Italy offers a dynamic market for international investors, serving as a gateway to Europe and the Mediterranean. However, its bureaucratic reputation is well-earned. For foreign entrepreneurs, navigating the setup of an Italian company requires patience, precision, and a clear understanding of the legal landscape.

The most common corporate structure for small to medium-sized businesses in Italy is the SRL (Società a Responsabilità Limitata). Similar to an LLC in the United States or a Private Limited Company in the UK, the SRL offers limited liability protection for its shareholders.

What You Will Learn in This Guide

- The Structure: Understanding the SRL and the difference between standard and simplified forms.

- The Requirements: Share capital, directors, and the registered office.

- The Process: A step-by-step walkthrough from the notary deed to the business register.

- The Taxes: VAT (Partita IVA) and social security (INPS) obligations.

- The Timeline: How long it takes and what it costs.

What is an SRL? (Società a Responsabilità Limitata)

An SRL is a private limited liability company. It is a distinct legal entity from its owners, meaning the personal assets of the shareholders are generally protected from the company’s debts and liabilities.

It is the preferred vehicle for foreign investors because it provides a professional corporate image while allowing for flexible governance.

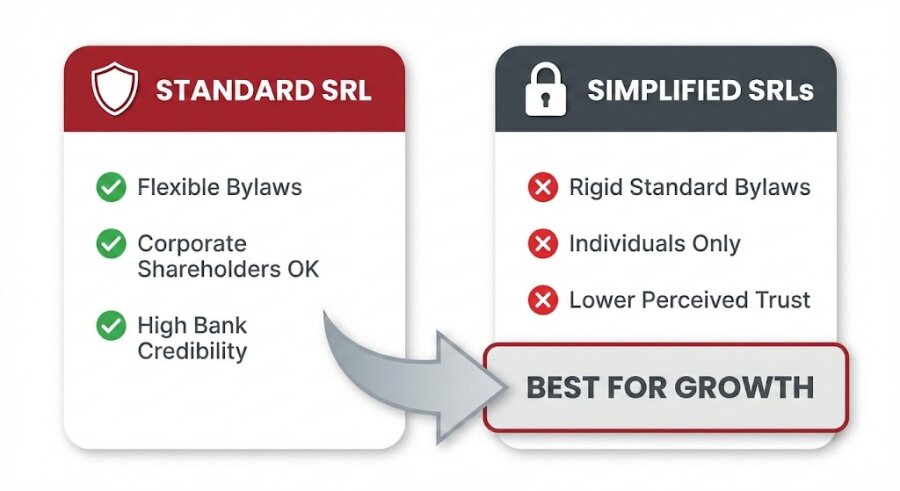

SRL vs. SRLs (Simplified SRL)

Italy introduced the SRLs (Società a Responsabilità Limitata Semplificata) to encourage entrepreneurship by lowering costs. However, it comes with restrictions that may not suit every investor.

| Feature | Standard SRL | Simplified SRL (SRLs) |

| Shareholders | Individuals or other companies (foreign or domestic). | Individuals only. No corporate shareholders allowed. |

| Minimum Capital | €10,000 (can be lower under specific conditions). | €1 to €9,999. |

| Notary Fees | Standard rates apply. | Exempt from notary honorariums (but taxes still apply). |

| Bylaws | Flexible and customizable articles of association. | Rigid, standard model set by law. Cannot be modified. |

| Credibility | Higher perceived trust with banks and partners. | Often perceived as a "starter" entity. |

Key Takeaway: While the Simplified SRL saves money upfront, the inability to customize bylaws or have corporate shareholders makes the Standard SRL the better choice for most international businesses.

Core Requirements Before You Start

Before you book a flight to Rome or Milan, you must prepare the foundational elements of your company.

Shareholders and Directors

- Shareholders: There are no restrictions on foreign nationality or residence for shareholders, provided there is a condition of reciprocity between Italy and the shareholder's country.

- Directors: You can have a sole director (Amministratore Unico) or a Board of Directors (Consiglio di Amministrazione). Directors do not necessarily need to be Italian residents.

The Registered Office (Sede Legale)

Every Italian company must have a physical address in Italy. This address will appear on all public records and official correspondence. Virtual offices are permitted for registration purposes, but you must have a valid lease or domiciliation contract.

Italian Tax ID (Codice Fiscale)

This is the starting point for any interaction with the Italian state. All shareholders and directors must obtain an Italian Tax Identification Number (Codice Fiscale).

- How to get it: You can apply at any Italian consulate abroad or the Italian Revenue Agency (Agenzia delle Entrate) in Italy.

Step-by-Step Guide to Registering an SRL

The process of forming an SRL is formalized and involves a public official known as a Notaio (Notary). Unlike in some common law jurisdictions, you cannot simply "file online" without a notary's involvement.

Step 1: Draft the Bylaws

You must prepare two key documents:

- Act of Incorporation (Atto Costitutivo): This proves the intent to form the company and lists the members.

- Articles of Association (Statuto): This document outlines the rules for running the company, such as how decisions are made, how profits are distributed, and how shares are transferred.

- Note: These documents must be in Italian. If you do not speak Italian, they must be translated, and an interpreter must be present during the signing.

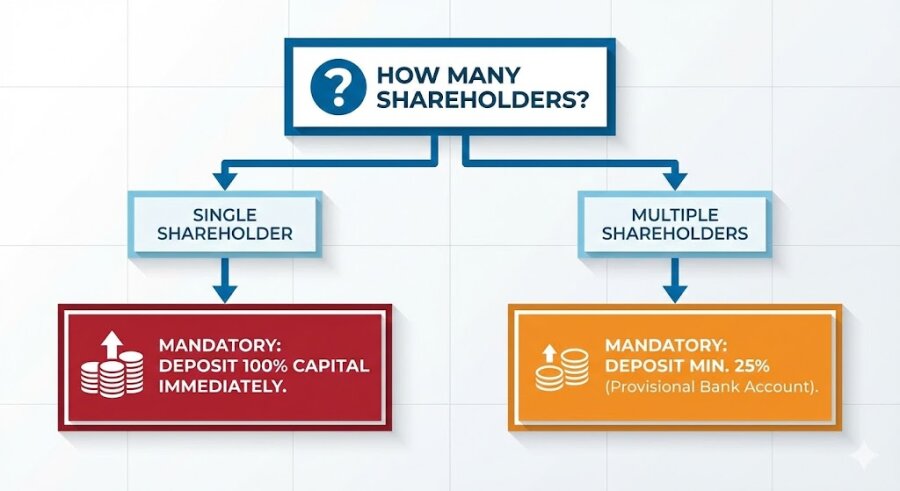

Step 2: Deposit the Share Capital

Traditionally, an SRL required a minimum capital of €10,000. While recent reforms allow for a lower capital (even €1), creating a company with under €10,000 triggers specific reserve requirements later on.

- Deposit Rule: If the company has multiple shareholders, you must deposit at least 25% of the share capital into a provisional bank account before the deed is signed.

- Single Shareholder: If you are the sole owner, you must deposit 100% of the share capital immediately.

Step 3: The Public Deed of Incorporation

This is the most critical step. The shareholders (or their attorneys holding a Power of Attorney) must appear before a Public Notary.

- The Notary reads the deed aloud to verify the identity of the parties and ensures the bylaws comply with Italian law.

- Once signed, the Notary registers the deed with the Tax Office and pays the registration taxes on your behalf.

Step 4: Registration with the Business Register

After the deed is signed, the Notary files the incorporation documents with the Registro delle Imprese (Register of Enterprises) at the local Chamber of Commerce (Camera di Commercio).

- Once this registration is complete, the company legally exists.

- You will receive a Visura Camerale, which is the company’s official certificate of registration.

Post-Incorporation Compliance

Forming the legal entity is only half the battle. To become operational, you must navigate Italy’s fiscal and administrative systems.

VAT Registration (Partita IVA)

Simultaneously with the business registration, the company will be assigned a VAT number (Partita IVA). This number is essential for invoicing and purchasing goods.

Certified Email (PEC)

Italy uses a unique system called PEC (Posta Elettronica Certificata). This is a certified email address that has the same legal value as a registered letter. Every company is legally required to have a PEC address and register it with the Chamber of Commerce.

- Why it matters: The government, courts, and tax authorities will send official notifications here. Ignoring your PEC inbox can lead to severe fines.

Digital Signature (Firma Digitale)

The company’s legal representative (director) must obtain a verified digital signature kit (smart card or USB token). This is required to sign annual filings, tax returns, and changes to the company structure.

INPS and Social Security

If the directors are also working operationally within the company (not just attending board meetings), they may need to register with INPS (Istituto Nazionale della Previdenza Sociale) for social security contributions. This is a complex area requiring a labor consultant (Consulente del Lavoro).

Declaration of Commencement of Business

Once you are ready to actually start trading (e.g., opening your shop or selling services), you must file a specific declaration (Comunicazione Unica) to the Chamber of Commerce signaling the start of economic activity.

Corporate Governance & Ongoing Maintenance

Running an SRL requires adherence to specific corporate formalities.

Shareholders' Meetings

Shareholders must meet at least once a year to approve the financial statements (Bilancio). The financial statements must be filed with the Business Register. Failure to file these on time results in penalties.

Corporate Books

The company must maintain specific corporate books, which are mandatory and must be stamped by a notary or the business register:

- Book of Shareholders’ Decisions.

- Book of Board of Directors’ Decisions.

- Book of Statutory Auditors (if applicable).

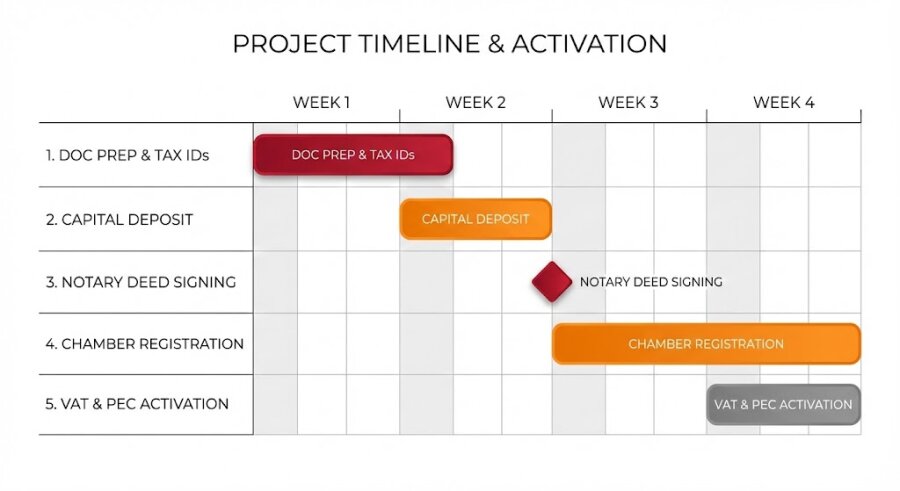

Timeline and Costs

How long does this actually take, and what is the investment?

Timeline:

- Preparation (Documents/Tax IDs): 1–2 weeks.

- Bank Deposit & Notary Appointment: 1 week.

- Registration (Chamber of Commerce): 3–5 days after the Notary files the deed.

- Total: Realistic expectancy is roughly 3 to 4 weeks from start to finish.

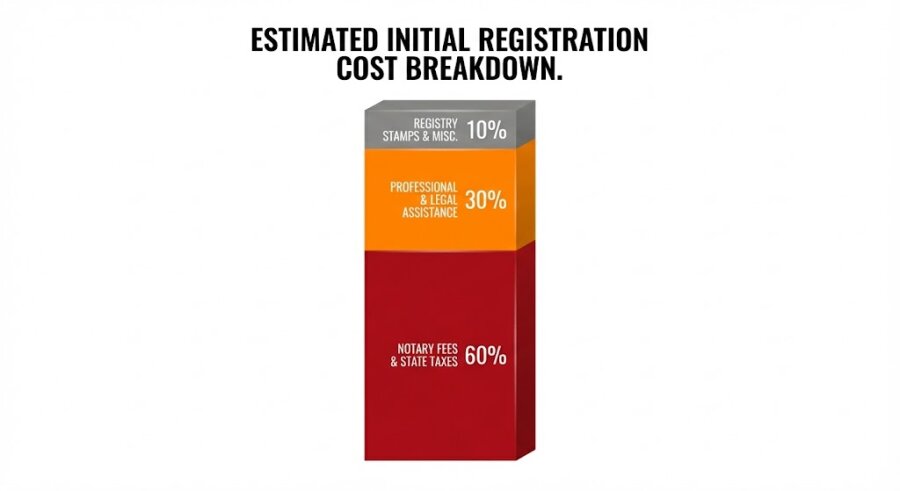

Estimated Costs:

- Minimum Share Capital: €1 to €10,000 (depending on structure).

- Notary Fees: €1,500 – €3,000 (varies by region and complexity).

- Registration Taxes & Stamps: Approx. €500 – €600.

- Annual Accountant Fees: €2,500 – €5,000+ per year (mandatory for filing VAT and balance sheets)

Bank Account Challenges: Opening a corporate bank account in Italy can be the slowest part of the process due to strict Anti-Money Laundering (AML) checks. Many investors choose to open the initial account with online banking platforms that offer Italian IBANs to speed up the capital deposit phase.

Why You Need a Corporate Lawyer

While the Notary handles the public deed, they are a neutral public official. They do not represent you. An Italian corporate lawyer acts as your advocate to ensure the structure benefits your specific business goals.

The Language Barrier

All official acts must be in Italian. A bilingual lawyer ensures you understand exactly what you are signing in the Statuto (Articles of Association).

Power of Attorney (Procura)

If you cannot travel to Italy for the notary meeting, you can grant a Power of Attorney to your lawyer. They can sign the incorporation deed on your behalf, saving you travel costs and logistical headaches.

Customizing the Bylaws

Standard bylaws provided by a notary are often generic. A lawyer can draft specific clauses regarding:

- Pre-emption rights (controlling who can buy shares).

- Drag-along and tag-along rights (protecting majority/minority shareholders during a sale). Specific voting majorities for key decisions.

Your Path Forward

Establishing an SRL in Italy opens the door to one of Europe’s largest economies, but the path is paved with strict formalities. From drafting the Atto Costitutivo to navigating the Registro delle Imprese, precision is required to avoid costly delays.

To ensure your company is set up correctly and compliant from day one, connect with a specialist. You can browse vetted corporate lawyers in Italy on Lawzana to guide you through the process.

What They Don’t Tell You at the Consulate

Can I manage my Italian SRL without ever setting foot in Italy?

Yes, but you will need a digital lifeline. Technically, there is no residency requirement for directors or shareholders. However, the bureaucracy is digital-heavy. You will need a PEC (Certified Email) address, which functions as your legal domicile for official notices, and a Digital Signature kit to sign documents remotely.

- The Catch: While you can run operations remotely, opening the initial bank account often requires an in-person visit due to anti-money laundering (AML) laws.

Is the "1 Euro" company (SRLs) a smart hack or a trap?

It is often a false economy. While starting a "Simplified" SRL with €1 of capital sounds appealing, it signals "low credibility" to banks and suppliers. More importantly, you cannot customize the bylaws. If you plan to bring in investors later, or want specific rules on selling shares, the rigid structure of the SRLs will likely force you to pay for a costly conversion to a standard SRL anyway.

If the company goes bankrupt, is my personal house safe?

Generally, yes, but not unconditionally. The "Limited Liability" in an SRL protects your personal assets from standard business debts. However, this veil can be pierced if you, as a director, act with "gross negligence" or fraud. If you treat the company's money as your own personal wallet, an Italian court can hold you personally liable for the company's downfall.

Why does everyone say opening a bank account is harder than the registration itself?

Because Italian banks are incredibly risk-averse with foreign entities. The "Know Your Customer" (KYC) protocols are stringent. If your company structure involves complex foreign holding companies (e.g., a Trust in a tax haven owning the Italian SRL), the bank may simply refuse you.

- Pro Tip: many investors now use "fintech" business accounts with Italian IBANs (like Qonto or Wise) to get started faster, as traditional banks can take months to approve a new corporate client.

I don't speak a word of Italian. Is this a dealbreaker?

Legally, no. Practically, it’s expensive. All official deeds (Incorporation, Bylaws) must be in Italian. If you cannot read them, the law requires the deed to be bi-lingual, and you must pay for a qualified interpreter to be present during the notary signing. You cannot just use Google Translate for a legal deed; the interpreter is a formal legal requirement that adds to your startup costs.

Can setting up an SRL get me a Visa to live in Italy?

Not automatically. Simply owning a company does not grant you the right to live in Italy. However, there is a specific "Self-Employment Visa" (Visto per Lavoro Autonomo) for company directors. It is one of the hardest visas to obtain because strict quotas apply (the "Decreto Flussi"). You must prove the company is real, capitalized, and can afford to pay you a compliant salary. Do not assume incorporation equals immigration.