- The Netherlands is a primary gateway for European IP protection, offering access to the Unified Patent Court (UPC) and the Benelux Office for Intellectual Property (BOIP).

- Tech companies can reduce their effective corporate tax rate to 9% on IP-derived profits through the Dutch Innovation Box.

- Enforcement in the Netherlands is renowned for "Summary Proceedings," which provide rapid injunctive relief against infringers, often within weeks.

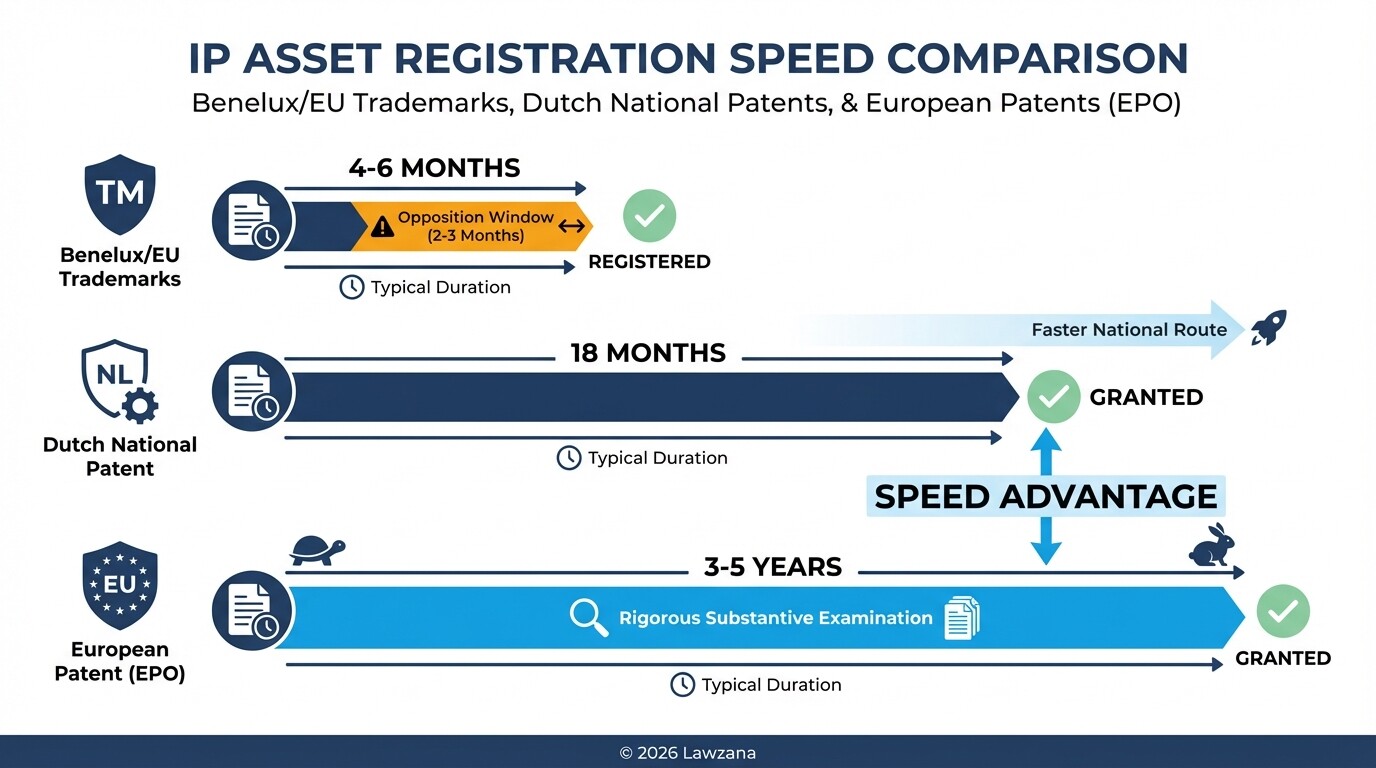

- Patent registration timelines vary significantly, but Dutch national patents are typically granted faster than European-wide patents.

- Costs for initial IP asset protection generally range between €2,500 and €6,000, covering filing fees and professional legal representation.

IP Protection Checklist for Tech Firms in the Netherlands

To secure intellectual property in the Netherlands and the wider European Union, international firms should follow this structured sequence of actions. This checklist ensures compliance with both local Benelux regulations and EU-wide mandates.

- Conduct a Conflict Search: Before filing, perform a comprehensive search in the BOIP Trademark Register and the EPO Patent Register to ensure your asset is unique.

- Determine Filing Route: Decide between a Benelux registration (covers NL, BE, LU), an EU-wide registration via EUIPO, or an international filing via the Madrid System.

- Secure an S&O Declaration (WBSO): Apply for a Research and Development (R&D) declaration from the Netherlands Enterprise Agency to qualify for tax incentives.

- Appoint a Dutch Legal Representative: While not strictly mandatory for all filings, a local representative is essential for navigating the "Innovation Box" tax requirements and handling Dutch-language correspondence with the Patent Office.

- Draft Non-Disclosure Agreements (NDAs): Ensure all local partnerships and employment contracts include Dutch-law-governed IP assignment clauses.

- File for "Kort Geding" Readiness: Prepare evidence of ownership and infringement evidence early to take advantage of the Dutch accelerated summary proceedings if a dispute arises.

How do you register EU Trademarks and Patents through Dutch legal representatives?

Registration of IP in the Netherlands involves coordinating with the Benelux Office for Intellectual Property (BOIP) for trademarks and the Netherlands Patent Office (Octrooicentrum Nederland) for patents. For broader European protection, Dutch legal representatives manage applications through the European Union Intellectual Property Office (EUIPO) and the European Patent Office (EPO).

Dutch legal representatives act as a bridge between international tech firms and European administrative bodies. For trademarks, a single application through the BOIP covers the entire Benelux region (Belgium, the Netherlands, and Luxembourg), serving as a cost-effective alternative to a full EU-wide filing if the firm's primary European operations are centered in the Dutch logistics hub.

For patents, firms can choose the national route (protection only in the Netherlands) or the European route. Since the inception of the Unitary Patent system, Dutch representatives can facilitate a single application that grants uniform protection across nearly all EU member states, significantly reducing the administrative burden and translation costs previously associated with individual national validations.

What are the advantages of the Dutch Innovation Box for corporate tax reduction?

The Innovation Box is a specialized tax regime that provides a significant corporate tax discount on profits derived from qualifying innovative activities. Instead of the standard corporate tax rate, qualifying income is taxed at an effective rate of only 9%.

To qualify for the Innovation Box, a company must have developed an intangible asset-such as software, a patented invention, or a new plant variety-for which it received a "WBSO" (R&D) declaration. For larger companies, an additional requirement usually involves holding a patent or an exclusive license.

- Qualifying Income: Includes royalties, licensing fees, and a portion of the sales price of products that incorporate the protected IP.

- Cost Recovery: Companies can first deduct the full costs of developing the IP from their standard-rate profits before the 9% rate begins to apply to the remaining earnings.

- International Appeal: This regime makes the Netherlands an ideal jurisdiction for "IP Holding Companies," where global tech firms centralize their intellectual property assets to optimize their global tax footprint legally.

How are IP rights enforced through Summary Proceedings and the Unified Patent Court?

Enforcement of IP rights in the Netherlands is exceptionally efficient due to the "Kort Geding" (summary proceedings) system and the presence of the Unified Patent Court (UPC) Local Division in The Hague. These venues allow rights holders to obtain rapid injunctions to stop infringement across borders.

Dutch Summary Proceedings (Kort Geding)

This is an accelerated procedure where a judge provides a preliminary ruling in urgent cases. In IP matters, this usually involves a request for a cease-and-desist order against an infringer. The process is remarkably fast, with hearings often scheduled within weeks and judgments delivered shortly thereafter. It is a preferred tool for tech firms needing to stop the sale of infringing hardware or software in the Dutch market immediately.

The Unified Patent Court (UPC)

The UPC is a dedicated court for litigating Unitary Patents and classic European patents. The Local Division in The Hague is one of the most active in Europe, staffed by experienced IP judges who handle cases in English.

- Cross-Border Scope: A single ruling from the UPC can be enforced across all participating EU member states.

- Speed: The UPC aims to deliver a decision on the merits within 12 months, which is significantly faster than traditional patent litigation in many other jurisdictions.

What are the estimated registration and filing costs in the Netherlands?

The cost of securing IP protection in the Netherlands depends on the breadth of protection required and the complexity of the asset. Generally, a tech firm should budget between €2,500 and €6,000 per asset for initial filing and representation.

| Asset Type | Official Filing Fees | Legal/Representation Fees | Estimated Total |

|---|---|---|---|

| Benelux Trademark | €244 (Basic) | €800 - €1,500 | €1,000 - €2,000 |

| Dutch National Patent | €120 - €200 | €3,000 - €5,000 | €3,200 - €5,500 |

| EU Trademark (EUIPO) | €850 (One Class) | €1,000 - €2,000 | €1,850 - €3,000 |

| Unitary Patent (EPO) | Variable (approx. €1,500) | €4,000 - €7,000 | €5,500 - €9,000+ |

Note: These figures exclude annual maintenance/renewal fees and potential translation costs for patents.

What are the timelines for IP registration?

The timeline for securing IP rights varies by the type of asset, with trademarks being relatively swift and patents requiring a multi-year commitment.

- Trademarks: A Benelux or EU trademark registration typically takes 4 to 6 months. This includes the mandatory opposition period (usually 2 to 3 months) where third parties can challenge the registration. If no oppositions are filed, the process is highly predictable.

- Patents: A Dutch national patent is usually granted within 18 months, as the Netherlands Patent Office does not conduct a substantive "grant/refuse" examination (the validity is tested later in court). However, a European Patent via the EPO typically takes 3 to 5 years to reach the grant stage due to rigorous examination of novelty and inventive step.

Common Misconceptions about Dutch IP Law

- "I need a separate registration for each Benelux country." This is false. There is no such thing as a "Dutch-only" trademark; the Benelux Office for Intellectual Property handles filings that automatically cover the Netherlands, Belgium, and Luxembourg as a single territory.

- "English contracts are not enforceable in Dutch courts." This is a myth. Dutch courts, especially the Netherlands Commercial Court (NCC) and the UPC, frequently handle cases entirely in English. Most B2B IP contracts in the Netherlands are drafted in English and are fully valid.

- "The Innovation Box is only for giant corporations." In reality, many Dutch startups and SMEs utilize the Innovation Box. The entry requirement is an R&D declaration (WBSO), which is accessible to any company performing technical development in the Netherlands.

FAQ

What is the difference between a Benelux Trademark and an EU Trademark?

A Benelux Trademark provides protection specifically in the Netherlands, Belgium, and Luxembourg. An EU Trademark (EUTM) provides protection across all 27 member states of the European Union. Firms often choose the Benelux route if their market is localized, as it is cheaper and carries a lower risk of conflicting with existing marks in distant EU countries.

Can I apply for the Innovation Box for software development?

Yes, software development is one of the primary drivers for Innovation Box applications. If the software is developed in-house and you have obtained a WBSO declaration for the R&D work, the profits generated from that software (including SaaS models) may qualify for the 9% tax rate.

Does the Netherlands belong to the Unified Patent Court?

Yes, the Netherlands is a founding member of the Unified Patent Court. The Hague hosts a Local Division of the court, making it a central hub for patent litigation in Europe.

When to Hire a Lawyer

You should engage a Dutch IP attorney if you are planning to centralize your intellectual property in a Dutch holding company or if you receive a notice of infringement. Expert legal counsel is essential when navigating the "Innovation Box" application, as it requires a specific "ruling" or agreement with the Dutch Tax Authorities. Additionally, if you need to initiate "Kort Geding" (summary proceedings), a lawyer is required to represent you in court and ensure the evidence meets Dutch procedural standards.

Next Steps

- Identify your IP assets: Audit your current software, hardware, or brand assets to determine what needs protection.

- Apply for WBSO: If you are performing R&D in the Netherlands, start the application for an S&O declaration through the RVO website.

- Consult an IP Strategist: Meet with a legal expert to determine whether a Benelux, EU, or Unitary Patent filing strategy best aligns with your business goals.

- Review Contracts: Ensure your employment and contractor agreements explicitly assign IP rights to your company under Dutch law.