- All business entities in Nigeria must register with the Corporate Affairs Commission (CAC) under the Companies and Allied Matters Act (CAMA 2020).

- A Private Limited Company (Ltd) is the most common vehicle for foreign investors, requiring a minimum share capital of 100,000 Naira (for local) or 100 million Naira (for foreign-owned).

- Nigeria now mandates the disclosure of "Persons with Significant Control" (PSC) to enhance transparency and combat money laundering.

- Tax Identification Numbers (TIN) are now generated automatically upon successful company registration through the CAC portal.

- Foreigners can own 100% of a Nigerian company, provided they comply with NIPC (Nigerian Investment Promotion Commission) requirements.

Essential Guide to CAC Business Registration in Nigeria

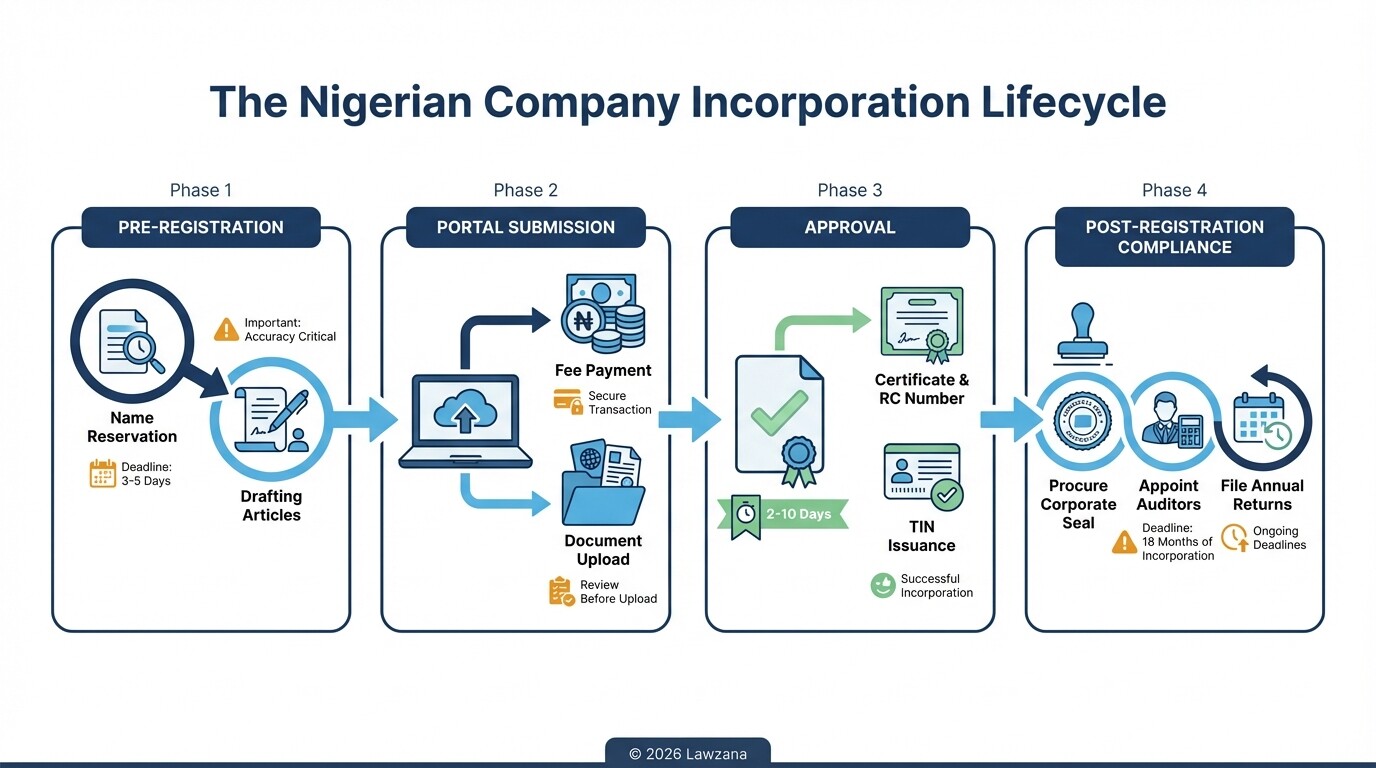

Registering a business in Nigeria is the mandatory first step for any entrepreneur or corporation looking to operate legally within the continent's largest economy. This process is governed exclusively by the Corporate Affairs Commission (CAC) through an online portal designed to streamline incorporation. For international investors, a Nigerian subsidiary provides the legal framework necessary to open bank accounts, hire local talent, and execute contracts.

Should You Choose a Private Limited Company (Ltd) or a Public Company (Plc)?

A Private Limited Company (Ltd) is designed for small to medium-sized businesses where shares are held privately, whereas a Public Limited Company (Plc) is built for large-scale operations intending to list on the stock exchange. Most foreign subsidiaries and startups choose the "Ltd" structure because it offers more privacy and has fewer regulatory filing requirements than a "Plc."

Key Differences at a Glance

| Feature | Private Limited Company (Ltd) | Public Limited Company (Plc) |

|---|---|---|

| Membership | Minimum 1, Maximum 50 | Minimum 2, No Maximum |

| Share Transfer | Restricted by the Articles of Association | Freely transferable to the public |

| Statutory Meetings | No requirement for Statutory Meetings | Must hold a Statutory Meeting within 6 months |

| Minimum Capital | 100,000 Naira (Local) / 100m (Foreign) | 2,000,000 Naira |

| Directorship | Minimum of 2 directors | Minimum of 2 directors |

The Private Limited Company is often the preferred choice for foreign entities because it limits the liability of the owners to the amount of capital they have invested, protecting personal or parent-company assets from business debts.

New 2026 Regulatory Compliance for Beneficial Ownership

Nigeria's 2026 compliance framework requires all registered entities to identify and report "Persons with Significant Control" (PSC) to the CAC's Open Ownership Register. This regulation ensures that the individuals who ultimately own or control a legal entity-even if they are hidden behind layers of corporate shareholders-are known to the authorities.

To comply with beneficial ownership requirements, you must disclose any individual who:

- Holds at least 5% of the shares in the company directly or indirectly.

- Holds at least 5% of the voting rights.

- Has the right to appoint or remove a majority of the board of directors.

- Exercises significant influence or control over the company.

Failure to declare a PSC during the initial registration or within 14 days of any change can result in heavy daily penalties and the "inactive" status of the company on the CAC portal, which prevents any further corporate filings.

Common Mistakes in Name Reservation and Article Drafting

Most delays in Nigerian business registration occur because applicants choose prohibited names or use generic "objects" in their Articles of Association that do not meet regulatory standards. The CAC frequently rejects names that are too similar to existing companies or contain restricted words like "Global," "Holdings," or "Group" without meeting specific capital requirements.

Avoiding Rejection: A Checklist

- Name Conflict: Check the Corporate Affairs Commission public search tool before submitting a reservation to ensure your desired name isn't already in use.

- Prohibited Words: Avoid words like "Chamber of Commerce," "Government," or "Regional" unless you have express permission from the Registrar-General.

- Vague Business Objects: Your Articles of Association must clearly state what the company does. Using a single sentence like "To carry out general contracts" is often insufficient for specialized industries like oil and gas or telecommunications.

- Director Qualifications: Ensure your directors are over 18, of sound mind, and have not been disqualified by a court for fraud.

Timeline for Certificate Issuance and Post-Incorporation Filings

The standard timeline for registering a business in Nigeria is between 2 to 10 business days once all documents are correctly uploaded to the CAC portal. Once approved, the Commission issues a digital Certificate of Incorporation, which includes your Company Registration Number (RC Number) and your Tax Identification Number (TIN).

What Happens After Incorporation?

Once you receive your certificate, your legal obligations have only just begun. You must complete the following post-incorporation steps:

- Appointment of Auditors: Required within six months of incorporation.

- First Annual General Meeting (AGM): Must be held within 18 months of incorporation.

- Annual Returns: You must file an annual return with the CAC every year (except in the year of incorporation) to confirm the company is still active.

- Corporate Seal: While CAMA 2020 has made the use of a physical seal optional, many Nigerian banks still require a company seal to open a corporate account.

Mandatory Tax Registration Steps After CAC Approval

While the CAC portal now generates a TIN automatically, this does not mean your tax obligations are fully managed; you must still register with the Federal Inland Revenue Service for specific tax types. This step is critical for obtaining a Tax Clearance Certificate (TCC), which is required for most government tenders and offshore fund transfers.

Essential Tax Registrations

- Value Added Tax (VAT): All companies must register for VAT. You are required to collect 7.5% on all qualifying goods and services and remit it monthly.

- Companies Income Tax (CIT): Small companies (turnover under 25 million Naira) are exempt from CIT, but they must still file tax returns. Standard companies pay 30% on profits.

- Education Tax: A 3% tax on assessable profits for all Nigerian-registered companies.

- WHT (Withholding Tax): An advance payment of income tax deducted at the source on certain transactions.

Common Misconceptions About Nigerian Business Registration

Myth 1: "I need a Nigerian partner to own a company." Actually, under the NIPC Act, foreigners can own 100% of the equity in a Nigerian company. There is no longer a requirement for a local director or shareholder for most industries, though specialized sectors like oil and gas (Local Content laws) or shipping may have specific local equity requirements.

Myth 2: "Registering a Business Name is the same as a Limited Company." A "Business Name" (Sole Proprietorship) does not provide a separate legal personality. If the business is sued or goes into debt, your personal assets are at risk. A Limited Liability Company creates a "corporate veil" that protects your personal finances.

Myth 3: "If I don't trade, I don't need to file anything." Even "dormant" companies must file annual returns with the CAC. If you fail to file for several years, the CAC can strike your company off the register, assuming it has been abandoned.

FAQ

How much share capital do I need for a foreign-owned company?

For a company with foreign participation, the revised minimum paid-up capital requirement is 100 million Naira. This does not mean you must pay this into a bank immediately, but the shares must be issued to the shareholders.

Can a single person start a company in Nigeria?

Yes, under CAMA 2020, a single individual can be the sole shareholder and the sole director of a Private Limited Company, provided it is not a large company as defined by the Act.

Do I need a physical office address to register?

Yes, you must provide a verifiable physical address in Nigeria at the time of registration. This is known as the "Registered Office Address" where all official correspondence will be sent.

Can I change my company name after registration?

Yes, you can apply for a "Change of Name" through the CAC portal. This requires a special resolution by the shareholders and a fresh availability search to ensure the new name is free.

When to Hire a Lawyer

While the CAC portal is open to the public, seeking professional legal counsel is highly recommended for:

- Foreign Direct Investment: Navigating the intersection of CAC, NIPC, and the Ministry of Interior for business permits and expatriate quotas.

- Complex Articles of Association: Drafting specialized clauses for shareholder rights, buy-sell agreements, or restrictive covenants.

- Regulatory Licensing: If your business is in banking, insurance, or telecommunications, you need a lawyer to handle the additional licenses required from the CBN or NCC.

- Dispute Resolution: Setting up proper structures to handle future conflicts between directors or shareholders.

Next Steps

- Conduct a Name Search: Visit the CAC website to see if your preferred business name is available.

- Assign Roles: Identify your initial directors, shareholders, and the Company Secretary (highly recommended for compliance).

- Draft the Constitution: Prepare your Articles of Association, ensuring the "Objects" reflect your full business scope.

- Submit and Pay: Complete the online forms and pay the stamp duties and registration fees.

- Open a Bank Account: Once you have your RC Number and TIN, approach a commercial bank to finalize your corporate setup.