- The Central Bank of Nigeria (CBN) categorizes fintech licenses into specific tiers, including Switching and Processing, Mobile Money Operations (MMO), and Payment Service Providers (PSP).

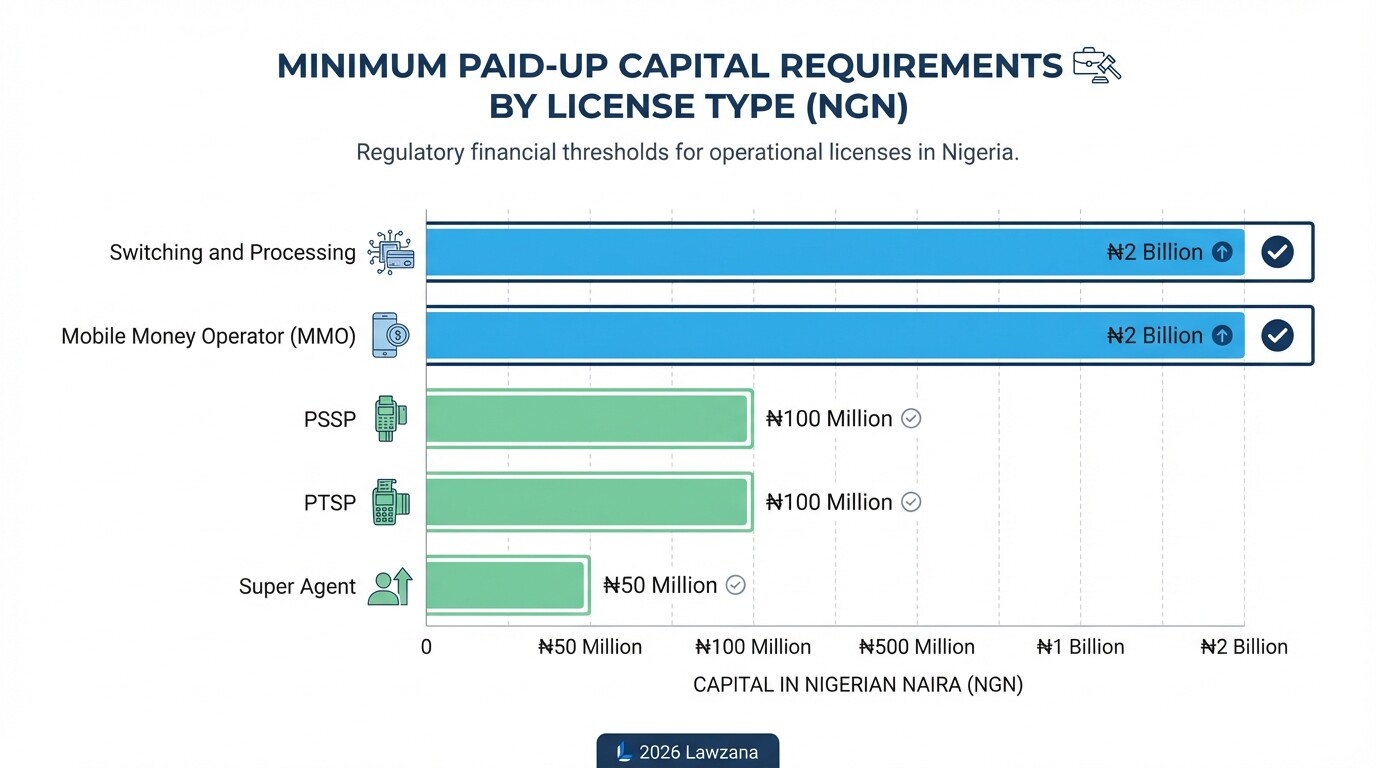

- Minimum paid-up capital requirements are substantial, ranging from ₦100 million for local payment services to ₦2 billion for switching and processing firms.

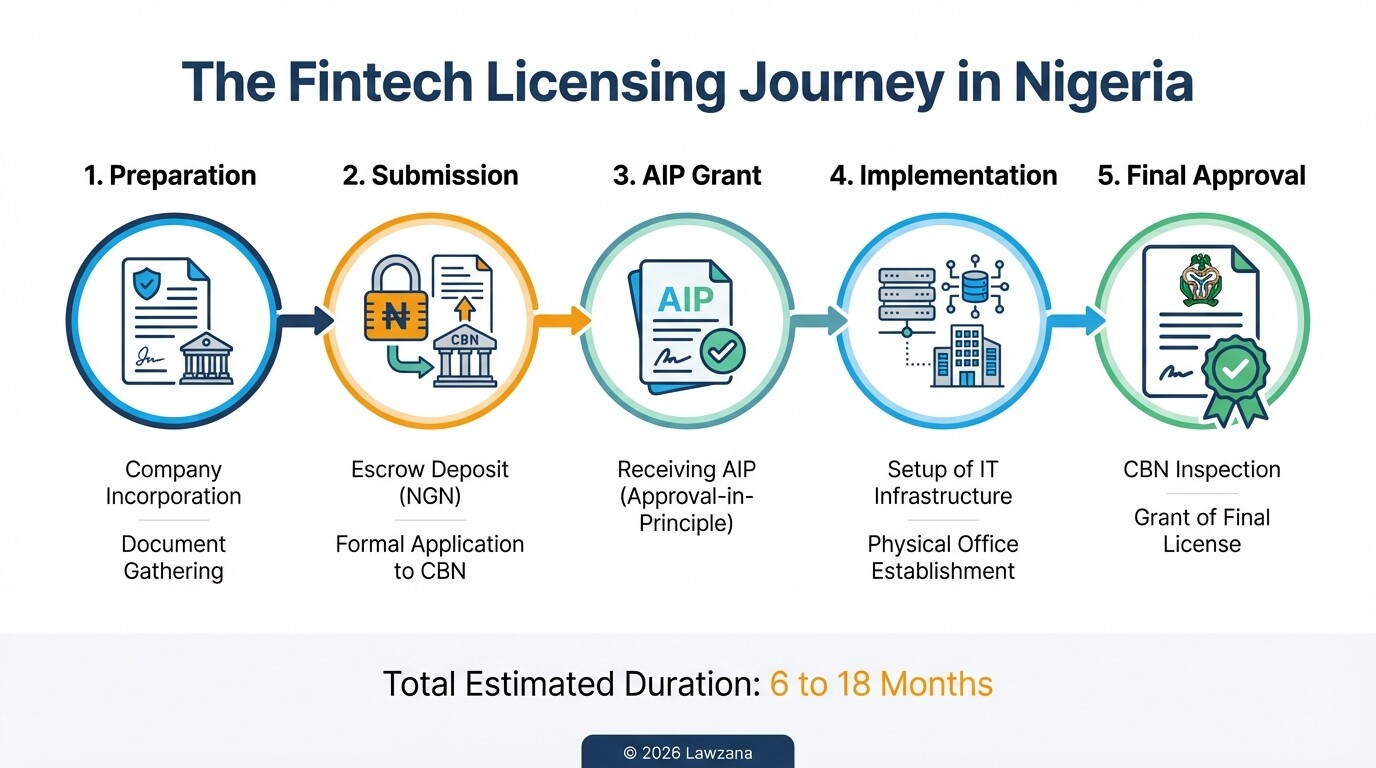

- The licensing process is a two-stage journey beginning with an Approval-in-Principle (AIP) before moving to a Final License.

- Share capital must be deposited in escrow with the CBN and is generally refundable (less administrative fees) once the final license is granted or the application is rejected.

- Strict compliance with the Nigeria Data Protection Act (NDPA) and Anti-Money Laundering (AML) regulations is mandatory for all licensed entities.

Checklist for Fintech Approval-in-Principle (AIP) in Nigeria

To launch a fintech in Nigeria, you must first secure an Approval-in-Principle. This document allows you to set up your infrastructure and systems without yet conducting live commercial transactions.

Use this checklist to ensure your application package is complete for the initial submission to the CBN:

- Certificate of Incorporation: Copy of the CAC (Corporate Affairs Commission) certificate for a Nigerian-incorporated company.

- Memorandum and Articles of Association (MEMART): Must clearly state that the company's object is to provide the specific fintech services being applied for.

- Business Plan: A detailed 3-5 year projection including financial statements, market analysis, and product roadmap.

- Tax Clearance Certificate: Evidence of tax compliance for the company and its directors over the last three years.

- Evidence of Escrow Deposit: A bank statement or letter confirming the minimum paid-up capital has been deposited into a designated CBN account.

- Fitness and Propriety Questionnaires: Completed forms for all major shareholders, directors, and top management staff.

- IT Policy: Detailed documents covering cybersecurity, business continuity, and disaster recovery.

- AML/CFT Policy: A comprehensive framework for Anti-Money Laundering and Combating the Financing of Terrorism.

Classification of Fintech Licenses: PSSP, MMO, and Digital Banking

Fintech services in Nigeria are strictly siloed to prevent systemic risk and ensure specialized oversight. Each license type dictates the specific financial activities a company can perform and the limitations on their operations.

The CBN currently utilizes a tiered licensing structure to organize the payments ecosystem. The main categories include:

- Switching and Processing: This is the most comprehensive license. It allows firms to facilitate the clearing and settlement of payment transactions between different financial institutions.

- Mobile Money Operator (MMO): This license allows firms to issue e-money, create digital wallets, and provide financial services via mobile phones. Unlike others, MMOs can hold customer funds.

- Payment Solution Service Provider (PSSP): These entities focus on the "pipes" of the payment system. They provide payment gateways, merchant portals, and software for transaction processing but cannot hold customer deposits.

- Digital Banking (Microfinance Bank): To provide lending and deposit-taking services through a digital-only interface, a company must obtain a Tier-1, Tier-2, or National Microfinance Bank (MFB) license.

| License Type | Permitted Activities | Target Audience |

|---|---|---|

| Switching/Processing | Inter-bank clearing, settlement, switching | Banks and other Fintechs |

| MMO | Wallet creation, e-money issuance, agency banking | Unbanked/Retail users |

| PSSP | Payment gateways, web acquiring | Merchants/Businesses |

| Digital MFB | Loans, savings, deposits | Individuals/SMEs |

Minimum Paid-up Capital and Escrow Requirements

The CBN requires fintech companies to demonstrate financial stability through minimum paid-up capital requirements. This capital must be deposited in full into a CBN escrow account before the application is processed.

The escrow deposit acts as a guarantee of the company's commitment and financial health. While the funds are held by the CBN, they are non-interest-bearing but are usually returned (or converted into company assets) once the final license is issued. The capital must be "unencumbered," meaning it cannot be borrowed or subject to any lien.

Current capital requirements (subject to CBN updates) include:

- Switching and Processing: ₦2 billion

- Mobile Money Operations (MMO): ₦2 billion

- Payment Solution Service Provider (PSSP): ₦100 million

- Payment Terminal Service Provider (PTSP): ₦100 million

- Super Agent: ₦50 million

Compliance with Anti-Money Laundering (AML) and Data Privacy

Fintech startups must integrate rigorous compliance frameworks into their software and daily operations to satisfy both the CBN and the Nigeria Data Protection Commission (NDPC).

Compliance is not just a legal hurdle but a foundational requirement for maintaining a license in Nigeria. Under the Nigeria Data Protection Act (NDPA), fintechs are considered "Data Controllers of Major Importance." They must appoint a Data Protection Officer (DPO) and conduct annual data audits.

Key compliance pillars include:

- KYC (Know Your Customer): Implementing tiered verification levels (BVN, NIN, and address verification) based on transaction limits.

- Transaction Monitoring: Automated systems to flag suspicious patterns that suggest money laundering or terrorism financing.

- NDPA Compliance: Ensuring that customer data is encrypted, stored securely (preferably within Nigeria), and processed only with explicit consent.

- Reporting Obligations: Filing regular reports with the Nigerian Financial Intelligence Unit (NFIU) and the CBN regarding large transactions or suspicious activities.

Projected Legal and Regulatory Filing Costs

Establishing a fintech in Nigeria requires significant upfront investment beyond the escrowed capital. These costs cover government fees, professional services, and administrative expenses.

While the paid-up capital is the largest line item, the administrative fees are non-refundable and must be factored into the initial budget. These costs vary depending on whether you are using a local legal consultant or a full-service corporate firm.

| Item | Estimated Cost (NGN) | Frequency |

|---|---|---|

| Application Fee | ₦100,000 - ₦1,000,000 | One-time |

| Licensing Fee | ₦1,000,000 - ₦5,000,000 | One-time (upon approval) |

| CAC Registration Fees | ₦500,000 - ₦1,500,000 | One-time |

| Annual Renewal Fee | Varies by license (approx. ₦500k+) | Annual |

| Legal/Consultancy Fees | ₦5,000,000 - ₦15,000,000 | Varies by complexity |

Common Misconceptions

- "I can use one license for everything." This is false. The CBN maintains a "No-Commingling" rule. For example, a company cannot hold an MMO license and a PSSP license under the same legal entity; they must be operated as separate subsidiaries if both services are desired.

- "The capital deposit is a lost cost." Many founders believe the ₦2 billion for an MMO is a fee paid to the government. In reality, it is a capital requirement. Once the license is granted, these funds can be used for the company's operations, such as purchasing hardware or office space.

- "I can start operating with just a CAC registration." Incorporating a company with the Corporate Affairs Commission (CAC) does not give you the right to process financial transactions. Doing so without a CBN license can lead to your bank accounts being frozen and potential criminal prosecution.

FAQ

How long does it take to get a fintech license in Nigeria?

The timeline generally ranges from 6 to 18 months. This includes the time spent preparing the application, the CBN's internal review for the AIP, and the final inspection of the physical office and IT infrastructure.

Can a foreign company own a Nigerian fintech?

Yes, foreign ownership is permitted, but the company must be incorporated locally in Nigeria. Additionally, the CBN assesses the fitness of foreign directors and requires evidence of capital importation via a Certificate of Capital Importation (CCI).

What is the difference between a PSSP and a PTSP?

A PSSP (Payment Solution Service Provider) focuses on digital gateways and web-based processing. A PTSP (Payment Terminal Service Provider) focuses on physical hardware, specifically the deployment and maintenance of Point of Sale (PoS) terminals.

Do I need a physical office for a digital bank?

Yes. Despite being a "digital" bank, the CBN requires a physical head office where they can conduct onsite inspections and where corporate records are maintained.

When to Hire a Lawyer

Navigating the CBN's regulatory landscape is technically demanding and requires precise documentation. You should engage a specialized fintech lawyer when:

- You are determining which license tier fits your business model to avoid over-capitalizing.

- You are drafting the Memorandum and Articles of Association (MEMART) to ensure the objects clause meets CBN standards.

- You need to structure investment deals or foreign capital importation.

- You are responding to queries from the CBN during the AIP phase.

Next Steps

- Identify your core product: Determine if you are moving money (MMO), processing it (PSSP), or lending it (MFB).

- Secure funding: Ensure you have the full minimum paid-up capital available for the escrow deposit.

- Incorporate your entity: Register with the Corporate Affairs Commission (CAC) with the appropriate share capital.

- Draft your policies: Prepare your AML, KYC, and Cybersecurity frameworks.

- Apply for AIP: Submit your formal application and escrow deposit to the Central Bank of Nigeria.