All commercial leases in Greece are legally protected for a minimum of three years, regardless of what the written contract states.

- Stamp Duty vs. VAT: Commercial rentals are typically subject to a 3.6% stamp duty, though some modern developments may opt for a 24% VAT structure.

- Rent Indexation: Annual rent increases are usually tied to the Consumer Price Index (CPI), but the Greek government may impose temporary caps during periods of high inflation.

- Maintenance Defaults: Under the Greek Civil Code, the landlord is responsible for structural repairs and "extraordinary" maintenance unless the contract explicitly states otherwise.

- Registration Requirement: All lease agreements must be electronically submitted to the AADE (Independent Authority for Public Revenue) portal within 30 days of signing.

Commercial Leasing in Greece: Legal FAQ for International Tenants

Navigating the Greek commercial real estate market offers significant opportunities for international businesses, but the legal framework differs substantially from Anglo-American systems. In Greece, commercial leases are governed by a combination of specific presidential decrees and the Greek Civil Code. This regulatory environment is generally "tenant-friendly," providing mandatory protections that cannot be waived by contract. For a foreign entity, understanding these "non-negotiable" legal statues is the first step toward a successful market entry.

What is the mandatory minimum duration for commercial leases in Greece?

Commercial leases in Greece have a mandatory minimum duration of three years. This legal floor applies even if the parties sign a contract for a shorter period, such as one or two years. If a shorter term is agreed upon, the tenant still retains the legal right to remain in the property for the full three-year period.

Following the enactment of Law 4242/2014, the Greek leasing market became more flexible, but this three-year protection remained as a safeguard for business continuity. After the initial three-year period expires, the lease continues either for the duration specified in the contract or as an "indefinite term" lease if the tenant remains and the landlord continues to accept rent.

Key Duration Rules:

- Binding for Both: The three-year minimum is binding for both the landlord and the tenant, though the tenant may have specific exit rights.

- Contractual Extensions: Parties are free to negotiate longer terms (e.g., 9 or 12 years), which is common for large retail or industrial spaces.

- Tacit Renewal: If neither party acts at the end of the term, the lease technically becomes an indefinite agreement, subject to termination with notice as per the Civil Code.

How are annual rent indexation and market adjustments regulated?

Rent increases in Greek commercial leases are typically determined by an "indexation clause" linked to the national inflation rate. In the absence of a specific agreement in the contract, the law defaults to an increase based on 75% of the change in the Consumer Price Index (CPI) as calculated by the Hellenic Statistical Authority.

Most international tenants negotiate a "CPI + X%" formula. However, it is vital to be aware that the Greek government has the authority to intervene in the private market during economic crises. For instance, in recent years, a 3% cap on annual rent increases was implemented for many commercial sectors to combat high inflation.

| Adjustment Type | Legal Default | Market Standard |

|---|---|---|

| Annual Indexation | 75% of CPI | CPI + 1% to 2% |

| Market Review | Not automatic | Every 3-5 years (if negotiated) |

| Emergency Caps | Determined by Decree | Usually 3% (temporary) |

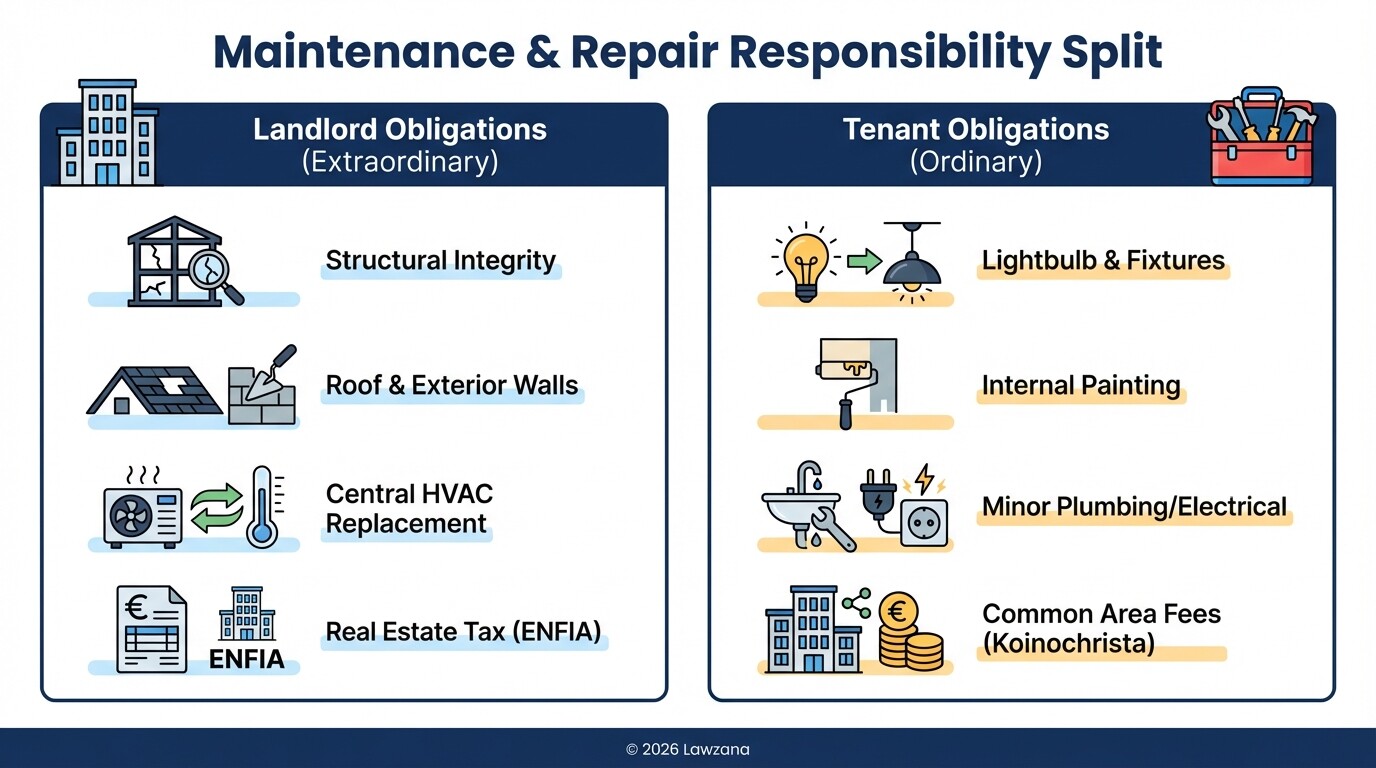

Who is responsible for maintenance and repairs?

Under the Greek Civil Code (Articles 574-618), the landlord is legally obligated to hand over the property in a state suitable for the agreed use and maintain it for the duration of the lease. This means the landlord is responsible for all "extraordinary" repairs, including structural issues, roof leaks, and the replacement of central HVAC systems.

The tenant is responsible for "ordinary" repairs and maintenance arising from daily use, such as lightbulb replacements, internal painting, or minor plumbing fixes. However, Greek law allows parties to deviate from these defaults in the contract. International tenants should be wary of "Triple Net" (NNN) style clauses that attempt to shift structural responsibilities onto the tenant, as these can be high-cost liabilities in older Greek buildings.

Maintenance Checklist:

- Structural Integrity: Landlord responsibility (Mandatory unless waived).

- Daily Operations: Tenant responsibility.

- Common Area Fees (Koinochrista): Usually paid by the tenant; covers cleaning, elevator maintenance, and shared utilities.

- Upgrades: Improvements made by the tenant usually remain with the property at the end of the lease without compensation, unless otherwise agreed.

What are the termination rights for tenants and the 'good cause' requirement?

Tenants generally have the right to terminate a commercial lease for "good cause" or through specific contractual break clauses. While Law 4242/2014 removed the old statutory right to terminate after one year with three months' notice for new leases, the parties can still negotiate flexible exit terms in the private contract.

A "good cause" termination usually involves a breach of contract by the landlord, such as failing to maintain the building's safety or the loss of a necessary operating permit due to building defects. If a tenant wishes to exit early without a break clause or a breach, they are typically liable for the remaining rent of the three-year mandatory period, although courts often reduce this penalty if the landlord finds a new tenant quickly.

Landlord Termination Rights: Landlords face significant hurdles if they wish to evict a tenant before the term expires. Common "good causes" for a landlord to terminate include:

- Non-payment of rent or common area fees.

- Misuse of the property (using it for a purpose not defined in the contract).

- Structural alterations made without permission.

- Self-Use: A landlord may terminate for "self-use" (reclaiming the space for their own business) or reconstruction, but this usually requires the payment of significant compensation to the tenant (often 8-24 months of rent).

What is the role of Stamp Duty and VAT in commercial rentals?

The financial structure of a Greek lease includes a mandatory tax component that must be settled with the Independent Authority for Public Revenue (AADE). Traditionally, commercial leases are subject to a 3.6% Stamp Duty (Chartosimo). This tax is calculated on the total monthly rent and is legally split 50/50 between the landlord and tenant, though many contracts stipulate the tenant pays the full amount.

In certain cases, specifically for new buildings or by the landlord's election, VAT at 24% may be applied instead of Stamp Duty. This is often preferred by international corporate tenants who are VAT-registered, as they can offset this as input tax.

Key Financial Obligations:

- Security Deposit: Usually equivalent to 2-3 months of rent; held by the landlord (interest-free) and returned upon exit.

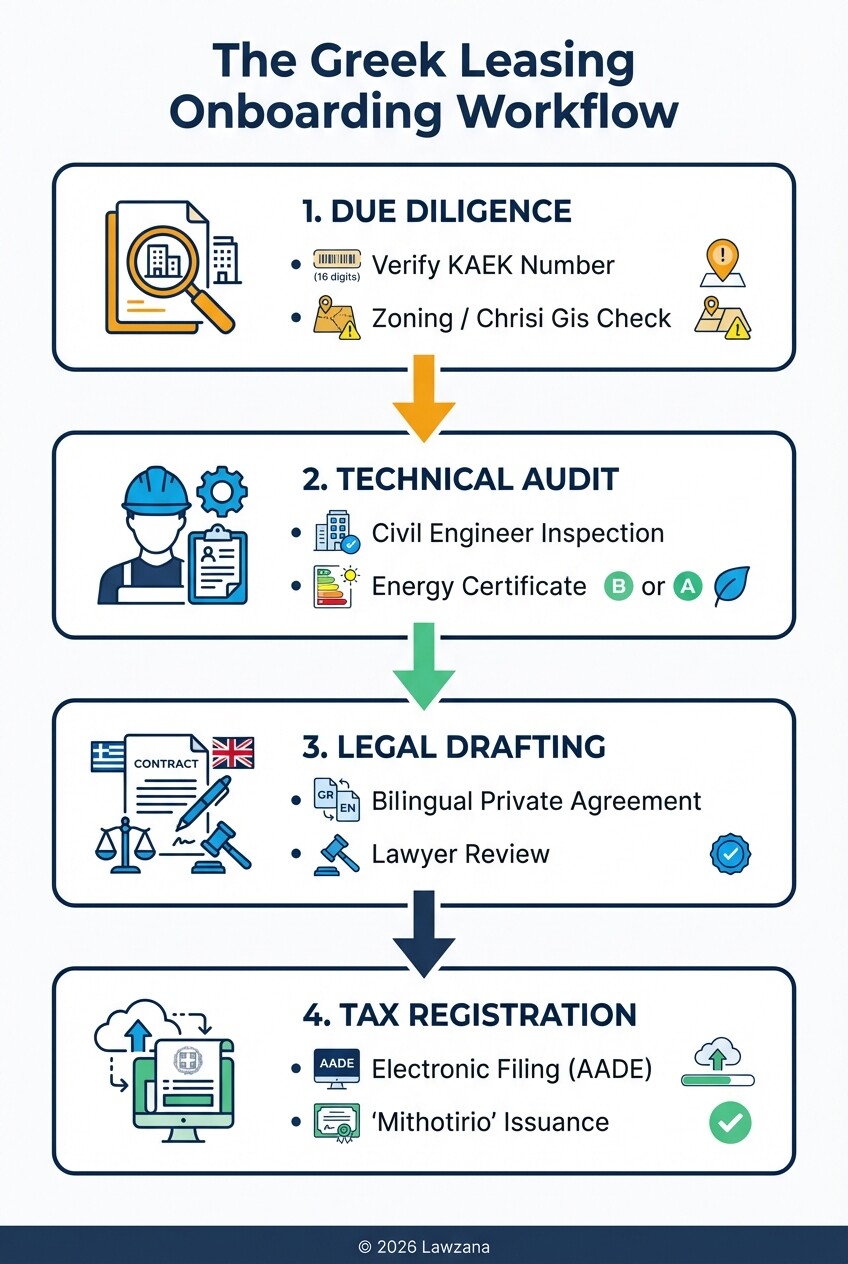

- Electronic Filing: The lease must be uploaded to the AADE platform. Without this electronic "Mithotirio," the lease is not recognized by tax authorities and cannot be used to obtain business licenses.

- Real Estate Tax (ENFIA): This is always the landlord's responsibility. Any clause passing ENFIA to the tenant should be viewed with extreme caution.

Common Misconceptions

"If it's not in the contract, it's not the law."

In Greece, the Civil Code and Presidential Decrees often override the written contract. For example, even if your contract says you can be evicted with one month's notice in the first year, the mandatory three-year rule protects you regardless.

"I can stop paying rent if the landlord won't fix the roof."

Greek law generally does not allow "self-help" rent withholding. If there is a maintenance issue, you must typically follow a formal legal notification process (Exodiko) before you can legally justify a rent reduction or withholding.

"A handshake or a simple signed paper is enough."

While a private agreement is a start, no commercial lease is legally "complete" until it is registered on the AADE electronic portal. This digital record is what the Greek state uses to verify your business address for tax and licensing purposes.

Practical Checklist for International Tenants

- Verify the "KAEK" Number: Ensure the property has a valid Land Registry (Ktimatologio) number to avoid renting an illegal or unregistered structure.

- Check the Zoning (Chrisi Gis): Confirm with a civil engineer that the property is legally zoned for your specific business activity (e.g., retail vs. food service).

- Negotiate the Indexation Cap: With fluctuating inflation, always push for a "ceiling" on your annual rent increases.

- Clarify Common Area Costs: Request the last 12 months of "Koinochrista" receipts to estimate your actual monthly overhead.

- Formalize the Inventory: Document the state of the property with photos and a signed annex to ensure the return of your security deposit.

FAQ

Can the landlord increase the rent by any amount they want?

During the first three years, the landlord must follow the indexation agreed upon in the contract. They cannot arbitrarily demand a massive "market adjustment" increase until the mandatory three-year period has ended.

Is a Greek notary required to sign a commercial lease?

Notaries are generally not required for standard commercial leases; a private agreement is sufficient. However, for very long-term leases (over 9 years) that you wish to record in the Land Registry for extra protection, a notarial deed is necessary.

How much notice must I give to leave after the 3-year term?

If the lease has become an "indefinite term" agreement, the Civil Code typically requires notice of at least half the rent period (e.g., 15 days notice for a monthly rent), but it is standard practice to negotiate a 3-to-6-month notice period in the contract.

When to Hire a Lawyer

You should consult a Greek real estate attorney before signing any Heads of Terms or Reservation Agreements. Legal counsel is essential when:

- Navigating the "Self-Use" compensation clauses that could affect your business's longevity.

- Translating and verifying the "Mithotirio" (Electronic Lease) to ensure it matches your private agreement.

- Handling properties owned by multiple heirs, which is a common and complex occurrence in Greece.

- Negotiating VAT election vs. Stamp Duty to optimize your tax position.

Next Steps

- Identify a Property: Use a local broker to find spaces that fit your zoning requirements.

- Technical Due Diligence: Hire a Greek civil engineer to verify the building's legality and "Energy Performance Certificate."

- Draft the Private Agreement: Have your lawyer draft a bilingual lease that incorporates both the mandatory Greek protections and your specific business requirements.

- Register with AADE: Ensure the landlord uploads the lease details to the tax portal and "accept" the filing through your own Greek tax credentials (AFM).