- Most international NGOs in Nigeria register as Incorporated Trustees under Part F of the Companies and Allied Matters Act (CAMA) 2020.

- Registration with the Special Control Unit against Money Laundering (SCUML) is a mandatory post-incorporation requirement for all non-profits.

- Foreign directors do not necessarily need to reside in Nigeria, but those who do must obtain a Combined Expatriate Residence Permit and Aliens Card (CERPAC).

- Non-profits are not automatically exempt from all taxes; they must apply for a Tax Identification Number (TIN) and seek specific exemptions from the Federal Inland Revenue Service (FIRS).

- Annual returns must be filed with the Corporate Affairs Commission (CAC) to maintain "active" status and avoid penalties or striking off.

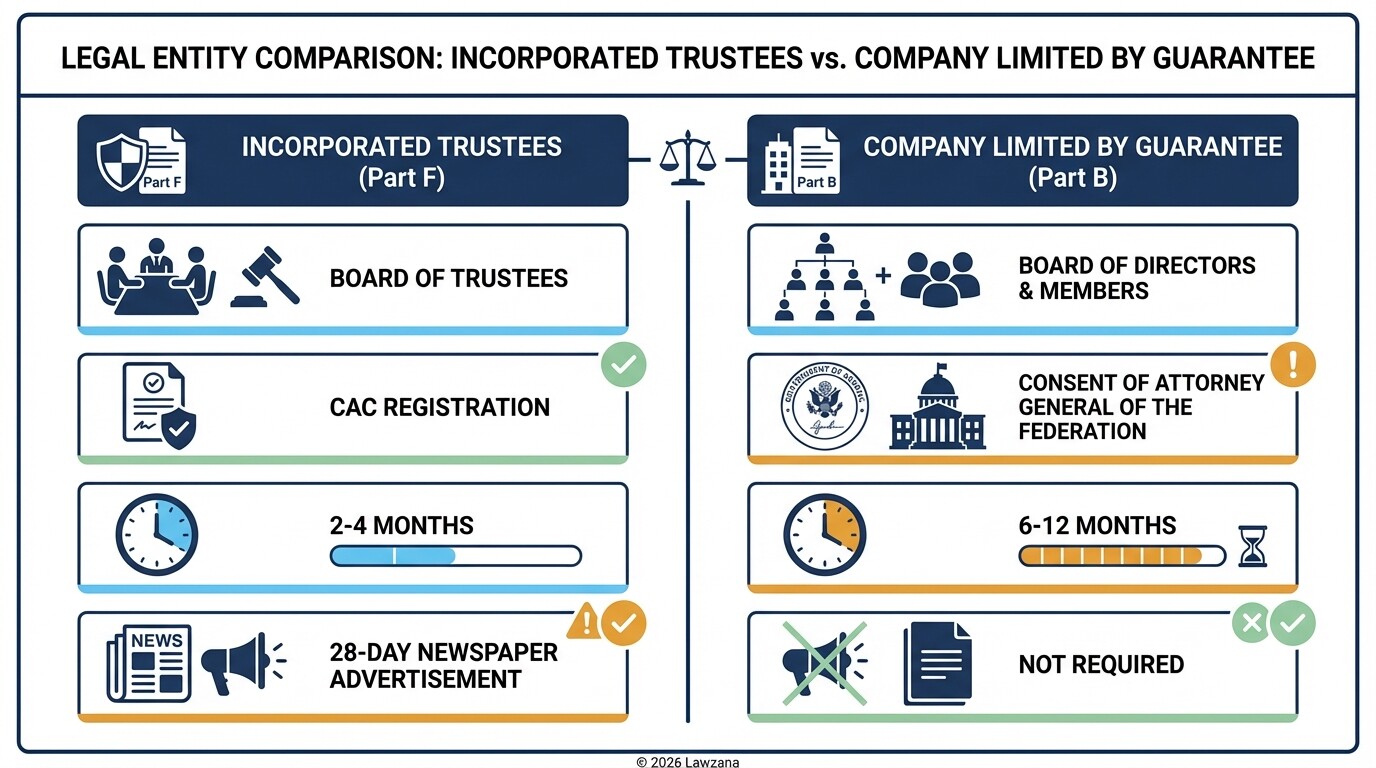

Should You Choose Incorporated Trustees or a Company Limited by Guarantee?

The choice between Incorporated Trustees and a Company Limited by Guarantee depends on the organization's specific goals and desired timeline. Incorporated Trustees (IT) is the most common vehicle for NGOs because it focuses on a board of trustees holding property for a charitable cause, whereas a Company Limited by Guarantee (Ltd/Gte) is a corporate entity where members guarantee a specific amount in the event of winding up.

Incorporated Trustees (Part F of CAMA)

This is the standard structure for religious, educational, literary, scientific, social, or charitable social clubs. It is generally faster to register than a Ltd/Gte.

- Governance: Managed by a Board of Trustees.

- Timeline: Usually takes 2 to 4 months.

- Requirement: Requires a public notice (advertisement) in two daily newspapers to allow for public objections before the CAC approves the registration.

Company Limited by Guarantee (Part B of CAMA)

This structure is often chosen for larger organizations or those involved in international research and consultancy that do not intend to distribute profits.

- Governance: Managed by a Board of Directors and members.

- Consent: Requires the mandatory "Consent of the Attorney General of the Federation" before registration can be completed.

- Timeline: This can take 6 to 12 months due to the administrative process at the Ministry of Justice.

How to Complete SCUML Registration for Anti-Money Laundering Compliance

All NGOs in Nigeria are classified as Designated Non-Financial Institutions (DNFIs) and must register with the Special Control Unit against Money Laundering (SCUML). This registration is required to open a corporate bank account and ensures the organization is not being used for money laundering or terrorism financing.

To register with SCUML, which is under the Economic and Financial Crimes Commission (EFCC), you must provide:

- Your CAC Certificate of Incorporation.

- The Constitution of the organization or Memorandum and Articles of Association.

- A detailed profile of the NGO's activities.

- Tax Identification Number (TIN) from the FIRS.

- Valid identification for all trustees or directors.

The process is completed online via the SCUML portal, and there is currently no official government fee for the registration certificate itself, though professional assistance may incur costs.

Requirements for Foreign Directors and Residency Permits

Foreign nationals can serve as trustees or directors of a Nigerian NGO, provided they meet the basic legal requirements of being of sound mind and over 18. While they do not need to be physically present in Nigeria to be on the board, any foreign staff or directors who intend to live and work in Nigeria must comply with immigration laws.

- Business Permit: NGOs with foreign participation must apply for a Business Permit from the Ministry of Interior.

- Expatriate Quota: If the NGO intends to employ foreign nationals, it must apply for an Expatriate Quota, which is the official permission to bring foreign workers into the country.

- CERPAC: Once the quota is granted, the individual must obtain the Combined Expatriate Residence Permit and Aliens Card (CERPAC). This allows the holder to live and work in Nigeria for up to two years, renewable thereafter.

How to Apply for Tax Exemptions with the Federal Inland Revenue Service (FIRS)

In Nigeria, NGOs are generally exempt from Companies Income Tax (CIT) on profits derived from charitable activities, provided those profits are not used for private gain. However, this exemption is not automatic; the organization must actively register with the Federal Inland Revenue Service (FIRS) and fulfill specific filing obligations.

To maintain tax-compliant status, an NGO must:

- Apply for a TIN: This is the first step after CAC registration.

- Value Added Tax (VAT): While the NGO's charitable services are often exempt, it must pay VAT on goods and services purchased from third parties.

- Withholding Tax (WHT): NGOs must deduct WHT from payments made to contractors or consultants and remit it to the FIRS.

- Annual Tax Returns: Even if the NGO is exempt from paying income tax, it must file annual tax returns including audited financial statements.

Annual Reporting Obligations to the Corporate Affairs Commission (CAC)

Every NGO registered in Nigeria is legally required to file annual returns with the Corporate Affairs Commission to confirm its continued existence and transparency. This filing must occur between June 30th and December 31st of each year, except for the year of incorporation.

Failure to file annual returns results in the organization being marked as "inactive" on the CAC public portal. This status prevents the NGO from performing basic corporate actions, such as changing trustees or updating its constitution.

- Filing Fee: The official fee is approximately 5,000 NGN per year for Incorporated Trustees, but late filings attract a daily penalty.

- Documents Needed: A simple form signed by a trustee and a secretary, often accompanied by a statement of affairs or audited accounts.

Common Misconceptions About NGOs in Nigeria

"NGOs Are Exempt from All Taxes"

This is the most frequent mistake. While NGOs are exempt from Companies Income Tax on their core charitable activities, they are still liable for VAT on purchases, must deduct WHT from vendors, and must remit Pay-As-You-Earn (PAYE) taxes for their employees to the relevant State Internal Revenue Service.

"Registration is a One-Week Process"

Because of the mandatory 28-day newspaper advertisement period for Incorporated Trustees and the background checks performed by the CAC, it is impossible to register an NGO in a single week. Expect a minimum of two months for a smooth application.

"International NGOs Can Operate Without Local Registration"

A foreign NGO cannot operate as a legal entity in Nigeria without being registered locally or obtaining a formal exemption from the Federal Executive Council. Operating without registration can lead to the seizure of funds and legal prosecution.

FAQ

Can a foreigner be the sole trustee of a Nigerian NGO?

While the law does not expressly forbid it, the CAC typically requires at least one Nigerian resident (not necessarily a citizen) to be among the trustees to facilitate local accountability and communication with regulatory bodies.

How much does it cost to register an NGO in Nigeria?

Official CAC filing fees and newspaper advertisement costs usually range from 70,000 NGN to 150,000 NGN. However, when including legal fees, SCUML processing, and tax registration, total costs for an international entity typically range from 450,000 NGN to 900,000 NGN ($300 - $600 USD) depending on complexity.

What is the minimum number of trustees required?

For an Incorporated Trustees structure, you need a minimum of one trustee, but it is standard practice to have at least three to five to ensure balanced governance and meet the requirements of donor organizations.

Do I need a physical office to register an NGO?

Yes, the CAC requires a physical address in Nigeria to serve as the registered office. This address will be used for all official correspondence and must be verified during the registration process.

When to Hire a Lawyer

Navigating the Nigerian regulatory landscape as a foreign entity can be treacherous due to shifting policies and bureaucratic hurdles. You should consult a Nigerian legal expert if:

- You are deciding between the IT and Ltd/Gte structures and need a bespoke governance framework.

- You are a foreign NGO needing to navigate the Ministry of Interior for Business Permits and Expatriate Quotas.

- You have encountered an objection during the 28-day public notice period.

- You need to draft a complex Constitution that complies with both Nigerian law and your home country's non-profit regulations.

Next Steps

- Select Your Trustees: Identify individuals with clean records who are willing to provide valid government IDs.

- Conduct a Name Search: Check the CAC Online Portal to ensure your desired name is available.

- Draft the Constitution: Ensure your objectives are clearly defined to avoid issues with the FIRS or SCUML later.

- Publish Advertisements: Place notices in two national newspapers as required by CAMA 2020.

- Prepare for Post-Incorporation: Secure a physical office and prepare your SCUML and TIN application documents immediately after receiving your certificate.