- Foreign investors must obtain an Investment Registration Certificate (IRC) before applying for an Enterprise Registration Certificate (ERC) to legally operate.

- Vietnam follows a "Negative List" approach, meaning any sector not explicitly restricted or conditional is open to 100% foreign ownership.

- All capital transfers, including initial investment and profit repatriation, must flow through a specialized Direct Investment Capital Account (DICA) opened at a licensed bank in Vietnam.

- Land ownership is not permitted for foreigners; instead, investors secure Land Use Rights (LUR) through leases, typically within designated Industrial Zones (IZs).

- Compliance with the Law on Investment 2020 and its subsequent decrees remains the primary legal framework for all FDI activities heading into 2026.

How do you obtain an Investment Registration Certificate (IRC) in Vietnam?

The Investment Registration Certificate (IRC) is the mandatory first license required for most foreign-invested projects in Vietnam. It functions as the formal approval of your investment project's scale, location, and capital commitments by the provincial Department of Planning and Investment (DPI) or an Industrial Zone Management Board.

For standard projects that do not require "Investment Policy Approval" from the Prime Minister or National Assembly, the procedure follows these steps:

- Dossier Preparation: You must compile documents including the investment proposal, proof of financial capacity (bank statements or audited reports), and legal identification of the investor (passport or certificate of incorporation).

- Online Application: Register the project details on the National Foreign Investment Information System to receive a tracking number.

- Physical Submission: Submit the hard-copy dossier to the relevant authority (DPI for projects outside zones; Management Board for projects inside Industrial Zones).

- Evaluation and Issuance: The authority evaluates the project's compliance with local planning and security. By law, the IRC should be issued within 15 days of receiving a valid dossier, though complex projects may take longer.

Once the IRC is granted, you have 90 days to contribute the committed charter capital. Following the IRC, you must apply for an Enterprise Registration Certificate (ERC) to establish the legal entity (the "company") itself.

What are the updated conditional and restricted business sectors for 2026?

Vietnam uses a "Negative List" system to regulate foreign market access, categorizing industries into prohibited sectors, restricted sectors, and conditional sectors. If a business activity is not on this list, foreign investors receive the same treatment as domestic investors.

Investors should consult the National Investment Portal to verify the current status of their specific HS codes (product codes). The 2026 landscape focuses on several key categories:

- Prohibited Sectors: These include trade in narcotics, firecrackers, human organs, and debt collection services.

- Restricted Sectors: Industries where foreign investment is entirely barred to protect national security or cultural heritage, such as certain types of press/media and specialized fishing.

- Conditional Sectors: These allow foreign investment only if specific criteria are met (e.g., minimum capital, specialized sub-licenses, or local partnership). Common examples include:

- Education and vocational training.

- Real estate business.

- Telecommunications and postal services.

- Logistics and transportation.

What are the current local equity participation requirements?

While most sectors in Vietnam now allow 100% foreign ownership, several strategic industries impose an "equity cap" or require a joint venture with a Vietnamese partner. These requirements are often dictated by Vietnam's WTO commitments or specific domestic laws like the Law on Credit Institutions.

Equity caps vary significantly by sub-sector. Below is a general guide to participation limits in common conditional industries:

| Industry Sector | Foreign Ownership Limit (FOL) | Key Requirement |

|---|---|---|

| Banking | 30% (aggregate) | Individual foreign investors capped at 5% to 15%. |

| Telecommunications | 49% to 65% | Depends on whether the service is network-based or non-network-based. |

| Advertising | 100% allowed | Must be a joint venture or business cooperation contract for certain media. |

| Internal Water Transport | 49% | Must partner with a local entity. |

| Electronic Games | 49% | Requires a joint venture with a Vietnamese partner. |

If you operate in a sector with an equity cap, your Articles of Association must clearly define the voting rights and profit distribution to ensure they align with these statutory limits.

How do foreign exchange controls and profit repatriation work in Vietnam?

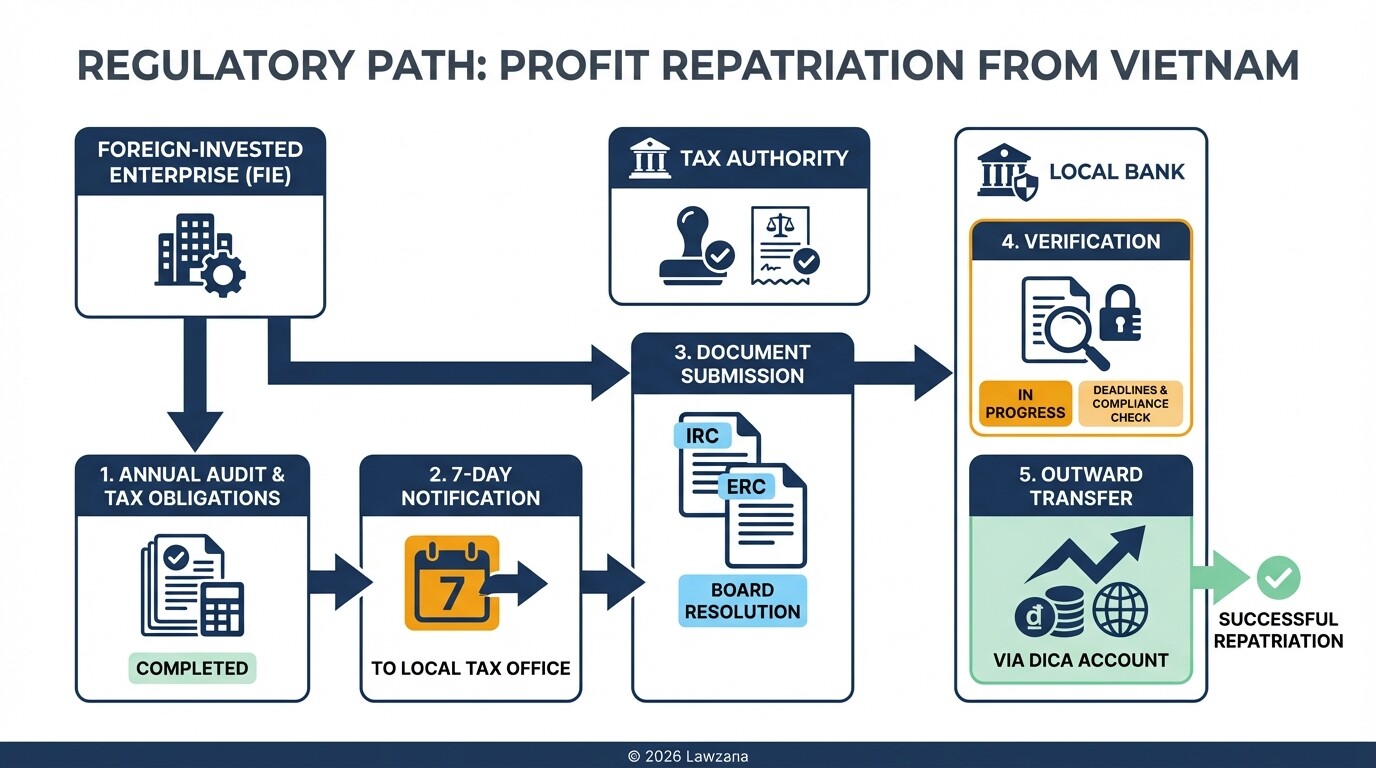

Vietnam maintains strict foreign exchange controls managed by the State Bank of Vietnam (SBV). To move money into or out of the country, a foreign-invested enterprise (FIE) must open a Direct Investment Capital Account (DICA) in a licensed local bank.

All capital contributions, offshore loan disbursements, and profit transfers must pass through this DICA. The process for repatriating profits involves several regulatory hurdles:

- Tax Clearance: Profits can only be sent abroad after the company has fulfilled all tax obligations for the fiscal year.

- Audited Financials: You must provide audited financial statements to the tax authorities.

- Notification: The company must notify the local tax office of its intent to repatriate profits at least seven working days before the transfer.

- Documentation for the Bank: The commercial bank will require the IRC, ERC, tax payment receipts, and the Board of Directors' resolution on dividend distribution before executing the wire transfer.

Note that Vietnam does not currently impose a "withholding tax" on dividends paid to corporate foreign investors, but a 5% withholding tax applies if the investor is an individual.

What are the land use rights for foreign-invested enterprises in industrial zones?

In Vietnam, individuals and organizations cannot "own" land; all land belongs to the people and is managed by the State. Foreign-invested enterprises (FIEs) are granted Land Use Rights (LUR) to utilize land for their business operations.

For 2026 investors, the most efficient route is leasing land within an Industrial Zone (IZ) or Export Processing Zone (EPZ). The benefits of this approach include:

- Infrastructure Readiness: IZs provide pre-built roads, electricity, and water treatment facilities.

- LUR Certificate: FIEs receive a "Red Book" (Land Use Rights Certificate), which can be used as collateral for loans at licensed credit institutions in Vietnam.

- Lease Terms: Leases typically align with the project duration, usually up to 50 years, with the possibility of a 20-year extension.

- Payment Options: Investors can choose to pay rent annually or as a one-time lump sum. Only the lump-sum payment allows the investor to sublease or mortgage the land rights.

Checklist for Land Acquisition in Vietnam

- Verify the zoning of the land matches your business activity.

- Confirm the Industrial Zone developer has the legal right to sub-lease (ensure they have paid their own land rent to the State).

- Review the Environmental Impact Assessment (EIA) requirements for the specific site.

- Ensure the land lease term matches the duration stated on your IRC.

Common Misconceptions About FDI in Vietnam

Myth 1: The IRC and ERC are the same thing

Many investors believe that once they have the Investment Registration Certificate, they can start hiring and selling. In reality, the IRC approves the project, while the Enterprise Registration Certificate (ERC) creates the legal entity. You need both to be fully compliant.

Myth 2: There is a universal minimum capital requirement

Vietnam's Law on Investment does not set a general minimum capital for most businesses. However, the capital you commit must be "reasonable" for the scale of the project. If you propose a manufacturing plant with only $10,000 in capital, the authorities will likely reject the application as unfeasible. Some sectors, like real estate or banking, do have specific legal capital minimums.

Myth 3: Foreigners can buy and sell land freely

Foreign investors often confuse "leasing land" with "owning land." While you can own the structures (factories or warehouses) built on the land, the land itself is leased. Any transfer of land rights must follow strict administrative procedures and usually involves transferring the entire investment project.

FAQ

How long does it take to set up a foreign company in Vietnam?

Typically, the process takes between 4 to 8 weeks. This includes 15 days for the IRC, 3 to 5 days for the ERC, and additional time for seal carving, bank account opening, and initial tax registration.

Can I change my business lines after getting the IRC?

Yes, but it requires an "Investment Amendment" process. You must apply to the DPI to update your IRC first, and subsequently update your ERC and any relevant sub-licenses.

What are the main taxes for an FIE in Vietnam?

The standard Corporate Income Tax (CIT) is 20%. However, many FDI projects in prioritized sectors or geographic areas qualify for tax holidays (0% tax for several years) or preferential rates (10% or 15%). Other taxes include Value Added Tax (VAT) and Personal Income Tax (PIT) for employees.

Do I need a physical office to register a company?

Yes. You must provide a valid lease agreement for a physical location (office or factory) as part of the application process. Virtual offices are increasingly scrutinized and may not be accepted for certain conditional business lines.

When to Hire a Lawyer

Navigating the Vietnamese bureaucracy requires more than just translating documents. You should consult a legal professional if:

- Your business falls into a "conditional" sector (e.g., medical, education, or finance).

- You are entering a joint venture and need a robust Shareholders' Agreement to protect your interests.

- You are negotiating a long-term land lease in an Industrial Zone.

- You need to structure complex cross-border financing or offshore loans.

- You are applying for specific tax incentives that require detailed legal justification.

Next Steps

- Market Entry Study: Define your HS codes and check the National Investment Portal for specific conditions or ownership caps.

- Location Scouting: Decide between an Industrial Zone (manufacturing) or a commercial office (services) and secure a Memorandum of Understanding (MOU) for the lease.

- Dossier Collection: Gather and notarize your corporate documents in your home country; remember that all foreign documents must be legalized by the Vietnamese embassy/consulate.

- Local Consultation: Engage a local legal expert to draft the investment proposal and manage the submission process with the DPI.