- A Representative Office (RO) in Vietnam is strictly for non-profit activities such as market research, promotion, and liaison; it cannot generate direct revenue or sign commercial contracts.

- Licensing is governed by the Department of Industry and Trade (DOIT), requiring the parent company to have been legally active for at least one year in its home country.

- The Chief Representative can be a foreign national or a local resident, but foreigners must obtain a valid work permit and a Temporary Residence Card (TRC).

- Compliance involves annual reporting due by January 30th each year and diligent Personal Income Tax (PIT) filings for all staff, even though the office pays no Corporate Income Tax (CIT).

- Converting an RO to a subsidiary is not an automatic "upgrade" and requires a full liquidation of the RO followed by a fresh company incorporation.

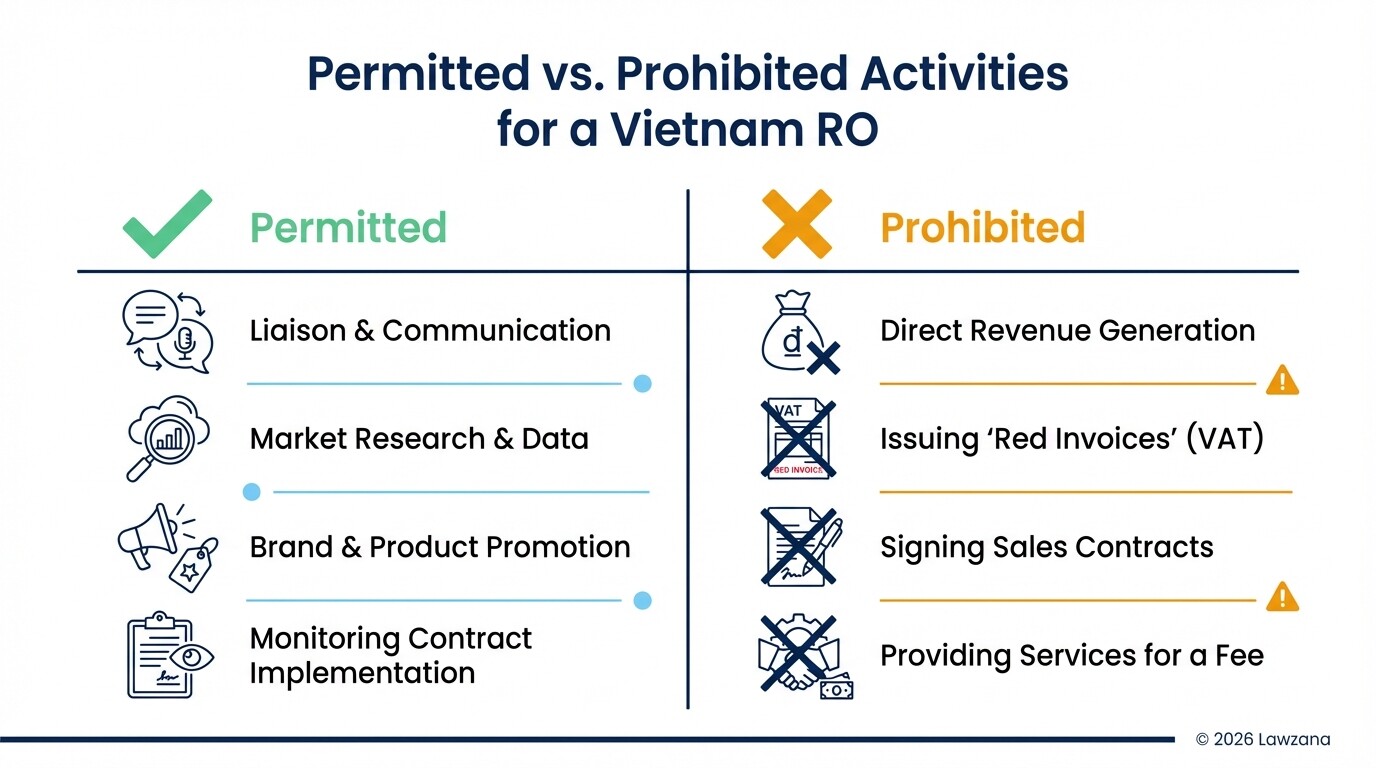

What activities are permitted for a Representative Office in Vietnam?

A Representative Office in Vietnam is legally restricted to liaison, market research, and brand promotion on behalf of its foreign parent company. It serves as a "listening post" to explore investment opportunities and monitor local market trends without the administrative burden of a full commercial enterprise.

Under Decree 07/2016/ND-CP, the permitted activities for an RO include:

- Acting as a liaison office to facilitate communication between the parent company and Vietnamese partners.

- Conducting market research and data collection regarding the Vietnamese industry or consumer behavior.

- Promoting the parent company's products or services through authorized marketing channels.

- Monitoring and accelerating the implementation of contracts signed between the parent company and Vietnamese entities.

It is critical to note that an RO cannot issue "Red Invoices" (VAT invoices), provide services for a fee, or enter into purchasing or sales contracts directly. Any contract signed by the Chief Representative must be backed by a specific Power of Attorney from the parent company's legal representative.

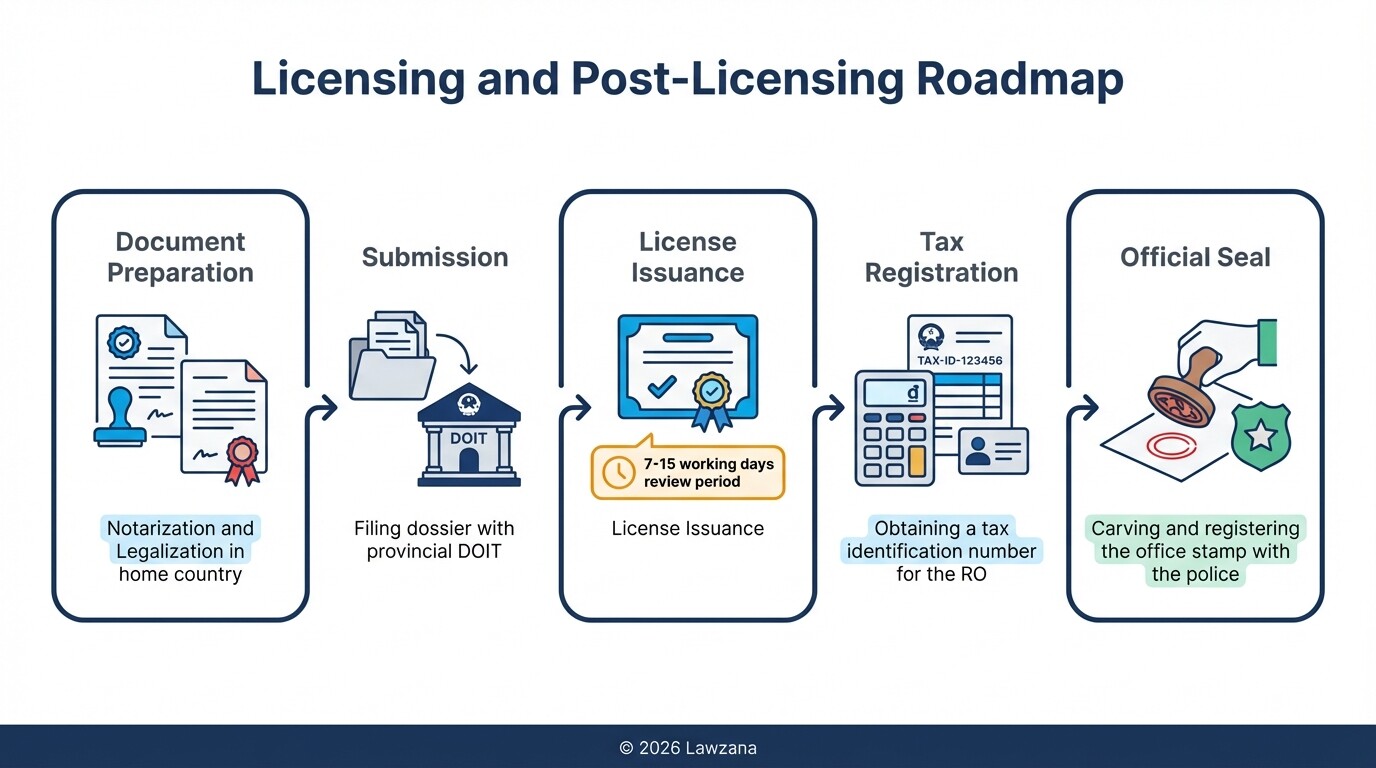

What are the licensing requirements from the Department of Industry and Trade?

The licensing process for a Representative Office is managed by the provincial Department of Industry and Trade (DOIT) where the office will be located. To qualify, the foreign parent company must provide evidence of its legal existence and have been operational for at least one year since its incorporation.

The application dossier typically requires the following documents, which must be notarized and legalized by the Vietnamese embassy in the parent company's home country:

- Application Form: A standard form prescribed by the Ministry of Industry and Trade.

- Certificate of Incorporation: Proof that the parent company is legally registered.

- Audited Financial Statements: A copy of the company's audited financial report for the most recent fiscal year to prove financial stability.

- Appointment Letter: A formal document appointing the Chief Representative.

- Office Lease Agreement: A signed memorandum of understanding or lease for a physical office space in Vietnam that complies with local zoning laws.

The DOIT generally issues the license within 7 to 15 working days once a valid and complete dossier is submitted. Following the issuance of the license, the RO must proceed with tax registration and obtain an official seal from the police department.

What are the Chief Representative labor contract and visa regulations?

The Chief Representative of a Vietnam RO acts as the primary point of contact for local authorities and is responsible for the office's legal compliance. If the Chief Representative is a foreign national, they must strictly adhere to Vietnam's labor and immigration laws, including obtaining a work permit and a long-term visa.

Key labor and immigration requirements include:

- Labor Contract: The Chief Representative must have a formal labor contract or an assignment letter from the parent company clearly defining their role and compensation.

- Work Permit: Foreign Chief Representatives generally require a work permit. However, they may be eligible for a work permit exemption if they are internally transferred within a company operating in certain service sectors.

- Visa and TRC: Once a work permit is secured, the representative can apply for a LD (Labor) Visa or a Temporary Residence Card (TRC), which is typically valid for up to two years and allows for multiple entries.

- Residency Rules: While the Chief Representative does not need to be physically present in Vietnam at all times, they must authorize another person in writing to perform their duties if they leave the country for more than 30 days.

What are the annual reporting and tax compliance requirements for 2026?

Representative Offices in Vietnam must maintain strict compliance with annual reporting and Personal Income Tax (PIT) regulations to avoid heavy fines or license revocation. While the RO is exempt from Corporate Income Tax (CIT) because it does not generate income, it acts as a tax agent for its employees.

For the 2026 calendar year, the compliance calendar is as follows:

- Annual Activity Report: This report must be submitted to the DOIT before January 30th of the following year. It summarizes the office's activities, staffing levels, and progress in market research.

- PIT Declaration: Monthly or quarterly PIT declarations are required for all Vietnamese and foreign staff. An annual PIT finalization for all employees must be completed by the end of the first quarter of the following year.

- Compulsory Insurance: The RO is responsible for paying Social Insurance, Health Insurance, and Unemployment Insurance for its local Vietnamese employees according to the rates set by the Vietnam Social Security administration.

- Accounting Records: Although simplified, the RO must maintain a cash book to track expenditures sent from the parent company for operational costs.

What are the timeline and costs for closure or conversion to a subsidiary?

Closing a Representative Office or converting it into a subsidiary is a multi-step legal process that centers on "tax finalization" and the settlement of all local liabilities. In Vietnam, there is no direct legal mechanism to "convert" an RO; instead, the RO must be formally dissolved, and a new legal entity (like a Limited Liability Company) must be incorporated.

| Phase | Timeline | Key Actions |

|---|---|---|

| Tax Finalization | 3 - 5 Months | The Tax Department audits all RO expenses and PIT filings to ensure no outstanding debts exist. |

| Labor Settlement | 1 Month | Termination of all labor contracts and payment of severance if applicable. |

| License Surrender | 15 Days | Returning the RO license to the DOIT and canceling the office seal. |

| Subsidiary Setup | 1 - 2 Months | Applying for an Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC). |

The estimated official government fees for closure are minimal (under 2,000,000 VND), but the primary costs lie in professional legal fees and potential tax arrears discovered during the final audit. Because the tax audit is retroactive, many companies find the closure process more time-consuming than the initial setup.

Common Misconceptions About Vietnam Representative Offices

Misconception 1: An RO can sign sales contracts

Many foreign investors believe the Chief Representative can sign any contract on behalf of the parent company. In reality, the RO can only sign "operational" contracts (like office leases or utility bills). To sign a commercial sales agreement with a Vietnamese client, the parent company must issue a specific, one-time Power of Attorney to the Chief Representative.

Misconception 2: An RO is the same as a branch

In many jurisdictions, these terms are used interchangeably, but in Vietnam, they are distinct. A Branch is allowed to conduct commercial activities and generate profit in specific sectors (like banking or legal services), whereas an RO is strictly non-commercial.

Misconception 3: You don't need accounting for an RO

Because there is no profit, companies often neglect their books. However, the Tax Department requires clear records of all funds transferred from the parent company to cover the RO's rent and salaries. Failure to track these can lead to complications during the annual PIT finalization or the eventual closure of the office.

FAQ

Can a Representative Office hire foreign employees?

Yes, an RO can hire both local and foreign employees. However, the number of foreign employees must be justified to the local labor department, and each must obtain a valid work permit or an exemption.

Is there a minimum capital requirement for an RO?

There is no statutory "minimum capital" for a Representative Office because it does not engage in business. However, the parent company must demonstrate through its audited financial statements that it has sufficient funds to support the RO's operating expenses.

How long is an RO license valid?

The license for a Representative Office is typically valid for five years. It can be renewed multiple times, provided the application for renewal is submitted at least 30 days before the current license expires.

Can an RO have more than one location in Vietnam?

No. An RO license is tied to a specific province. If a foreign company wants a presence in both Hanoi and Ho Chi Minh City, it must apply for two separate RO licenses from the respective Departments of Industry and Trade in those cities.

When to Hire a Lawyer

Engaging a legal professional is highly recommended when dealing with the Vietnamese bureaucracy, specifically for the legalization of foreign documents and tax finalization. You should hire a lawyer if:

- Your parent company's documents are from a jurisdiction with complex notarization requirements.

- You are appointing a foreign Chief Representative who needs a work permit and TRC.

- You are planning to close an office and need to navigate the rigorous tax audit process.

- You need a specialized Power of Attorney to allow the Chief Rep to sign specific commercial agreements.

Next Steps

- Verify Eligibility: Ensure your parent company has been operational for at least one year and has audited financial records.

- Select a Location: Secure a memorandum of understanding for an office lease, as this address is required for the license application.

- Legalize Documents: Begin the process of notarizing and legalizing your incorporation documents at the nearest Vietnamese embassy.

- Appoint a Representative: Decide whether your Chief Representative will be a local or an expat, and prepare their appointment letter.

- Submit to DOIT: Work with a local consultant or lawyer to file your application with the Department of Industry and Trade.