- The CREATE Act reduced the standard Corporate Income Tax (CIT) for foreign-owned corporations from 30% to 25%, making the Philippines more competitive within the ASEAN region.

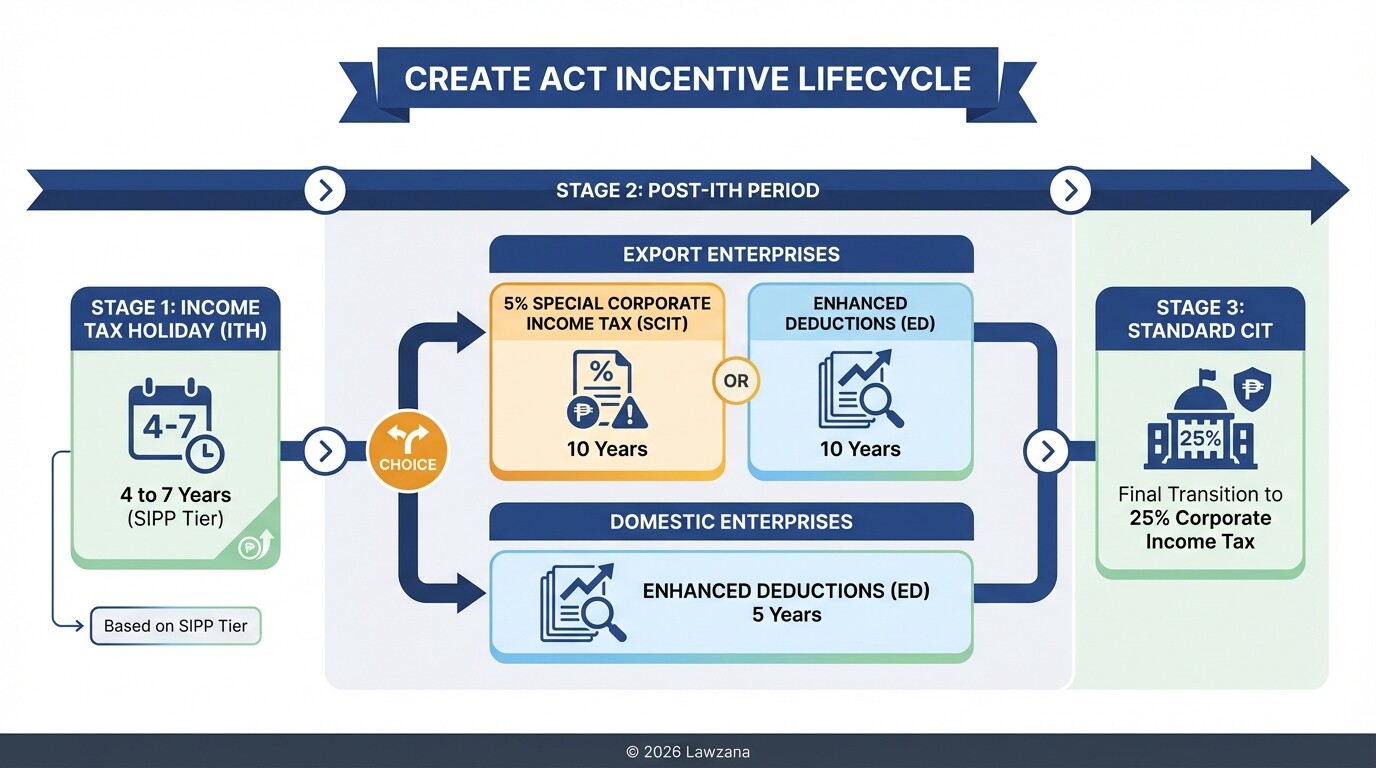

- Incentives are performance-based and categorized into three Tiers based on the Strategic Investment Priority Plan (SIPP), with higher-tier industries receiving longer tax holidays.

- Export enterprises can choose between a 5% Special Corporate Income Tax (SCIT) on Gross Income Earned or Enhanced Deductions after their initial tax holiday.

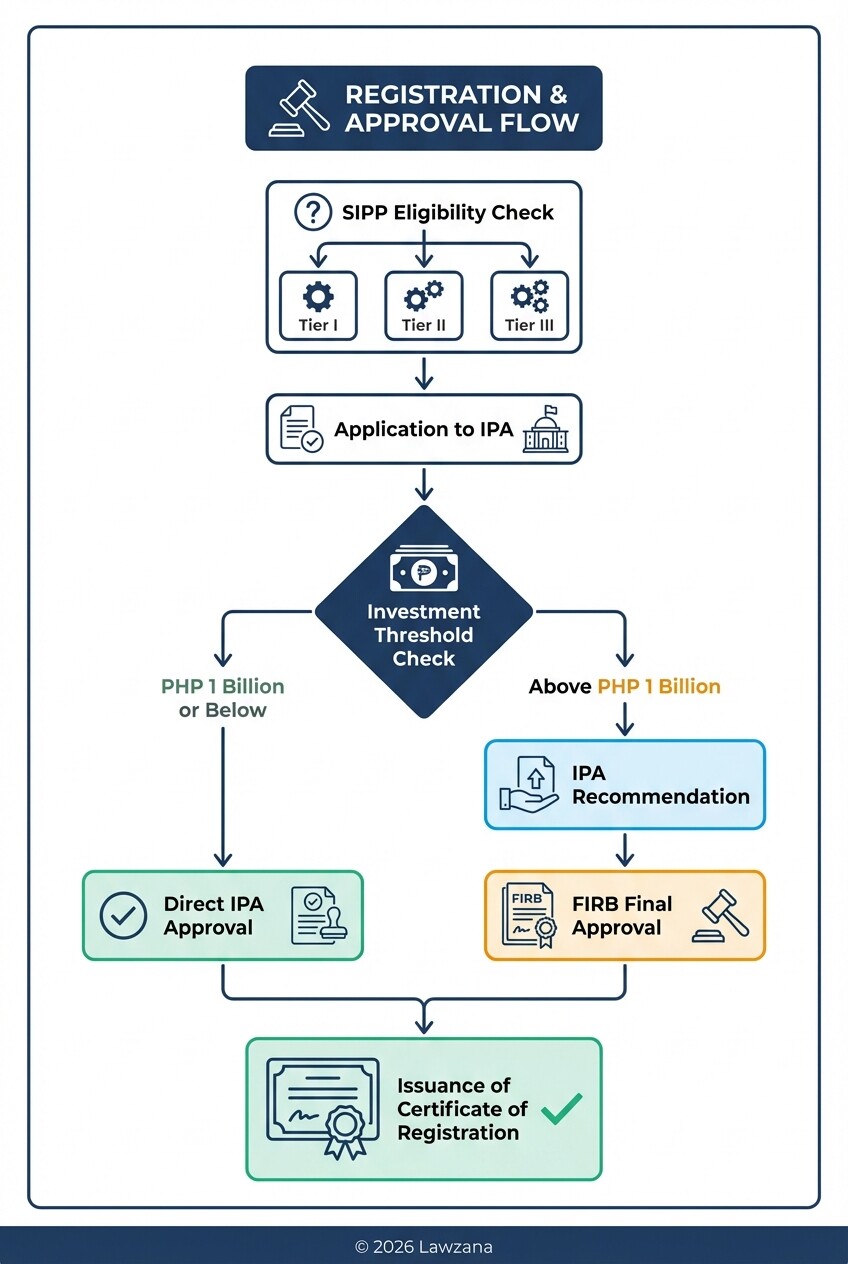

- All incentive applications must be processed through an Investment Promotion Agency (IPA) and, for large-scale projects, approved by the Fiscal Incentives Review Board (FIRB).

- Strict compliance with annual reporting to the Bureau of Internal Revenue (BIR) is mandatory to prevent the forfeiture of tax-exempt status.

How does the CREATE Act reduce Corporate Income Tax (CIT) for foreign firms?

The CREATE Act (Corporate Recovery and Tax Incentives for Enterprises) lowered the standard Corporate Income Tax (CIT) for most foreign-owned corporations from 30% to 25%. This reduction is part of a broader fiscal reform designed to attract foreign direct investment and provide immediate relief for businesses operating in the Philippines.

For foreign corporations, the tax landscape under CREATE is divided into two primary categories:

- Standard Rate: Most foreign-owned domestic corporations and resident foreign corporations are now subject to a flat 25% CIT rate on their taxable income.

- Micro, Small, and Medium Enterprises (MSMEs): While primarily targeting local firms, a lower 20% rate applies to domestic corporations with a net taxable income not exceeding PHP 5 million and total assets (excluding land) not exceeding PHP 100 million.

The law also lowered the Minimum Corporate Income Tax (MCIT) and the Percentage Tax for non-VAT registered taxpayers during the transition period, significantly reducing the immediate tax burden on new business registrations.

What are the criteria for Enhanced Deductions and Special Corporate Income Tax?

Enhanced Deductions (ED) and Special Corporate Income Tax (SCIT) are "sunset" incentives provided to businesses after their initial Income Tax Holiday (ITH) expires. To qualify, a business must be a Registered Business Enterprise (RBE) engaged in an activity listed under the Strategic Investment Priority Plan (SIPP).

Special Corporate Income Tax (SCIT)

The SCIT is a highly sought-after incentive for export-oriented firms. It offers a 5% tax rate based on Gross Income Earned (GIE) in lieu of all national and local taxes. This simplifies tax administration and significantly lowers the effective tax rate compared to the standard 25% CIT.

Enhanced Deductions (ED)

Enterprises that do not qualify for or choose the SCIT can opt for Enhanced Deductions. This allows businesses to deduct more than the actual cost of specific expenses from their taxable income:

- Depreciation Allowance: Additional 10% for buildings and 20% for machinery.

- Labor Expense: An additional deduction of 50% of the increment in direct labor wages.

- Research and Development: An additional deduction of 100% of R&D expenses.

- Training Expense: An additional deduction of 100% of training costs.

- Domestic Input Power: An additional deduction of 50% of the cost of power.

What is the difference between Export and Domestic Market Enterprises?

The CREATE Act distinguishes between export and domestic market enterprises to determine the duration and type of incentives available. Export enterprises are those that manufacture or process products and export at least 70% of their total output, whereas domestic market enterprises serve the local Philippine economy.

| Feature | Export Enterprises | Domestic Market Enterprises |

|---|---|---|

| Primary Incentive | 4 to 7 years of Income Tax Holiday (ITH) | 4 to 7 years of Income Tax Holiday (ITH) |

| Post-ITH Options | Choice of 5% SCIT or Enhanced Deductions | Enhanced Deductions only |

| Duration of Post-ITH | 10 years | 5 years |

| Customs Duties | Duty exemption on imports of raw materials and capital equipment | Duty exemption on imports (if qualified under SIPP) |

| VAT Incentives | VAT zero-rating on local purchases and VAT exemption on imports | VAT incentives generally limited to specific activities |

Export enterprises enjoy a significantly longer "incentive tail," as the 10-year period for SCIT or ED provides a long-term predictable tax environment that domestic firms generally cannot access.

How do you apply for incentives through the Fiscal Incentives Review Board?

Applying for incentives involves registering your business with an Investment Promotion Agency (IPA), such as the Philippine Economic Zone Authority (PEZA) or the Board of Investments (BOI). While the IPA handles the initial evaluation, the Fiscal Incentives Review Board (FIRB) serves as the ultimate oversight body for high-value projects.

The application process generally follows these steps:

- Determine SIPP Eligibility: Ensure your business activity falls under Tier I, II, or III of the Strategic Investment Priority Plan.

- Submit Application to IPA: File your proposal with the relevant IPA (e.g., PEZA for manufacturing in zones, BOI for general industry).

- Threshold Review:

- Projects with investment capital of PHP 1 billion and below are approved directly by the IPA.

- Projects above PHP 1 billion are forwarded by the IPA to the FIRB for final approval.

- Grant of Certificate of Registration: Once approved, the business receives a certificate specifying the incentives granted and the duration of the tax holiday.

The FIRB is responsible for ensuring that the incentives granted are commensurate with the economic contribution of the project, focusing on job creation and technology transfer.

What are the compliance requirements to maintain tax-exempt status?

Securing incentives is only the first step; maintaining them requires strict adherence to reporting and operational standards. Failure to comply can lead to the cancellation of registration and the retroactive collection of taxes.

To keep your tax-exempt status, your business must:

- File Annual Reports: Submit the Annual Tax Incentives Report (ATIR) and the Annual Benefits Report (ABR) through the FIRB's online portal.

- Maintain Separate Books: If you have both registered and non-registered activities, you must maintain distinct accounting records to ensure tax incentives are only applied to the qualified project.

- Submit Audited Financial Statements: Provide regular financial disclosures to the BIR and your respective IPA.

- Adhere to the SIPP: The business must continue the specific activity for which it was registered. Shifting business models without IPA approval can void incentives.

- Electronic Filing: Use the BIR's electronic filing and payment system (eFPS) for all tax returns to ensure transparency.

Common Misconceptions about the CREATE Act

"All businesses in the Philippines automatically get a tax reduction."

While the CIT was reduced from 30% to 25% for most firms, the specialized incentives (like the tax holiday and SCIT) are not automatic. They require a formal application process and must meet the specific industry criteria set out in the SIPP.

"The 5% SCIT lasts forever."

The SCIT is no longer a perpetual incentive. Under the CREATE Act, it is limited to a period of 10 years for export enterprises. This is a major shift from previous laws where some zones offered a 5% tax on GIE indefinitely.

"Foreign investors cannot own 100% of an export enterprise."

In the Philippines, export enterprises are generally exempt from the foreign equity restrictions found in the Foreign Investment Negative List. A foreign entity can own 100% of an export firm while still qualifying for full CREATE Act incentives.

Checklist for Foreign Investors Navigating CREATE

- Verify Industry Tier: Check if your business is Tier I (Essential), Tier II (Green/Tech), or Tier III (High-tech/Innovation).

- Choose an IPA: Decide between PEZA (location-specific) or BOI (location-independent).

- Register with the SEC: Complete your primary business registration with the Securities and Exchange Commission.

- Prepare Feasibility Study: Include projected job creation and capital expenditure for the IPA/FIRB application.

- Obtain BIR Certificate: Register your books of accounts with the Bureau of Internal Revenue specifically as an RBE.

FAQ

What is the Strategic Investment Priority Plan (SIPP)?

The SIPP is a government document that lists the priority industries and activities entitled to tax incentives. It is updated periodically to reflect the country's economic goals, such as boosting digital transformation or renewable energy.

Can a domestic company move from the old tax system to the CREATE incentives?

Existing registered enterprises were allowed to transition into the CREATE framework. However, the duration of their remaining incentives depends on how long they have already been operating under previous tax laws.

What happens if I fail to meet my export quota?

If an export enterprise fails to export at least 70% of its output, it may lose its "Export Enterprise" status. This typically results in the loss of the SCIT incentive and a shift to the standard 25% CIT rate.

Is VAT still zero-rated for exporters under CREATE?

Yes, the sale of goods and services to a registered export enterprise is generally subject to 0% VAT, provided those goods and services are directly and exclusively used in the registered project or activity.

When to Hire a Lawyer

Navigating the CREATE Act requires a blend of legal, tax, and regulatory expertise. You should consult a lawyer if:

- You are unsure which IPA (PEZA vs. BOI) offers the best strategic advantage for your specific business model.

- Your investment exceeds PHP 1 billion, requiring a complex presentation to the FIRB.

- You need to draft inter-company agreements that comply with transfer pricing rules while utilizing tax incentives.

- You are transitioning an existing business from old incentive regimes to the CREATE Act framework.

Next Steps

- Conduct a Gap Analysis: Compare your current tax structure against the potential savings offered by the 5% SCIT or Enhanced Deductions.

- Consult a Tax Professional: Engage a legal or tax advisor to review your eligibility under the current SIPP tiers.

- Contact an IPA: Reach out to the Board of Investments to start a preliminary discussion about your project's eligibility for incentives.

- Formalize Registration: Begin the SEC registration process to establish your legal presence in the Philippines before applying for fiscal incentives.