- Inherited property in South Africa is exempt from Transfer Duty, but the estate may still be liable for Estate Duty if the total value exceeds R3.5 million.

- No property can be sold or transferred until the Master of the High Court issues formal Letters of Executorship to the appointed representative.

- The Executor is the only person legally authorized to sign transfer documents on behalf of the deceased.

- A Rates Clearance Certificate from the local municipality is a mandatory requirement for the Deeds Office to register a transfer.

- The average timeline for winding up an estate with property is 6 to 12 months, though delays at the Master's Office can extend this.

Property Transfer Checklist for Heirs and Executors

The transfer of residential property from a deceased estate requires a specific set of documents to satisfy both the Master of the High Court and the Registrar of Deeds. Use this checklist to track the progress of the transfer.

- Original Will: Must be lodged with the Master of the High Court to determine the rightful heirs.

- Death Notice and Certificate: Required to report the estate and initiate the file.

- Letters of Executorship: The official document authorizing the Executor to act.

- Title Deed: The original deed for the property (if lost, an application for a certified copy must be made).

- Valuation Certificate: A formal appraisal by a sworn appraiser to determine the market value at the time of death.

- Liquidation and Distribution (L&D) Account: Must be approved by the Master and lay dormant for inspection for 21 days.

- Rates Clearance Certificate: Evidence that all municipal debts, including water and electricity, are paid in full.

- Master's Section 42(1) Endorsement: Required if the property is being sold by the Executor rather than simply transferred to an heir.

- Conveyancing Documents: Power of Attorney to pass transfer and various affidavits signed by the Executor.

The Legal Role of the Executor of the Estate

The Executor is the legal representative of the deceased estate, tasked with collecting assets, paying debts, and distributing the remaining balance to heirs. They hold the fiduciary duty to protect the estate's value and are the only party authorized to sign a Sale of Property Agreement or transfer documents.

Once the Master of the High Court issues the Letters of Executorship, the Executor takes full control of the property. If the deceased left a Will, the Executor follows those instructions; if there is no Will, the Executor must follow the Intestate Succession Act. The Executor must work closely with a specialized attorney, known as a conveyancer, to move the property title from the deceased's name to the heir's name at the Deeds Office.

Master of the High Court Requirements and Timelines

The Master of the High Court oversees the administration of all deceased estates in South Africa to ensure the lawful distribution of assets. Every estate with assets exceeding R250,000 follows a formal process that begins with reporting the death to the Master's Office in the jurisdiction where the deceased lived.

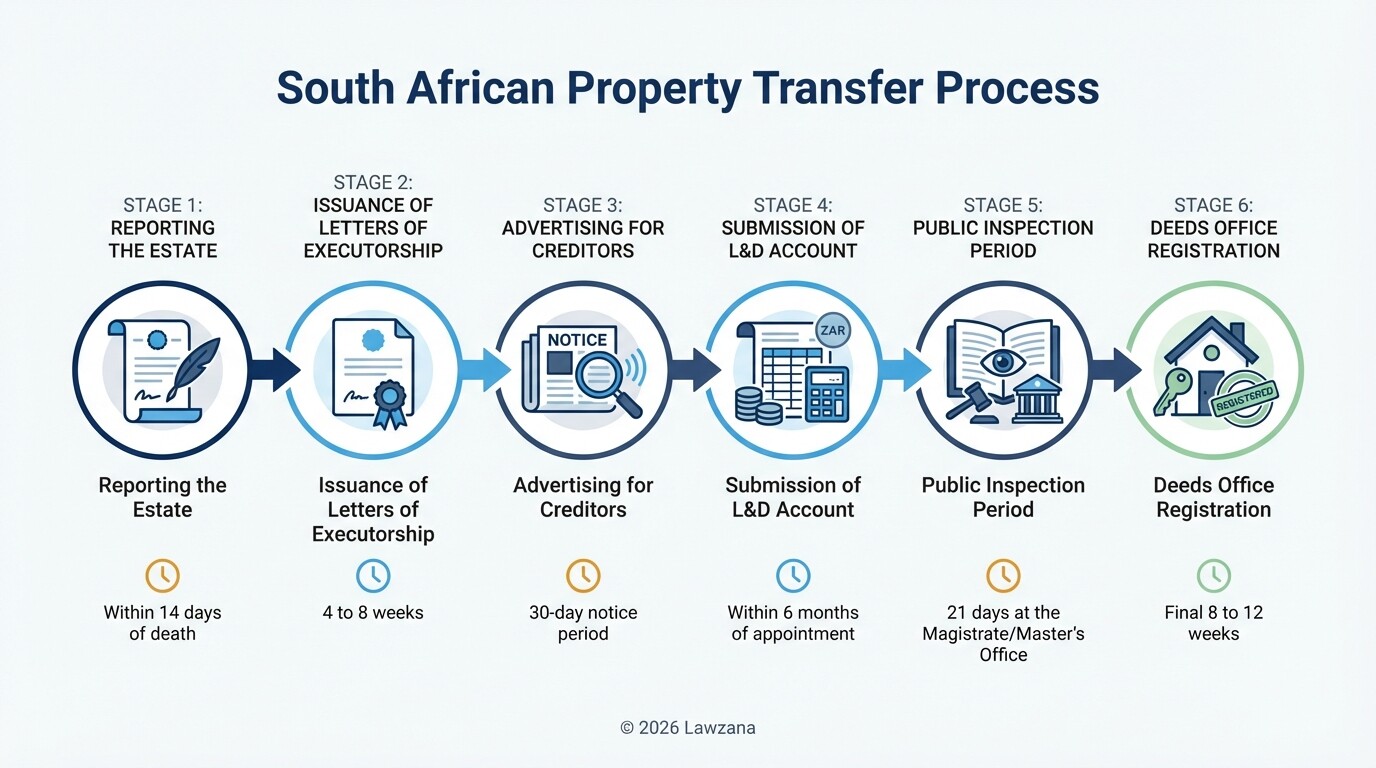

- Reporting the Estate: Within 14 days of death, the estate must be reported to the Master.

- Issuance of Letters of Executorship: This can take between 4 to 8 weeks, depending on the specific Master's Office.

- Advertising for Creditors: The Executor must place a notice in the Government Gazette and a local newspaper, giving creditors 30 days to lodge claims.

- Submission of the L&D Account: The Executor has 6 months from the issuance of Letters of Executorship to submit the Liquidation and Distribution account.

- Inspection Period: The L&D account must lie open for public inspection for 21 days. If no objections are raised, the Master will authorize the distribution of assets.

Transfer Duty Exemptions and Inheritance Tax in 2026

In South Africa, heirs do not pay Transfer Duty on property inherited through a deceased estate, regardless of the property's value. This exemption, found in Section 9(1)(e) of the Transfer Duty Act, applies to both testate (with a Will) and intestate (without a Will) successions.

However, the estate itself may be subject to Estate Duty, which is the South African version of inheritance tax. As of 2026, the primary rebate remains R3.5 million. This means the first R3.5 million of the total estate value is tax-free. Any value above this threshold is taxed at 20%, and amounts exceeding R30 million are taxed at 25%. If the property is left to a surviving spouse, the transfer is generally exempt from Estate Duty under Section 4(q) of the Estate Duty Act.

| Tax/Fee Type | Responsible Party | Standard Rate/Rule |

|---|---|---|

| Transfer Duty | Heir | Exempt (R0) |

| Estate Duty | The Estate | 20% on value over R3.5 million |

| Conveyancing Fees | The Estate | Based on property value (LPC Guideline) |

| Capital Gains Tax | The Estate | Death is a "deemed disposal" event |

Winding Up the Estate: Necessary Documentation

Winding up an estate involves the final settlement of all financial affairs and the formal transfer of property ownership. This process is documented through the Liquidation and Distribution (L&D) account, which provides a transparent view of the estate's solvency.

To finalize the property portion of the winding-up process, the conveyancer requires the approved L&D account to prove the property is being transferred to the correct person. Additionally, the Executor must provide a formal "Power of Attorney to Pass Transfer." This document is filed at the Deeds Office and serves as the legal proof that the Executor consents to the change in ownership. Without these documents, the Registrar of Deeds will reject any attempt to update the property title.

Dealing with Outstanding Municipal Debts and Rates Clearance

Before any property can be transferred in South Africa, the local municipality must issue a Rates Clearance Certificate (RCC). This certificate confirms that all rates, taxes, and service charges (water, electricity, refuse) have been paid in full for the two years preceding the date of application.

The Executor is responsible for settling these debts using the cash available in the estate. If the estate lacks sufficient cash, the Executor may be forced to sell the property or other assets to cover the municipal bill, or the heirs may choose to pay the debt out of their own pockets to ensure the transfer proceeds. It is important to note that the Deeds Office will not register the property in the heir's name without a valid RCC, which is typically valid for 60 to 120 days from the date of issue.

Common Misconceptions

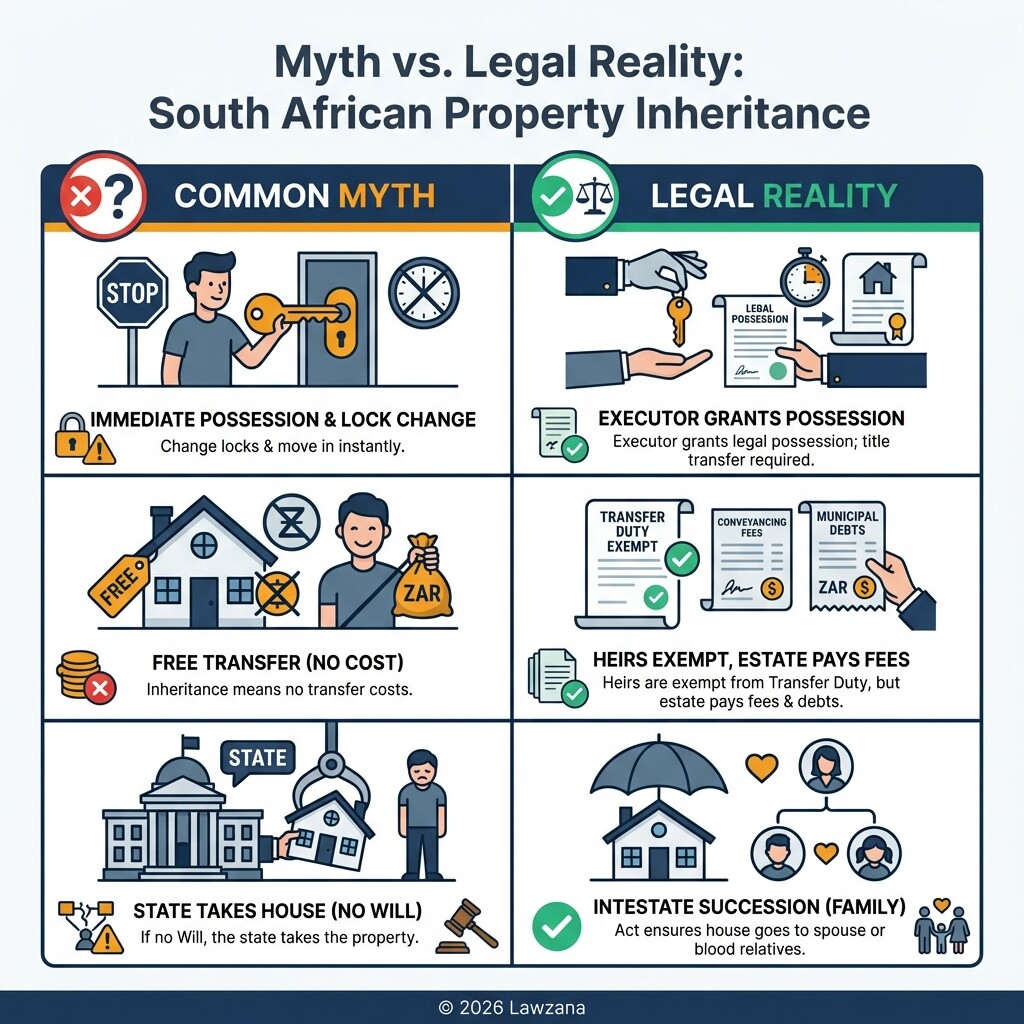

"I can move into the house and change the locks immediately."

While heirs may eventually own the property, they do not have the immediate legal right to take possession or exclude others until the Executor grants permission. The property technically belongs to the "Deceased Estate" until the transfer is registered.

"The transfer is free because it's an inheritance."

While you are exempt from Transfer Duty (the government tax), you are not exempt from costs. The estate must still pay conveyancing attorney fees, valuation costs, and municipal clearance figures. If the estate has no cash, the heirs often have to cover these expenses to receive the property.

"If there is no Will, the government takes the house."

This is a common fear but is rarely true. If there is no Will, the property is distributed according to the Intestate Succession Act, which prioritizes the surviving spouse and children. The state only claims the estate if no living relatives can be found within 30 years.

FAQ

How long does it take to transfer a house from a deceased estate?

The process usually takes between 6 to 12 months. This includes the time needed to obtain Letters of Executorship, the 21-day inspection period for the L&D account, and the 8 to 12 weeks for the Deeds Office registration.

Can the Executor sell the house instead of transferring it to the heirs?

Yes, but only under specific conditions. The Executor can sell the property to pay off the estate's debts or if the Will specifically instructs them to do so. If the heirs agree to sell the property instead of taking ownership, they can sign a redistribution agreement.

Who pays for the property transfer costs?

The deceased estate is responsible for the costs of transfer, including conveyancing fees. If the estate does not have enough liquidity (cash), the heirs may need to contribute the funds, or the property may need to be sold to cover the costs.

When to Hire a Lawyer

Navigating a deceased estate is a complex legal requirement in South Africa, and the Master of the High Court generally requires the assistance of a professional if the estate is valued over R250,000. You should consult a lawyer or a professional deceased estate administrator if:

- The deceased passed away without a valid Will (intestate).

- The estate includes immovable property (real estate).

- There are disputes between heirs regarding the distribution of assets.

- The estate is insolvent (debts exceed assets).

- You have been nominated as an Executor and need to fulfill your fiduciary duties without incurring personal liability.

Next Steps

- Locate the Will: Search for the original signed Will, as copies are generally not accepted by the Master without a High Court order.

- Report the Estate: Visit the nearest Master of the High Court office or contact a specialized attorney to file the Death Notice.

- Secure the Property: Ensure that the property is insured and that any tenants or occupants are aware of the legal status of the estate.

- Appoint a Conveyancer: If you are the Executor, select a conveyancing attorney to begin the property transfer process as soon as the Letters of Executorship are received.

- Request a Rates Statement: Contact the local municipality to determine if there are significant outstanding debts that need to be settled.