- The 2026 Sunset: On January 1, 2026, federal estate tax exemptions are scheduled to drop by nearly 50 percent, making proactive planning essential for Florida property owners.

- Probate Avoidance: Florida has one of the most rigorous probate systems in the country; using a Revocable Living Trust is the primary way to keep your estate private and out of court.

- Homestead Protection: Florida offers unique "Homestead" creditor protections and tax benefits that must be correctly addressed in your estate plan to remain valid.

- Immediate Authority: A Durable Power of Attorney in Florida grants immediate powers to your agent unless otherwise specified, making it a critical document for incapacity planning.

- Digital Legacy: Florida law now allows fiduciaries to manage your digital assets, including cryptocurrency and social media, provided you grant explicit permission in your legal documents.

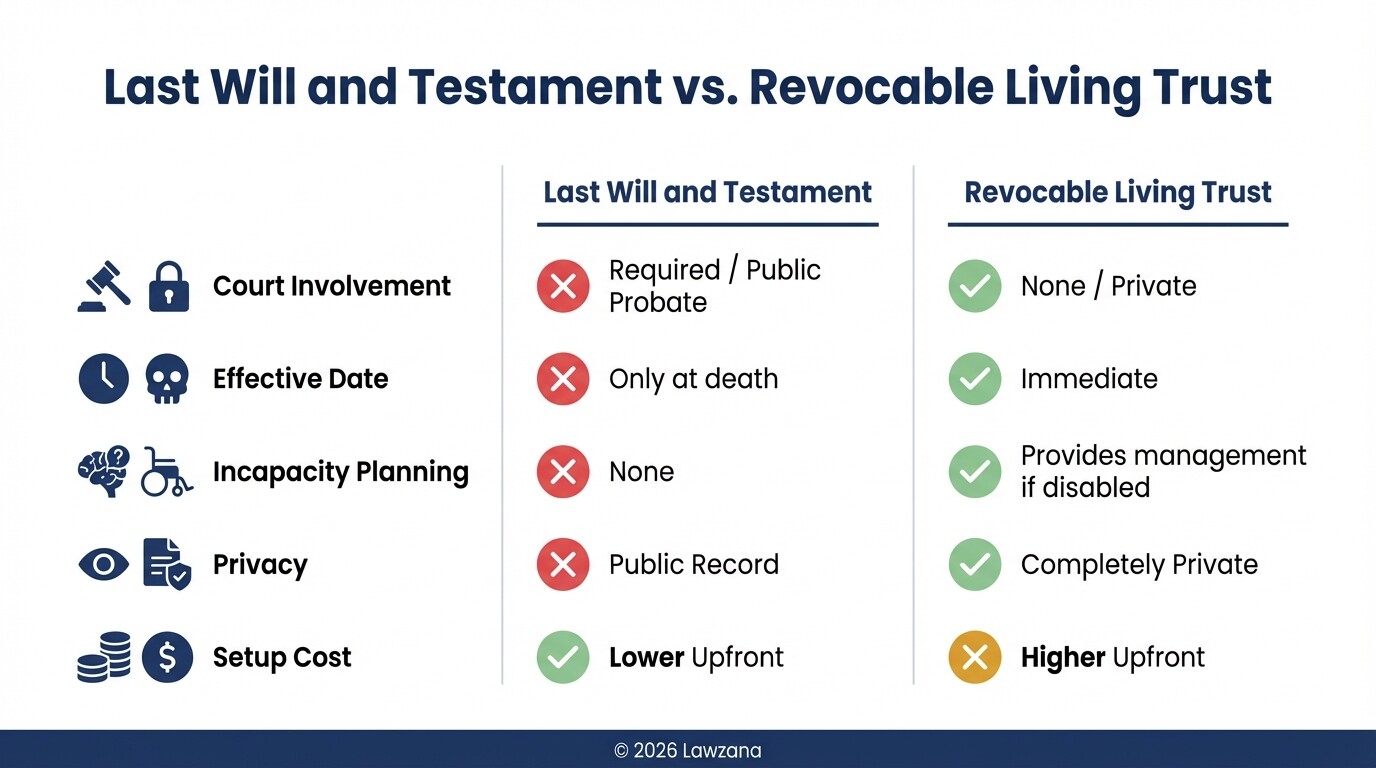

What Is the Difference Between a Last Will and a Revocable Living Trust?

A Last Will and Testament is a legal document that outlines how your assets should be distributed after death, while a Revocable Living Trust is a private entity that holds and manages your assets during your lifetime and beyond. While both allow you to name beneficiaries, a Will must go through the public court process known as probate, whereas a Trust allows for the private, immediate transfer of assets without court intervention.

In Florida, choosing between these two often depends on the size of your estate and your desire for privacy.

- Last Will and Testament:

- Only becomes effective upon your death.

- Requires a court-supervised probate process to validate.

- Becomes a matter of public record.

- Generally less expensive to draft initially but more expensive for your heirs later.

- Revocable Living Trust:

- Effective as soon as it is signed and "funded" (assets are moved into the trust's name).

- Avoids the probate court entirely for all assets held within the trust.

- Remains a private document.

- Provides a roadmap for your care if you become incapacitated before death.

How Do I Designate a Durable Power of Attorney and Healthcare Proxy?

To designate a Durable Power of Attorney (DPOA) and Healthcare Proxy in Florida, you must sign specific legal documents that name a "surrogate" or "agent" to make decisions on your behalf if you cannot do so yourself. Florida law is strict regarding these documents: they must be signed in the presence of two witnesses and a notary public to be legally binding.

These "living documents" are often more important than a Will because they protect you while you are still alive.

- Durable Power of Attorney: This grants someone the legal authority to manage your finances, pay bills, and sell property. In Florida, these powers are typically "durable," meaning they remain in effect even if you become mentally incompetent.

- Healthcare Surrogate: This person is authorized to make medical decisions for you, access your medical records, and talk to your doctors if you are unable to communicate.

- Living Will: Distinct from a "Last Will," this document outlines your preferences for end-of-life medical treatment, such as whether you wish to be kept on life support.

What Are the Updated 2026 Estate Tax Exemption Limits?

The federal estate tax exemption is currently at an all-time high of $13.99 million per individual (for 2025), but this "bonus" exemption is scheduled to expire on December 31, 2025. On January 1, 2026, the exemption is projected to drop to approximately $7 million per person, adjusted for inflation. Any estate valued above this threshold could be subject to a federal tax rate of up to 40 percent.

While Florida does not have its own state-level inheritance or estate tax, the federal change will impact many Floridians who previously did not have to worry about tax planning.

| Year | Individual Exemption (Estimated) | Top Tax Rate |

|---|---|---|

| 2024 | $13.61 Million | 40% |

| 2025 | $13.99 Million | 40% |

| 2026 (Post-Sunset) | ~$7 Million | 40% |

If your total assets (including your home, life insurance payouts, and retirement accounts) exceed $7 million, you should consider "Gifting" strategies or Irrevocable Trusts before the 2026 deadline to lock in the current higher exemptions.

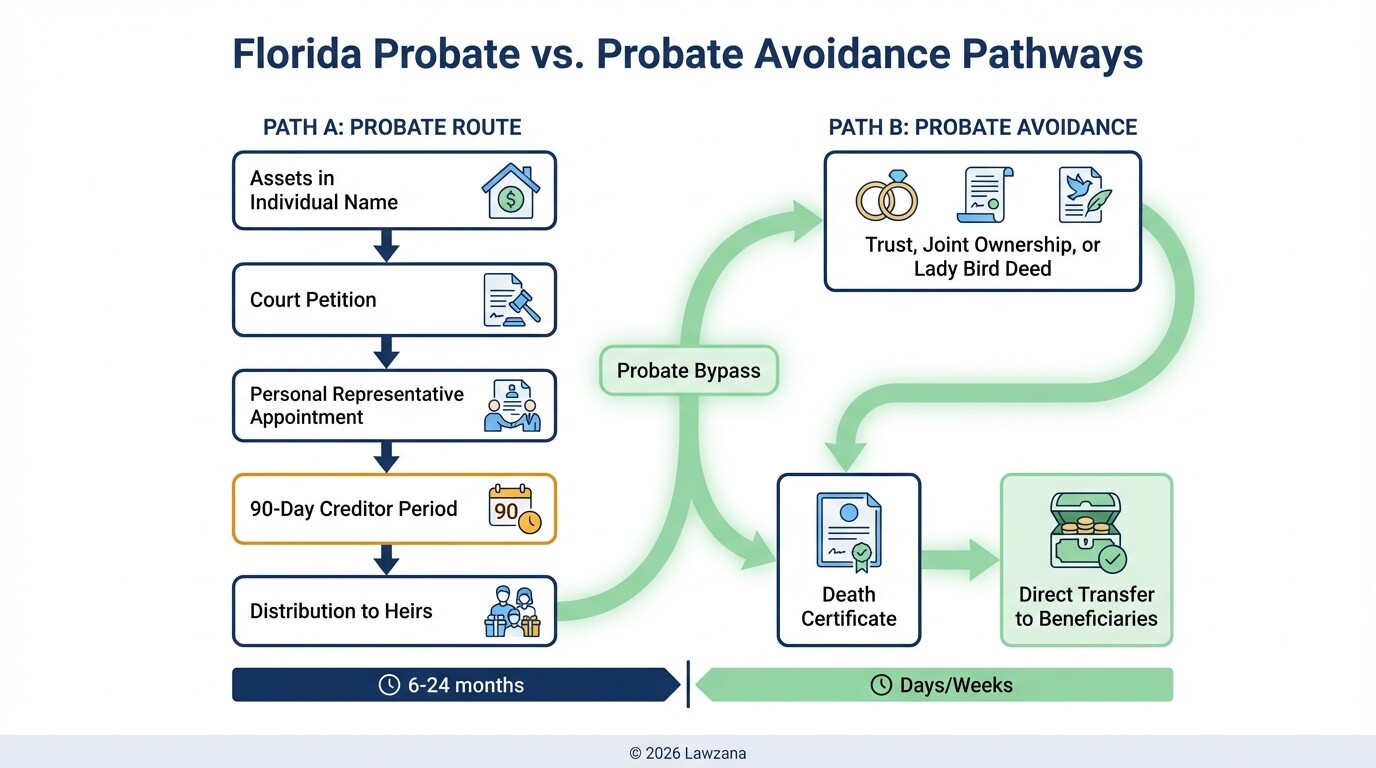

How Can I Bypass the Lengthy Florida Probate Process?

Bypassing Florida probate is achieved by ensuring that no assets are held solely in your individual name at the time of your death. Assets that have a named beneficiary or are held in a trust do not need a judge's signature to be transferred to your heirs.

Florida probate can take anywhere from six months to two years, and attorney fees are often calculated as a percentage of the estate value, which can be costly.

- Revocable Living Trusts: The most common tool for probate avoidance.

- Beneficiary Designations: Use "Payable on Death" (POD) for bank accounts and "Transfer on Death" (TOD) for brokerage accounts.

- Joint Ownership: Assets held as "Joint Tenants with Rights of Survivorship" or "Tenants by the Entirety" (for married couples) pass automatically to the survivor.

- Lady Bird Deeds (Enhanced Life Estate Deeds): A unique Florida tool that allows you to keep control of your home during your life but transfer it automatically to beneficiaries upon death without probate.

How Do I Plan for Digital Assets and Cryptocurrency Inheritance?

Planning for digital assets requires including specific language in your Will or Trust that grants your personal representative or trustee the authority to access "digital content" under the Florida Fiduciary Access to Digital Assets Act (UFADAA). Without this specific authorization, privacy laws may prevent your family from accessing your email, social media, or crypto wallets, even with a death certificate.

Digital asset planning should follow a three-step process:

- Inventory your Assets: List your hardware (phones, laptops), data (cloud storage, photos), and financial accounts (Coinbase, Robinhood, PayPal).

- Provide Access: Use a secure password manager and share the "master key" with a trusted person, or utilize the "Legacy Contact" features provided by Apple, Google, and Meta.

- Legal Authorization: Ensure your lawyer includes a "Digital Assets" clause in your Power of Attorney and Trust documents. This provides the legal "consent" required by service providers to hand over data.

Common Misconceptions About Florida Estate Planning

"I don't need a plan because I have a small estate."

Even small estates in Florida can get stuck in probate if a single asset (like a car or a small bank account) is held in only one name without a beneficiary. Furthermore, estate planning is not just about death; it is about who makes your medical decisions if you are in an accident tomorrow.

"My spouse automatically gets everything anyway."

While Florida has "elective share" laws that prevent you from completely disinheriting a spouse, the process is not always automatic or simple. If you have children from a previous marriage, Florida's intestacy laws (rules for when someone dies without a Will) divide assets between the spouse and children, which may not be what you intended.

"My Homestead property is automatically protected from probate."

While Florida's Constitution provides incredible protections for your primary residence against creditors, the home still technically "vests" in your heirs. To sell the house or clear the title, your family will usually still need to go to court for a "Petition to Determine Homestead," unless the home was held in a trust or a Lady Bird Deed.

Frequently Asked Questions

Does Florida have an inheritance tax?

No. Florida does not impose a state inheritance tax or an estate tax. Florida residents are only subject to federal estate taxes if their total estate exceeds the federal exemption limits.

What is the "Elective Share" in Florida?

The Florida Statutes (Section 732.201) provide that a surviving spouse has a right to claim 30 percent of the "elective estate" of the deceased spouse. This prevents someone from being entirely cut out of a spouse's wealth, regardless of what the Will says.

Can I write my own Will in Florida?

While "holographic" (handwritten, unwitnessed) wills are not recognized in Florida, you can technically draft your own Will. However, it must be signed by you and two witnesses who also sign in each other's presence. Errors in execution are the most common reason Florida courts throw out DIY wills.

How often should I update my Florida estate plan?

You should review your plan every 3 to 5 years, or whenever a "Life Event" occurs, such as marriage, divorce, the birth of a child, a significant change in wealth, or the death of a named executor.

When to Hire a Lawyer

Estate planning is not a one-size-fits-all process. You should consult a Florida board-certified wills, trusts, and estates attorney if:

- Your total assets exceed the projected 2026 federal tax exemption ($7 million).

- You own a business or professional practice.

- You have a "blended family" with children from previous relationships.

- You have a child with special needs who requires a Supplemental Needs Trust.

- You own real estate in more than one state, which could lead to multiple probate cases.

Next Steps

- Audit Your Assets: Create a comprehensive list of all bank accounts, properties, and digital assets.

- Check Your Beneficiaries: Review your life insurance and retirement accounts to ensure the beneficiaries listed are still correct.

- Secure Your Documents: Place your original Will or Trust in a safe location (not a safe deposit box, as these can be locked upon death) and tell your executor where it is.

- Consult a Professional: Schedule a review of your current plan to ensure it is "Sunset-proof" before the 2026 tax law changes take effect.

For more information on court procedures and forms, visit the Florida Courts official website.