- Claims for accidents where the driver is identified must be lodged within three years of the incident.

- "Hit and run" claims involving unidentified drivers have a much shorter deadline of only two years.

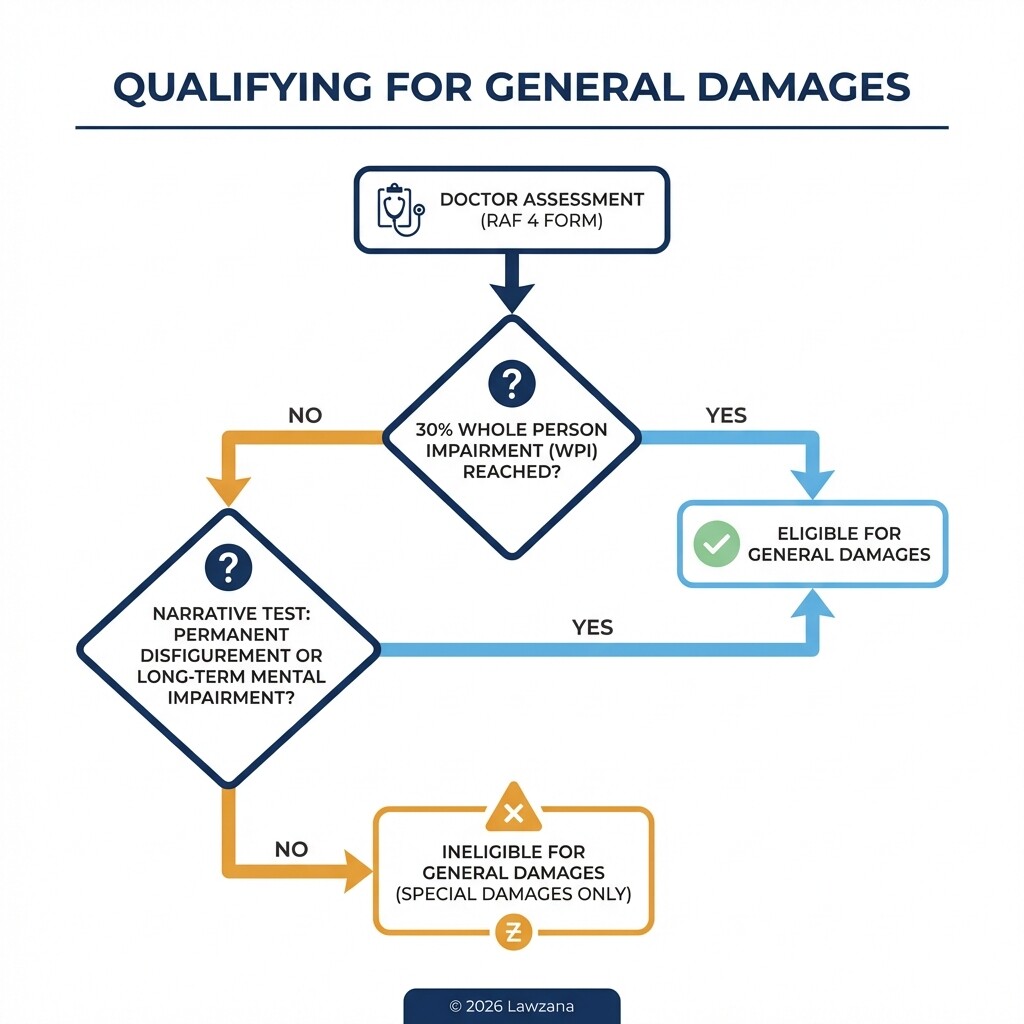

- General damages for pain and suffering are only available if your injury is classified as "serious" (30% or more Whole Person Impairment).

- You cannot claim for vehicle or property damage through the RAF; it covers only bodily injuries or loss of support.

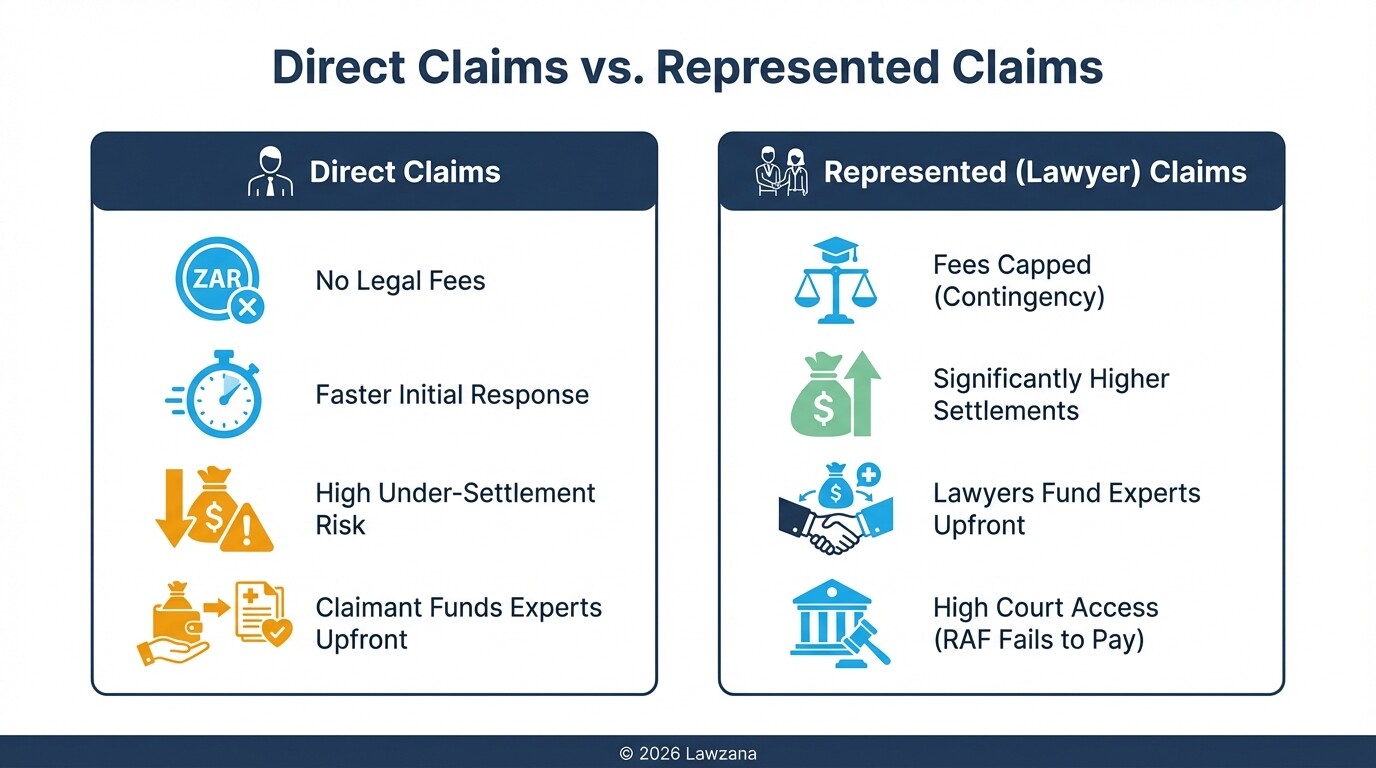

- While the RAF encourages direct claims, legal representation typically results in significantly higher settlement amounts due to expert quantification.

What is the time limit to file an RAF claim in South Africa?

The time limit for filing a Road Accident Fund (RAF) claim depends on whether the identity of the person who caused the accident is known. If the driver or owner of the vehicle is identified, you have three years from the date of the accident to lodge your claim. If the driver is unidentified, such as in a "hit and run" scenario, the claim must be lodged within two years.

Failure to meet these statutory deadlines, known as prescription, results in the permanent loss of your right to seek compensation. It is vital to distinguish between "lodging" a claim (submitting the initial paperwork) and "summonsing" (taking legal action if the RAF does not respond), as both have specific legal triggers.

| Scenario | Deadline for Lodging |

|---|---|

| Identified Driver/Owner | 3 years from the date of the accident |

| Unidentified Driver (Hit and Run) | 2 years from the date of the accident |

| Minors (Identified Driver) | 3 years after the minor turns 18 |

| Minors (Unidentified Driver) | 2 years from the date of the accident (No extension) |

What evidence is required to support an RAF claim?

To successfully file a claim, you must provide objective proof of the accident, the other driver's negligence, and the extent of your injuries. The RAF requires a specific set of documents, starting with the official RAF 1 statutory claim form, which must be completed by the victim and a medical professional.

Without a comprehensive evidence trail, the RAF is likely to repudiate the claim or offer a minimal settlement. You should gather the following records immediately after the accident:

- Police Accident Report: A copy of the official report (OAR) containing the accident report (AR) number.

- Medical Records: Your complete hospital file, including emergency room notes, X-ray reports, and discharge summaries.

- Witness Statements: Contact details and written accounts from anyone who saw the accident occur.

- Financial Proof: Salary slips, tax returns, and employment contracts to prove loss of income.

- Photographic Evidence: Images of the accident scene, the vehicles involved, and your physical injuries.

What is the difference between general damages and loss of earnings?

General damages compensate for non-monetary losses like pain, suffering, and loss of amenities of life, whereas loss of earnings compensates for the actual financial impact on your ability to work. In South Africa, general damages are only awarded if a medical expert determines your injury meets the "serious injury" threshold, whereas loss of earnings is calculated based on your historical and projected career path.

General Damages

General damages are subjective. To qualify, a medical professional must complete an RAF 4 report confirming that you have reached at least a 30% Whole Person Impairment (WPI) or that your injury falls under the "narrative test" (e.g., permanent disfigurement or severe long-term mental impairment).

Loss of Earnings and Support

These are considered "special damages."

- Past Loss of Earnings: Money you did not earn while recovering from the accident.

- Future Loss of Earnings: The difference between what you would have earned if the accident never happened and what you are now likely to earn with your injuries.

- Loss of Support: Claimed by dependents (spouses or children) if the primary breadwinner was killed in the accident.

Why are medico-legal experts necessary for an RAF claim?

The Road Accident Fund rarely accepts a victim's personal assessment of their injuries; they require expert testimony to quantify the claim in monetary terms. Medico-legal experts are specialized doctors and professionals who evaluate how your injuries will affect your life, your mobility, and your future career.

These experts do not treat you; instead, they provide forensic reports that serve as evidence in court or during settlement negotiations. A typical claim may involve:

- Orthopedic Surgeons: To evaluate bone and joint injuries.

- Neurologists: To assess brain injuries or nerve damage.

- Occupational Therapists: To determine how injuries impact your daily tasks and workplace ergonomics.

- Industrial Psychologists: To project your career trajectory and future earning potential.

- Actuaries: To perform the complex mathematical calculations required to convert these expert opinions into a final Rand (ZAR) value, accounting for inflation and life expectancy.

Should you accept a direct settlement or pursue litigation?

While the RAF has recently promoted "direct claims" to reduce legal costs, there is a significant risk in bypassing legal representation. Direct claimants often receive offers that only cover medical expenses, ignoring the nuances of future loss of earnings or the complexities of the serious injury threshold.

Direct Claims

- Pros: No legal fees; potentially faster initial processing.

- Cons: High risk of under-settlement; the claimant must navigate complex medical and legal requirements alone; the RAF acts as both the "defendant" and the "assessor," creating a conflict of interest.

Litigation (Represented Claims)

- Pros: Lawyers ensure all experts are paid for upfront (often on a contingency basis); higher likelihood of a fair settlement that covers long-term needs; ability to take the RAF to the High Court if they refuse to pay.

- Cons: Legal fees (capped by the Contingency Fees Act); the court process can be lengthy.

Common Misconceptions About RAF Claims

Myth 1: "I can claim for my car repairs."

The Road Accident Fund is strictly for bodily injuries and death. It does not cover damage to vehicles, fences, or personal property. For these damages, you must rely on private insurance or sue the other driver in their personal capacity.

Myth 2: "The RAF pays out within a few months."

Due to administrative challenges and financial constraints at the Fund, the average claim takes between three to five years to finalize. If the matter goes to trial in the High Court, it may take even longer.

Myth 3: "If the accident was partially my fault, I can't claim."

South Africa follows a "comparative negligence" system. If you were 20% at fault and the other driver was 80% at fault, you can still claim 80% of your total damages from the RAF.

Cost and Timeline Overview

| Process Stage | Estimated Duration | Potential Costs |

|---|---|---|

| Investigation & Lodging | 6 - 12 months | Expert report fees (R5,000 - R15,000 per report) |

| RAF Assessment | 1 - 2 years | Administrative costs |

| Litigation/Court Date | 1 - 3 years | Advocate fees, court filing fees |

| Payment After Settlement | 180+ days | Interest may apply if paid late |

Frequently Asked Questions

Can I claim if I was a passenger in the vehicle?

Yes. Passengers are almost always eligible to claim 100% of their damages because they are rarely responsible for the accident. Even if the driver of the car you were in was at fault, you can claim against the RAF.

What is the "Serious Injury" threshold?

The "Serious Injury" threshold is a legal requirement for claiming general damages (pain and suffering). It requires a doctor to certify that you have a 30% Whole Person Impairment or meet specific criteria regarding long-term impairment or disfigurement.

Can I claim if I am a foreign national?

Yes, foreign nationals can claim from the RAF, provided the accident occurred within the borders of South Africa. However, the calculation of loss of earnings may be adjusted based on the economic conditions of your home country.

When to Hire a Lawyer

Navigating the RAF is increasingly difficult due to changing internal policies and strict statutory requirements. You should hire a lawyer if:

- Your injuries are severe and require long-term care or surgery.

- You are unable to return to your previous job or have lost income.

- The RAF has ignored your claim for more than 120 days after lodging.

- You were involved in a hit-and-run where the driver is unknown.

- You want to ensure your settlement is "future-proofed" against inflation and medical cost increases.

Next Steps

- Seek Medical Attention: Ensure all injuries are documented in a hospital file immediately.

- Report to SAPS: Obtain an Accident Report (AR) number from the South African Police Service.

- Gather Records: Collect copies of your ID, driver's license, and all medical bills.

- Consult a Specialist: Contact a personal injury attorney to evaluate the merits of your case and ensure you do not miss the two or three-year prescription deadline.

- Download Official Forms: If claiming directly, visit the Road Accident Fund official website to access the necessary statutory forms.