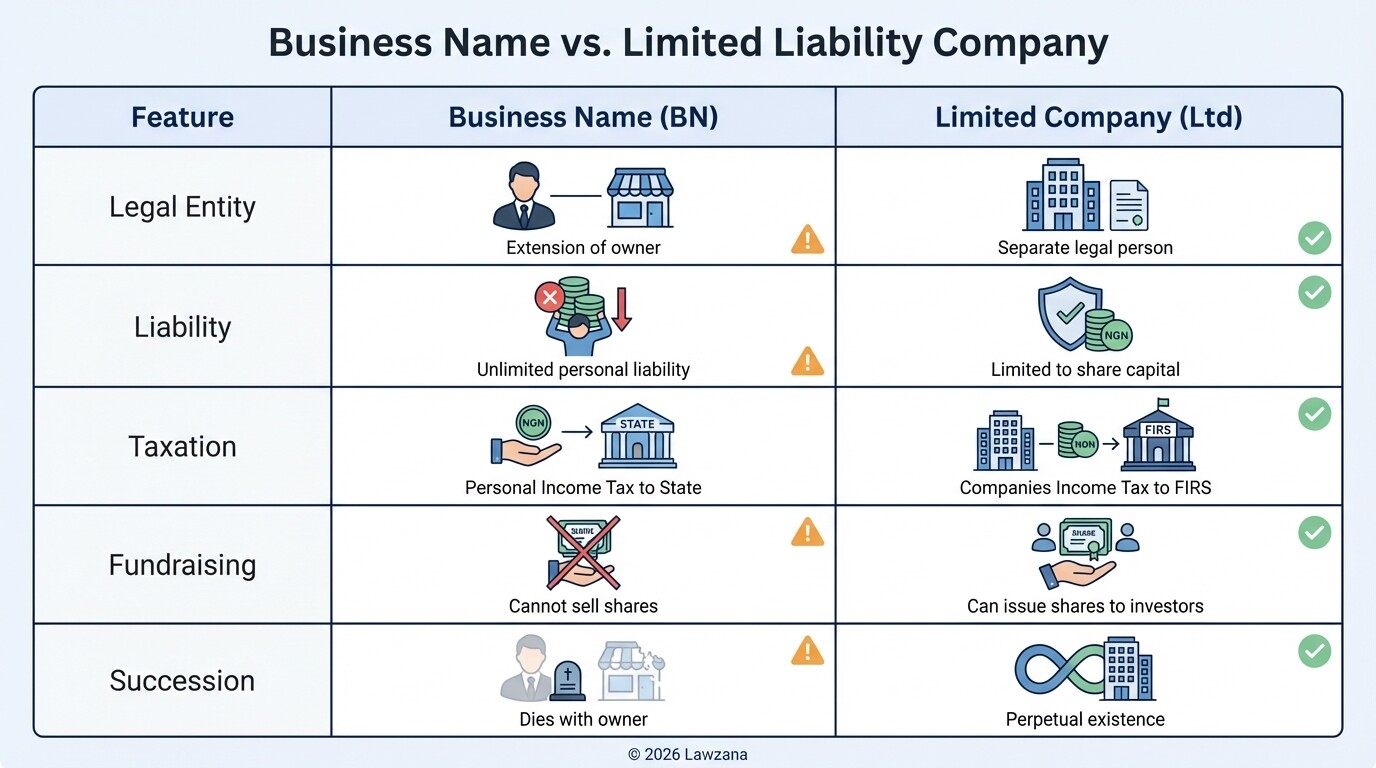

- Legal Personality: Upgrading to a Private Limited Company (Ltd) creates a separate legal entity, protecting your personal assets from business liabilities.

- Cessation Requirement: You must formally file a "Notice of Cessation of Business" for the existing business name before or during the incorporation of the new company.

- Capital Minimums: The Companies and Allied Matters Act (CAMA 2020) mandates a minimum issued share capital of NGN 100,000 for private companies.

- Contractual Transfer: Existing contracts and assets do not automatically move to the new company; they require formal legal assignments or novation agreements.

- Tax Transition: The business will move from Personal Income Tax (PIT) oversight by the State to Companies Income Tax (CIT) administered by the Federal Inland Revenue Service (FIRS).

Why should you convert your business name to a limited liability company?

Converting your business name to a limited liability company (Ltd) provides a legal "corporate veil" that separates your personal finances from the business's debts and obligations. While a business name is essentially an extension of the individual owner, a private limited company is a distinct "person" in the eyes of the law, capable of suing and being sued in its own name.

This transition is essential for growth for two primary reasons:

- Limited Liability: If a business name incurs debt or faces legal action, the owner's personal houses, cars, and bank accounts are at risk. In a limited company, your financial exposure is strictly limited to the amount you invested in shares.

- Capital Raising and Equity: You cannot sell "shares" of a business name to investors. To bring in venture capital, private equity, or new partners who hold a percentage of the business, you must have a corporate structure with a defined share capital.

- Perpetual Succession: A business name often dies with the owner or the end of a partnership. A limited company continues to exist regardless of changes in directors or shareholders, ensuring the brand lives on for generations.

How do you legally transition from a business name to a private limited company?

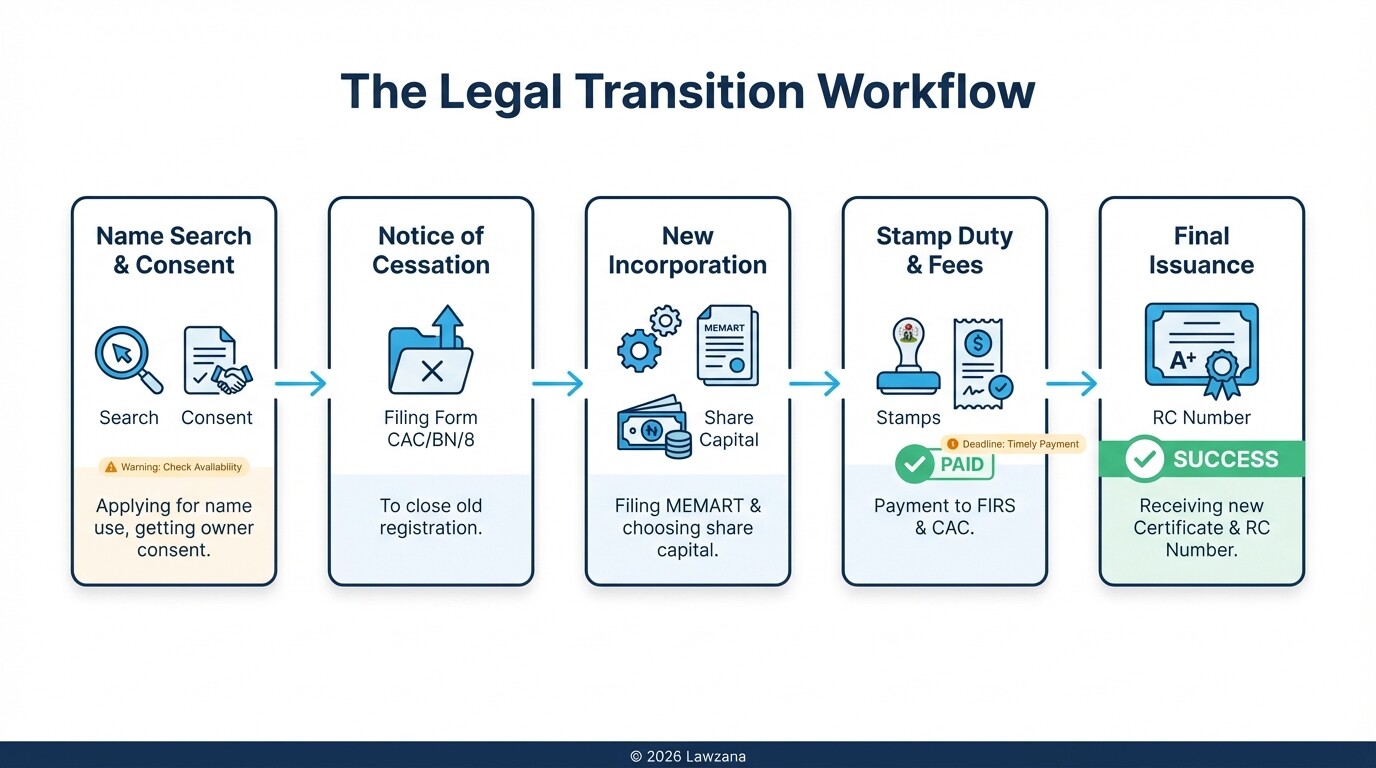

The transition process in Nigeria involves closing the "Business Name" registration and simultaneously registering the new "Limited Liability Company" with the Corporate Affairs Commission (CAC). This ensures that you retain the rights to the name while shifting to a more robust legal structure.

The step-by-step procedure follows this path:

- Consent for Name Use: If you wish to keep the exact same name, you must apply for a "Name Availability" search. You will need to provide a formal letter of consent from the proprietors of the old business name allowing the new company to use it.

- Filing for Cessation: You must file a "Notice of Cessation of Business" (Form CAC/BN/8). This informs the CAC that the business name is no longer operating as a sole proprietorship or partnership.

- New Incorporation: You then proceed with the standard incorporation process under Part B of CAMA 2020. This includes drafting the Memorandum and Articles of Association (MEMART).

- Payment of Fees and Duties: You must pay the CAC filing fees and the Federal Inland Revenue Service (FIRS) stamp duties based on your authorized share capital.

- Issuance of Certificate: Once the CAC approves the filing, you receive a new Certificate of Incorporation and a Status Report, which includes your new Company Registration Number (RC Number).

What are the minimum share capital requirements for the new company?

Under the Companies and Allied Matters Act (CAMA 2020), the minimum issued share capital for a private limited company in Nigeria is NGN 100,000. This represents the total value of shares that the company has issued to its initial shareholders at the time of incorporation.

However, specific industries and circumstances require higher thresholds:

| Company Type | Minimum Share Capital |

|---|---|

| Standard Private Company (Local) | NGN 100,000 |

| Company with Foreign Participation | NGN 10,000,000 |

| Private Security Company | NGN 10,000,000 |

| Travel/Tours Agency | NGN 2,000,000 |

| Shipping Agency | NGN 25,000,000 |

It is important to note that you do not need to "deposit" this money in a bank account to register. You only need to demonstrate that the shares have been "allotted" or issued to the shareholders.

How are existing assets and contracts transferred to the new company?

Assets, bank accounts, and contracts do not automatically migrate from a business name to a limited company because the two are different legal "persons." You must execute formal legal documents to transfer ownership of everything from office equipment to intellectual property and client service agreements.

To ensure a seamless transition, follow these steps:

- Novation or Assignment: For existing contracts, you must enter into a "Novation Agreement" where the client, the old business entity, and the new company all agree to transfer the rights and obligations to the new entity.

- Asset Transfer Agreement: Draft a simple agreement stating that the new company is purchasing or acquiring the assets of the business name in exchange for shares or a set cash value.

- Updating Land Titles: If the business name owned real estate, you must file a Deed of Assignment at the appropriate Land Registry to reflect the new company as the owner.

- Bank Account Migration: You cannot simply change the name on your old business bank account. You will need to open a new corporate bank account using the new Certificate of Incorporation and then transfer the remaining balance from the old account.

What are the tax implications and updated FIRS registration requirements?

The conversion significantly changes how your business is taxed and which government tier oversees your collections. While a business name pays Personal Income Tax to the State Board of Internal Revenue, a limited company pays Companies Income Tax (CIT) to the Federal Government.

Key tax changes include:

- New Tax Identification Number (TIN): Your old TIN associated with the business name will become obsolete for corporate purposes. The CAC now generates a TIN automatically upon incorporation, which is printed on your certificate.

- Companies Income Tax (CIT): Small companies (turnover under NGN 25 million) are currently exempt from CIT, while medium companies pay 20%, and large companies pay 30%.

- Value Added Tax (VAT): You must register for VAT with the FIRS if your annual turnover exceeds NGN 25 million.

- Education Tax: Limited companies are required to pay a 3% Tertiary Education Tax on their assessable profits.

What are common myths about upgrading a business registration in Nigeria?

Many entrepreneurs harbor misconceptions about the "upgrade" process that can lead to legal or financial complications later. Understanding the reality of the CAC's framework prevents these common errors.

Myth 1: It is a "Simple Name Change" Many believe you just swap the certificate. In reality, the CAC does not "rename" the entity; they kill the old one (Cessation) and birth a new one (Incorporation). You get a new RC Number, and the old BN Number is retired.

Myth 2: Past Debts Disappear with the Business Name Converting to a limited company does not wipe the slate clean of personal liabilities incurred while operating as a business name. Creditors can still pursue the individuals who owned the business name for debts incurred before the date of incorporation.

Myth 3: You Can Keep the Old Bank Account Banks are strictly regulated by the Central Bank of Nigeria (CBN). Because a limited company is a new legal person, the bank will require you to close the old account and go through a fresh "Know Your Customer" (KYC) process for the new entity.

FAQ

Can I use the exact same name for my new company?

Yes, provided you file a letter of consent from the owners of the business name and concurrently file for the cessation of the old business name. The name will end in "Limited" or "Ltd."

Do I need more than one person to form a limited company now?

No. Under CAMA 2020, a single individual can now be the sole shareholder and sole director of a small private limited company in Nigeria.

How long does the entire conversion process take?

Generally, the process takes between 2 to 4 weeks, depending on the speed of the CAC portal and how quickly you provide the necessary documentation and consent letters.

Do I have to pay for a new stamp duty?

Yes. Stamp duty is a tax on the share capital of the company. Even though you had a business name, the new company's shares are being created for the first time, necessitating a payment to the FIRS.

When to Hire a Lawyer

While the CAC portal is accessible to the public, hiring a legal professional is highly recommended during a conversion for several reasons. A lawyer ensures that your Memorandum and Articles of Association (MEMART) are customized to protect your interests, especially if you are bringing on new investors. Furthermore, legal counsel is essential for drafting the Asset Transfer Agreements and Novation Agreements required to move your contracts and property into the new entity without legal hitches. If your business operates in a regulated sector (like fintech or oil and gas), a lawyer will ensure you meet the specific minimum share capital and licensing requirements of your industry's regulator.

Next Steps

- Audit Your Assets: Create a comprehensive list of all equipment, intellectual property, and contracts currently held under your business name.

- Secure Consent: Draft the formal letter of consent signed by all current partners or the sole proprietor of the business name.

- Consult a Professional: Engage a corporate lawyer or a CAC-accredited agent to begin the name search and cessation filing.

- Notify Stakeholders: Inform your bank, suppliers, and major clients that you are transitioning to a limited company to prepare them for new contracts and payment details.

- Register with FIRS: Once your certificate is issued, visit the nearest FIRS office to validate your new corporate TIN and understand your updated tax filing schedule.