- The Dutch Participation Exemption eliminates corporate income tax on dividends and capital gains derived from qualifying subsidiaries.

- The Netherlands offers one of the world's most extensive networks of Bilateral Investment Treaties (BITs), providing legal protection against foreign government interference.

- Maintaining "substance" is critical; holding companies must demonstrate a physical and economic presence in the Netherlands to benefit from tax treaties.

- The Dutch BV (private limited company) is the most common entity for holding structures due to its flexibility and low minimum capital requirements.

- Transparency is mandatory, requiring companies to register "Ultimate Beneficial Owners" (UBOs) and file annual accounts with the Chamber of Commerce.

Why Investors Choose the Netherlands for Holding Structures

A Dutch holding company serves as a central hub for managing international investments, offering a combination of tax efficiency, legal stability, and a pro-business regulatory environment. By positioning a Dutch entity between a parent company and its global subsidiaries, investors can streamline cash flows and protect their assets under Dutch law.

The Netherlands is consistently ranked as a top jurisdiction for corporate headquarters because it balances rigorous compliance with high flexibility. Whether you are looking to consolidate EU operations or protect investments in emerging markets, the Dutch legal framework provides a predictable and robust foundation for long-term growth.

How Does the Participation Exemption Benefit Holding Companies?

The Dutch Participation Exemption ensures that profits already taxed at the subsidiary level are not taxed again at the holding company level. This rule applies to both dividends received and capital gains realized upon the sale of shares in a subsidiary.

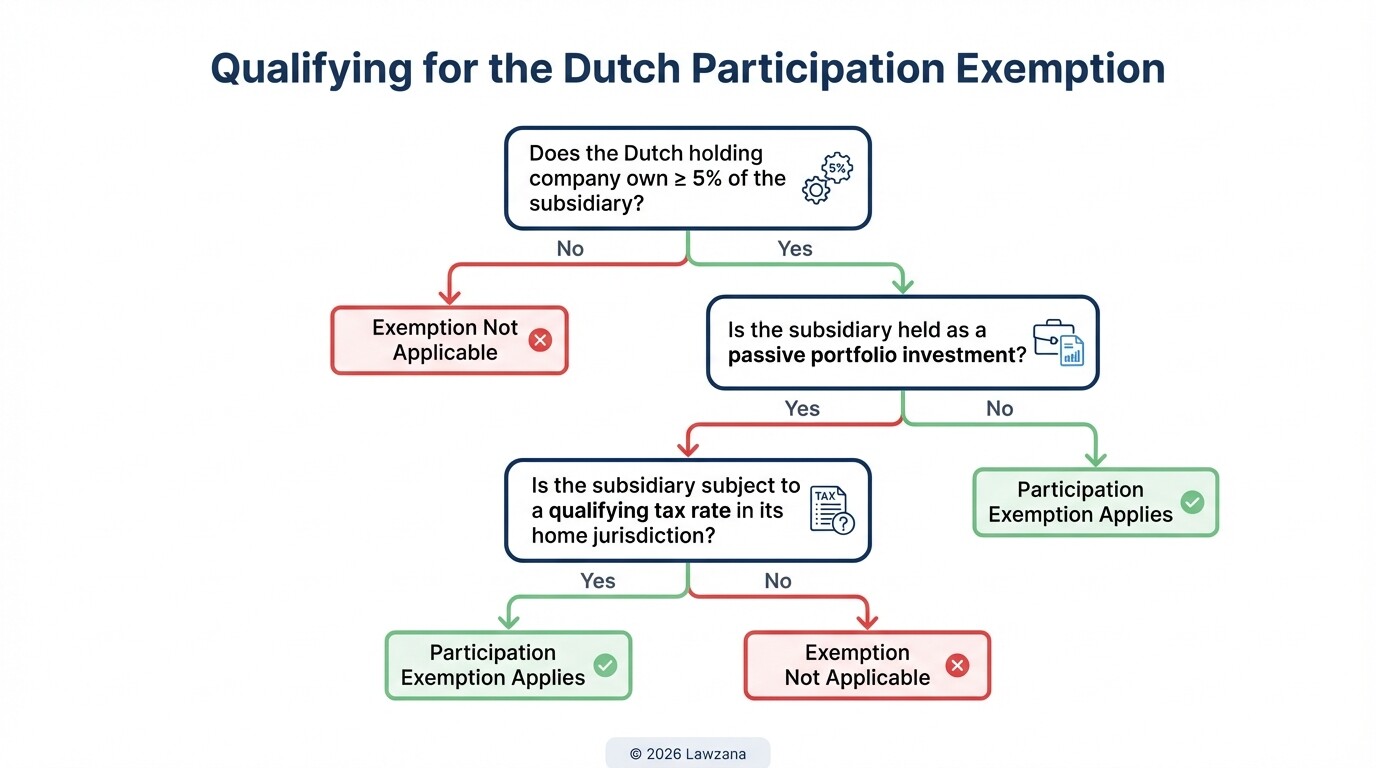

To qualify for this exemption, the Dutch holding company must generally hold at least 5% of the nominal paid-up share capital of the subsidiary. Additionally, the subsidiary must not be held as a mere passive portfolio investment, or it must be subject to a "qualifying" tax rate in its home jurisdiction. This mechanism prevents double taxation and makes the Netherlands an ideal location for re-investing profits into new ventures without losing a percentage to the tax authorities.

Conditions for the Participation Exemption:

- Minimum Interest: The parent company must hold at least 5% of the subsidiary's shares.

- Motive or Asset Test: The subsidiary should not be held primarily as a portfolio investment, or its assets must consist of less than 50% "passive" assets.

- Subject-to-Tax Test: If the motive test is not met, the subsidiary must be subject to a reasonable tax levy based on Dutch standards.

What Protections Do Dutch Bilateral Investment Treaties (BITs) Offer?

Dutch Bilateral Investment Treaties provide international investors with a safety net against political risks, such as expropriation or discriminatory treatment by foreign governments. These treaties allow investors to bypass local courts in foreign jurisdictions and seek resolution through international arbitration.

The Netherlands has signed over 70 BITs with countries worldwide. This network is particularly valuable for companies investing in jurisdictions with developing legal systems. If a foreign government seizes assets or changes regulations in a way that targets a Dutch-held subsidiary, the Dutch holding company can invoke the BIT to claim compensation through organizations like the International Centre for Settlement of Investment Disputes (ICSID).

Standard Protections in Dutch BITs:

- Fair and Equitable Treatment: Protection against arbitrary or discriminatory government actions.

- Expropriation Rules: Guarantees that if a government takes private property, it must pay prompt and adequate compensation.

- Transfer of Funds: The right to freely transfer dividends and investment returns out of the host country.

- Dispute Settlement: Access to neutral, third-party international arbitration.

What Are the Governance and Substance Requirements for a Dutch BV?

To qualify for tax treaty benefits and avoid being classified as a "conduit" company, a Dutch holding company must maintain adequate "substance." This means the company must demonstrate that it is actually managed and controlled within the Netherlands.

Regulatory authorities and the Dutch Tax and Customs Administration look for specific physical and operational markers to confirm substance. If a company fails these tests, it may be denied access to the Participation Exemption or reduced withholding tax rates under various international treaties.

Checklist for Dutch Substance:

- Local Management: At least half of the managing directors should reside in the Netherlands.

- Board Meetings: Key board decisions must be made within the Netherlands, and meetings should be physically held there.

- Qualified Personnel: The board must have the necessary professional knowledge to perform their duties and manage the company's transactions.

- Physical Office: The company must have a registered office address in the Netherlands (not just a PO Box).

- Bank Account: The company should maintain its primary corporate bank account in the Netherlands.

- Accounting: All bookkeeping and corporate records must be kept in the Netherlands.

How Seamless Are Cross-Border Mergers Within the EU?

The Netherlands has fully integrated EU Directives that simplify cross-border mergers, divisions, and conversions of companies within the European Economic Area (EEA). This allows a Dutch holding company to absorb subsidiaries in other EU member states without needing to liquidate the original entities.

This legal framework is designed to facilitate "freedom of establishment." When two companies merge across borders, the assets, liabilities, and legal relationships of the disappearing company automatically transfer to the surviving Dutch entity by operation of law. This process minimizes the administrative burden of re-titling assets or renegotiating contracts, making the Netherlands a strategic choice for consolidating European operations.

The Cross-Border Merger Process:

- Common Draft Terms: Both companies must prepare and sign a merger proposal.

- Shareholder Approval: The general meeting of shareholders in both companies must vote to approve the merger.

- Public Disclosure: The merger proposal must be filed at the KVK (Chamber of Commerce) and published in a national newspaper to notify creditors.

- Creditor Opposition: Creditors have a one-month window to oppose the merger if they believe their claims are at risk.

- Notarial Deed: A Dutch civil law notary must execute the deed of merger after confirming all legal requirements have been met.

What Are the Reporting and Transparency Obligations?

Operating a Dutch holding company involves strict compliance with transparency laws, including the mandatory registration of Ultimate Beneficial Owners (UBOs). These rules are part of the EU's Anti-Money Laundering (AML) initiatives and are designed to prevent the misuse of corporate structures.

Every Dutch BV must file its annual financial statements with the Chamber of Commerce. The level of detail required depends on the size of the company (classified as micro, small, medium, or large based on assets, turnover, and employee count). While holding companies with no employees often fall into the "micro" or "small" categories, they must still provide a balance sheet and notes to the accounts that are accessible to the public.

| Obligation | Description | Frequency |

|---|---|---|

| UBO Registration | Identifying individuals who own or control more than 25% of the company. | Upon setup and any changes |

| Annual Accounts | Filing a balance sheet and profit/loss statement with the KVK. | Annually (within 12 months) |

| Corporate Income Tax | Filing a tax return, even if the Participation Exemption applies. | Annually |

| VAT Filing | Required if the holding company performs active management services. | Quarterly or Annually |

Common Misconceptions About Dutch Holding Companies

Myth 1: The Netherlands is a tax haven. While the Netherlands offers tax efficiencies like the Participation Exemption, it is not a tax haven. It has high compliance standards, transparent reporting, and has implemented all recent EU anti-tax avoidance directives (ATAD 1 and 2). It is a highly regulated, "white-listed" jurisdiction.

Myth 2: You don't need a physical office if you have a Dutch director. Simply hiring a local director is not enough to satisfy "substance" rules. Tax authorities increasingly look for "economic reality," which includes having a functional office space and a board that exercises genuine decision-making power on Dutch soil.

Myth 3: Setting up a BV takes months. With a clear structure and completed "Know Your Customer" (KYC) checks, a Dutch BV can typically be incorporated within one to two weeks. The bottleneck is often opening a corporate bank account, which requires rigorous documentation.

FAQs

How much capital is required to start a Dutch BV?

There is no longer a high minimum capital requirement for a BV. The law allows for a minimum share capital of €0.01. However, most investors opt for a more practical amount, such as €100 or €1,000, to facilitate share issuance.

Does a Dutch holding company need a local bank account?

Yes, for both practical and substance reasons. A local bank account is usually required to pay local taxes and expenses, and it is a key indicator to tax authorities that the company is genuinely operating within the Netherlands.

Can a foreigner be the sole director of a Dutch holding company?

Yes, there are no nationality or residency requirements for directors in the Dutch Civil Code. However, to meet substance requirements for tax purposes, it is highly recommended that at least half of the directors reside in the Netherlands.

What is the corporate tax rate in the Netherlands?

As of 2024, the corporate income tax rate is 19% for profits up to €200,000 and 25.8% for profits exceeding that amount. Note that income qualifying for the Participation Exemption is effectively taxed at 0%.

When to Hire a Lawyer

Structuring a Dutch holding company involves navigating complex tax laws and international treaties. You should consult a Dutch corporate lawyer if:

- You are planning a cross-border merger or acquisition involving multiple jurisdictions.

- You need to draft a bespoke Shareholders' Agreement (SHA) to manage relationships between international partners.

- You are unsure if your subsidiary structure qualifies for the Participation Exemption.

- You need assistance navigating the "substance" requirements to ensure your tax treaty benefits are protected.

- You are dealing with a dispute that may require invoking a Bilateral Investment Treaty.

Next Steps

- Define Your Objectives: Determine if your primary goal is tax consolidation, asset protection, or preparing for an exit.

- Select a Notary: In the Netherlands, only a civil law notary can incorporate a BV. They will perform mandatory identity and background checks.

- Draft the Articles of Association: Work with legal counsel to ensure the governing documents of your BV reflect your governance needs.

- Fulfill Substance Requirements: Secure a physical office address and ensure your board composition meets Dutch tax standards.

- Register with the KVK: Once the notary signs the deed of incorporation, the company must be registered in the Commercial Register and the UBO register.