- South African courts generally require an attachment of property to establish jurisdiction over a foreign defendant who has no local presence.

- The Hague Service Convention streamlines the process of serving legal documents on entities located in member countries, reducing the risk of procedural challenges.

- International arbitration is often the most efficient route for debt recovery as awards are enforceable in over 160 countries under the New York Convention.

- Creditors must account for significant upfront costs, including sheriff fees, translation services, and the risk of exchange rate fluctuations during litigation.

- A South African court judgment is not automatically enforceable abroad; it requires a separate "recognition and enforcement" process in the debtor's home country.

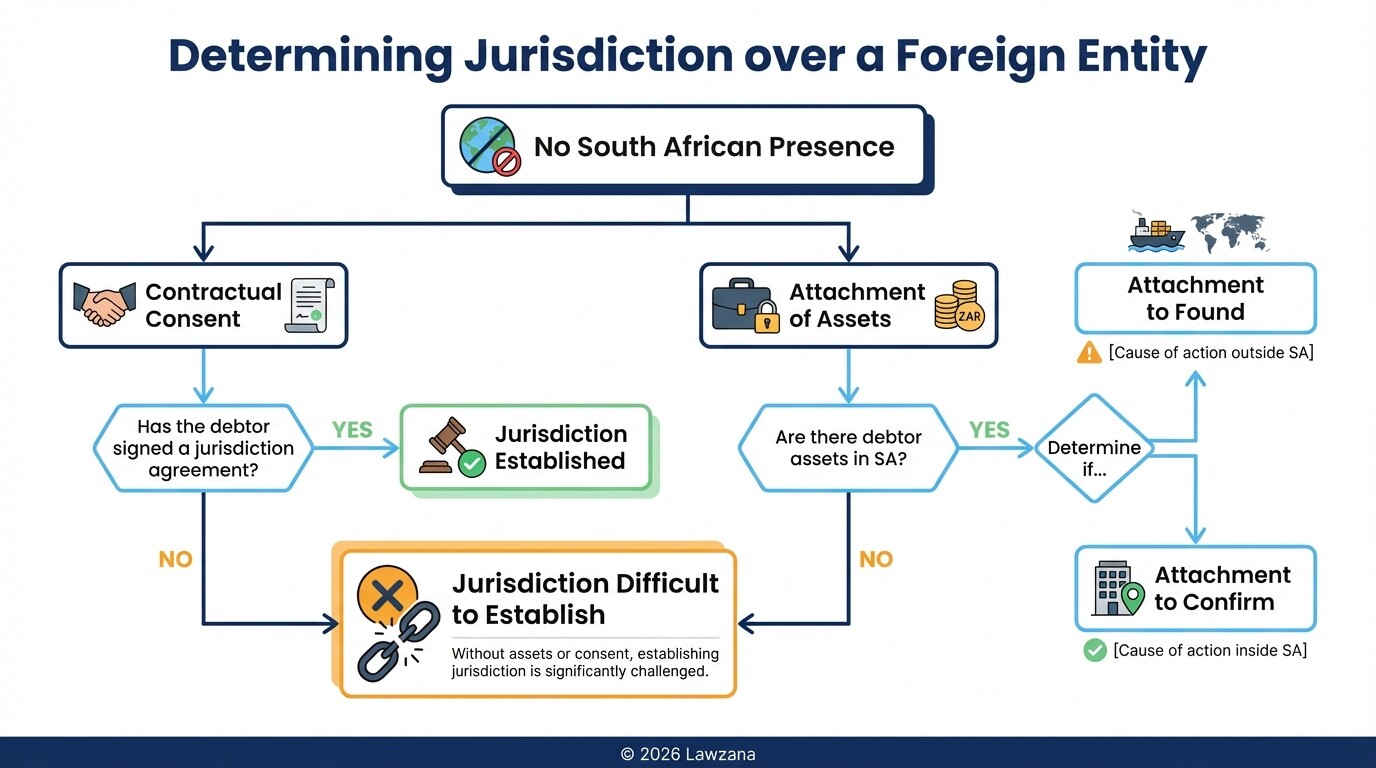

How Is Jurisdiction Established Against Foreign Entities in South Africa?

South African courts establish jurisdiction over a foreign entity (a peregrinus) primarily through the attachment of the debtor's assets located within South Africa. This legal mechanism, known as "attachment to found or confirm jurisdiction," ensures that the court has the authority to hear the case and provides a form of security for the debt.

If the creditor is a South African resident (an incola), the court may grant an order to attach any property belonging to the foreign debtor-such as bank accounts, physical goods, or intellectual property rights-found within the court's area of influence. This process follows specific legal requirements:

- Attachment to Found Jurisdiction: Used when the cause of action (the reason for the debt) did not arise in South Africa, but the creditor wants to sue in a local court.

- Attachment to Confirm Jurisdiction: Used when the debt arose within South Africa (e.g., the contract was signed or performed there), and the attachment serves to strengthen the court's existing authority.

- Consent: A foreign entity can voluntarily submit to the jurisdiction of South African courts through a written agreement, which may bypass the need for physical attachment.

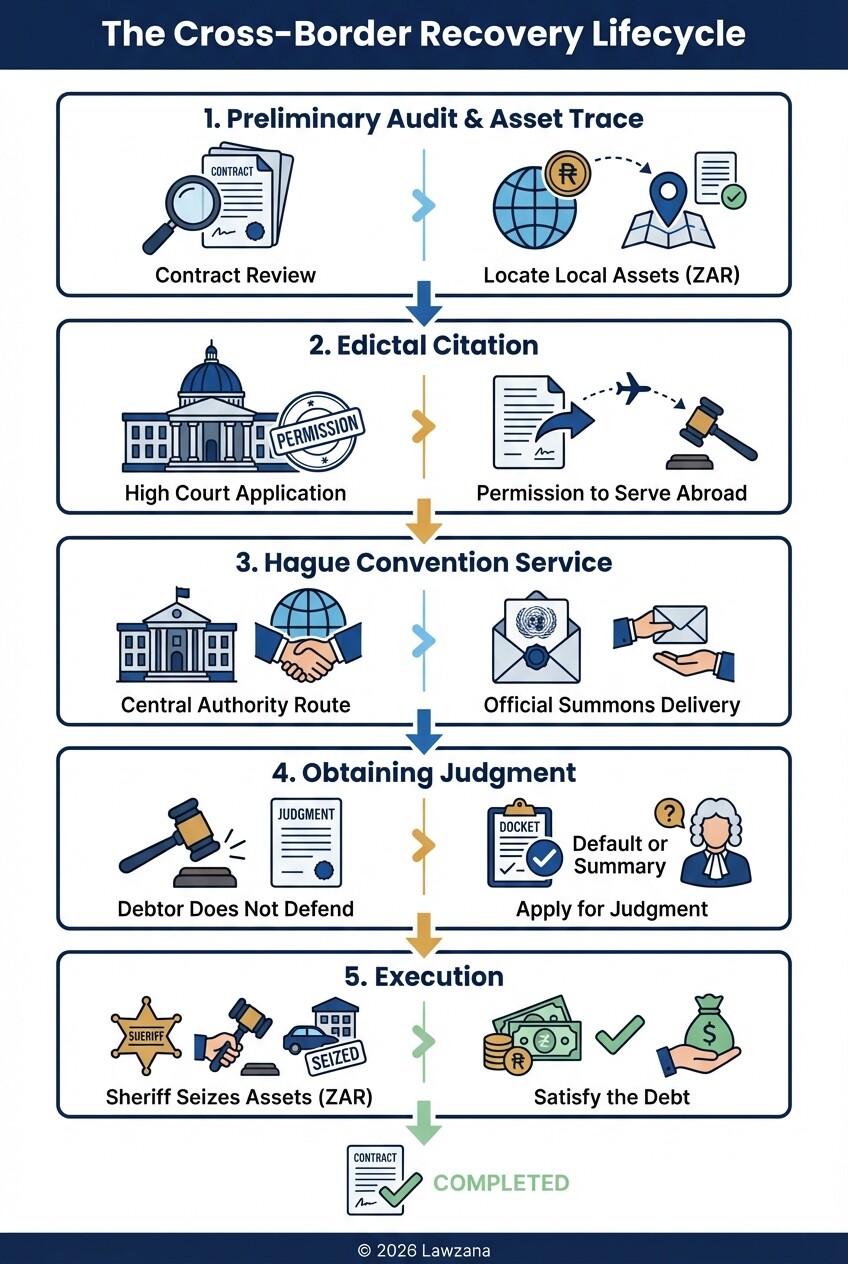

How Do You Obtain a Judgment Against a Foreign Debtor in South African Courts?

Obtaining a judgment involves initiating a formal summons through the High Court of South Africa and demonstrating that the debt is liquid, undisputed, or based on a breach of contract. The process begins with an application for "edictal citation," which is a specialized court procedure allowing a plaintiff to serve legal papers on a party located outside the country.

Once the court grants permission for edictal citation, the following steps typically occur:

- Issue of Summons: The legal team drafts a combined summons outlining the nature of the claim, the amount owed, and the basis for the South African court's jurisdiction.

- Service of Process: The summons is served on the foreign entity according to the laws of their home country or international treaties.

- Application for Default Judgment: If the foreign entity fails to file a "Notice of Intention to Defend" within the prescribed period (usually 21 to 30 days depending on the distance), the creditor can apply for a default judgment.

- Summary Judgment: If the debtor defends the case but has no bona fide defense, the creditor can apply for summary judgment to fast-track the recovery without a full trial.

What Is the Role of the Hague Convention in Cross-Border Debt Recovery?

The Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents (Hague Service Convention) provides a standardized, reliable method for South African litigants to serve legal papers on foreign defendants. By using the "Central Authority" designated by each member state, creditors ensure that the service is legally valid and recognized by both South African and foreign courts.

South Africa's participation in this convention simplifies what was previously a chaotic process involving diplomatic channels. The benefits include:

- Legal Certainty: Proper service under the Convention prevents the debtor from later claiming they were never notified of the lawsuit.

- Proof of Service: The foreign Central Authority provides a formal certificate confirming that the documents were delivered, which is essential for obtaining a judgment in South Africa.

- Cost Efficiency: While there are administrative fees, it is generally more affordable than hiring private international process servers who may not follow local legal requirements.

How Does International Arbitration Speed Up Debt Settlement?

International arbitration allows South African businesses to resolve debt disputes in a private forum rather than through the public court system, often resulting in a faster and more final resolution. Under the South African International Arbitration Act of 2017, which incorporates the UNCITRAL Model Law, arbitration awards are treated with high deference and are difficult for debtors to overturn.

The primary advantage of arbitration for debt recovery is the "New York Convention." This international treaty ensures that an arbitration award issued in South Africa can be enforced in almost any major global economy with minimal judicial interference.

| Feature | Litigation (Courts) | International Arbitration |

|---|---|---|

| Speed | Can take 2-4 years | Often resolved in 6-12 months |

| Enforceability | Requires "Exequatur" abroad | Simplified via New York Convention |

| Privacy | Public record | Confidential proceedings |

| Costs | Lower upfront, higher long-term | Higher upfront (arbitrator fees) |

What Are the Risks and Costs of "Attach and Execute" Procedures?

The "attach and execute" procedure involves the physical seizure and sale of a debtor's assets to satisfy a court order, but it carries significant financial and logistical risks. In South Africa, the Sheriff of the Court is responsible for this process, and the creditor must often indemnify the Sheriff against potential claims if the wrong property is seized.

Key risks and costs include:

- Storage and Security: If physical goods are attached, the creditor may be liable for the costs of removal, storage in a bonded warehouse, and insurance until the auction date.

- Valuation Risk: Assets sold at a forced execution sale often fetch prices significantly below market value, which might not cover the total debt and legal fees.

- ZAR Volatility: Legal costs are paid in South African Rand (ZAR), but if the debt is in USD or EUR, exchange rate fluctuations can erode the actual value recovered by the time the process concludes.

- Prioritized Creditors: Other parties, such as the South African Revenue Service (SARS) or secured creditors (banks), may have preferential claims to the attached assets.

Common Misconceptions About Foreign Debt Recovery

Myth 1: A South African judgment automatically freezes assets worldwide.

A judgment from a South African High Court only has direct power within the borders of South Africa. To freeze assets in London, New York, or Dubai, you must apply for a "Mirror Order" or seek recognition of the South African judgment in those specific foreign jurisdictions.

Myth 2: If the debtor has no assets in South Africa, you cannot sue them here.

While attachment of property is the standard way to establish jurisdiction, you can still sue a foreign entity in South Africa if the contract specifically designates South Africa as the chosen forum or if the "cause of action" occurred entirely within the country. However, enforcing that win will require moving the legal battle to where the debtor's assets actually sit.

Myth 3: International debt recovery is too expensive for small businesses.

While complex, many South African law firms offer "staged" fee structures or work with litigation funders who cover the costs of international recovery in exchange for a percentage of the successful collection.

FAQs

Can I recover interest and legal costs from a foreign entity?

Yes, South African courts generally award "party and party" costs to the winning side, which covers a portion of your legal expenses. You can also claim interest at the "mora" rate (the legal rate for late payment) as prescribed by the Prescribed Rate of Interest Act, unless your contract specifies a different rate.

How long does it take to recover debt from a foreign company?

If the entity does not defend the claim, you can obtain a default judgment in approximately 3 to 6 months. If the matter is contested or requires enforcement in a foreign country, the process can extend to 18 months or more.

What happens if the foreign entity files for bankruptcy in their home country?

If the debtor enters insolvency proceedings abroad, South African courts generally recognize the foreign liquidator's authority under the principle of "comity." This usually results in a stay of your local legal action, requiring you to lodge your claim in the foreign bankruptcy estate.

When to Hire a Lawyer

You should consult a commercial litigation expert the moment a foreign invoice becomes 30 days overdue and the debtor stops responding to standard communications. Cross-border recovery is highly technical; a single error in the service of process or a failure to properly attach assets can result in the case being dismissed with a punitive cost order against your business.

Expert legal counsel is essential if:

- The debt exceeds R500,000.

- The debtor has assets in South Africa that might be moved or hidden.

- The contract involves complex international trade terms (Incoterms).

- You need to navigate the Hague Service Convention or international arbitration rules.

Next Steps

- Audit Your Documents: Gather all signed contracts, invoices, proof of delivery, and email correspondence.

- Asset Trace: Conduct a preliminary search to identify if the foreign entity holds any bank accounts, property, or trademarks within South Africa.

- Check Jurisdiction Clauses: Review your agreement to see if you have already consented to the jurisdiction of South African courts or an arbitration forum.

- Issue a Final Demand: Have a South African attorney draft a "Letter of Demand" that complies with local High Court rules to show the court you attempted to resolve the matter before litigating.

- Formal Consultation: Schedule a strategy session with a litigation specialist to weigh the costs of recovery against the likelihood of successful collection.

For more information on court procedures and the Hague Convention, you can visit the Department of Justice and Constitutional Development or the Supreme Court of Appeal of South Africa.