Table of Contents:

Introduction: Navigating the 2025 Compliance Cycle

The Foundation of UAE's Modern Tax System

- Core Legislation and Strategic Objectives

- Roles of the Ministry of Finance and the Federal Tax Authority (FTA)

Determining Your Tax Obligations

- Juridical vs. Natural Persons

- The Concept of Tax Residency and Non-Resident Nexus

The Mechanics of Tax Calculation

- Tax Rates and the Domestic Minimum Top-up Tax (DMTT)

- Calculating Taxable Income

- Expense Deductibility Rules

Strategic Frameworks and Special Regimes

- The Qualifying Free Zone Person (QFZP) Regime

- Small Business Relief (SBR)

- Tax Groups

International Compliance Standards

- Transfer Pricing (TP) Rules

- Domestic Minimum Top-up Tax (DMTT)

Administrative Compliance and Enforcement

- Registration, Filing, and Payment

- Mandatory Audited Financial Statements

- Record-Keeping and Penalties

Key 2025 Legislative Changes

Strategic Implications and Business Considerations

- Intersection with UAE Commercial and Companies Law

- Impact on Corporate Structuring

Looking Ahead: Compliance Best Practices

The United Arab Emirates has undergone a transformative shift in its fiscal landscape, moving from a historically low-tax jurisdiction to implementing a comprehensive and internationally-aligned corporate tax in the UAE system. As businesses navigate their first complete compliance cycle in 2025, understanding the complexities of this new regime has become critical for successful operations in the Emirates.

This landmark year represents more than just a new tax obligation. It marks the crystallization of significant legislative frameworks that fundamentally alter how businesses structure their operations, manage intercompany transactions, and plan their long-term strategies in the UAE. For companies operating on a calendar financial year, the deadline for filing their first corporate tax return for the 2024 tax period falls on September 30, 2025, making immediate compliance preparation essential.

The Foundation of UAE's Modern Tax System

The cornerstone of the UAE's contemporary tax architecture is Federal Decree-Law No. 47 of 2022, which established the first federal-level direct tax on business profits in the nation's history. This legislation became effective for financial years commencing on or after June 1, 2023, creating a staggered implementation that affects different businesses based on their financial year-end dates.

The strategic objectives underlying this transformation extend beyond revenue generation. The UAE aimed to cement its position as a leading global business hub by providing a clear, competitive tax framework while aligning with international standards for tax transparency. This alignment specifically addresses the OECD's Base Erosion and Profit Shifting (BEPS) initiatives, ensuring that profits are taxed where underlying economic activities are performed and value is created.

The administrative structure divides responsibilities between two key bodies: the Ministry of Finance serves as the primary policymaking entity, developing overarching tax policy and issuing, implementing legislation through Cabinet Decisions and Ministerial Decisions. Meanwhile, the Federal Tax Authority (FTA) handles day-to-day administration, collection, and enforcement, including managing the EmaraTax portal for tax return submissions and conducting compliance audits.

Determining Your Tax Obligations

Understanding whether your business falls within the scope of corporate tax in the UAE requires careful analysis of the "Taxable Person" definition. The law distinguishes between two main categories:

Juridical Persons represent the primary category subject to corporate tax, encompassing all companies and legal entities incorporated, established, or registered in the UAE. This includes mainland entities and those registered in any of the UAE's numerous Free Zones. Importantly, foreign legal entities that are "effectively managed and controlled" from within the UAE also fall under this classification.

Natural Persons (individuals) become subject to corporate tax only under specific circumstances. The tax applies when they conduct business activities in the UAE requiring commercial licenses or permits, but only if their total turnover from these activities exceeds AED 1 million in a Gregorian calendar year. Personal income from employment, real estate investments, dividends, and bank interest remains outside the corporate tax scope.

The concept of tax residency creates a critical distinction affecting the basis of taxation. Resident Persons face UAE corporate tax on both domestic and foreign-sourced income (worldwide taxation), while Non-Resident Persons are taxed only on UAE-sourced income. A significant development for 2025 is Cabinet Decision No. 35 of 2025, which expands the concept of taxable 'nexus' for non-residents, particularly targeting income from UAE immovable property, regardless of whether a traditional Permanent Establishment exists.

The Mechanics of Tax Calculation

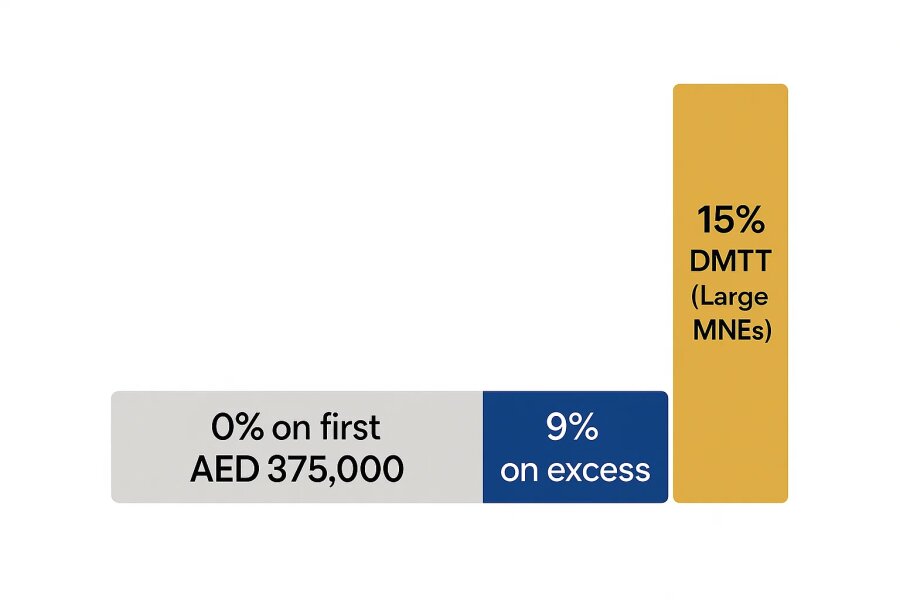

The UAE operates a competitive two-tier corporate tax rate system designed to be among the most favorable globally. The structure applies a 0% rate to taxable income up to AED 375,000, with a 9% rate on amounts exceeding this threshold. This progressive marginal system ensures that a business with AED 500,000 in taxable income pays 0% on the first AED 375,000 and 9% only on the remaining AED 125,000.

However, the introduction of the Domestic Minimum Top-up Tax (DMTT) in 2025 creates a third tier affecting large multinational enterprises. This implementation of the OECD's Pillar Two framework ensures that qualifying MNEs pay a minimum effective tax rate of 15% on UAE profits, potentially neutralizing benefits from preferential regimes.

The calculation process begins with accounting net profit as reported in financial statements prepared according to International Financial Reporting Standards (IFRS). From this starting point, businesses must make various adjustments: adding back non-deductible expenses, subtracting exempt income, and applying other reliefs and adjustments. The resulting figure becomes the taxable income for the period.

A crucial aspect of tax compliance in the UAE involves understanding expense deductibility rules. The general principle requires expenses to be incurred "wholly and exclusively" for business purposes. The law specifically disallows deductions for fines, penalties, bribes, donations to non-approved organizations, recoverable VAT, and expenditure related to deriving exempt income.

Strategic Frameworks and Special Regimes

The Qualifying Free Zone Person (QFZP) regime represents one of the most significant strategic considerations for businesses operating in UAE Free Zones. This preferential system offers a 0% tax rate on qualifying income, but requires meeting seven stringent conditions throughout each tax period.

These conditions include maintaining adequate economic substance within the Free Zone, conducting core income-generating activities locally, deriving qualifying income as specifically defined, maintaining proper transfer pricing documentation, preparing audited financial statements, and meeting de minimis requirements. The adequate substance requirement ensures that the 0% benefit is granted only to businesses with genuine economic operations in the Free Zone.

The distinction between qualifying and non-qualifying income is critical for QFZP status. Cabinet Decision No. 100 of 2023 defines qualifying income to include transactions with other Free Zone Persons (excluding "Excluded Activities"), income from specific "Qualifying Activities" with non-Free Zone entities, income from qualifying intellectual property, and other income meeting de minimis requirements.

The de minimis rule creates a critical threshold: non-qualifying revenue cannot exceed the lower of AED 5 million or 5% of total revenue. Breaching this threshold results in losing QFZP status for the current period plus the subsequent four tax periods, which is a five-year disqualification that significantly impacts long-term tax planning.

For smaller businesses, the Small Business Relief (SBR) offers an alternative approach. Available to resident businesses with total revenue not exceeding AED 3 million (including all previous periods), this temporary relief (available only until December 31, 2026) treats electing businesses as having zero taxable income. However, SBR comes with significant trade-offs: businesses cannot utilize tax loss carry-forwards or deduct net interest expenses during the relief period.

The Tax Groups provisions allow two or more resident companies to consolidate for tax purposes, enabling loss sharing and administrative efficiencies. However, Ministerial Decision No. 301 of 2024, effective from January 1, 2025, introduces new complexities around utilizing pre-grouping losses and expands transfer pricing requirements within groups.

International Compliance Standards

The UAE has fully embraced international tax standards through comprehensive Transfer Pricing (TP) rules aligned with OECD guidelines. These rules require that transactions between related parties follow the "arm's length principle"; meanwhile, pricing and terms must match those that would exist between independent entities under comparable circumstances.

TP compliance involves tiered documentation requirements: all businesses with related party transactions must complete disclosure forms with their annual returns, while larger multinational groups exceeding specific revenue thresholds must prepare and maintain Master Files and Local Files providing detailed transaction analysis and group structure information.

The introduction of the DMTT represents the UAE's most significant alignment with global tax standards. Effective January 1, 2025, this regime applies to MNEs with UAE constituent entities and consolidated global revenues exceeding EUR 750 million in at least two of the four preceding years. The system calculates whether the MNE's effective tax rate in the UAE meets the 15% minimum, imposing a top-up tax to cover any shortfall.

Administrative Compliance and Enforcement

Successful tax compliance in the UAE requires understanding the comprehensive administrative framework governing registration, filing, payment, and record-keeping obligations. All businesses within scope must register with the FTA and obtain a Tax Registration Number (TRN), regardless of their specific regime (including Free Zone entities and those qualifying for Small Business Relief).

The central compliance event is the annual tax return filing through the EmaraTax portal, with deadlines falling within nine months of the relevant tax period's end. The system uses dynamic, interactive forms where required schedules are tailored based on the taxpayer's specific characteristics and elections, requiring detailed breakdowns of exempt income, related party transaction adjustments, and, for QFZPs, specific data on capital and operating expenses.

A critical development for 2025 is Ministerial Decision No. 84 of 2025, which mandates audited financial statements for all QFZPs regardless of revenue level and any business with revenue exceeding AED 50 million. This requirement significantly raises financial reporting standards across the UAE economy while increasing compliance costs.

The law requires maintaining all relevant records for at least seven years following the relevant tax period's end. The FTA has established clear penalty structures for non-compliance, including administrative penalties for late registration, filing, and payment. Additionally, the General Anti-Abuse Rule allows the FTA to disregard transactions primarily designed to obtain unintended tax advantages.

Key 2025 Legislative Changes

Several critical pieces of legislation took effect in 2025, fundamentally altering the corporate tax landscape. The DMTT implementation represents the most significant change, effectively neutralizing the 0% QFZP benefit for large MNEs by imposing the 15% minimum rate.

Tax Groups regulations have been refined to address pre-grouping loss utilization and expand transfer pricing requirements within groups. The mandatory audit requirements create new compliance costs and governance standards, while the expanded non-resident nexus rules bring previously exempt foreign real estate investors into the tax net.

These changes demonstrate the UAE's strategic pivot toward using tax policy as a sophisticated tool for multiple objectives: ensuring OECD compliance, enhancing financial transparency, and promoting specific economic activities. The proposed R&D tax incentive, expected to take effect in 2026 with potential 30-50% expenditure-based credits, signals continued evolution toward incentivizing high-value innovation.

Strategic Implications and Business Considerations

The new corporate tax regime in the UAE necessitates a fundamental reassessment of business strategies and structures. The choice between mainland and Free Zone operations now carries significant long-term tax consequences that must be carefully modeled. For Free Zone entities, the decision between maintaining QFZP status through complex compliance requirements or electing simpler alternatives like SBR requires detailed financial analysis considering both immediate costs and future implications.

The intersection of UAE commercial law in 2025 with tax obligations creates new complexities for business operations. Transfer pricing documentation requirements affect all intercompany transactions, while the enhanced audit requirements elevate corporate governance standards. These changes may trigger business legal disputes in the UAE as parties reassess contractual arrangements and pricing structures to ensure arm's length compliance.

Understanding the UAE companies law in the context of tax obligations becomes crucial for corporate structuring decisions. The effective management and control tests for tax residency, combined with substance requirements for preferential regimes, require careful coordination between legal structure and operational substance. For businesses considering restructuring or new investments, the tax implications must be integrated with broader legal and commercial considerations.

Looking Ahead: Compliance Best Practices

Successfully navigating tax compliance in the UAE requires proactive planning and robust internal controls. Businesses should conduct comprehensive reviews of their current structures against the new requirements, particularly assessing QFZP status conditions and transfer pricing obligations. For entities approaching the AED 50 million revenue threshold or considering Free Zone operations, engaging qualified auditors and tax advisors becomes essential.

The dynamic nature of the legislative environment demands continuous monitoring of new guidance from the FTA and legislative updates from the Ministry of Finance. The complexity of calculating taxable income, managing multiple regimes, and meeting documentation requirements often exceeds internal capabilities, making professional advisory support a strategic necessity rather than a compliance luxury.

For businesses seeking expert guidance through these complex requirements, qualified tax lawyers in the UAE provide essential support in navigating both compliance obligations and strategic planning opportunities. The integration of tax considerations with broader legal and commercial strategies requires specialized expertise to ensure optimal outcomes while maintaining full compliance with the evolving regulatory framework.

The transformation of the UAE's tax landscape represents both challenge and opportunity. While compliance costs and complexity have increased significantly, the clear framework provides predictability for long-term planning. Businesses that invest in understanding and properly implementing these requirements position themselves advantageously in the UAE's evolving economic environment, ensuring sustainable growth while meeting their tax obligations efficiently and effectively.

The era of simple tax planning in the UAE has definitively ended, replaced by a sophisticated system requiring an integrated legal, tax, and business strategy. Success in this new environment demands not just compliance expertise but strategic foresight to leverage opportunities while managing risks in one of the world's most dynamic business jurisdictions.