Table of Contents

Introduction: The Current Landscape for Cheque Law in the UAE

The New Legal Landscape: What Really Changed?

- The Shift from Criminal to Civil Enforcement

- The Power of a "Writ of Execution"

- The Bank's New Obligations

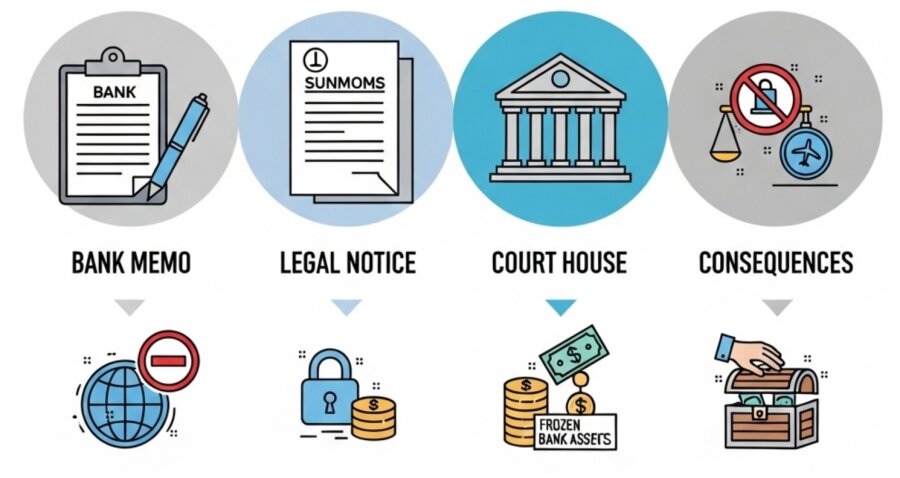

For the Creditor: A Step-by-Step Enforcement Guide

- Step 1: Obtain the Official Dishonour Documents

- Step 2: Issue a Formal Legal Notice

- Step 3: File a Case with the Execution Court

- Step 4: The Court's Enforcement Actions

For the Drawer: Understanding the Consequences

- Immediate Civil Enforcement and Lasting Credit Damage

- The Bounced Cheque Penalty: Central Bank Sanctions

- When a Bounced Cheque is Still a Crime

Special Scenarios: Navigating Complex Situations

- The Risk of "Security Cheques"

- Who is Liable for a Company Cheque?

Conclusion: Navigating the Current UAE Cheque Law with Caution

The legal landscape for cheques in the United Arab Emirates has undergone a significant transformation, driven by Federal Decree-Law No. 50 of 2022. The old system, which often led to immediate criminal action for a cheque returned for insufficient funds, has been replaced by a new, faster civil enforcement model. This legal shift has created some uncertainty. A common misconception has emerged that all bounced cheque cases have been decriminalized, which is incorrect. Both individuals and businesses, whether holding a dishonored cheque or having issued one, are often unsure of the new procedures and the serious consequences that remain.

This guide will provide clarity on how to handle cheque bounce cases in the UAE under the current law. We will explain the new civil enforcement pathway available to creditors, detail the financial and administrative penalties for drawers, and clarify which specific "bad faith" actions are still treated as criminal offenses. This article offers a clear guide for anyone navigating a cheque-related dispute in the UAE's modernized legal environment.

The Current Legal Landscape and What Really Changed?

The recent legal reforms represent a strategic shift in how the UAE manages commercial disputes. Spearheaded by Federal Decree-Law No. 50 of 2022, the changes fundamentally alter the procedures and consequences for bounced cheques.

The Shift from Criminal to Civil Enforcement

The core change is the move away from primarily treating a bounced cheque as a criminal offense. For the most common reason a cheque is dishonored, "insufficient funds," the primary recourse is no longer a criminal complaint filed with the police. Instead, the law has created a direct and expedited civil enforcement model. This legislative overhaul was designed to reduce the significant burden on the criminal justice system and provide creditors with more efficient tools for civil recovery.

The Power of a "Writ of Execution"

A tool introduced by the new law is the reclassification of a bounced cheque as a "writ of execution". This legal term means the cheque itself is recognized by the court as having the authority of a final, unappealable judgment. This status allows the holder to bypass the entire litigation process and proceed directly to the enforcement stage with the Execution Court. This significant provision applies to cheques returned for "insufficient funds" and was later expanded by a binding judicial ruling to also include cheques returned due to a "closed account".

The Bank's New Obligations

Financial institutions also have new, clearly defined responsibilities under the law. Banks are now mandated to make partial payment against a cheque if the account holds any funds, unless the bearer explicitly refuses to accept it. Upon dishonoring a cheque for any reason, the bank must provide the holder with an official "Cheque Return Memo". This certified document, stating the reason for non-payment, serves as the primary evidence required to initiate an enforcement case.

For the Drawer and Understanding the Consequences

For a creditor holding a dishonored cheque, the new legal framework provides a direct and effective mechanism for recovery. However, success depends on adhering to a precise procedural roadmap.

Step 1: Obtain the Official Dishonour Documents

The process begins the moment a bank refuses to honor a presented cheque. At this stage, it is necessary for the creditor to obtain two important items from the bank:

- The original dishonored cheque.

- An official "Cheque Return Memo" or a stamp on the cheque itself, which clearly states the reason for the bounce (e.g., "insufficient funds" or "account closed").

This bank-issued document is essential for any subsequent legal action; without it, initiating a case in the Execution Court is not possible.

Step 2: Issue a Formal Legal Notice

While the law does not require it as a prerequisite for filing an execution case, sending a formal legal notice to the drawer is a highly recommended strategic step. A notice serves several key purposes. It acts as a final official demand for payment before court intervention. Additionally, it demonstrates to the court that the creditor made a reasonable attempt to resolve the matter amicably. The threat of imminent legal action often motivates the drawer to settle the debt immediately, which avoids court fees and legal costs for both parties.

Step 3: File a Case with the Execution Court

If the drawer fails to pay after the legal notice period expires, the creditor can proceed with legal action for a bounced cheque in the UAE by going directly to the Execution Court. The application for an execution order must be accompanied by a complete set of documents, which includes the original bounced cheque , the original bank-issued Cheque Return Memo, a copy of the applicant's Emirates ID or trade license , and a completed application form.

Step 4: The Court's Enforcement Actions

An Execution Judge reviews the application on a summary basis. If the documents are in order, the judge will stamp the cheque as an executory instrument and issue an execution order, often within a matter of days. The debtor is then formally notified and given a grace period, typically 15 days, to settle the full amount. Should the debtor fail to comply, the creditor can request the court to deploy a range of enforcement measures to compel payment, including:

- A Travel Ban: An immediate prohibition on the individual signatory, manager, or owner from leaving the UAE.

- Asset Freezing: A directive to all banks in the UAE to freeze the bank accounts of the debtor.

- Seizure of Assets: The attachment and subsequent public auction of the debtor's movable assets (like vehicles) and real estate.

- An Arrest Warrant: In cases of persistent non-compliance with the court's payment order, an arrest warrant can be issued against the debtor or the company's legal representative.

When a Bounced Cheque is Still a Crime

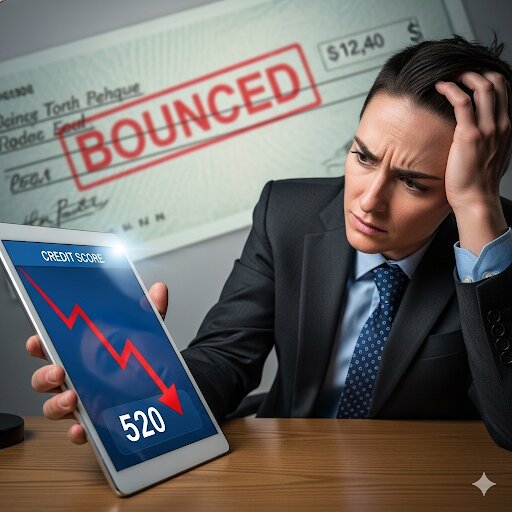

For the issuer of a bounced cheque, the narrative of decriminalization can be misleading. While the immediate threat of jail for a simple lack of funds has been removed, the new legal framework introduced a coordinated and effective system of civil, financial, and administrative penalties that can create financial difficulty. A drawer now faces multiple penalties against a swift legal process, a permanent negative mark on their credit record, and direct administrative sanctions.

Immediate Civil Enforcement and Lasting Credit Damage

Upon a cheque's dishonor, the beneficiary can act quickly, proceeding directly to the Execution Court to obtain an enforceable order. This means that within weeks, a drawer could be facing measures like a travel ban or frozen bank accounts without having had the opportunity to present a defense in a traditional trial. Perhaps an enduring consequence is the damage to one's creditworthiness. Banks are legally obligated to report all instances of bounced cheques to the Al Etihad Credit Bureau (AECB). This information becomes a part of the drawer's credit report for up to five years and has a negative impact on their credit score, which can impede their ability to secure future financing like loans, mortgages, or even credit cards.

The Bounced Cheque Penalty in the UAE: Central Bank Sanctions

Separate from any court-ordered measures, the UAE Central Bank is empowered to impose its own administrative penalties on drawers of bounced cheques. For an individual, if four cheques are returned for insufficient funds within a one-year period, their bank may be required to close their account and impose a ban on issuing them a new chequebook for two years. The penalties for companies are even stricter. Sanctions can include financial fines and the suspension of the company's trade license for up to six months. In cases of repeated violations, the authorities can order the cancellation of the trade license, effectively shutting down the business.

Special Scenarios: Security Cheques and Corporate Liability

Beyond a standard bounced cheque, several complex situations frequently arise in commercial practice. Navigating these scenarios, especially those involving security cheques and corporate liability, requires a nuanced understanding of the law.

The Risk of "Security Cheques"

The practice of issuing post-dated cheques as security for loans or rent is widespread in the UAE, but it carries legal risk for the drawer. UAE courts have consistently maintained that a cheque is an instrument of payment, not a guarantee of future performance. Any notation like "security" is generally disregarded by the legal system. A cheque is legally viewed as an unconditional order to pay the amount stated on its date. Consequently, a security cheque that bounces is fully enforceable through the expedited Execution Court process, which can trigger immediate enforcement measures like travel bans and asset freezes. The drawer's only recourse against a beneficiary who has wrongfully encashed the cheque is to file a separate and new civil lawsuit, in which the drawer bears the burden of proving the beneficiary had no right to present it. This creates a risk, as a drawer’s assets could be frozen long before they have a chance to argue the merits of the underlying dispute in their own case.

Who is Liable for a Company Cheque?

When a company issues a cheque, questions of liability can extend beyond the corporate entity itself. While a Limited Liability Company (LLC) is a distinct legal entity with liability limited to shareholders' capital, the individual who signs the company's cheque can be held personally liable. In cases involving bad faith or fraud, criminal liability attaches directly to the signatory.

UAE courts are generally reluctant to "pierce the corporate veil" and hold shareholders personally liable for corporate debts. However, this protection is not absolute. Under the Commercial Companies Law, managers and directors can be held personally and jointly liable for the company's obligations in cases of fraud, abuse of authority, gross error, or violation of the law. Furthermore, the UAE Bankruptcy Law provides another path to personal liability. If a company is declared bankrupt and its assets are insufficient to cover at least 20% of its debts, a court can order directors to personally contribute to the company's debts if mismanagement is proven.

Navigating the Current UAE Cheque Law with Caution

The UAE has reformed its laws to streamline cheque bounce cases in the UAE, creating an efficient civil enforcement tool for creditors. The new system prioritizes quick debt recovery through the Execution Courts. However, the consequences for drawers are also severe, with a combination of impacts on their financial and commercial standing through court actions, credit score damage, and Central Bank penalties. It is crucial to remember that criminal liability for any act of bad faith remains a risk with the potential for imprisonment. Proactive cheque management and open communication are the best strategies to avoid disputes, while swift action is essential for creditors to protect their rights.

Navigating this new legal framework requires clear and accurate advice. Whether you are a creditor seeking to recover funds or a drawer facing legal action, professional guidance is critical. Lawzana connects you with vetted business lawyers in Dubai who can provide the strategic counsel needed to protect your interests.