- Foreign manufacturers must obtain an Investment Registration Certificate (IRC) followed by an Enterprise Registration Certificate (ERC) to operate legally.

- Industrial Zones (IZs) offer established infrastructure, while Economic Zones (EZs) provide the most significant corporate income tax incentives.

- Environmental compliance is non-negotiable, requiring either an Environmental Impact Assessment (EIA) or a specific Environmental License before construction begins.

- Export-Processing Enterprises (EPEs) can benefit from 0% VAT and zero import/export duties if they meet strict physical separation and export volume requirements.

- Labor compliance for large-scale factories necessitates registered Internal Labor Regulations (ILR) and mandatory social insurance contributions for all employees.

Manufacturing Setup Checklist for Vietnam

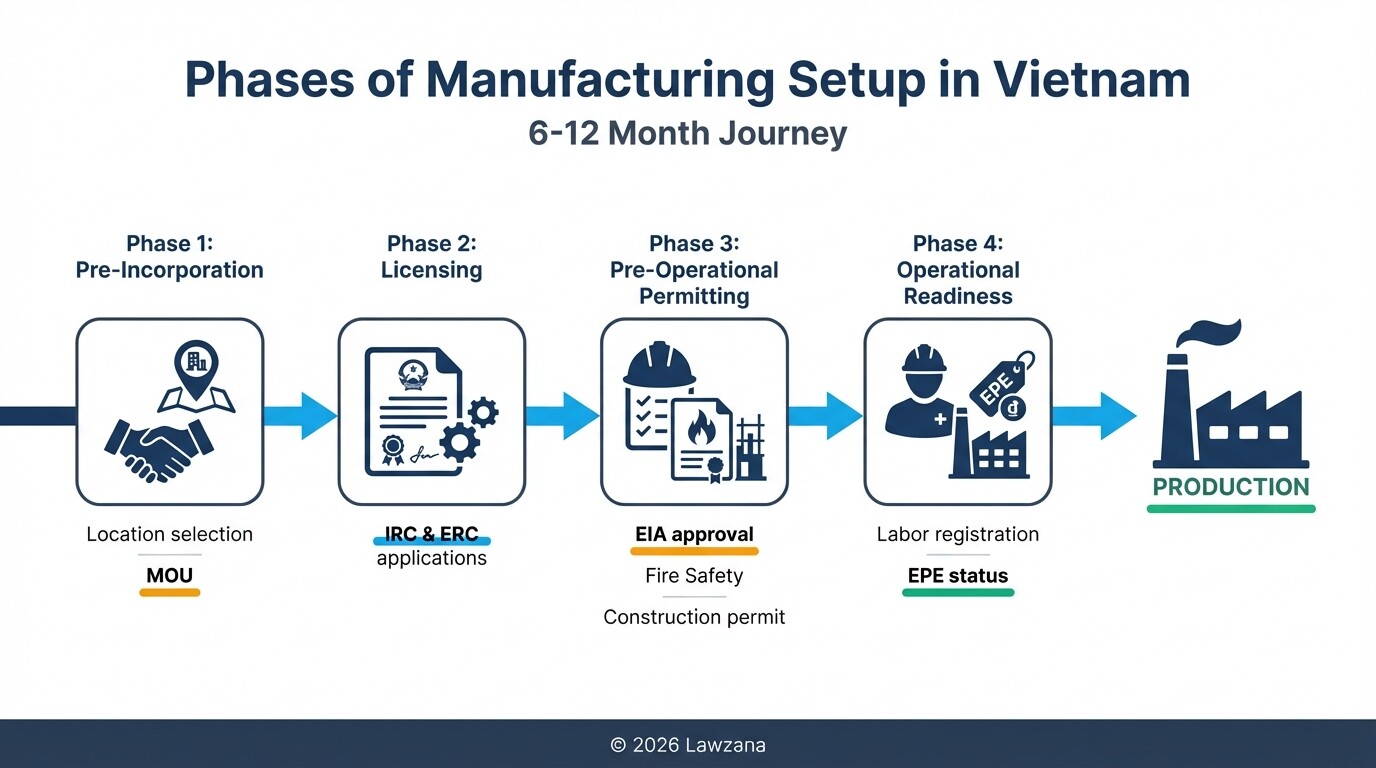

Establishing a manufacturing facility in Vietnam involves multiple regulatory layers. Use this checklist to track the critical milestones from project conception to the start of production.

| Phase | Task | Relevant Authority |

|---|---|---|

| Pre-Incorporation | Identify location (IZ, EZ, or High-Tech Park) | IZ/EZ Management Board |

| Sign Memorandum of Understanding (MOU) or Land Lease Agreement | Land Lessor / Developer | |

| Licensing | Apply for Investment Registration Certificate (IRC) | DPI or IZ Management Board |

| Apply for Enterprise Registration Certificate (ERC) | Department of Planning & Investment | |

| Post-Licensing | Obtain Company Seal and Tax ID | Business Registration Office |

| Open Capital Account and Transaction Accounts | Commercial Bank | |

| Permitting | Environmental Impact Assessment (EIA) or License | Ministry of Natural Resources (MONRE) |

| Fire Prevention and Fighting (FPF) Design Approval | Fire Police Department | |

| Construction Permit (if building a new factory) | Department of Construction | |

| Operational | Register Internal Labor Regulations (ILR) | Department of Labor (DOLISA) |

| Apply for EPE Status (if applicable) | Customs Authority |

Obtaining the Investment Registration Certificate (IRC) for 2026

The Investment Registration Certificate (IRC) is the primary document authorizing a foreign investor to implement a specific project in Vietnam. For manufacturing projects, the application must detail the investment capital, project lifespan (usually 50 years), and the specific manufacturing technologies to be utilized.

To obtain an IRC, investors must submit a formal proposal to the Department of Planning and Investment (DPI) or the Management Board of the Industrial Zone where the factory will be located. Under the Law on Investment 2020, the statutory processing time is 15 days from the receipt of a valid file, though complex projects involving "conditional" sectors or high environmental risks may take 30 to 60 days for inter-departmental appraisal.

Key requirements for the IRC application include:

- Proof of Financial Capacity: Bank statements or audited financial statements showing sufficient funds for the registered capital.

- Location Documentation: A signed land lease agreement or a Memorandum of Understanding (MOU) with an Industrial Zone developer.

- Technology Description: Detailed explanation of the production line to ensure it does not use obsolete, energy-intensive, or environmentally harmful machinery.

Leasing Land in Industrial Zones vs. Economic Zones

Choosing between an Industrial Zone (IZ) and an Economic Zone (EZ) depends on whether your priority is proximity to supply chains or maximizing long-term tax holidays. IZs are specialized areas for industrial production, while EZs are larger areas that include IZs but offer a more comprehensive suite of incentives.

Industrial Zones provide ready-to-use infrastructure, including power grids, wastewater treatment, and security, making them ideal for small to medium-sized manufacturers. Economic Zones, however, are preferred for massive capital investments because they often provide a 10% preferential corporate income tax (CIT) rate for 15 years, compared to the standard 20% rate found elsewhere.

Comparison of Site Options

| Feature | Industrial Zone (IZ) | Economic Zone (EZ) |

|---|---|---|

| Primary Incentive | Standard 2-year tax holiday / 4-year 50% reduction | 4-year tax holiday / 9-year 50% reduction |

| CIT Rate | 20% (Standard) | 10% (Preferential for 15 years) |

| Infrastructure | High-quality, centralized | Rapidly developing, often remote |

| Best For | General manufacturing, SMEs | Large-scale hubs, electronics, automotive |

Environmental Impact Assessment (EIA) Requirements for Factories

Manufacturing projects in Vietnam are categorized by their potential risk to the environment, determining whether they require a full Environmental Impact Assessment (EIA) or a simpler Environmental License. This requirement is governed by the Law on Environmental Protection 2020, which emphasizes "polluter pays" principles and strict waste management.

Investors must conduct the assessment during the feasibility study phase and obtain approval before starting any construction. Failure to secure these permits can lead to significant fines, suspension of operations, or the withholding of the construction permit.

Environmental compliance categories:

- Group I (High Risk): Large-scale chemical plants, smelting, or projects in protected areas. Requires a full EIA and an Environmental License.

- Group II & III (Medium/Low Risk): General assembly or light manufacturing. Typically requires an Environmental License focusing on specific discharge points.

- Group IV (Minimal Risk): Simple packaging or eco-friendly assembly. May only require basic environmental registration with local authorities.

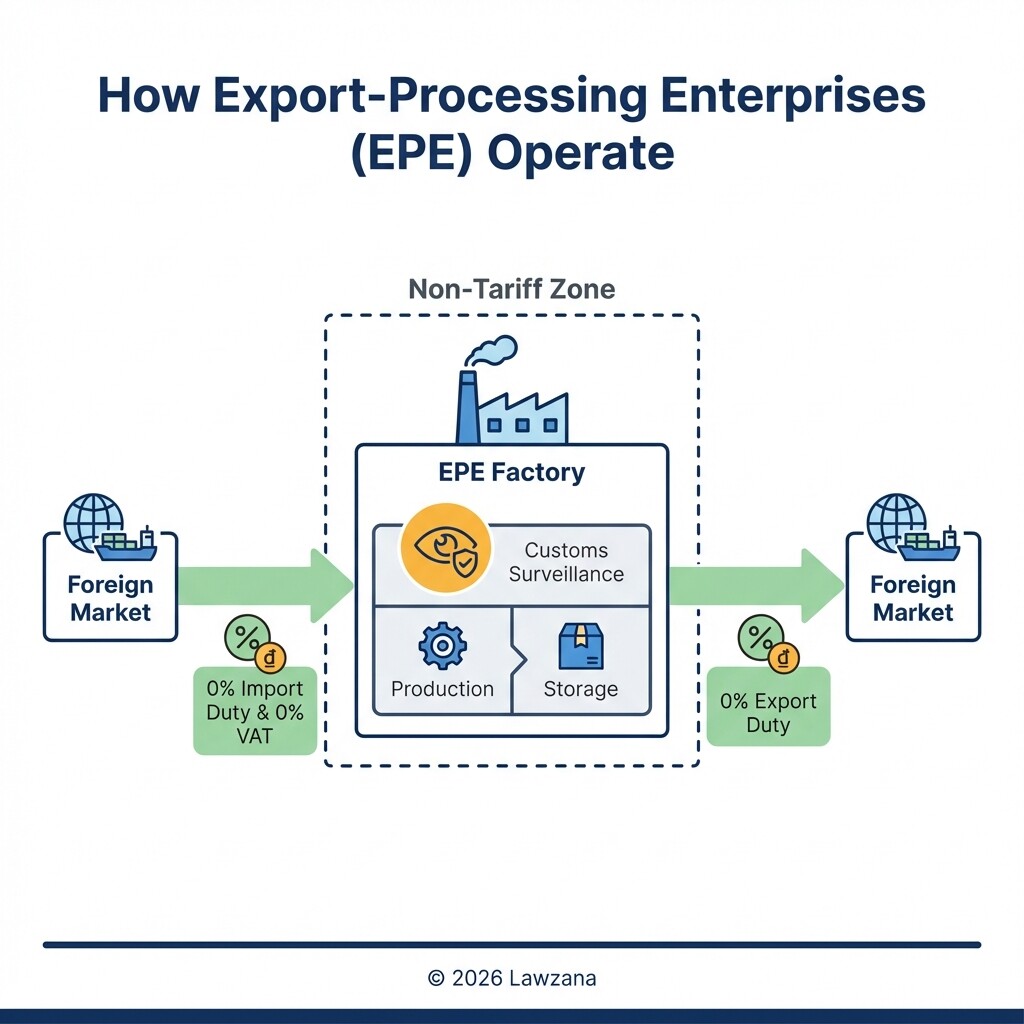

Import-Export Duty Exemptions for Export-Processing Enterprises (EPEs)

An Export-Processing Enterprise (EPE) is a specialized legal status for manufacturers that export 100% (or nearly 100%) of their products. EPEs operate within a "non-tariff zone" framework, meaning they are treated as being outside of Vietnam's customs territory for the purposes of import and export duties.

The primary advantage of EPE status is the 0% Value Added Tax (VAT) on both the import of raw materials and the export of finished goods. Furthermore, EPEs are exempt from import duties on machinery, equipment, and raw materials used directly in production. To qualify, the factory must have a physical fence or wall separating it from the surrounding area and maintain strict customs-monitored entrance and exit points.

Requirements for EPE designation:

- Physical Separation: Clear boundaries (walls/fences) and camera surveillance connected to the Customs Department.

- Export Commitment: Documentation proving that the vast majority of output is destined for foreign markets.

- Customs Warehouse: A dedicated area for storing duty-free raw materials and finished goods under customs supervision.

Labor Contract Compliance for Large-Scale Manufacturing

Labor relations in Vietnam are governed by the Labor Code 2019, which provides strong protections for employees and requires meticulous record-keeping for manufacturers. Large factories must manage thousands of contracts, making digital compliance and standardized internal rules essential for avoiding disputes.

Every manufacturing enterprise with 10 or more employees must register its Internal Labor Regulations (ILR) with the provincial labor department. These regulations cover working hours, rest periods, workplace safety, and disciplinary procedures. Additionally, employers are responsible for withholding and paying Social, Health, and Unemployment Insurance, which currently totals approximately 21.5% of the employee's gross salary from the employer's side.

Critical Labor Compliance Elements:

- Probationary Periods: Maximum of 60 days for technical/managerial roles and 30 days for general factory workers.

- Contract Types: Transitioning from fixed-term (maximum two terms) to indefinite-term contracts is mandatory.

- Overtime Limits: Generally capped at 40 hours per month and 200 hours per year (with extensions up to 300 hours for specific manufacturing sectors like textiles or electronics).

- Trade Unions: Employers must contribute 2% of their total payroll toward the Trade Union fund, regardless of whether a formal union is established at the factory.

Common Misconceptions About Manufacturing in Vietnam

Misconception 1: 100% Foreign Ownership is Difficult to Obtain

In reality, the Vietnamese government actively encourages 100% Foreign-Invested Enterprises (FIEs) in the manufacturing sector. Unlike the service or retail sectors, which may have "sub-license" requirements or equity caps, manufacturing is generally open to full foreign ownership without the need for a local partner.

Misconception 2: Business Licenses are "One and Done"

Many investors believe that once they have the IRC and ERC, they are fully legal. This is incorrect. Manufacturing requires a series of post-incorporation permits, including Fire Prevention approval, Environmental Licenses, and Work Permits for foreign staff. Operating without these can lead to forced closures during government inspections.

FAQ

How much capital is required to start a factory in Vietnam?

There is no statutory minimum capital for most manufacturing sectors. However, the authorities will evaluate if your "Investment Capital" is realistic compared to your project's scale, machinery costs, and land lease obligations. Generally, a minimum of $200,000 to $500,000 USD is expected for a small facility to ensure project viability.

How long does the entire setup process take?

From signing a land MOU to beginning production, the timeline typically ranges from 6 to 12 months. This includes 2-3 months for licensing (IRC/ERC) and several months for factory construction, environmental permitting, and machinery installation.

Can I lease an existing factory instead of building one?

Yes. Many Industrial Zones offer "Ready-Built Factories" (RBF) for lease. This significantly reduces your lead time, as you avoid the construction permitting process and can focus immediately on interior fit-out and machinery setup.

Do I need to pay VAT on materials imported for manufacturing?

If you are an Export-Processing Enterprise (EPE), you are exempt from VAT on imported raw materials. If you are a standard manufacturer, you must pay VAT at the border but can claim it back as a credit or refund if the finished products are eventually exported.

When to Hire a Lawyer

Navigating the Vietnamese manufacturing landscape requires more than just filling out forms; it involves complex negotiations with IZ developers and local authorities. You should consult a legal expert if:

- You are negotiating a long-term land lease agreement (50 years) involving millions of dollars.

- Your manufacturing process involves hazardous chemicals or high-pollutant risks.

- You are applying for EPE status and need to ensure your factory layout meets customs requirements.

- You are hiring a large workforce and need to draft compliant Internal Labor Regulations (ILR).

Next Steps

- Conduct a Site Visit: Tour at least three different Industrial Zones to compare infrastructure quality and proximity to ports.

- Draft a Business Plan: Detail your production capacity, intended markets, and environmental impact.

- Secure a Land MOU: Reserve your lot or factory space with a formal Memorandum of Understanding.

- Initiate IRC Application: Prepare your financial documents and technology descriptions for submission to the DPI or IZ Management Board.