- A foreign branch office is an extension of the head office, meaning the parent company remains fully liable for all Philippine-based debts and obligations.

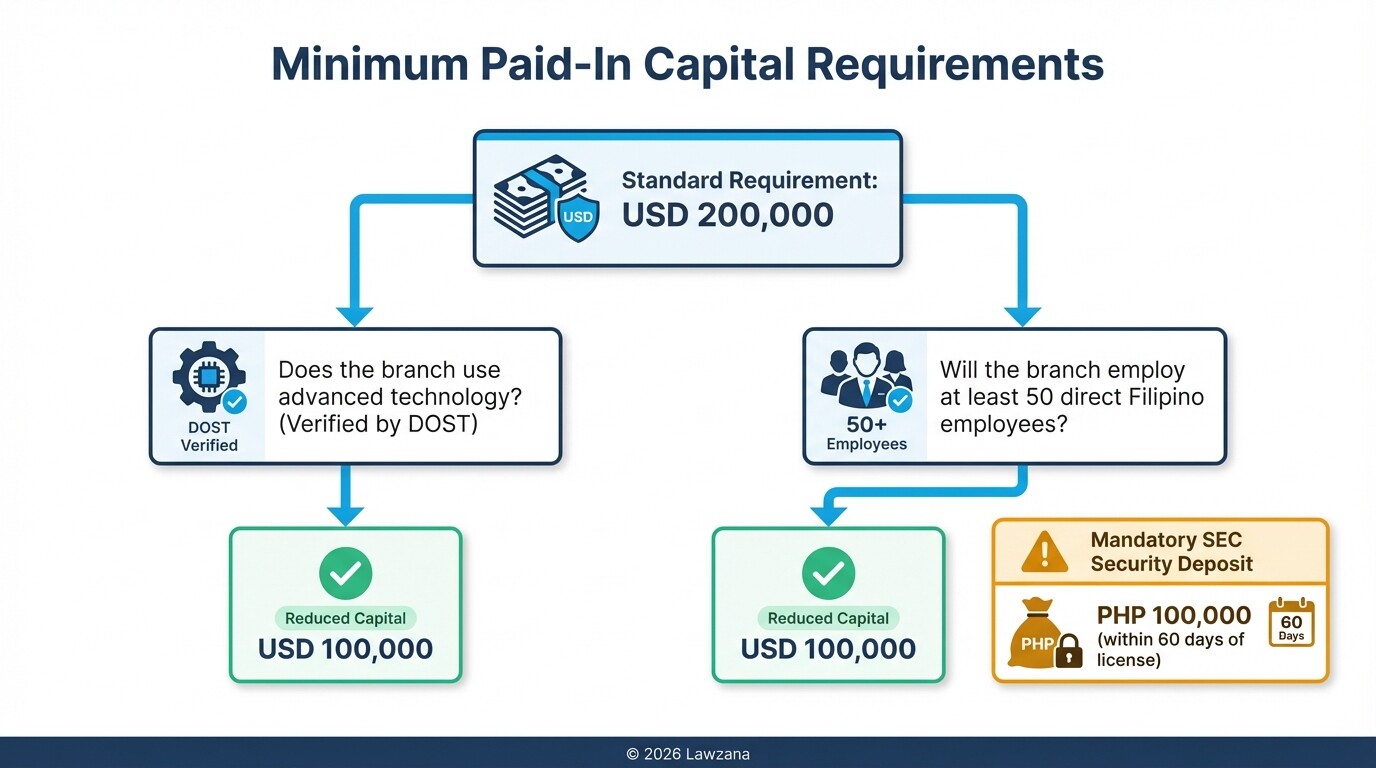

- Minimum paid-in capital is generally USD 200,000, which can be reduced to USD 100,000 if the company involves advanced technology or employs at least 50 direct Filipino employees.

- You must appoint a Resident Agent (an individual or a domestic corporation) who is legally authorized to receive summons and legal proceedings on behalf of the company.

- A security deposit of at least PHP 100,000 in government bonds or equity is required by the SEC within 60 days of license issuance to protect local creditors.

- Branch offices pay a 25% corporate income tax on Philippine-sourced income and a 15% Branch Profit Remittance Tax (BPRT) on profits sent to the head office.

Foreign Branch Office Registration Checklist

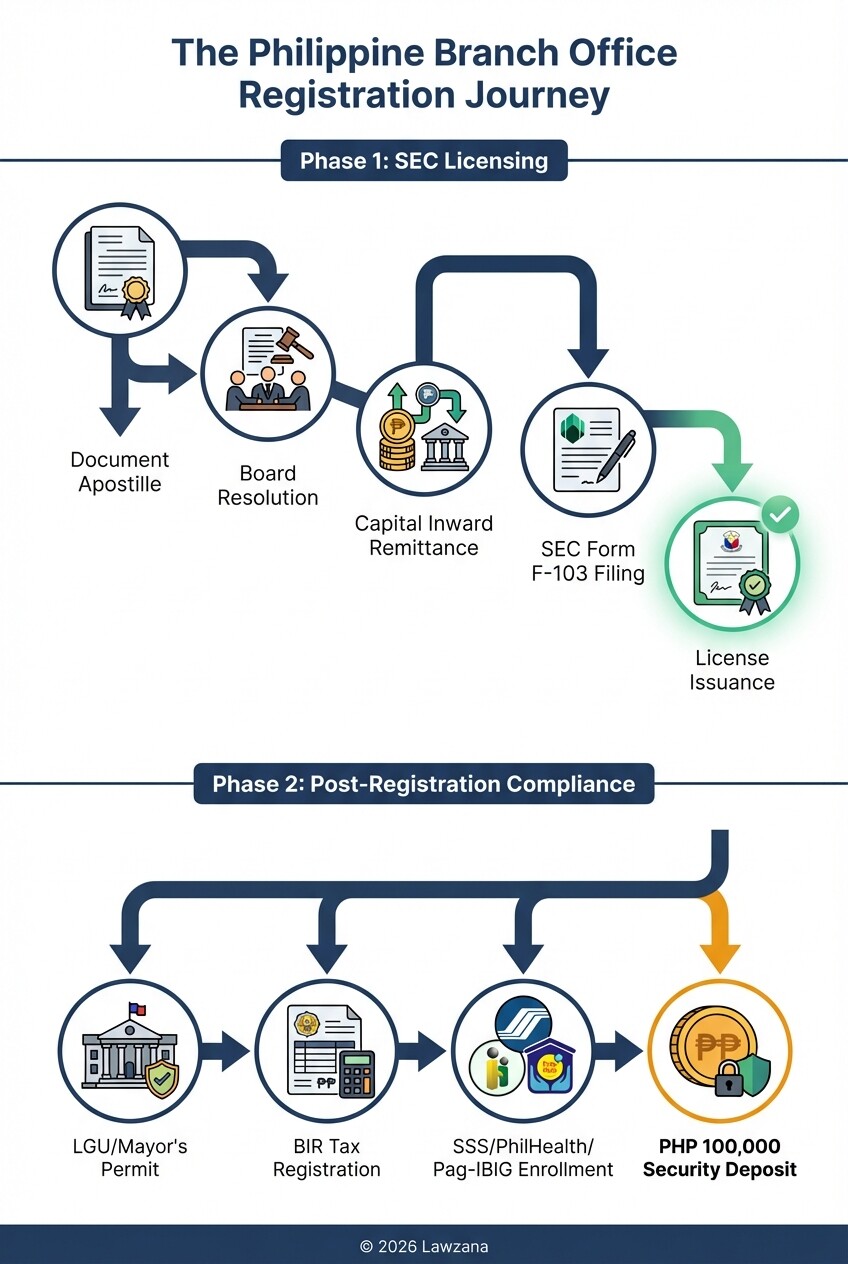

Registering a foreign branch office in the Philippines requires coordinating with multiple government agencies, primarily the Securities and Exchange Commission (SEC). This checklist outlines the essential documents and steps needed to obtain your License to Do Business.

Pre-Registration Requirements

- Board Resolution: A certified resolution from the parent company's Board of Directors authorizing the opening of a Philippine branch and appointing a Resident Agent.

- Financial Statements: Audited financial statements of the parent company for the year immediately preceding the application, certified by an independent Certified Public Accountant.

- Articles of Incorporation: A certified true copy of the parent company's Articles of Incorporation or equivalent organizational documents.

- Capital Remittance: Proof of inward remittance of the minimum paid-in capital (USD 200,000 or USD 100,000 if applicable) verified by a Philippine bank certificate.

Post-SEC Approval Requirements

- Bureau of Internal Revenue (BIR) Registration: Obtain a Tax Identification Number (TIN) and register books of accounts and official receipts.

- Local Government Unit (LGU) Permits: Secure a Mayor's Permit and Business Permit from the city or municipality where the office is located.

- Social Agencies: Register with SSS (Social Security System), PhilHealth, and Pag-IBIG for mandatory employee contributions.

- SEC Security Deposit: Deposit government securities valued at PHP 100,000 within 60 days of license issuance.

SEC Registration and the Doing Business Definition

The Securities and Exchange Commission (SEC) requires all foreign corporations intending to "do business" in the Philippines to secure a License to Do Business. Under Philippine law, "doing business" includes soliciting orders, entering into contracts, or opening offices, even if the primary income-generating activities occur elsewhere.

A foreign branch office does not possess a separate legal personality from its parent company. It is essentially the same entity operating in a different jurisdiction. This lack of a "corporate veil" means the parent company is directly liable for any legal or financial liabilities incurred by the Philippine branch. The registration process involves submitting an SEC Form F-103, which documents the parent company's financial health and its intent to operate within the country.

Minimum Paid-In Capital and Security Deposit Requirements

Foreign branch offices are generally required to remit an initial minimum capital of USD 200,000 to a Philippine bank account. This requirement ensures that the foreign entity has sufficient liquidity to support its operations and meet initial obligations within the local market.

There are two primary exceptions to the USD 200,000 rule:

- Technological Advantage: If the branch utilizes advanced technology as verified by the Department of Science and Technology, the capital may be reduced to USD 100,000.

- Direct Employment: If the branch will directly employ at least 50 Filipino workers, the capital requirement is lowered to USD 100,000.

Additionally, the SEC mandates a "security deposit" for the benefit of Philippine creditors. Within 60 days of receiving the license, the branch must deposit securities (typically government bonds or shares of stock in registered enterprises) worth at least PHP 100,000. Annually, the branch must provide additional securities if its gross income exceeds PHP 5 million, typically amounting to 2% of the excess income.

The Role and Requirements of a Resident Agent

A Resident Agent is a mandatory legal representative who resides in the Philippines and is authorized to receive legal notices, summons, and processes on behalf of the foreign corporation. The appointment of a Resident Agent is a condition precedent to the issuance of the SEC license.

The Resident Agent can be an individual or a domestic corporation. If an individual, they must be of good moral character and a resident of the Philippines. If a corporation, it must be authorized by its own articles of incorporation to act as an agent. The parent company must execute a specific Power of Attorney or a Board Resolution designating this agent and filed with the SEC.

Sample Resident Agent Appointment Clause

The Foreign Corporation hereby appoints [Name of Agent], a resident of [Address in the Philippines], as its Resident Agent in the Philippines, upon whom any summons and other legal processes may be served in all actions or legal proceedings against the Foreign Corporation for causes of action arising out of its business operations in the Philippines.

Taxation: Branch Profit Remittances vs. Dividends

Foreign branch offices are taxed only on income derived from sources within the Philippines at a standard corporate income tax rate of 25%. Unlike a domestic subsidiary, which pays dividends to shareholders, a branch office "remits" profits to its head office.

The taxation of these transfers differs significantly:

| Feature | Foreign Branch Office | Domestic Subsidiary |

|---|---|---|

| Taxable Income Base | Philippine-sourced income only | Worldwide income |

| Corporate Income Tax | 25% | 25% |

| Profit Transfer Tax | 15% Branch Profit Remittance Tax (BPRT) | 15% - 25% Dividend Tax |

| Tax Treaty Relief | Applicable (can reduce BPRT to 10%) | Applicable |

The 15% BPRT is applied to the total profits applied or earmarked for remittance without any deduction for the tax component thereof. However, profits registered with the Philippine Economic Zone Authority (PEZA) are often exempt from this remittance tax.

Annual Reporting Obligations to the SEC and BIR

Every foreign branch office must maintain transparency with the Philippine government by filing annual reports that reflect its financial standing and operational status. Failure to meet these deadlines can result in heavy fines or the revocation of the license to do business.

The primary reporting obligations include:

- General Information Sheet (GIS): Filed with the SEC within 30 days of the anniversary of the license issuance, detailing the current resident agent and officers.

- Annual Audited Financial Statements (AFS): Filed with both the SEC and the Bureau of Internal Revenue (BIR). The AFS must be prepared in accordance with Philippine Financial Reporting Standards (PFRS).

- Tax Returns: Monthly and quarterly filings for Value Added Tax (VAT) or Percentage Tax, and quarterly/annual filings for Income Tax.

- Security Deposit Increases: Proof of additional securities if the gross income thresholds are met.

Common Misconceptions

"A branch office is safer because it is a separate entity."

This is incorrect. A branch office is a legal extension of the head office. If the branch is sued or accumulates debt in the Philippines, the parent company's global assets are at risk. If you seek limited liability, a domestic subsidiary is the appropriate structure.

"I can use the USD 200,000 capital for operations immediately."

While the capital is intended for business use, the SEC requires a "Bank Certificate of Deposit" showing the funds are in a local account during the registration process. Once the license is issued, the funds can be utilized for business operations, but the "Security Deposit" (PHP 100,000+) must remain restricted or in the form of specific securities.

"Branch offices can perform any business activity."

Branch offices are generally prohibited from engaging in activities on the "Foreign Investment Negative List" (FINL), such as mass media, retail trade under certain thresholds, and small-scale mining.

FAQ

How long does it take to register a branch office?

On average, the process takes 8 to 12 weeks. This includes the time needed to notarize and apostille documents in the home country, secure the SEC license, and obtain local permits from the Mayor's office and the BIR.

Can a branch office own land in the Philippines?

No. Under the Philippine Constitution, land ownership is restricted to Filipino citizens or corporations where at least 60% of the capital is owned by Filipinos. Since a branch is 100% foreign-owned, it can only lease land.

What happens if I don't appoint a Resident Agent?

The SEC will not issue a license without a Resident Agent. If a Resident Agent resigns or dies, the branch must appoint a replacement within 30 days. Failure to do so is grounds for the revocation of the license to do business in the Philippines.

Is the BPRT always 15%?

No. The Philippines has tax treaties with several countries (including the US, Japan, and many EU nations). These treaties may reduce the Branch Profit Remittance Tax to 10% or provide other relief, provided you secure a Tax Treaty Rates Relief (TTRR) or a Request for Confirmation from the BIR.

When to Hire a Lawyer

Navigating the SEC and BIR bureaucracy requires precise documentation and an understanding of local administrative laws. You should consult a lawyer if:

- You are unsure if your business activities fall under the "Foreign Investment Negative List."

- You need assistance drafting Board Resolutions and Power of Attorney documents that comply with both your home country's laws and Philippine SEC requirements.

- You require a Resident Agent or a corporate secretary to manage local compliance.

- You are negotiating a lease for commercial space and need to ensure the contract complies with Philippine land laws.

Next Steps

- Secure Parent Company Documents: Begin gathering your Articles of Incorporation and Audited Financial Statements; ensure they are apostilled or authenticated.

- Identify a Resident Agent: Determine if you will appoint an individual or use a professional corporate services firm.

- Remit Initial Capital: Open a treasurer-in-trust account (TITAN) or a regular corporate account to facilitate the inward remittance of the required USD 200,000.

- File with the SEC: Submit SEC Form F-103 along with all supporting documents to initiate the licensing process.