International Inheritance in Greece: A Guide for Foreign Heirs

- Non-resident heirs have exactly one year to renounce an inheritance if the estate includes debts.

- Greek "Forced Heirship" laws prevent immediate family members from being entirely disinherited, even if a will says otherwise.

- Accepting property requires a formal "Acceptance of Inheritance" deed signed before a Greek notary and registered at the Land Registry.

- Inheritance tax is calculated based on "Objective Value" (state-set values) and the heir's degree of kinship to the deceased.

- Foreign wills are not automatically valid; they must be published by a Greek court or recognized through specific legal procedures.

What is Forced Heirship under the Greek Civil Code?

Forced heirship, known as Nomimi Mira, is a legal provision that guarantees a minimum share of the estate to the deceased's closest relatives. This law limits "testamentary freedom," meaning a person cannot legally leave their entire Greek estate to a distant friend or charity if they have a surviving spouse, children, or parents.

If a will excludes these "forced heirs," they are still entitled to half of the share they would have received if no will existed (intestate succession). The Greek Civil Code identifies forced heirs in the following order:

- First Rank: Children and the surviving spouse.

- Second Rank: Parents and the surviving spouse (if there are no children).

- Third Rank: The surviving spouse (if there are no children or parents).

If a will violates these portions, the forced heirs can file a legal claim to reduce the testamentary dispositions and claim their lawful share. This is a critical factor for foreign heirs to consider when a will drafted in the US or UK is applied to Greek real estate.

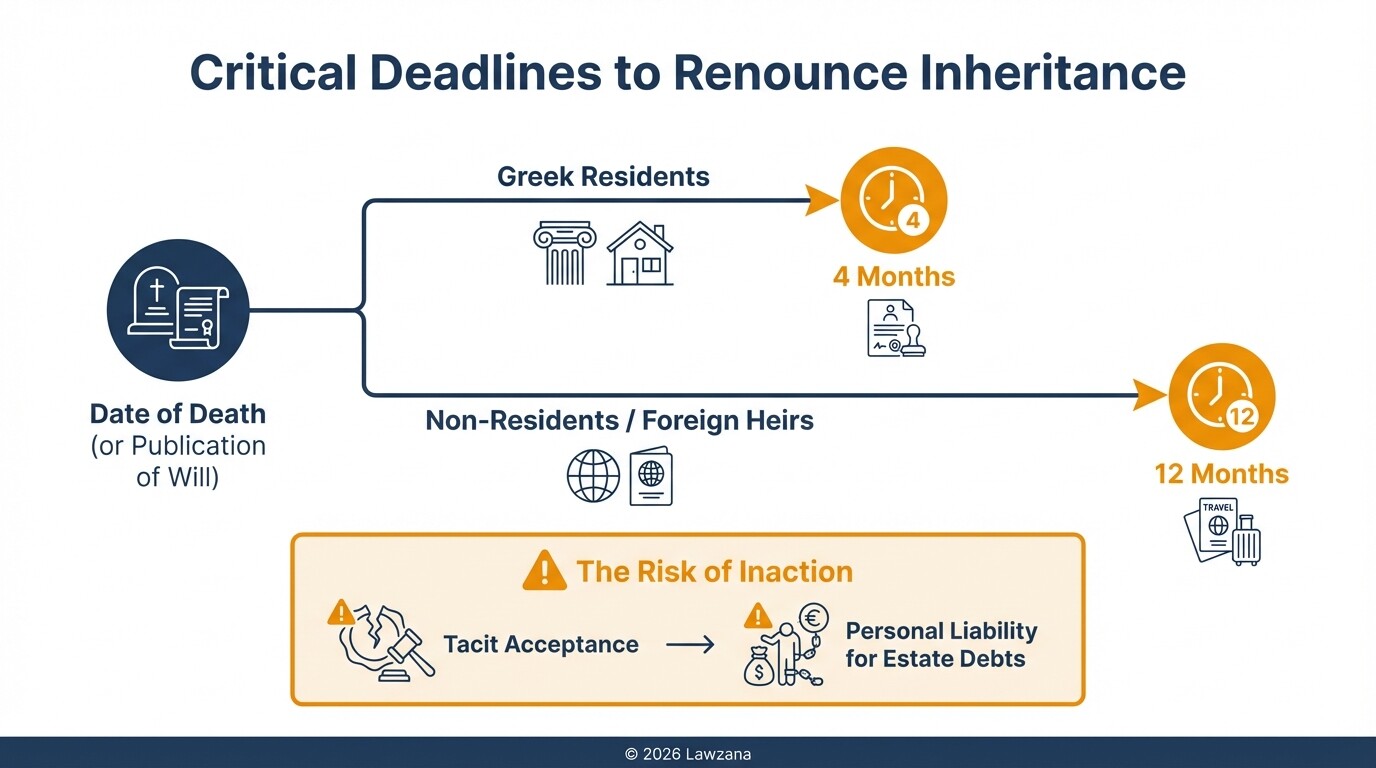

What are the deadlines for accepting or renouncing an inheritance?

Non-resident heirs must formally renounce an inheritance within one year if they wish to avoid liability for the deceased's debts. For residents of Greece, this window is much shorter, lasting only four months from the date of death or the date the will was published.

Failing to act within these deadlines results in "tacit acceptance." This means you legally become the owner of the assets but also become personally liable for any of the deceased's outstanding debts, taxes, or mortgages.

- Non-residents: 12 months to renounce.

- Greek residents: 4 months to renounce.

- Calculation start: The clock begins either on the date of death (if there is no will) or on the date the will is officially published by a court.

To renounce, the heir or their legal representative must file a declaration at the Secretariat of the competent Court of First Instance in Greece.

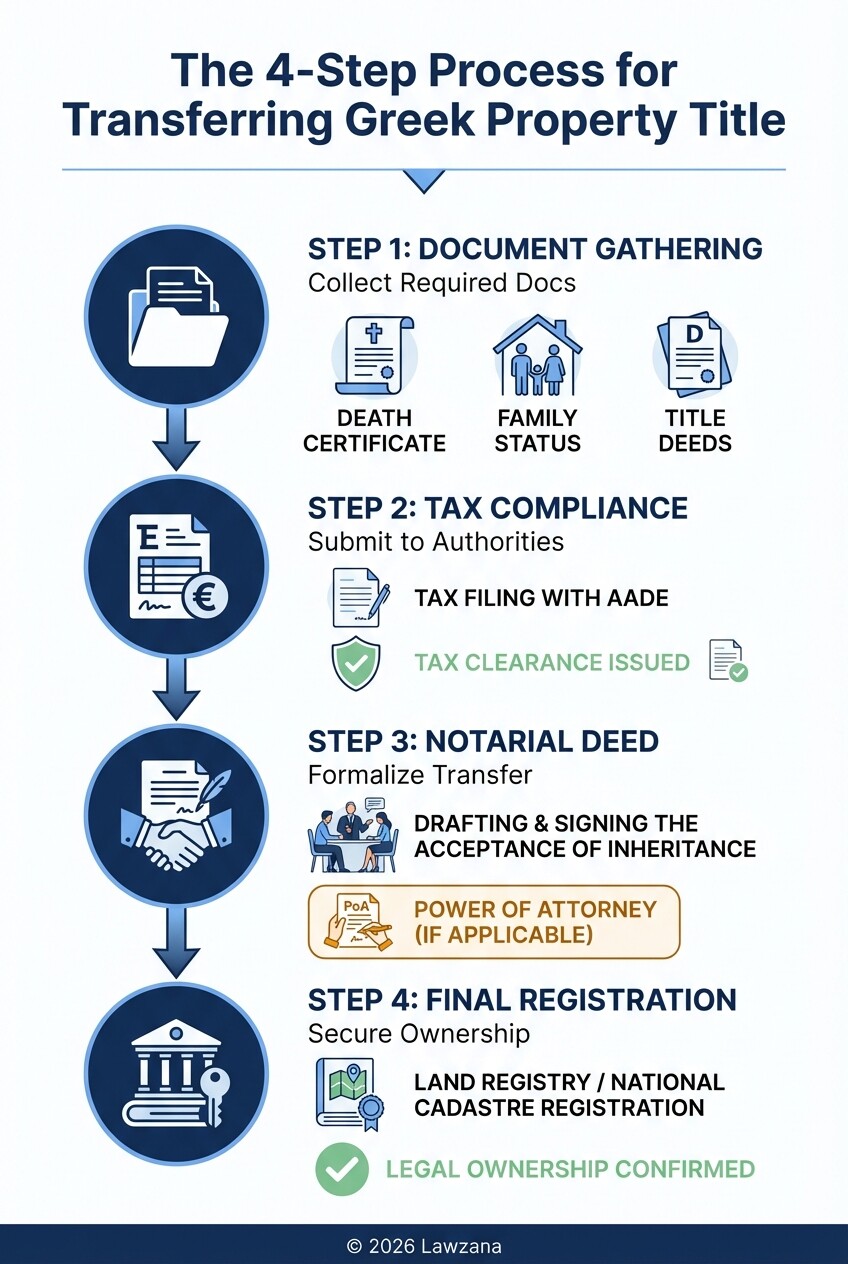

What is the process of 'Acceptance of Inheritance' through a notary?

The "Acceptance of Inheritance" (Apodochi Klironomias) is the formal legal act that transfers property ownership to the heir. In Greece, inheriting real estate is not automatic upon death; it requires the execution of a public deed before a Greek notary.

The process generally follows these steps:

- Document Collection: Gathering death certificates, certificates of closest relatives, and title deeds for the property.

- Tax Filing: The heir must file an inheritance tax return with the Greek Tax Authority (AADE). Even if no tax is due, the filing is mandatory to proceed.

- The Notarial Deed: Once the tax is settled or cleared, a notary drafts the Acceptance of Inheritance deed. The heir signs this document, or a lawyer signs on their behalf via a Power of Attorney.

- Registration: The deed must be filed with the local Land Registry (Ypothikofylakeio) or the National Cadastre (Ktimatologio). Ownership is only legally perfected once this registration is complete.

How is Greek inheritance tax calculated for non-resident beneficiaries?

Greek inheritance tax is calculated based on the "Objective Value" of the property and the heir's relationship to the deceased. The Objective Value is a state-determined price based on the property's location, size, and age, which may differ from the actual market price.

Heirs are divided into three categories for tax purposes:

| Category | Relationship | Tax-Free Threshold | Tax Rates |

|---|---|---|---|

| Category A | Spouse, children, grandchildren, parents | €150,000 | 1% to 10% |

| Category B | Grandparents, siblings, nephews/nieces | €30,000 | 5% to 20% |

| Category C | All other relatives and strangers | €6,000 | 20% to 40% |

For Category A, the first €150,000 of the objective value is tax-exempt. Values exceeding this amount are taxed on a sliding scale. It is important to note that many double-taxation treaties exist between Greece and other nations, which may allow you to credit the tax paid in Greece against taxes owed in your home country. You can find more information on tax compliance at the Independent Authority for Public Revenue (AADE).

How do you validate a foreign will for use in Greece?

A foreign will is not immediately enforceable in Greece; it must undergo a validation process to ensure it complies with both the laws of the country where it was written and Greek public policy.

The validation steps typically include:

- Apostille/Legalization: The original will must bear an Apostille stamp (if the country is a member of the Hague Convention) or be legalized by a Greek Consulate.

- Official Translation: The document must be translated into Greek by a certified translator or the Ministry of Foreign Affairs.

- Publication by a Greek Court: The foreign will must be submitted to a Greek Court of First Instance to be "published." This makes the will a matter of public record in Greece.

- Exequatur (if applicable): If the will has already been probated in a foreign court, a Greek court may need to grant "Exequatur" (recognition of a foreign judgment) to give the foreign probate order legal force in Greece.

Common Misconceptions About Greek Inheritance

Many foreign heirs operate under assumptions that can lead to significant financial or legal penalties.

"The will from my home country automatically covers my Greek property."

While Greece generally respects the validity of foreign wills regarding the distribution of assets, the process of transferring title must follow Greek law. Furthermore, a foreign will cannot override the "Forced Heirship" rights of protected relatives unless the deceased was a citizen of a country that does not recognize forced heirship and chose their national law to govern their estate (under EU Regulation 650/2012).

"I don't need to do anything if I don't want the property."

If the deceased had significant debts in Greece, doing nothing is dangerous. Silence is interpreted as "tacit acceptance" after the one-year deadline passes. If you do not want to inherit a property burdened with debt, you must actively renounce it through a formal court filing.

Costs and Timelines

Inheriting property in Greece involves several administrative and professional fees beyond the inheritance tax itself.

- Notary Fees: Usually 1% to 2% of the property value, plus VAT.

- Registration Fees: Approximately 0.5% to 0.8% for the Land Registry.

- Legal Fees: Typically a percentage of the estate or a flat fee for the entire process, including tax filings and court representation.

- Timeline: A straightforward inheritance usually takes 6 to 12 months to finalize, though court-validated foreign wills can extend this timeline by several months.

FAQ

Can I manage the entire inheritance process without traveling to Greece?

Yes. Most foreign heirs appoint a Greek lawyer via a specialized Power of Attorney (PoA). This PoA can be signed at a Greek Consulate in your home country or before a local notary (with an Apostille). Your lawyer can then handle tax filings, sign the acceptance deed, and register the property on your behalf.

What happens if the deceased died without a will (Intestate)?

If there is no will, Greek law dictates the distribution of the estate through "ranks" of kinship. The surviving spouse always receives 25% of the estate, while the remaining 75% is divided equally among the children. If there are no children, the spouse receives 50%, and the remaining 50% goes to the deceased's parents or siblings.

Is there a deadline to pay inheritance tax?

The inheritance tax return must generally be filed within 6 to 9 months of the death (or the publication of the will). Once the tax is assessed, it can often be paid in installments, but the Acceptance of Inheritance deed cannot be signed until the tax clearance is issued.

When to Hire a Lawyer

Navigating the Greek legal system as a non-resident is difficult due to language barriers and bureaucratic complexity. You should consult a lawyer if:

- The estate involves real estate that has not been registered in the National Cadastre (Ktimatologio).

- You suspect the deceased had outstanding debts to the Greek state or private banks.

- You are a forced heir who has been excluded from a foreign will.

- You need to coordinate between Greek authorities and your home country's tax requirements.

Next Steps

- Locate the Title Deeds: Find the original deeds to any Greek property owned by the deceased.

- Obtain a Death Certificate: You will need an original copy, likely with an Apostille, to begin any proceedings in Greece.

- Consult the Land Registry: Verify the current legal status of the property to ensure there are no existing liens or disputes.

- Issue a Power of Attorney: If you cannot travel to Greece, contact a Greek legal professional to draft a Power of Attorney so they can act on your behalf immediately.