- Expanded Officer Exculpation: Delaware law now allows corporations to shield senior officers, not just directors, from personal liability for certain breaches of the duty of care in merger agreements.

- Enhanced Transparency: Foreign acquirers must comply with the Corporate Transparency Act (CTA), requiring the disclosure of beneficial owners to the federal government as part of the acquisition process.

- Mission-Critical Oversight: The Delaware Court of Chancery has increased its focus on "Caremark duties," holding boards accountable for failing to monitor essential regulatory and safety risks.

- Escrow and Indemnity Trends: Post-closing claims in cross-border deals are increasingly managed through tiered escrow structures to account for international tax and regulatory timelines.

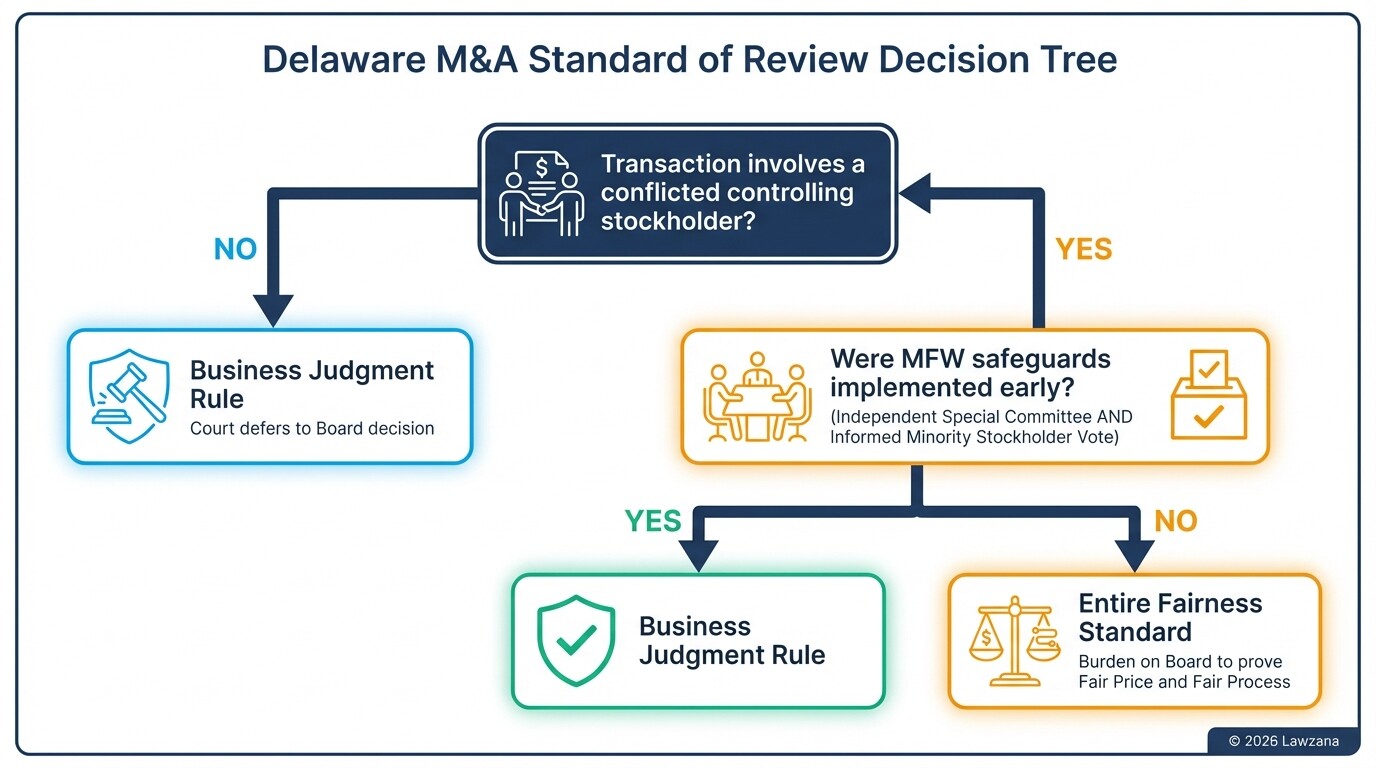

- Standard of Review: Transactions involving a conflicted "controlling stockholder" are subject to the rigorous "Entire Fairness" test unless specific procedural safeguards are implemented early in the deal.

2026 Delaware Cross-Border M&A Readiness Checklist

International acquirers must navigate a complex web of state-level corporate law and federal regulatory requirements. This checklist provides a framework for ensuring compliance with the latest Delaware standards and federal disclosure rules before executing a merger or acquisition.

| Phase | Action Item | Key Requirement |

|---|---|---|

| Governance | Review Charter for Section 102(b)(7) | Ensure the target's charter includes the 2026 updated officer exculpation language to protect the management team. |

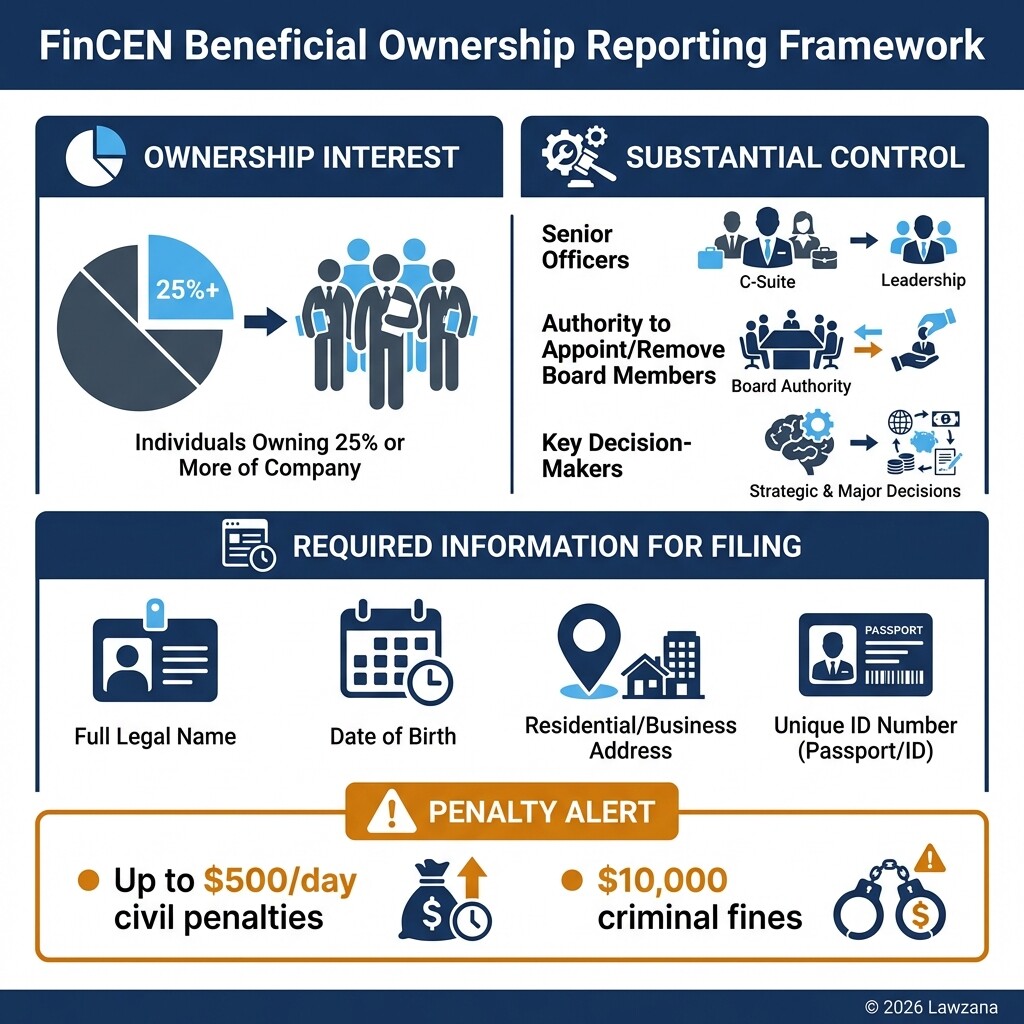

| Disclosure | FinCEN Beneficial Ownership Filing | Identify and document all individuals with >25% ownership or substantial control for CTA compliance. |

| Due Diligence | Mission-Critical Risk Assessment | Audit the target's internal reporting systems for "red flag" monitoring as per recent Caremark rulings. |

| Structuring | Multi-Jurisdictional Escrow | Set up an escrow account that accounts for international currency fluctuations and different tax statutes of limitations. |

| Procedural | "Special Committee" Formation | If a controlling stockholder is involved, establish an independent committee early to satisfy the MFW framework. |

| Filing | Delaware Secretary of State | File the Certificate of Merger/Conversion with the Delaware Division of Corporations. |

Sample Officer Exculpation Provision

To be included in the Certificate of Incorporation: "To the fullest extent permitted by the Delaware General Corporation Law (DGCL), an Officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as an officer, except for liability arising from (i) any breach of the officer's duty of loyalty, (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, or (iii) any transaction from which the officer derived an improper personal benefit."

New Beneficial Ownership Disclosure Rules for Foreign Acquirers

Foreign entities acquiring US-based companies must now provide detailed reports on their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This federal mandate, reinforced by Delaware's 2026 administrative updates, aims to prevent the use of shell companies for money laundering or illicit finance.

Foreign acquirers must identify any individual who, directly or indirectly, exercises "substantial control" over the reporting company or owns at least 25% of the ownership interests.

- Reporting Deadlines: New entities created or registered in 2026 typically have 30 to 90 days to file their initial reports.

- Required Information: Filings must include the individual's full legal name, date of birth, current residential or business address, and a unique identifying number from an acceptable legal document (e.g., a passport).

- Penalties for Non-Compliance: Failure to report can result in civil penalties of up to $500 for each day the violation continues and criminal fines of up to $10,000 or imprisonment.

Detailed guidance on these federal requirements can be found at FinCEN.gov.

Updated Merger Agreement Liability Standards for 2026

Delaware has expanded the scope of Section 102(b)(7) of the General Corporation Law to allow corporations to limit the personal liability of certain senior officers. Previously, this protection was only available to board directors, but the 2026 landscape reflects a more balanced approach to corporate governance.

These "exculpation" provisions protect officers from being personally sued for money damages for breaching their "duty of care"-essentially, for making an honest but mistaken business decision.

- Limited Scope: Exculpation does not apply to breaches of the "duty of loyalty" (acting in self-interest) or for "bad faith" actions.

- Covered Officers: This generally includes the president, CEO, COO, CFO, and other highly compensated officers who have consented to service of process in Delaware.

- Direct vs. Derivative Claims: While officers can be protected from direct claims brought by stockholders, they may still face liability in derivative claims (lawsuits brought on behalf of the corporation itself).

Recent Shifts in Board Fiduciary Duty Interpretations

The Delaware Court of Chancery is placing higher expectations on boards to implement and monitor internal reporting systems, particularly regarding "mission-critical" risks. Under the evolving Caremark doctrine, a board's failure to oversee essential business operations can lead to a breach of fiduciary duty.

In the context of an acquisition, the buyer must investigate whether the target board has been "proactively" monitoring its most significant risks, such as food safety for a restaurant chain or airplane safety for an aerospace company.

- The "Red Flag" Test: Boards must not ignore "red flags" that suggest corporate wrongdoing or safety failures.

- Reporting Channels: Effective boards must have established protocols where compliance information flows from management directly to the board level.

- Documenting Oversight: 2026 best practices require detailed board minutes that prove the directors discussed and scrutinized regulatory compliance and risk management.

Structuring Escrow Holdbacks for International Post-Closing Claims

Cross-border M&A deals often involve unique risks, such as foreign tax audits or intellectual property disputes in multiple jurisdictions, which require sophisticated escrow and holdback structures. An escrow is a portion of the purchase price held by a third party to satisfy potential indemnity claims made by the buyer after the deal closes.

To protect against international complexities, parties are increasingly using "tiered" release schedules where funds are released in stages as specific risk periods expire.

| Feature | Standard US Deal | Cross-Border 2026 Strategy |

|---|---|---|

| Escrow Amount | 7% - 10% of purchase price | 12% - 15% to account for global volatility |

| Release Period | 12 - 18 months | 18 - 36 months (aligned with foreign tax statutes) |

| Currency | USD Only | Multi-currency accounts or "locked-box" mechanisms |

| Dispute Resolution | Delaware Court of Chancery | International Arbitration (ICC or LCIA) |

Sample Escrow Language

"The Escrow Agent shall hold the Escrow Funds in a segregated account. If, prior to the expiration of the Survival Period, Buyer delivers a Claim Notice asserting an Indemnifiable Loss related to Foreign Tax Liabilities, the Escrow Agent shall retain an amount equal to the claimed loss until such claim is resolved by mutual agreement or final adjudication."

Best Practices for Navigating Delaware Court of Chancery Proceedings

The Delaware Court of Chancery is a non-jury trial court that handles high-stakes corporate disputes with speed and specialized expertise. For international companies, understanding the "Rules of the Bench" is critical to a successful litigation outcome.

The court prioritizes "substance over form" and expects a high degree of transparency and professionalism from legal counsel.

- Speed of Litigation: Cases in the Chancery Court can move from filing to trial in months, not years, particularly when an injunction is sought to stop a merger.

- Emphasis on "Entire Fairness": If a deal involves a conflict of interest, the court will look at both the "Fair Price" and the "Fair Process."

- Document Retention: Delaware has strict discovery rules. Acquirers must ensure all communications (including WhatsApp or Signal messages used for business) are preserved if litigation is anticipated.

Common Misconceptions

1. "Only Directors have fiduciary duties in Delaware."

This is false. Officers of a Delaware corporation owe the same fiduciary duties of care and loyalty as directors. While recent law allows for some liability protection (exculpation) for officers, they remain high-value targets in M&A litigation if they act in their own self-interest.

2. "If the majority of stockholders vote 'Yes,' the deal is safe from lawsuits."

Not necessarily. If a "controlling stockholder" (someone with significant influence, even if less than 50% ownership) is on both sides of the deal, the court may apply the "Entire Fairness" standard despite the vote. This requires the company to prove the deal was objectively fair to the minority stockholders.

3. "Foreign companies don't need to worry about US federal disclosure."

With the implementation of the Corporate Transparency Act, this is no longer true. Even if an entity is formed in a foreign jurisdiction, if it is registered to do business in the US or acquires a US entity, it likely faces significant federal reporting requirements regarding its owners and controllers.

FAQ

What is the "Business Judgment Rule" in Delaware M&A?

The Business Judgment Rule is a legal presumption that in making a business decision, the directors of a corporation acted on an informed basis, in good faith, and in the honest belief that the action taken was in the best interests of the company. Unless a plaintiff can prove otherwise, the court will not second-guess the board's decision.

How much does it cost to file a merger in Delaware?

For 2026, the minimum filing fee for a Certificate of Merger is $200, plus additional fees based on the complexity and the number of entities involved. Professional service fees for registered agents and legal counsel will significantly increase the total cost of the transaction.

Can a foreign company use its own country's laws for a Delaware acquisition?

While the merger agreement itself may sometimes use different "choice of law" provisions, the "Internal Affairs Doctrine" dictates that the internal governance of a Delaware corporation (such as fiduciary duties and stockholder rights) is always governed by Delaware law.

When to Hire a Lawyer

Navigating a cross-border acquisition requires specialized legal counsel when:

- You are an international entity acquiring a company incorporated in Delaware.

- The transaction involves a "controlling stockholder" or a potential conflict of interest.

- You need to draft complex indemnity and escrow provisions to mitigate global risks.

- You are served with a "Books and Records" demand (Section 220) by a target's stockholders.

- You must ensure compliance with the Corporate Transparency Act to avoid federal penalties.

Next Steps

- Audit Corporate Documents: Review the target company's Certificate of Incorporation and Bylaws to check for updated officer exculpation provisions.

- Engage a Registered Agent: If you are forming a new US entity for the acquisition, secure a Delaware registered agent to handle legal service of process.

- Draft a Disclosure Plan: Identify your beneficial owners early in the process to ensure timely FinCEN filings.

- Consult a Delaware Specialist: Engage legal counsel experienced in the Court of Chancery to review the merger agreement's "standard of review" protections.