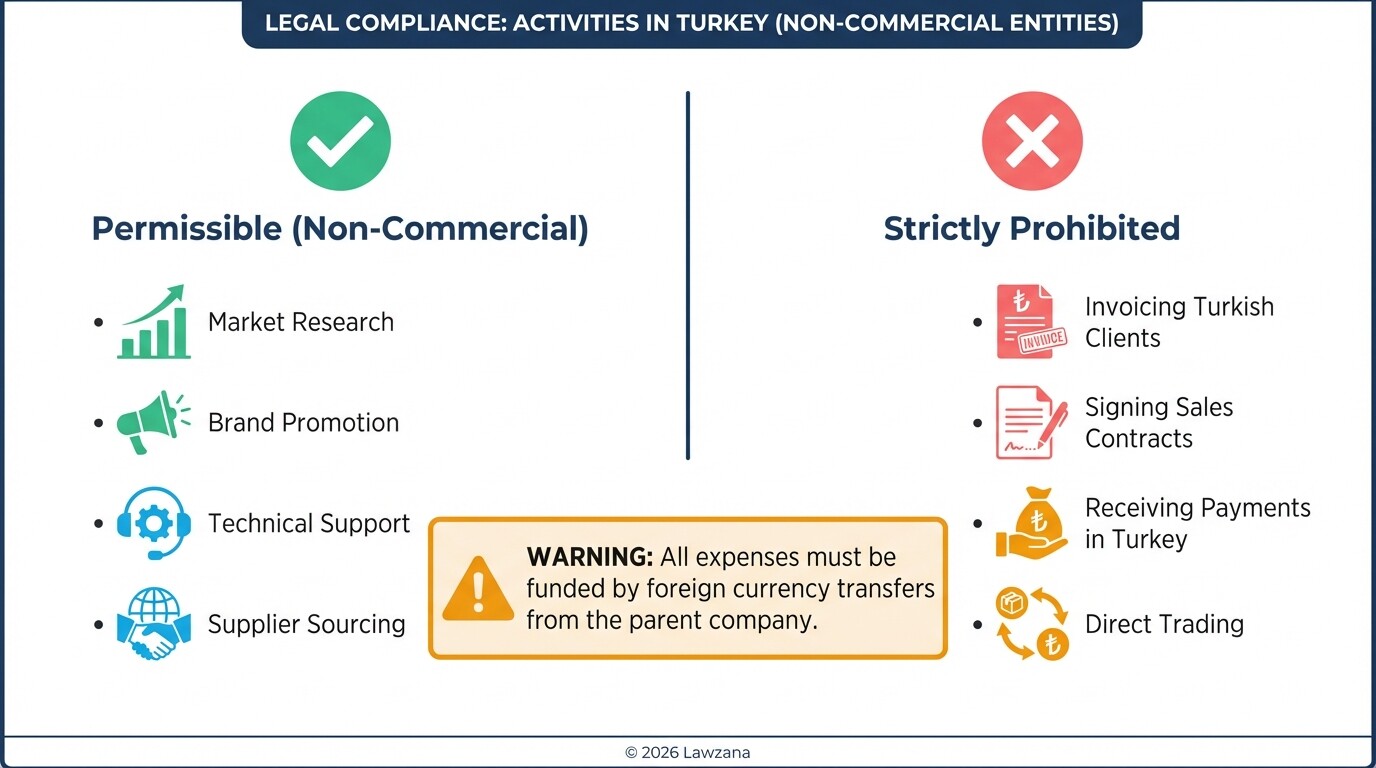

- Liaison offices in Turkey are strictly prohibited from engaging in any commercial or revenue-generating activities.

- The Ministry of Industry and Technology grants initial operating permits for a maximum duration of three years.

- All expenses of the liaison office must be covered entirely by foreign currency transferred from the parent company abroad.

- Employees of a liaison office are generally exempt from personal income tax, provided their salaries are paid from funds sourced outside Turkey.

- Detailed annual activity reports must be submitted to the Ministry every May to maintain legal standing and eligibility for permit renewal.

What Is a Liaison Office in Turkey?

A liaison office (İrtibat Bürosu) is a non-commercial entity established by a foreign company to represent its interests and conduct market research within the Turkish jurisdiction. It does not possess a separate legal personality from its parent company and is legally barred from engaging in trade, invoicing, or profit-making ventures.

Foreign investors typically utilize liaison offices as a low-cost, low-risk "entry strategy" to explore the Turkish market before committing to a full-scale subsidiary or branch. Under the Foreign Direct Investment Law No. 4875, these offices serve as a bridge for communication and coordination.

Permissible Activities for Liaison Offices

The Ministry of Industry and Technology strictly regulates what a liaison office can do. Authorized activities include:

- Market Research: Gathering data on local industry trends, consumer behavior, and competitor analysis.

- Promotion and Advertising: Marketing the parent company's products or services to the Turkish public.

- Representation and Hosting: Acting as a local point of contact for Turkish clients and partners.

- Technical Support: Providing information or training regarding the parent company's products.

- Supplier Sourcing: Identifying and vetting potential Turkish suppliers for the parent company's global operations.

- Regional Management Center: Coordinating the parent company's operations in other countries (requires special approval).

Liaison Office Establishment Checklist

Establishing a liaison office requires specific documentation to prove the parent company's legal existence and intent. Use this checklist to prepare your application for the Ministry of Industry and Technology.

- Application Form: A formal request detailing the intended activities and objectives of the office.

- Certificate of Activity: An apostilled or notarized document from the parent company's home country showing its current legal status.

- Operational Report: A summary or balance sheet of the parent company to prove financial stability.

- Power of Attorney: A notarized document appointing a specific individual to manage the establishment process in Turkey.

- Letter of Commitment: A signed statement confirming the office will not engage in commercial activities.

- Passport Copy: For the appointed office representative (notarized and translated if foreign).

- Lease Agreement: A copy of the rental contract for the physical office space in Turkey.

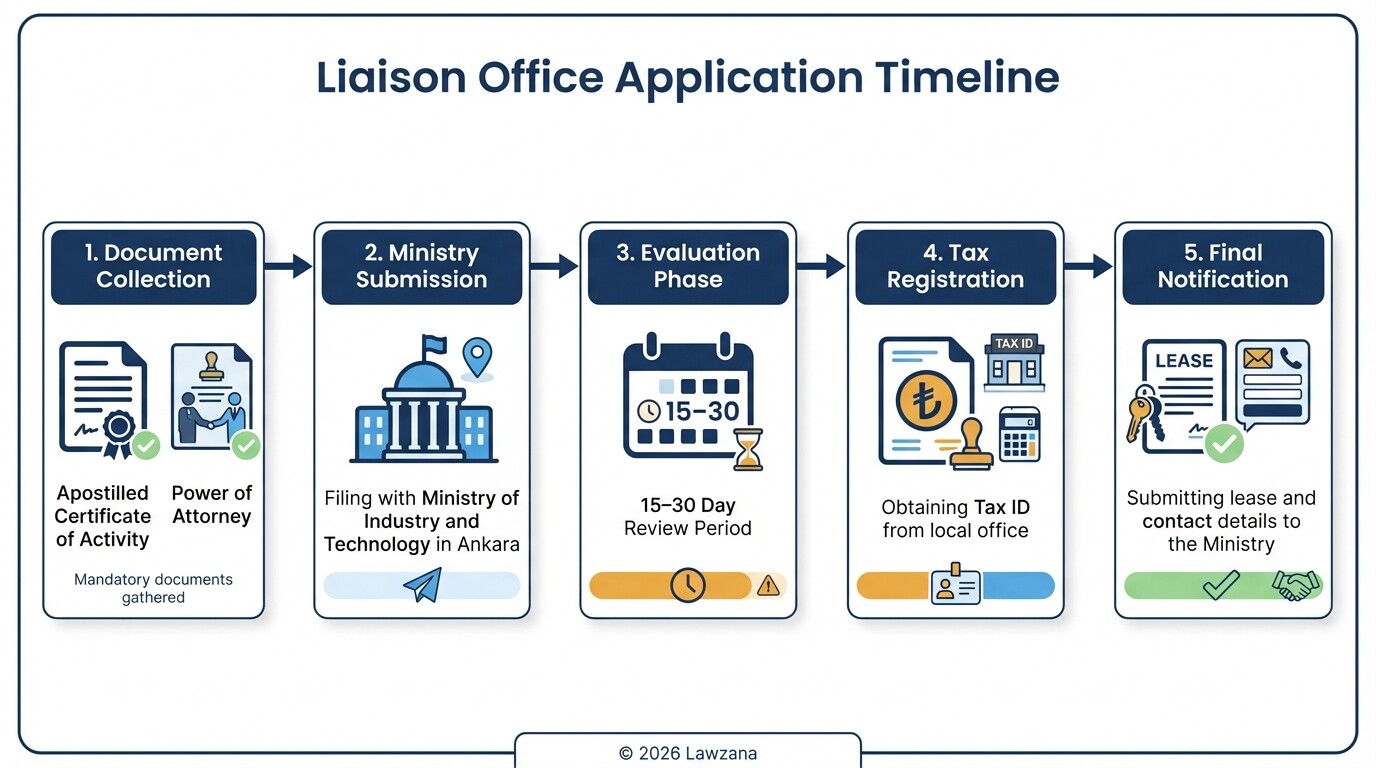

The Application Process with the Ministry of Industry and Technology

The establishment of a liaison office is governed by the General Directorate of Incentive Implementation and Foreign Investment. Unlike standard companies, liaison offices do not register with the Trade Registry; they operate solely under the permit granted by the Ministry.

- Document Preparation: Collect and apostille all required corporate documents from the home country.

- Ministry Submission: File the application with the Ministry of Industry and Technology in Ankara. There is no government fee for the application itself.

- Evaluation Period: The Ministry typically reviews applications within 15 to 30 days. They may request additional information regarding the parent company's global footprint.

- Tax Office Registration: Once the permit is issued, the office must register with the local tax office to obtain a tax identification number (needed for payroll and leases).

- Notification: After tax registration and signing the lease, the office must notify the Ministry of its official address and the representative's contact details.

Duration of Permit and Renewal Requirements

The Ministry of Industry and Technology issues the initial operating permit for a maximum of three years. This duration is intended to give the foreign parent company sufficient time to evaluate the market and decide on a permanent investment.

To extend the permit, the office must apply for a renewal before the current permit expires. The Ministry evaluates renewal requests based on the office's past activities and its future goals. If the office has complied with all reporting requirements and stayed within the bounds of non-commercial activity, renewals are typically granted for periods of five to ten years. If the office intends to transition into a commercial entity, it must close the liaison office and incorporate a Limited Liability Company (LLC) or a Branch.

Tax Exemptions and Reporting Obligations

Liaison offices enjoy significant tax advantages because they do not generate taxable income in Turkey. However, they are still subject to strict compliance and reporting standards to ensure they are not operating as "shadow" commercial entities.

Tax Benefits

- Corporate Tax: Since there is no profit, there is no Corporate Income Tax.

- Personal Income Tax Exemption: Under Article 23/14 of the Turkish Income Tax Law, employees of liaison offices are exempt from income tax if they are paid in foreign currency from funds brought from abroad.

- VAT: While the office pays VAT on local purchases (rent, utilities), it cannot deduct this VAT since it does not issue its own invoices.

Reporting Obligations

Liaison offices must submit the "Liaison Office Activity Report" to the Ministry every year by the end of May. This report details the activities conducted in the previous year and must be accompanied by documents proving that all office expenses were covered by foreign currency transfers from the parent company. Failure to submit this report can result in the cancellation of the operating permit.

Comparing Entry Strategies: Liaison Office vs. Branch vs. LLC

Choosing the right structure depends on whether you intend to sell products or services directly within Turkey.

| Feature | Liaison Office | Branch Office | Limited Liability Company (LLC) |

|---|---|---|---|

| Commercial Activity | Prohibited | Permitted | Permitted |

| Legal Personality | No (Part of Parent) | No (Part of Parent) | Yes (Independent) |

| Initial Capital | None required | None (but must be solvent) | Min. 10,000 TRY |

| Corporate Tax | Exempt | 25% on Turkish income | 25% on global income |

| Permit Duration | 3 years (renewable) | Indefinite | Indefinite |

| Reporting | Annual (to Ministry) | Standard Accounting | Standard Accounting |

Common Misconceptions

"A liaison office can sign sales contracts."

This is a frequent mistake that can lead to severe legal penalties. While a liaison office representative can facilitate negotiations, they cannot sign sales contracts on behalf of the parent company that result in payments being made to a Turkish bank account. All commercial transactions must be handled directly by the parent company or an authorized distributor.

"Liaison offices are exempt from all taxes."

While they are exempt from corporate and employee income tax, they are still responsible for "Withholding Tax" (Stopaj) on their office rent and professional services (like accounting). They must also pay Social Security (SGK) contributions for their employees.

FAQs

Can a liaison office hire Turkish citizens?

Yes, a liaison office can hire both Turkish nationals and foreign expatriates. For foreign employees, the office must apply for a work permit through the Ministry of Labor and Social Security, which is usually granted easily if the liaison office permit is valid.

How much does it cost to maintain a liaison office?

There are no government renewal fees, but the office must cover rent, salaries, and social security. You should also budget for an accountant or tax advisor to manage the monthly withholding tax filings and the mandatory annual activity report.

Can a liaison office be converted into a Limited Liability Company?

No, there is no direct "conversion" process. You must officially close the liaison office through the Ministry of Industry and Technology and simultaneously incorporate a new LLC through the Trade Registry.

When to Hire a Lawyer

Navigating the Turkish bureaucracy requires precision, especially regarding the Ministry's strict documentation standards. You should consult a lawyer if:

- You need to draft a Power of Attorney that complies with both your home country's laws and Turkish requirements.

- You are unsure if your intended activities cross the line into "commercial activity."

- You need to secure work permits for foreign executives moving to Turkey.

- You are facing a permit renewal rejection or an audit by the Ministry.

Next Steps

- Define Your Objectives: Confirm that your goals in Turkey are strictly non-commercial for the next three years.

- Gather Parent Company Documents: Contact your home country's registry to obtain an updated Certificate of Activity and have it apostilled.

- Appoint a Representative: Select a trusted individual or legal professional in Turkey to handle the filing with the Ministry of Industry and Technology.

- Secure Office Space: Look for a physical office or a virtual office (which is generally accepted for liaison offices) to provide a legal address for the application.

- Apply for the Permit: Submit your dossier to the General Directorate in Ankara to begin the 30-day review period.