- Every Nigerian company must file an annual return with the Corporate Affairs Commission (CAC) to remain in "active" status.

- Small companies and startups with a single shareholder are now legally recognized, significantly reducing administrative overhead.

- Disclosure of Persons with Significant Control (PSC) is mandatory, with heavy daily penalties for non-compliance.

- The CAC Companies Registration Portal (CRP) is the exclusive platform for all post-incorporation filings and compliance updates.

- Failure to comply with CAMA 2020 can lead to the striking off of your company from the federal register and personal liability for directors.

Essential CAMA 2020 Compliance Checklist for Startups

Maintaining legal standing in Nigeria requires a proactive approach to corporate governance. This checklist provides the specific milestones every startup founder must meet to avoid penalties or involuntary dissolution by the Corporate Affairs Commission.

- Annual Returns: File within 42 days of your Annual General Meeting (AGM) or by June 30th of the following year.

- PSC Register: Identify and notify the CAC of any individual holding 5% or more of shares or voting rights within 7 days of any change.

- Financial Records: Maintain updated accounting records at the registered office address for at least six years.

- Statutory Meetings: Hold an AGM within 18 months of incorporation (unless classified as a small company).

- Director Disclosure: Update the CAC within 14 days if a director changes their residential address or if a new director is appointed.

- Share Capital: Ensure at least 25% of the authorized share capital is fully paid up at all times.

- Signage: Display the full registered company name and RC number at every office or place where business is conducted.

Annual Return Filing Requirements and Deadlines for 2026

Annual returns are mandatory yearly reports filed with the CAC to confirm that a company is still operational and to update the public record regarding its directors and shareholders. For the 2026 filing cycle, startups must ensure their records reflect their financial position as of the end of the 2025 fiscal year.

The deadline for filing annual returns is generally 42 days after the company's Annual General Meeting. For most startups, this means filing by June 30th of the following year to avoid late fees. In 2026, failing to file within this window results in a daily penalty that accumulates until the default is rectified.

| Entity Type | Standard Filing Fee (Approx.) | Late Filing Penalty |

|---|---|---|

| Small Company | ₦3,000 | ₦5,000 + Daily Accruals |

| Private Company (Large) | ₦5,000 | ₦10,000 + Daily Accruals |

| Public Company | ₦10,000 | ₦25,000 + Daily Accruals |

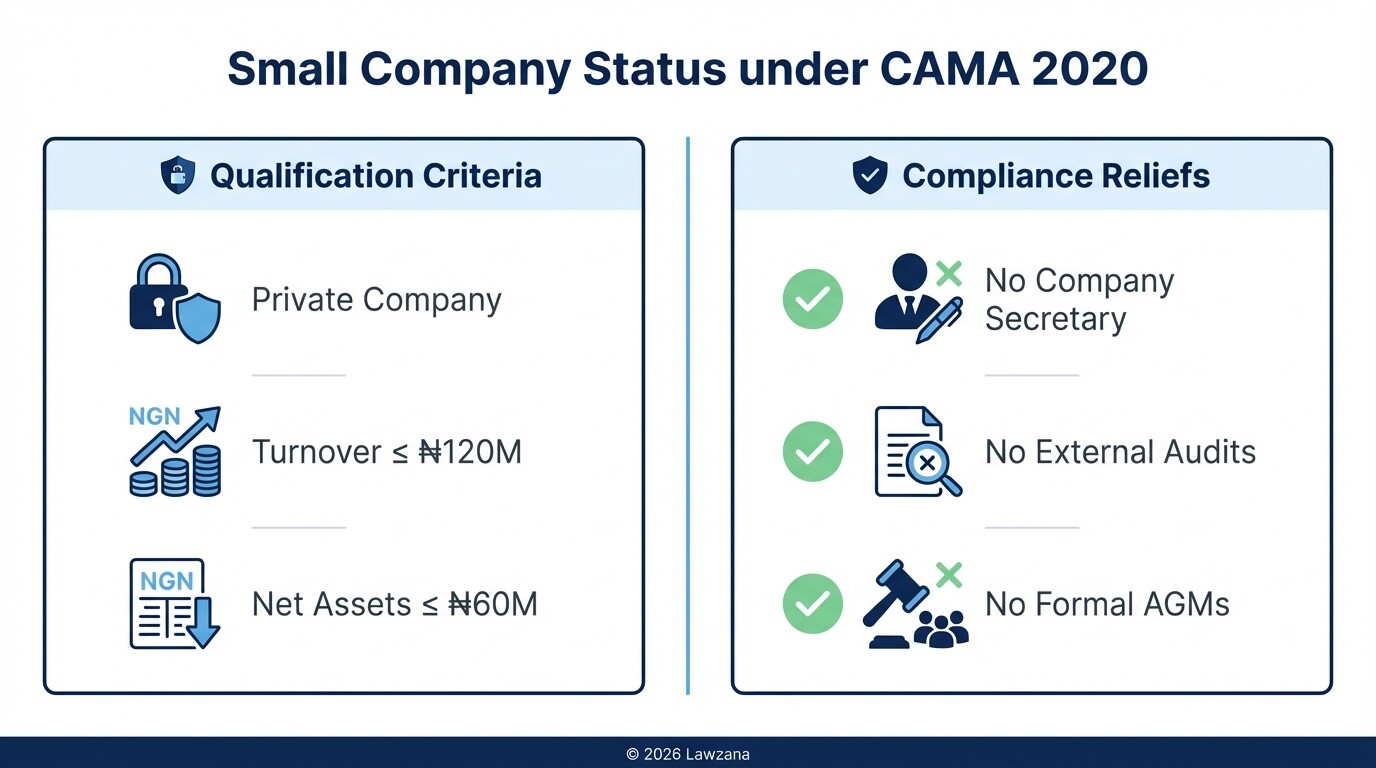

Provisions for Small Companies and Single-Shareholder Entities

CAMA 2020 introduced significant relief for startups by allowing a single person to form and manage a private company. This removes the previous requirement for at least two directors and two shareholders, making it easier for solo entrepreneurs to access corporate benefits without the burden of finding a co-founder.

Additionally, companies classified as "small" enjoy simplified compliance hurdles. A small company is defined as a private company with a turnover of not more than ₦120 million and net assets of not more than ₦60 million. These entities are exempt from the mandatory requirement to appoint a company secretary, hold Annual General Meetings, or have their financial statements audited by external professionals.

Benefits of Small Company Status

- Audit Exemption: You are not required to hire an external auditor if your turnover and assets stay below the threshold.

- Meeting Flexibility: Decisions can be made via written resolutions rather than formal physical meetings.

- Administrative Savings: No legal requirement to pay for a dedicated Company Secretary unless specifically desired.

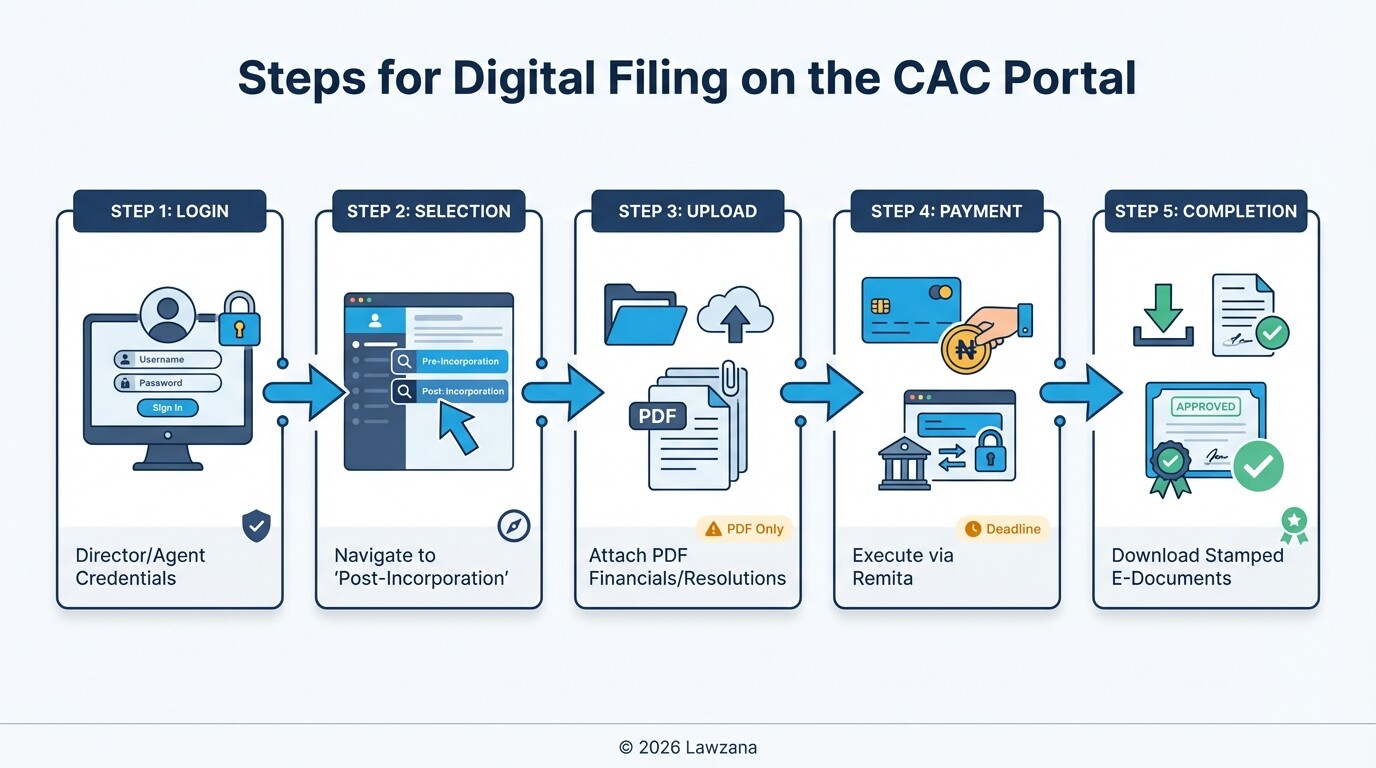

Digital Compliance Procedures via the CAC Portal

The Corporate Affairs Commission has transitioned to a fully digital workflow through the Companies Registration Portal (CRP). Startups must register an account on this portal to perform post-incorporation tasks such as filing returns, changing directors, or increasing share capital.

To complete a filing, the company must upload digital copies of its financial statements (for annual returns) or board resolutions (for structural changes). Once the "Administrative Desk" at the CAC reviews the submission, an electronic certificate or acknowledgment is issued. It is vital to ensure that the "Status" of your company on the portal shows as "Active"; an "Inactive" status can prevent the business from opening bank accounts or bidding for government contracts.

- Login: Access the CRP using the credentials of a director or an accredited agent (Lawyer/Accountant).

- Selection: Choose the "Post-Incorporation" module and select the specific filing type.

- Uploads: Attach clear PDF copies of all required resolutions and financial documents.

- Payment: Pay the filing fees through Remita directly on the portal.

- Download: Once approved, download the stamped documents for your internal records.

Legal Implications of Failing to Update the PSC Register

The Person with Significant Control (PSC) register is a transparency mechanism designed to prevent money laundering and corporate veil abuse. Any individual who holds at least 5% of shares, voting rights, or the power to appoint directors must be disclosed to the CAC within one month of reaching that threshold.

Failing to update the PSC register is a criminal offense under CAMA 2020. Both the company and every officer in default are liable to a fine for every day the default continues. Beyond financial penalties, the CAC has the power to restrict the transfer of shares or the exercise of voting rights for those individuals who have not been properly disclosed on the register.

Timeline for Resolving Corporate Disputes Through the CAC

The CAC provides an internal mechanism for resolving disputes related to the management or registration of companies through the Administrative Proceedings Committee (APC). This is often a faster and more cost-effective alternative to litigation in the Federal High Court for issues like unauthorized removal of directors or fraudulent share transfers.

The timeline for resolution typically spans 30 to 90 days, depending on the complexity of the case. Once a formal complaint is lodged, the CAC notifies the opposing party, who has a set period to respond. If the matter cannot be resolved through written submissions, the APC schedules a hearing. Decisions made by the APC are binding but can be appealed to the Federal High Court if a party is dissatisfied with the outcome.

Common Misconceptions About Nigerian Corporate Law

"Dormant companies do not need to file returns."

This is a dangerous myth. Even if a company has not commenced business or has no bank account activity, it is still legally required to file "Nil" returns. Failure to do so will result in the company being marked as "Inactive" and eventually struck off the register.

"Only lawyers can access the CAC portal."

While accredited agents (lawyers, chartered accountants, and chartered secretaries) frequently handle these filings, CAMA 2020 allows company directors to create their own accounts and perform filings directly. However, complex filings often benefit from professional oversight to avoid technical rejections.

Frequently Asked Questions

What happens if I miss the annual return deadline?

If you miss the deadline, the CAC will charge a late filing fee. More importantly, your company status will change from "Active" to "Inactive" on the public search portal, which can stop you from conducting business with banks and government agencies.

Can a foreigner be the sole shareholder of a Nigerian startup?

Yes, CAMA 2020 allows for a single shareholder, and this individual can be a foreigner. However, foreign-owned companies must still meet the minimum share capital requirements set by the Ministry of Interior (currently ₦100 million for companies with foreign participation) to obtain a Business Permit.

Does a small company need a Company Secretary?

No, small companies are no longer required to appoint a Company Secretary under CAMA 2020. However, many startups choose to retain one to ensure that statutory books are kept correctly and filings are made on time.

When to Hire a Lawyer

Navigating CAMA 2020 is straightforward for basic maintenance, but professional legal counsel is necessary during structural changes. You should consult a lawyer if you are restructuring your share capital, handling a hostile takeover, resolving a dispute between shareholders, or preparing for a Venture Capital (VC) investment. A lawyer ensures that your constitutional documents (Articles of Association) are tailored to protect your interests while remaining compliant with federal laws.

Next Steps

- Check Your Status: Visit the CAC Public Search portal to verify if your company is currently "Active."

- Review Your PSC: Identify any shareholder with 5% or more equity and ensure they are recorded in your PSC register.

- Audit Your Filings: If you have missed previous years of annual returns, calculate the penalties and prepare to file back-to-back returns to restore your company's good standing.

- Update Records: Ensure all changes to your business address or directorship from the last 14 days are updated on the CRP portal immediately.