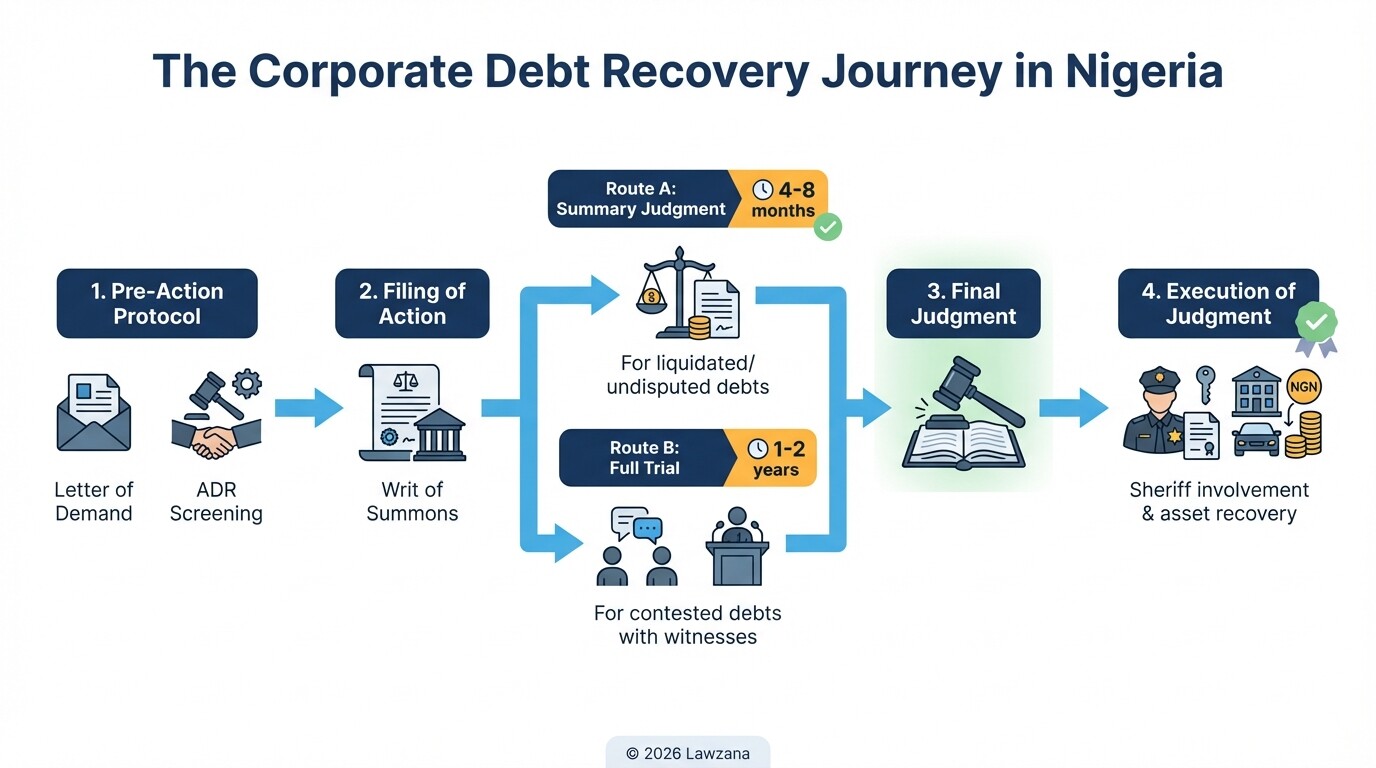

- Pre-Action Requirement: A formal Letter of Demand is a mandatory prerequisite for most debt recovery litigation in Nigerian courts to demonstrate that the debtor was given a fair opportunity to pay.

- Fast-Track Options: The Summary Judgment procedure (or the "Undefended List") allows businesses to bypass full trials when the debtor has no valid defense, significantly shortening the recovery timeline.

- Statute of Limitations: Debt recovery actions for simple contracts must be initiated within six years of the debt becoming due; otherwise, the claim becomes legally "statute-barred" and unenforceable.

- Cost Structures: Legal fees for corporate debt recovery in Nigeria typically range from 10% to 25% of the recovered amount, often structured as a contingency fee.

- ADR Preference: Courts in major commercial hubs like Lagos and Abuja now mandate a "Multi-Door Courthouse" screening to encourage mediation before a case proceeds to trial.

The Essential Letter of Demand

A Letter of Demand is a formal document issued by a creditor or their lawyer to a debtor, officially requesting the payment of an outstanding sum within a specific timeframe. It serves as a final warning and fulfills a critical evidentiary requirement in Nigerian civil procedure by proving that a dispute exists and that the creditor attempted an out-of-court settlement.

Failure to send a demand letter can lead to the court denying the creditor the "costs" of the action, even if they win, as the court may view the litigation as premature. In 2026, Nigerian courts continue to emphasize pre-action protocols designed to reduce the burden on the judicial system.

Corporate Debt Recovery Demand Letter Template

This template provides a standard framework for a formal demand in a B2B context.

[Your Company Letterhead]

Date: [Insert Date]

To: [Debtor Company Name] [Debtor Registered Address] Attn: The Managing Director / Chief Financial Officer

RE: FORMAL DEMAND FOR PAYMENT OF OUTSTANDING DEBT - ₦[Insert Amount]

We refer to the [Contract/Invoice Number] dated [Insert Date] regarding the supply of [Goods/Services].

As of the date of this letter, our records indicate that an outstanding balance of ₦[Insert Amount] remains unpaid despite previous reminders sent on [Dates of previous reminders]. The payment was due on [Original Due Date].

DEMAND IS HEREBY MADE for the immediate payment of the total sum of ₦[Insert Amount] to be paid within seven (7) business days from the receipt of this letter.

Payment should be made via [Bank Transfer/Check] to the following account: Account Name: [Your Company Name] Bank: [Bank Name] Account Number: [Number]

Please be advised that if the aforementioned sum is not received by [Insert Deadline Date], we have been instructed to exercise all legal remedies available to us under Nigerian law. This includes, but is not limited to, the initiation of debt recovery proceedings in the High Court, where we shall also seek interests at the rate of [Insert %] per annum, legal fees, and the costs of the action.

We hope to resolve this matter amicably and look forward to receiving confirmation of payment.

Yours faithfully,

[Signature]

[Name of Authorized Representative/Legal Counsel] [Title]

Using Summary Judgment Procedures for Fast Recovery

Summary Judgment is a legal procedure designed for cases where the claimant believes there is no real defense to the claim, allowing for a judgment without a full-blown trial. In Nigeria, this is governed by the Civil Procedure Rules of various states (such as Order 11 of the Lagos State High Court Rules) and is the primary tool for recovering "liquidated money demands."

A liquidated demand is a specific, fixed sum of money-such as a debt arising from a contract, a loan, or an unpaid invoice-where the calculation is not in dispute. By filing an application for summary judgment alongside the initial writ of summons, a business can often secure a court order in a fraction of the time a standard trial would take.

Requirements for Summary Judgment in Nigeria

To successfully utilize this procedure, the creditor must provide specific documentation:

- Affidavit of Facts: A sworn statement detailing the transaction, the amount owed, and the belief that the debtor has no defense.

- Documentary Evidence: Attached copies of the contract, invoices, delivery notes, and the Letter of Demand.

- Written Address: A legal argument outlining why the court should grant the judgment immediately.

Timelines for Debt Recovery in Nigeria

Recovering a corporate debt through the Nigerian court system generally takes between 6 months and 2 years, depending on the complexity of the case and the court's schedule. While the Summary Judgment procedure is faster, standard litigation involving witnesses and cross-examinations can experience significant delays due to heavy court dockets.

| Stage of Process | Estimated Timeline | Factors Influencing Speed |

|---|---|---|

| Pre-action (Demand/ADR) | 2-4 Weeks | Debtor's responsiveness |

| Filing and Service | 1-2 Months | Ease of locating the debtor's office |

| Summary Judgment Hearing | 4-8 Months | Court's availability for "Fast Track" |

| Full Trial (Standard List) | 1-2 Years | Number of witnesses and adjournments |

| Execution of Judgment | 2-6 Months | Availability of debtor's assets (Sheriff's office) |

Legal Fees and Cost Structures in 2026

Legal fees for debt recovery in Nigeria are typically structured to align the lawyer's incentives with the successful recovery of funds. While some firms charge a "retainer" (fixed upfront fee), the most common B2B model is the contingency fee, where the lawyer takes a percentage of the amount actually recovered.

Under the Rules of Professional Conduct for Legal Practitioners in Nigeria, lawyers are permitted to enter into "contingent fee" arrangements, provided the fees are reasonable. In 2026, the standard rates for corporate recovery are:

- Contingency Fees: 10% to 25% of the recovered sum. High-value debts (above ₦100 million) often attract lower percentages, while smaller, more difficult debts may be closer to 25%.

- Administrative/Filing Fees: These are out-of-pocket costs paid to the court registry, ranging from ₦50,000 to ₦500,000 depending on the claim size.

- Appearance Fees: Some firms charge a small fixed fee per court session to cover logistics and transportation.

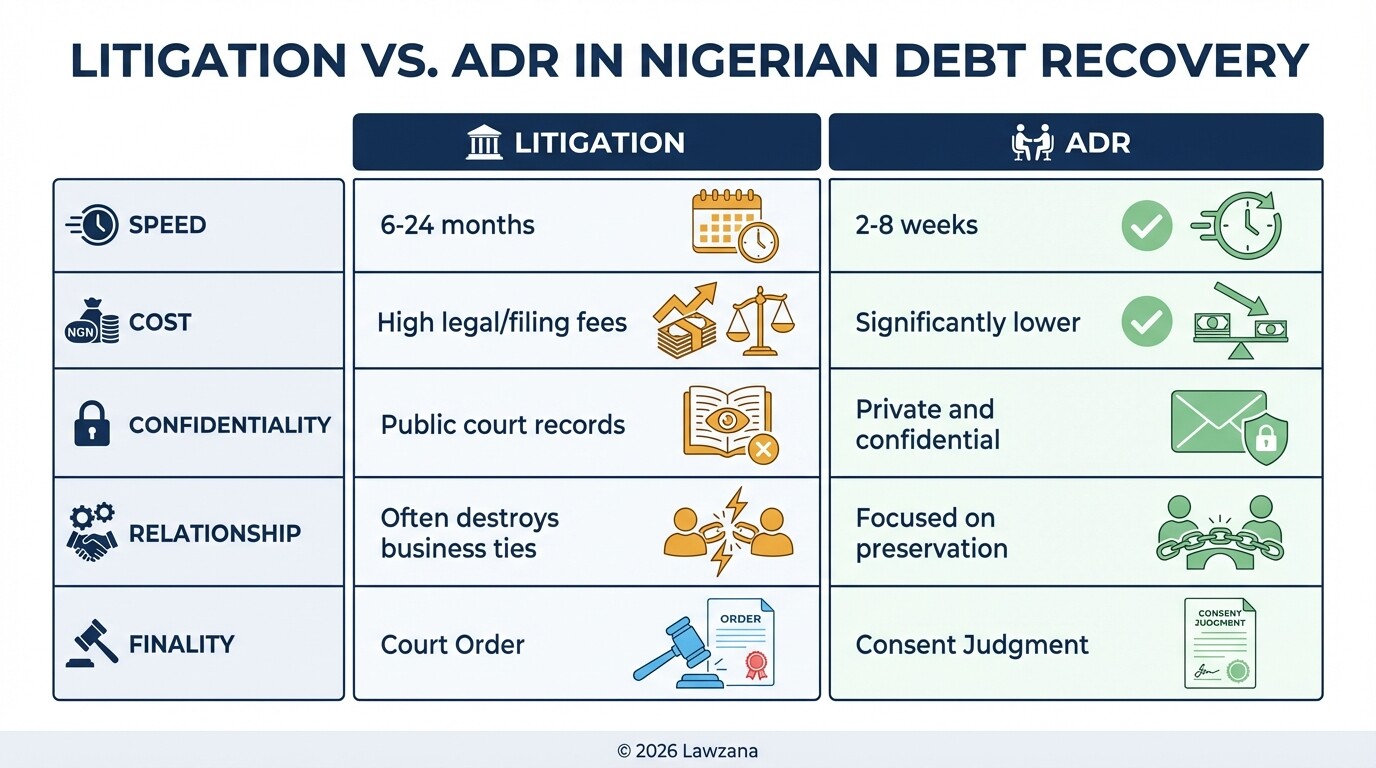

Alternative Dispute Resolution (ADR) as a Faster Path

Alternative Dispute Resolution (ADR) provides a mechanism for settling debts through mediation or arbitration without the adversarial nature of a courtroom. In Nigeria, many state judiciaries have integrated "Multi-Door Courthouses" (like the LMDC in Lagos) which offer court-connected mediation that is faster and more confidential than public litigation.

The advantage of ADR in a B2B context is the preservation of business relationships. A mediated settlement is transformed into a "Terms of Settlement," which, once signed by a judge, becomes a "Consent Judgment." This judgment is as enforceable as any other court order, but it is reached through negotiation rather than judicial decree.

Comparison: Litigation vs. ADR

- Speed: ADR can resolve a debt in weeks; litigation often takes years.

- Cost: ADR is generally cheaper due to fewer filings and lower legal man-hours.

- Privacy: ADR proceedings are private; court records are generally public.

- Enforceability: Both result in legally binding orders if handled through the Multi-Door Courthouse.

Common Misconceptions About Nigerian Debt Recovery

"The Police Can Collect the Debt for Us"

In Nigeria, debt recovery is strictly a civil matter. The police have no legal authority to arrest or detain a person for a simple breach of contract or failure to pay a debt. Using the police for debt recovery can expose the creditor to lawsuits for "fundamental rights enforcement," often resulting in the creditor being ordered to pay heavy damages to the debtor.

"If there is no written contract, I cannot recover the money"

While a written contract is the best evidence, it is not the only way to prove a debt. Invoices, email trails, WhatsApp messages, and bank statements showing a transfer of funds are all admissible evidence in Nigerian courts to prove the existence of a debt.

Frequently Asked Questions

What is the statute of limitations for debt recovery in Nigeria?

For simple contracts, the Limitation Act and various state Limitation Laws provide a window of six years from the date the debt became due. If you do not file a lawsuit within this period, your right to sue is lost unless the debtor acknowledges the debt in writing during those six years.

Can I recover interest on the outstanding debt?

Yes, you can recover interest if it was specifically mentioned in the contract. If the contract is silent on interest, you can still claim "pre-judgment interest" at the court's discretion and "post-judgment interest" (usually 10% per annum) from the date the court delivers its judgment until the money is paid.

What happens if the debtor company is insolvent?

If a debtor company cannot pay its debts (insolvency), you may need to initiate "Winding Up" proceedings under the Companies and Allied Matters Act (CAMA) 2020. This process involves the court appointing a liquidator to sell the company's assets and distribute the proceeds to creditors.

When to Hire a Lawyer

Professional legal intervention is necessary when the debtor ignores the initial Letter of Demand or when the amount exceeds the company's internal threshold for manageable loss. You should specifically seek a commercial litigator if:

- The debtor has disputed the debt or claimed a "set-off."

- You need to file for a "Mareva Injunction" to freeze the debtor's bank accounts to prevent them from moving funds abroad.

- The debt is owed by a foreign company operating in Nigeria.

- The six-year statute of limitations is approaching.

Next Steps

- Audit Your Records: Gather all invoices, delivery notes, and correspondence related to the debt.

- Send a Final Warning: Issue a formal Letter of Demand (using the template above) via a method that provides proof of delivery.

- Consult Counsel: If the deadline in the demand letter passes without payment, engage a lawyer to evaluate if the claim qualifies for the Summary Judgment/Undefended List procedure.

- Explore Mediation: Check if the contract contains an arbitration or mediation clause, or suggest the Multi-Door Courthouse as a faster alternative to filing a writ.

For official information regarding court rules and filing procedures, you can visit the Nigeria Law Reform Commission or the Supreme Court of Nigeria.