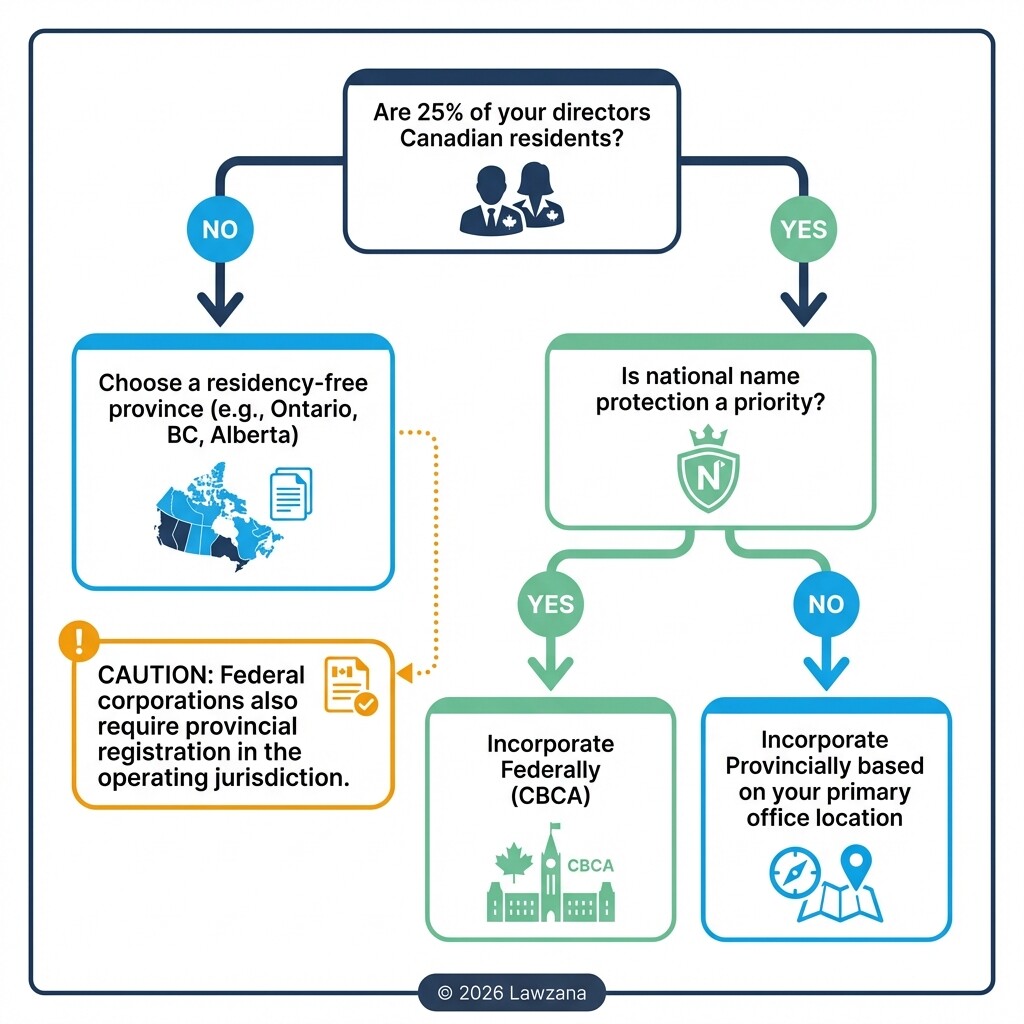

- Federal incorporation (CBCA) provides nationwide name protection but requires 25% of directors to be Canadian residents.

- Several provinces, including Ontario, British Columbia, and Alberta, have eliminated director residency requirements, making them ideal for foreign investors.

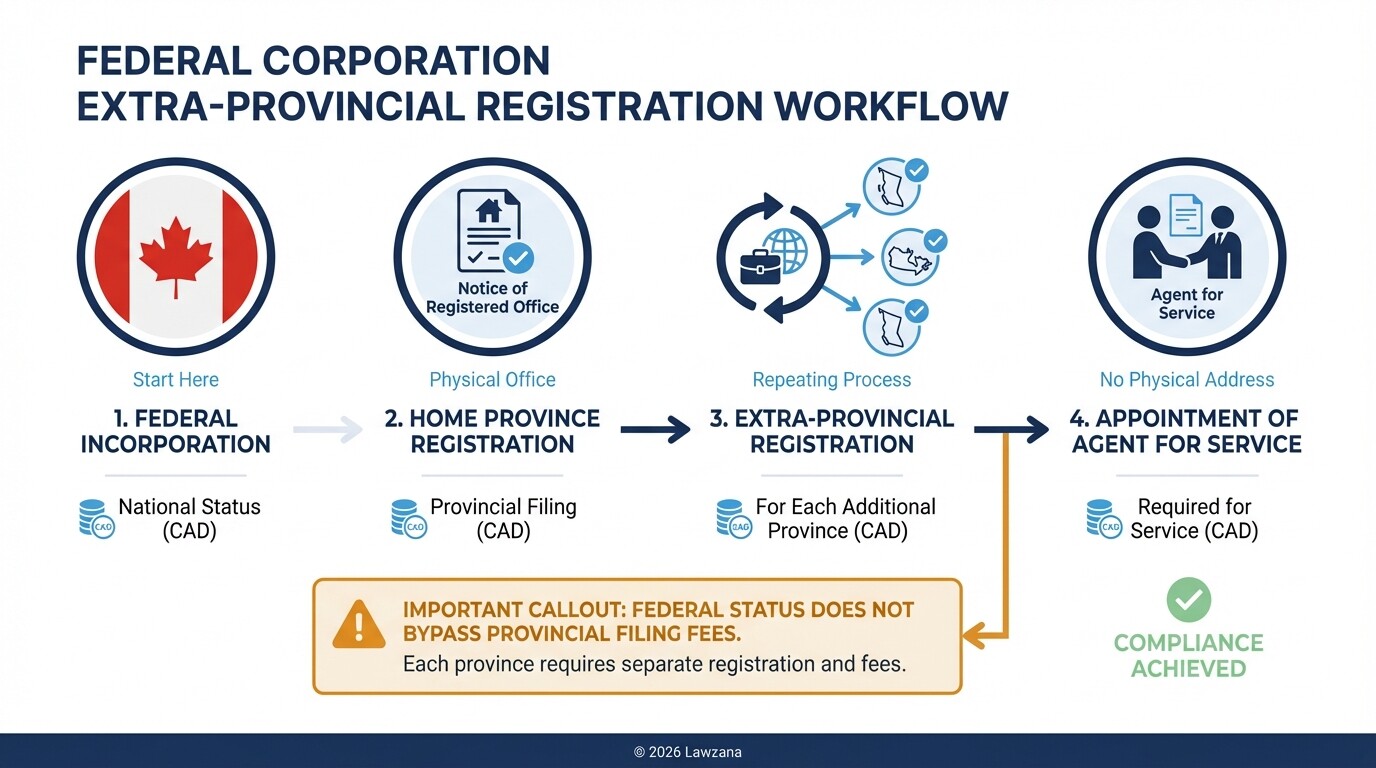

- Federal corporations must still complete extra-provincial registration in every province where they conduct business.

- Foreign-controlled corporations generally do not qualify for the "Small Business Deduction" available to Canadian-Controlled Private Corporations (CCPCs).

- All Canadian corporations are now required to maintain a register of Individuals with Significant Control (ISC) to ensure transparency and prevent financial crimes.

What is the Difference Between Federal and Provincial Incorporation?

Incorporating at the federal level gives your business the right to operate under the same name across all of Canada, while provincial incorporation is generally faster and limited to one specific region. Federal companies are governed by the Canada Business Corporations Act (CBCA), whereas provincial companies follow the specific statutes of their home province, such as the Ontario Business Corporations Act (OBCA).

Choosing the right jurisdiction involves balancing your need for brand protection against the administrative complexity of your operations.

| Feature | Federal (CBCA) | Provincial (e.g., OBCA, BCBCA) |

|---|---|---|

| Name Protection | Across all of Canada | Only within the home province |

| Director Residency | 25% must be Canadian residents | Varies (Many provinces require 0%) |

| Registration Cost | $200 (Online) | $300 - $500 (Varies by province) |

| Annual Filings | Federal + Provincial | Provincial only |

How Do Director Residency Requirements Compare Between the CBCA and OBCA?

The Canada Business Corporations Act (CBCA) requires that at least 25% of a corporation's directors be resident Canadians. In contrast, provinces like Ontario (OBCA), British Columbia, and Alberta have abolished residency requirements entirely, allowing a board to consist 100% of foreign nationals.

For international investors who do not have local partners or employees in Canada, the provincial route is often the most viable path.

Key Residency Considerations

- Federal (CBCA): If a board has fewer than four directors, at least one must be a resident Canadian. If it has four or more, 25% must be residents.

- Ontario (OBCA): As of 2021, Ontario removed the residency requirement, making it a top choice for foreign tech startups and investors.

- British Columbia (BCBCA): BC has long been a "residency-free" jurisdiction, offering a streamlined process for international entities.

- Impact on Strategy: If you cannot find a local director, you must incorporate provincially in a jurisdiction that permits 100% foreign boards.

What Level of Corporate Name Protection Do You Receive in Canada?

Federal incorporation offers the highest level of name protection, granting the corporation the right to use its name in every province and territory. Provincial registration only protects your corporate name within that specific province's borders, meaning a company with a similar name could open in a neighboring province.

Investors with plans to scale across Canada usually choose federal incorporation to prevent future trademark or branding conflicts.

The Name Approval Process

- NUANS Search: You must obtain a Newly Upgraded Automated Name Search (NUANS) report. This compares your proposed name against existing federal and provincial trademarks and business names.

- Approval Standards: Federal examiners are stricter than provincial ones. They may reject names that are too descriptive or too similar to existing high-profile brands.

- Provincial Limitations: If you register in Ontario and later want to expand to Quebec, your name is not automatically protected there. You would need to check name availability in Quebec at that later date.

How Does Extra-Provincial Registration Work for Multi-Region Operations?

Even if you incorporate federally, you must register your business in every province where you maintain an office, hire employees, or have a physical presence. This process is called extra-provincial registration and ensures that your business is recognized by local provincial governments for tax and legal purposes.

While federal incorporation grants the "right" to the name, the provincial registration provides the "license" to actually do business on the ground.

Steps to Register Extra-Provincially

- Select Your Home Base: Incorporate either federally or in your primary province.

- File Statements of Registration: Submit the required forms to the corporate registry of the "host" province.

- Appoint an Agent for Service: In most provinces, if you do not have a local office, you must appoint an individual or a law firm to receive legal documents on your behalf.

- Pay Local Fees: Each province charges its own registration fee, typically ranging from $200 to $600 CAD.

What Are the Tax Considerations for Foreign-Controlled Private Corporations?

In Canada, corporations controlled by non-residents do not qualify for the "Canadian-Controlled Private Corporation" (CCPC) status. This status is highly sought after because it allows for a significantly lower corporate tax rate on the first $500,000 of active business income, known as the Small Business Deduction.

Foreign investors must typically pay the general corporate tax rate, which is higher but still competitive globally.

Tax Implications for Investors

- General Corporate Rate: Foreign-controlled companies pay a combined federal and provincial tax rate, usually between 23% and 27% depending on the province.

- Withholding Taxes: When a Canadian subsidiary sends dividends back to its foreign parent company, a withholding tax (often 25%) applies, though this is frequently reduced to 5% or 15% through international tax treaties.

- Transfer Pricing: If your Canadian entity buys or sells goods/services from your foreign headquarters, you must ensure the pricing is at "arm's length" to satisfy Canada Revenue Agency (CRA) regulations.

What Are the Reporting Obligations for Beneficial Ownership in Canada?

Canada has implemented strict transparency laws requiring all corporations to maintain a register of "Individuals with Significant Control" (ISC). This register must identify any individual who owns or controls 25% or more of the corporation's shares or voting rights.

The goal of these regulations is to combat money laundering and tax evasion by ensuring the government knows exactly who owns Canadian businesses.

Maintaining an ISC Register

- Required Data: You must record the individual's full name, date of birth, last known address, and the date they acquired significant control.

- Annual Updates: Corporations must review and update this information at least once a year and within 15 days of any change.

- Public Disclosure: While the register was traditionally kept at the corporate office, Corporations Canada now requires some of this information to be filed with the federal government, where parts of it may be accessible to the public or law enforcement.

Common Misconceptions About Canadian Business Registration

Myth 1: Federal incorporation means I don't need provincial licenses.

Federal incorporation handles the birth of the legal entity and the name protection, but it does not bypass provincial requirements. You still need to register for provincial sales tax (PST), workers' compensation, and local business licenses in the city where you operate.

Myth 2: I must be a Canadian citizen to start a company.

Any person of legal age and sound mind can be a shareholder of a Canadian corporation. The restrictions only apply to the board of directors (at the federal level) and certain regulated industries (like telecommunications or aviation).

Myth 3: A corporate name is the same as a trademark.

Registering a business name gives you the right to use that name as a legal entity. It does not give you the same broad, enforceable rights as a registered trademark. For full brand protection, you should file a trademark application with the Canadian Intellectual Property Office (CIPO).

FAQ

Does a federal corporation have to pay two sets of annual fees?

Yes. Federal corporations must file an annual return with Corporations Canada ($12 online) and may also have to file annual reports or pay renewal fees in provinces where they are extra-provincially registered.

Can I change from provincial to federal incorporation later?

Yes. This process is called "Continuance." You can move a corporation from a provincial jurisdiction to the federal jurisdiction (or vice versa), though it requires filing articles of continuance and paying government fees.

Which province is the best for foreign investors?

Ontario and British Columbia are generally considered the best due to the lack of director residency requirements and their robust legal frameworks for business.

How long does it take to register a business in Canada?

Federal and many provincial registrations can be completed online in as little as 1 to 3 business days, provided you have your NUANS name search report ready.

When to Hire a Lawyer

While you can file incorporation papers yourself, a lawyer is essential if you are managing complex international ownership structures. You should consult a legal professional if you need to draft a customized Unanimous Shareholders Agreement (USA), if you are unsure how tax treaties apply to your home country, or if you need to appoint an Agent for Service. A lawyer ensures that your corporate minute book is set up correctly from day one, which is vital for future audits or business sales.

Next Steps

- Decide on a Jurisdiction: Determine if you have a resident Canadian to serve as a director (Federal) or if you need a residency-free province (Ontario/BC).

- Conduct a NUANS Search: Verify that your proposed business name is available and does not infringe on existing trademarks.

- Draft Articles of Incorporation: Define your share structure, including classes of shares and any restrictions on share transfers.

- Register for Tax Accounts: Once incorporated, obtain your Business Number (BN) from the CRA and register for GST/HST.

- Establish a Corporate Minute Book: Document your first board resolutions, issue share certificates, and create your ISC register.