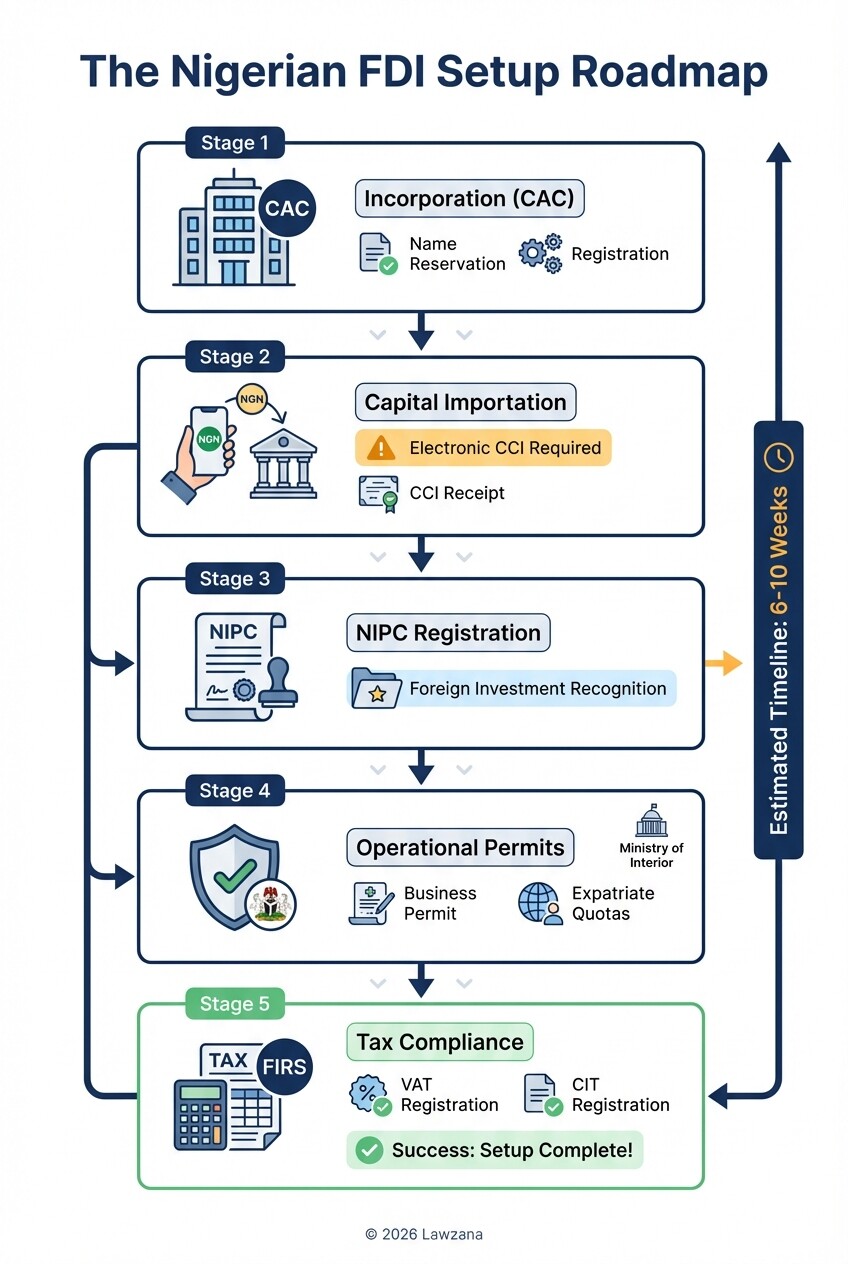

- Foreign investors must register their business with the Corporate Affairs Commission (CAC) and the Nigerian Investment Promotion Commission (NIPC) before commencing operations.

- The minimum issued share capital for any Nigerian company with foreign participation is 100 million Naira as of recent regulatory updates.

- 100% foreign ownership is permitted in most sectors, excluding those on the "Negative List" such as arms, ammunition, and narcotics.

- A Certificate of Capital Importation (CCI) is essential for the legal repatriation of profits, dividends, and capital in foreign currency.

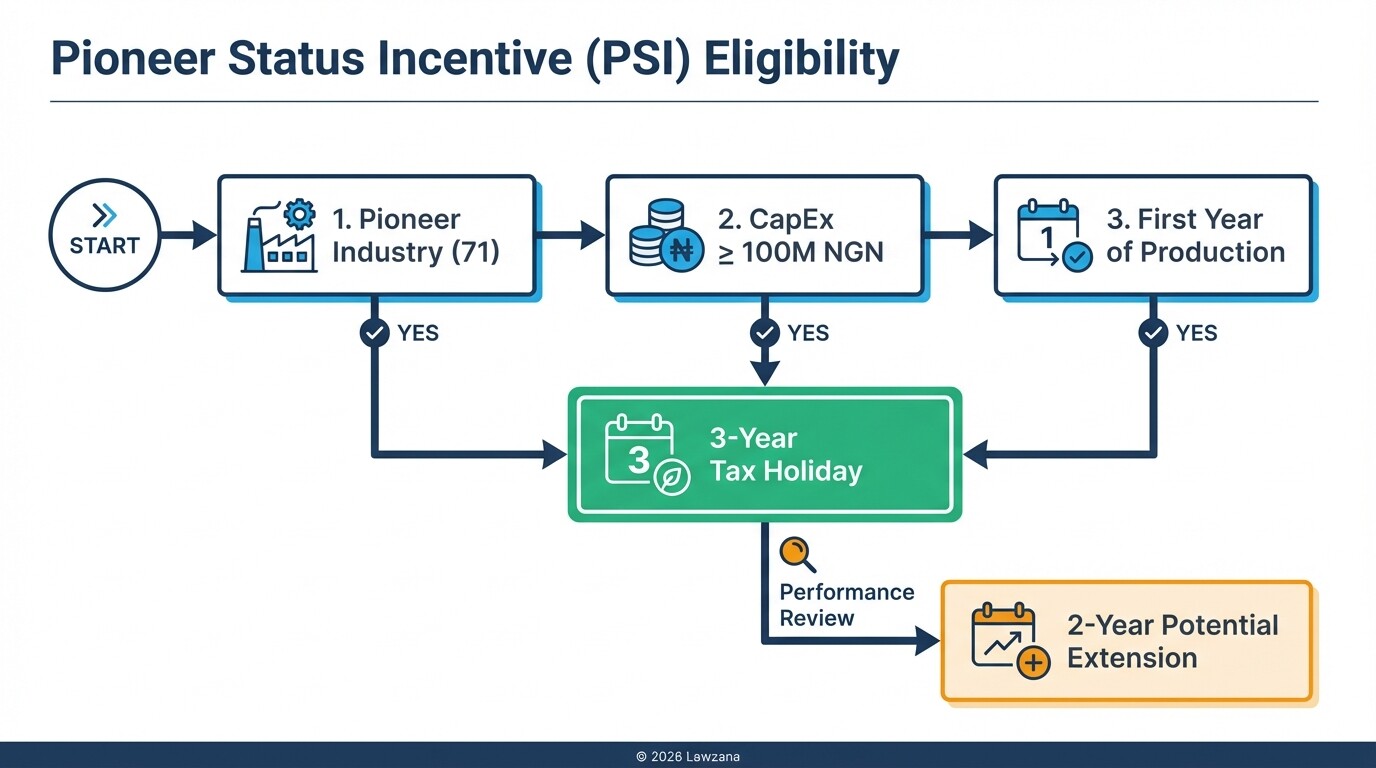

- Eligible companies can apply for "Pioneer Status," granting a corporate income tax holiday for an initial period of three years, renewable for up to two more.

How Do Foreign Companies Comply With the Companies and Allied Matters Act (CAMA)?

Foreign entities must incorporate a local subsidiary with the Corporate Affairs Commission (CAC) to conduct business in Nigeria. Under the Companies and Allied Matters Act (CAMA) 2020, a foreign company cannot simply open a branch office; it must exist as a separate legal entity unless it receives a specific exemption from the Federal Executive Council.

The incorporation process is fully digital and involves several distinct steps:

- Name Reservation: Investors submit preferred names via the CAC portal to ensure uniqueness.

- Director and Shareholder Disclosure: Companies must provide details of at least two directors (for larger entities) or one for small companies, though foreign participation usually necessitates a more robust board structure.

- Drafting Constitutional Documents: This includes the Memorandum and Articles of Association (MEMART), which define the company's business objects and internal governance rules.

- Tax Identification: Upon successful incorporation, the CAC automatically generates a Tax Identification Number (TIN) through the Federal Inland Revenue Service (FIRS) integration.

Why Is Registration With the Nigerian Investment Promotion Commission (NIPC) Mandatory?

All foreign-owned enterprises must register with the Nigerian Investment Promotion Commission (NIPC) to enjoy legal protections and investment incentives. This registration serves as the official recognition of the foreign investment by the Nigerian government and is a prerequisite for obtaining further business permits.

The NIPC registration process provides the following advantages:

- Legal Protection: Investors are protected against nationalization or expropriation by the government without fair compensation and public interest justification.

- Dispute Resolution: It guarantees access to international arbitration for the settlement of investment disputes.

- Business Permits: Registration is a mandatory step before applying for a Business Permit and Expatriate Quota from the Ministry of Interior.

- Incentive Access: It acts as the gateway to applying for various sector-specific tax breaks and grants.

What Is the Minimum Share Capital for Foreign Participation?

The Nigerian government requires companies with foreign shareholders to have a minimum issued share capital of 100,000,000 Naira (NGN 100,000,000). This requirement is designed to ensure that foreign-backed ventures are sufficiently capitalized to sustain operations and contribute to the local economy.

It is important to note the difference between "authorized" and "issued" capital. Under current regulations, the concept of authorized share capital has been replaced by issued share capital, meaning the full 100 million Naira must be allotted to shareholders at the time of incorporation.

Key considerations for capitalization include:

- Payment of Stamp Duties: Stamp duties are calculated based on the value of the share capital. For a 100 million Naira company, this represents a significant upfront cost.

- Sectoral Exceptions: Certain industries, such as banking, insurance, or oil and gas, have much higher minimum capital requirements set by their respective regulators (e.g., the Central Bank of Nigeria).

- Proof of Investment: While the full amount does not always need to be transferred immediately into a Nigerian bank account, the company must demonstrate the ability to meet this capital threshold to secure a Business Permit.

How Does the Pioneer Status Incentive Provide Tax Holidays?

The Pioneer Status Incentive (PSI) is a tax relief program that grants eligible companies a three-year holiday from paying Corporate Income Tax. This incentive is designed to encourage investment in industries that are not yet operating at a sufficient scale in Nigeria or are deemed crucial for national development.

To benefit from this incentive, a company must meet specific criteria:

- Eligible Industry: The business must operate within one of the 71 "Pioneer Industries" listed by the government, which include telecommunications, software development, large-scale agriculture, and waste management.

- Capital Expenditure: The applicant must demonstrate a minimum capital expenditure (land, buildings, or equipment) of at least 100 million Naira.

- Application Timing: The application must be submitted within the first year of the company's production or operations.

If the company shows significant progress and compliance during the first three years, it can apply for an extension of an additional one or two years, totaling a five-year tax-free period.

How Can Investors Repatriate Capital and Profits?

Foreign investors have the right to repatriate their profits and original investment in any convertible currency, provided the funds were initially brought into Nigeria through "Authorized Dealers" (usually commercial banks). The process is governed by the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act.

The mechanism for repatriation involves the following:

| Requirement | Description |

|---|---|

| Certificate of Capital Importation (CCI) | An electronic document issued by a Nigerian bank within 24 hours of funds entering the country. It proves that the investment was made in foreign currency. |

| Dividend Repatriation | Investors can transfer dividends net of a 10 percent withholding tax, provided they present the CCI and audited financial statements. |

| Capital Repatriation | In the event of a sale or liquidation, the original investment can be moved out of the country using the CCI. |

| Service Fees | Payments for technical management or royalties require additional approval from the National Office for Technology Acquisition and Promotion (NOTAP). |

Without an electronic CCI, foreign investors face significant legal hurdles when trying to access the official foreign exchange market to move money out of Nigeria.

Common Misconceptions About Nigerian FDI

Misconception 1: You must have a local Nigerian partner. Contrary to popular belief, foreign investors can own 100 percent of the shares in a Nigerian company in almost all sectors. While a local partner can provide valuable market insights, it is not a legal requirement under CAMA or the NIPC Act for the majority of businesses.

Misconception 2: Incorporation is the final step for business operations. Incorporation with the CAC is only the beginning. A foreign-owned company must also obtain a Business Permit and Expatriate Quotas (for hiring foreign staff) from the Ministry of Interior, and register for Value Added Tax (VAT) and Corporate Income Tax (CIT).

Misconception 3: The 100 million Naira share capital must be paid as a cash deposit to the government. The 100 million Naira is the "issued share capital," not a fee or a deposit. It represents the value of the investment the company is committed to making. While stamp duties are paid on this amount, the capital itself is used for the company's own business operations, such as purchasing equipment or leasing office space.

FAQ

Can a foreign company operate in Nigeria without incorporating a local subsidiary?

No. Under Section 78 of CAMA, every foreign company intending to carry on business in Nigeria must take steps to obtain incorporation as a separate entity in Nigeria. Limited exceptions apply only to specific government-contracted projects.

How long does it take to register a foreign-owned business in Nigeria?

The incorporation with the CAC typically takes 5 to 7 business days. However, the entire setup process-including NIPC registration, opening a bank account, and obtaining a Business Permit-usually takes between 6 to 10 weeks.

What is the "Negative List" for foreign investment?

The Negative List includes sectors where investment is prohibited for both Nigerians and foreigners. These include the production of arms and ammunition, dealing in narcotics, and the production of military or paramilitary uniforms.

Is there a specific tax for foreign companies?

Foreign-owned subsidiaries are taxed at the same rate as local companies. The Corporate Income Tax rate is 30 percent for large companies (turnover above 100 million NGN) and 20 percent for medium-sized companies.

When to Hire a Lawyer

Navigating the Nigerian regulatory landscape requires professional legal guidance to ensure compliance with overlapping federal authorities. You should consult a corporate lawyer if:

- You are structuring complex shareholder agreements between international and local entities.

- You need to process "Expatriate Quotas" to bring foreign management or technical staff into Nigeria.

- You are applying for Pioneer Status or other sector-specific tax incentives.

- You are navigating the regulatory requirements for the oil and gas or telecommunications sectors.

- You need to draft and register technology transfer agreements with NOTAP.

Next Steps

- Verify Your Sector: Determine if your business qualifies for Pioneer Status or falls under specific regulatory oversight.

- Draft Your MEMART: Work with a legal advisor to draft the Memorandum and Articles of Association that reflect your corporate governance needs.

- Initiate CAC Registration: Begin the digital incorporation process to establish your local legal entity.

- Fund Your Account: Transfer the investment capital through an authorized dealer to secure your electronic Certificate of Capital Importation (CCI).

- Secure NIPC Registration: Complete your registration with the Investment Promotion Commission to formalize your status as a foreign investor.

For further information on investment regulations, you may visit the official websites of the Corporate Affairs Commission and the Nigerian Investment Promotion Commission.