- Golden Visa holders can own 100% of a mainland (onshore) LLC in the UAE for most commercial activities without a local partner.

- Unlike Free Zone companies, onshore LLCs can trade directly within the UAE market and bid for government contracts without a distributor.

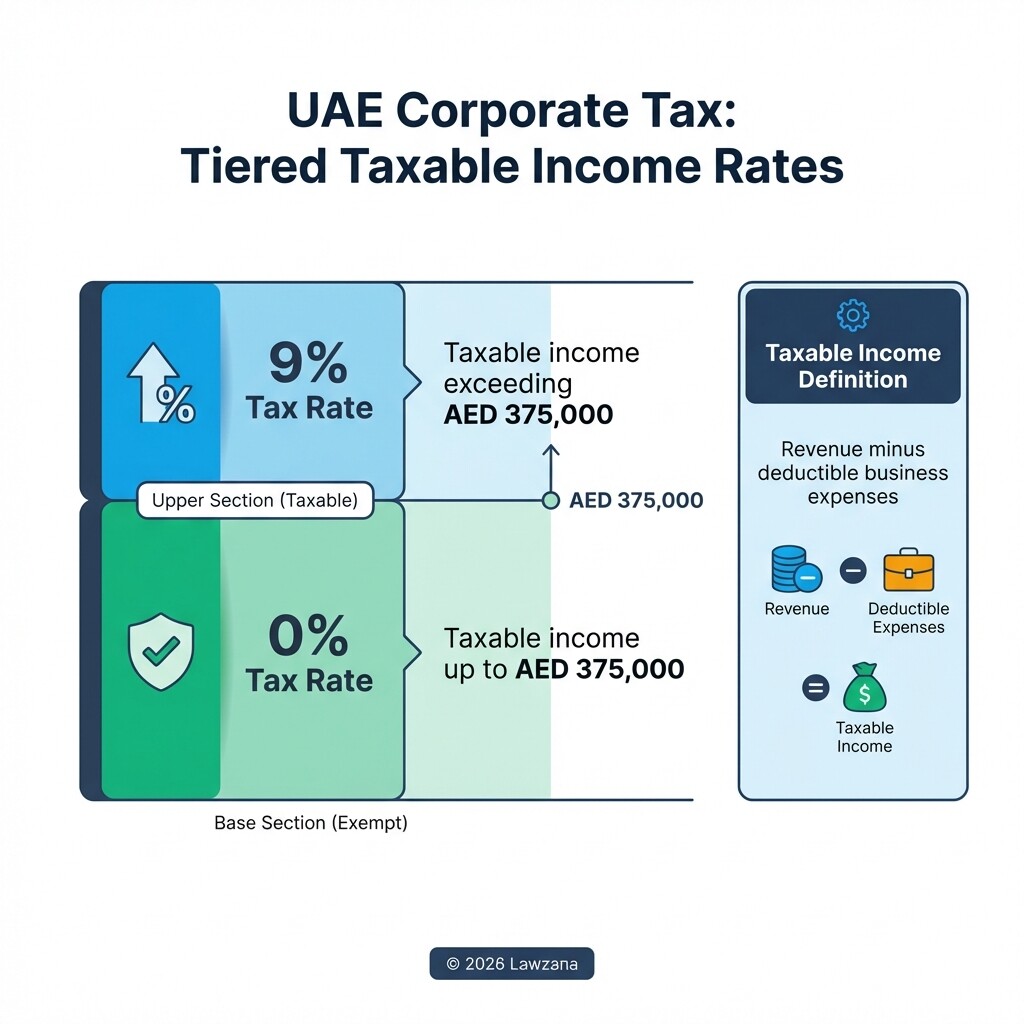

- Onshore companies are subject to a 9% federal corporate tax on annual profits exceeding AED 375,000.

- While the "local sponsor" requirement is largely removed, certain strategic sectors still require UAE national participation.

- The Golden Visa simplifies the "Manager" role requirement, as the residency is not tied to a specific corporate employer.

Checklist for Golden Visa Holders Opening a Mainland LLC

Golden Visa holders must follow a specific administrative path to transition their residency status into active business ownership on the UAE mainland. This process involves coordinating with the Department of Economy and Tourism (DET) and federal authorities.

- Activity Selection: Verify that your chosen business activity is eligible for 100% foreign ownership under the Department of Economy and Tourism (DET) "Positive List."

- Trade Name Reservation: Submit at least three name options to the DET for approval, ensuring they do not violate public order or trademark laws.

- Initial Approval: Obtain a certificate from the DET confirming the UAE government has no objection to you starting the business.

- MoA Drafting: Draft a Memorandum of Association (MoA) that explicitly states 100% foreign ownership and outlines the management powers.

- Physical Office Space: Secure a commercial lease (Ejari) for a physical office or warehouse, as mainland licenses require a physical address.

- Regulatory Approvals: Seek additional permits if your industry is regulated (e.g., DHA for healthcare, KHDA for education).

- License Issuance: Pay the required fees (typically ranging from AED 15,000 to AED 30,000 depending on activity) to receive the final Trade License.

- Corporate Tax Registration: Register with the Federal Tax Authority (FTA) to obtain a Tax Registration Number (TRN).

What is the difference between Free Zone and Mainland (Onshore) setups?

The primary difference lies in geographic trade restrictions and ownership flexibility. Mainland companies can operate anywhere in the UAE and internationally, whereas Free Zone companies are generally restricted to trading within their specific zone or internationally unless they use a local agent.

For Golden Visa holders, the choice between the two has narrowed because the mainland now offers the 100% ownership once exclusive to Free Zones. However, mainland setups offer the distinct advantage of being able to work on government tenders and provide services directly to any client in the UAE without intermediary costs.

| Feature | Mainland (Onshore) LLC | Free Zone Company |

|---|---|---|

| Ownership | 100% Foreign Ownership (most activities) | 100% Foreign Ownership |

| Trade Scope | Unlimited (Local & International) | Restricted to Zone & International |

| Office Location | Anywhere in the UAE | Inside the Free Zone |

| Audit Requirement | Mandatory for most licenses | Depends on specific Free Zone |

| Govt. Tenders | Permitted | Generally not permitted |

How do Golden Visa holders navigate the Commercial Companies Law amendments?

The UAE Federal Decree-Law No. 32 of 2021 transformed the corporate landscape by removing the requirement for a UAE National to hold 51% of shares in mainland companies. Golden Visa holders can now leverage this by registering as the sole shareholder or partnering with other foreign investors.

To utilize these amendments, the company's Memorandum of Association (MoA) must be carefully drafted to reflect the absence of a local partner. This document serves as the constitution of your LLC and must be notarized by the Dubai Courts or the relevant judicial department in other Emirates.

Sample Clause for 100% Foreign Ownership in an MoA

"The Shareholders have agreed that the Company shall be owned 100% by [Name of Golden Visa Holder], a [Nationality] national, in accordance with the provisions of Federal Decree-Law No. 32 of 2021 regarding Commercial Companies. No UAE National partner is required for the specified commercial activities of this Company."

What are the corporate governance requirements for foreign-owned LLCs?

Corporate governance for a mainland LLC involves a clear separation between ownership and management, even if the Golden Visa holder performs both roles. Under the law, an LLC must have at least one manager (and up to 11) who is responsible for the day-to-day operations and legal compliance of the entity.

Key requirements include:

- Appointment of Managers: Managers must be named in the MoA or in a separate management contract.

- General Assembly: The company must hold at least one annual general assembly meeting within four months of the end of the financial year.

- Financial Records: LLCs are required to maintain accurate accounting records for at least five years at the company's head office.

- Statutory Reserve: 10% of net profits must be set aside annually until the reserve reaches 50% of the company's paid-up capital.

How does the UAE Corporate Tax impact onshore operations?

Onshore LLCs are subject to the UAE Federal Corporate Tax regime introduced by Federal Decree-Law No. 47 of 2022. While the UAE remains a low-tax jurisdiction, Golden Visa holders must account for a 9% tax on taxable income that exceeds the AED 375,000 threshold.

It is vital to distinguish between "Revenue" and "Taxable Income." Expenses that are wholly and exclusively for business purposes can be deducted before calculating the tax. Furthermore, Small Business Relief may be available for companies with revenue below a certain threshold (currently AED 3 million), allowing them to be treated as having no taxable income for a specific period.

How can international residents open corporate bank accounts?

Opening a corporate bank account is often the most time-consuming step in the UAE business setup process. Banks perform rigorous "Know Your Customer" (KYC) checks to comply with international anti-money laundering (AML) standards, which can take anywhere from four to eight weeks.

To improve your chances of approval, provide the following:

- Proof of Residency: Your Golden Visa and Emirates ID.

- Source of Wealth: Documentation showing the origin of the funds being invested in the UAE.

- Business Plan: A brief document outlining your clients, expected turnover, and key suppliers.

- Office Lease: Most Tier-1 banks will not open accounts for companies using "Flexi-desks" or virtual offices on the mainland; they require a physical Ejari.

Common Misconceptions About Golden Visa Business Ownership

"The Golden Visa is a business license."

The Golden Visa is a residency permit, not a permit to conduct commercial activity. You still must apply for a trade license from the Department of Economy and Tourism to legally sell goods or services.

"100% ownership applies to all industries."

Certain "Strategic Impact" sectors-such as oil and gas, telecommunications, and defense-still require a specific percentage of UAE National ownership or direct government approval.

"I don't need to pay tax if I have a Golden Visa."

Residency status does not grant tax immunity. All mainland entities, regardless of the owner's visa type, must register for and pay Corporate Tax if they meet the profit thresholds.

Frequently Asked Questions

Can I convert my existing Free Zone company to a Mainland LLC?

You cannot "convert" the legal entity directly. You must incorporate a new Mainland LLC and then transfer the assets, contracts, and employees from the Free Zone entity to the new onshore company.

Do I need a local service agent (LSA) for a mainland LLC?

For commercial and industrial licenses, an LSA is no longer required. However, for some professional licenses (like legal or medical consultancies), a UAE National may still need to be appointed as an LSA to manage administrative dealings with government departments, though they hold 0% equity.

What is the minimum capital requirement for a mainland LLC?

The UAE Commercial Companies Law states that capital should be "sufficient" to achieve the company's purpose. In practice, for a standard LLC in Dubai, there is no fixed minimum paid-up capital requirement to be deposited in a bank, though AED 300,000 is often cited as a benchmark for documentation.

When to Hire a Lawyer

Navigating the UAE's evolving legal landscape requires precision, especially when drafting foundational documents. You should consult a corporate lawyer if:

- You are drafting a complex Memorandum of Association with multiple international shareholders.

- Your business activity falls under a "Strategic Impact" sector requiring special government permissions.

- You are acquiring an existing UAE business and need to perform legal due diligence.

- You need to structure your business to be "Tax-Ready" while remaining compliant with Economic Substance Regulations (ESR).

Next Steps

- Verify Your Activity: Check the UAE Ministry of Economy website to ensure your business activity allows for 100% foreign ownership.

- Secure Your Office: Look for commercial real estate that meets the DET requirements for your specific license type.

- Draft the MoA: Engage a legal professional to draft a Memorandum of Association that protects your 100% ownership rights.

- Register for Tax: Once your license is issued, immediately create an account on the Federal Tax Authority portal to ensure compliance.