- Labuan companies engaged in trading activities enjoy a low corporate tax rate of 3% on net audited profits, provided they meet economic substance requirements.

- To maintain tax benefits, entities must fulfill specific substance criteria, including a minimum number of full-time employees and a minimum annual operating expenditure within Labuan.

- Labuan is a mid-shore jurisdiction, meaning it offers the tax advantages of an offshore center while maintaining high regulatory standards and transparency aligned with global norms.

- Foreigners can own 100% of a Labuan company, and the entity can operate in any currency other than the Malaysian Ringgit for international trade.

- Comparison with mainland Malaysia shows that Labuan is significantly more cost-effective for international trading, though it restricts the company from conducting business with Malaysian residents in most cases.

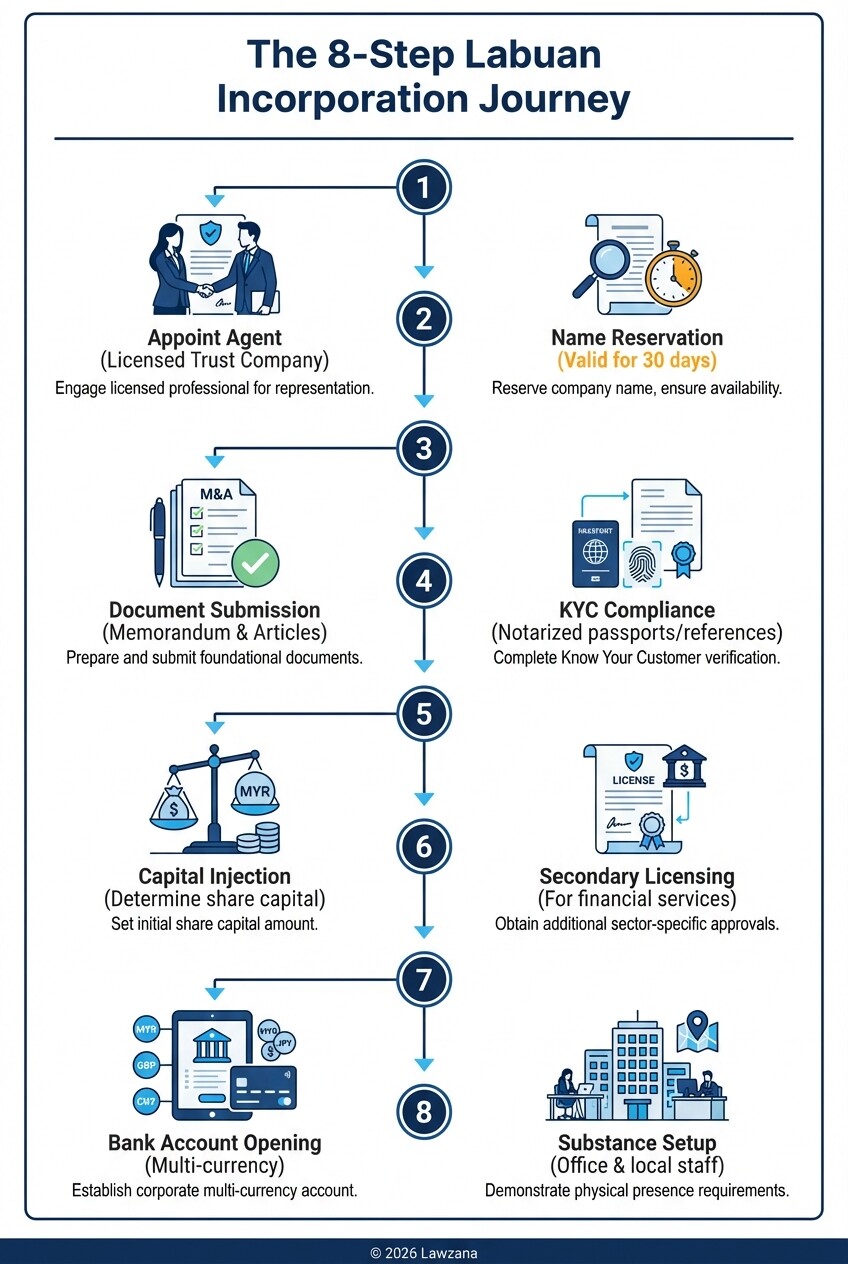

Step-by-Step Checklist for Labuan Business Registration

Registering an international trading hub in Labuan requires a structured approach through the Labuan Financial Services Authority (Labuan FSA). Because Labuan is a "mid-shore" jurisdiction, you must engage a licensed Labuan trust company to act as your incorporation agent and provide a registered office.

Follow these steps to complete your registration:

- Appoint a Licensed Trust Company: All applications must be submitted through a licensed trust company in Labuan. They serve as your liaison with the Labuan FSA.

- Name Reservation: Choose three potential names for your company. Your trust company will check for availability and reserve the name with the Labuan FSA for a period of 30 days.

- Submit Incorporation Documents: Provide the Memorandum and Articles of Association, Form 7 (Notice of Situation of Registered Office), and Form 14 (Consent to Act as Director).

- Due Diligence (KYC): Submit notarized passport copies, proof of residence, and bank reference letters for all directors and shareholders to comply with Anti-Money Laundering (AML) regulations.

- Capital Injection: Decide on your share capital. While there is no minimum paid-up capital for a general trading company, certain licensed activities (like insurance or banking) have specific capital requirements.

- Apply for Business Licenses: If your hub involves specific financial services, you must apply for a secondary license (e.g., Labuan Money Broking or Credit Provider license).

- Open a Labuan Bank Account: Once incorporated, you can open multi-currency accounts with Labuan offshore banks or Malaysian commercial banks.

- Fulfill Substance Requirements: Hire the required number of local staff and secure a physical office space in Labuan to ensure your tax status is protected.

Tax Advantages of the Labuan IBFC for Trading vs. Non-Trading Activities

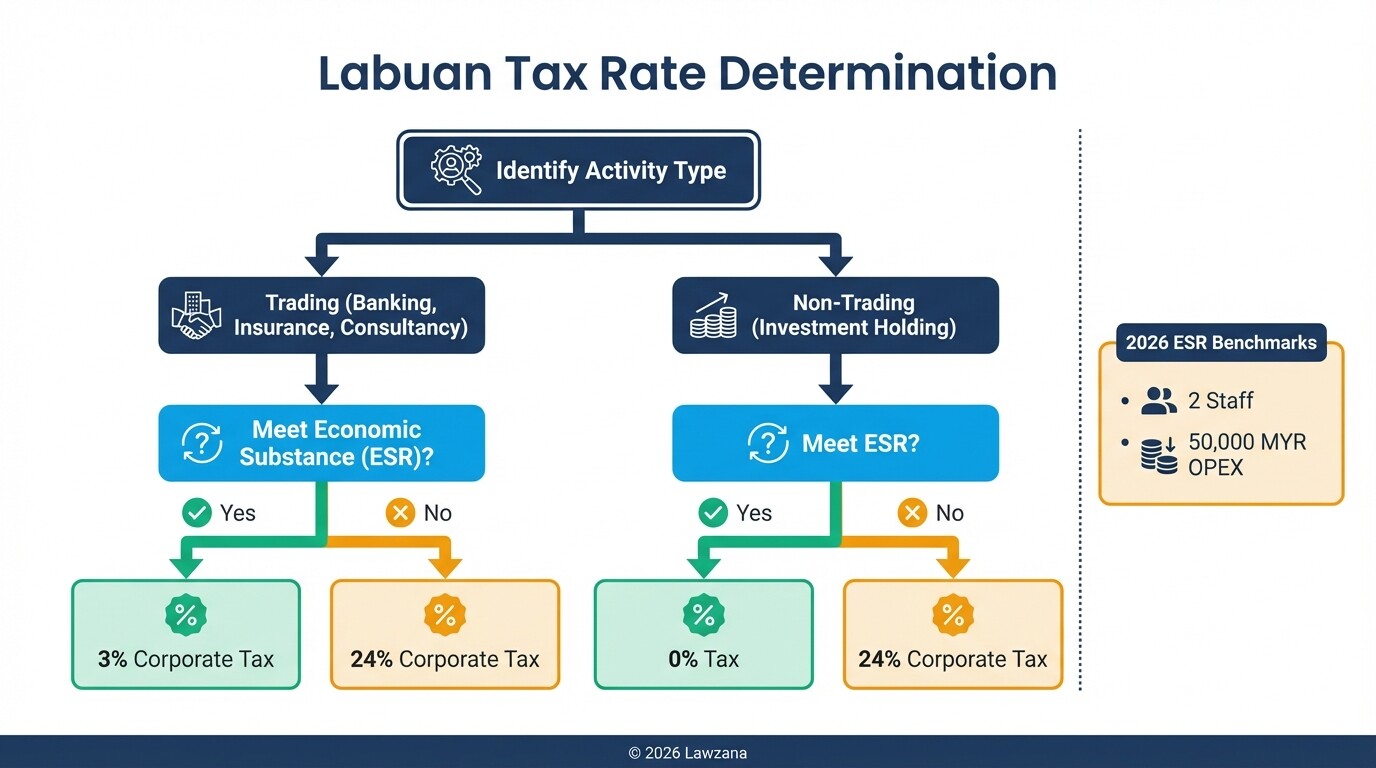

The Labuan International Business and Financial Centre (IBFC) distinguishes between trading and non-trading activities to determine tax liability. Trading activities include banking, insurance, shipping, and consultancy, while non-trading activities refer to the holding of investments in securities, stocks, or real estate.

Labuan trading companies pay a flat tax rate of 3% on their net audited profits. This is significantly lower than the mainland Malaysian corporate tax rate of 24%. To qualify for this 3% rate, the company must meet the economic substance requirements. If a trading company fails to meet these requirements, it is taxed at a much higher rate of 24% on its net audited profits.

Non-trading entities, such as pure investment holding companies, pay 0% tax on their income. This makes Labuan an exceptionally attractive location for regional headquarters that primarily hold assets or intellectual property. However, even these 0% tax entities must meet specific substance requirements, such as a minimum annual operating expenditure, to remain compliant with the Labuan Business Activity Tax Act 1990.

Economic Substance Requirements for International Entities in 2026

Economic substance requirements (ESR) are mandatory benchmarks that companies must meet to prove they have a genuine physical and economic presence in Labuan. These rules were introduced to align Malaysia with the OECD standards against base erosion and profit shifting (BEPS).

By 2026, the enforcement of these requirements is expected to be even more rigorous. For a standard Labuan trading company, the current requirements generally include employing at least two full-time employees in Labuan and incurring a minimum annual operating expenditure (OPEX) of 50,000 MYR (approximately 11,000 USD). These figures can vary depending on the specific type of license or business activity the hub performs.

Failure to meet these requirements results in the loss of preferential tax rates. Instead of the 3% or 0% rates, the entity will be taxed at the prevailing mainland corporate rate of 24%. It is critical for business owners to maintain detailed records of their local hires and local spending to present during annual tax filings.

Comparison of Labuan Setup vs. Mainland Malaysia Registration

Choosing between Labuan and mainland Malaysia depends on whether your primary market is domestic or international. Mainland companies (Sdn Bhd) are designed for doing business within Malaysia, while Labuan companies are vehicles for international trade and financial services.

| Feature | Labuan Company (International) | Mainland Malaysia (Sdn Bhd) |

|---|---|---|

| Tax Rate | 3% (Trading) or 0% (Non-trading) | 17% to 24% |

| Foreign Ownership | 100% allowed | 100% allowed (with some restrictions) |

| Currency | Any currency except MYR | Primarily MYR |

| Business Scope | International / Outside Malaysia | Domestic and International |

| Audit Requirement | Mandatory for all trading entities | Mandatory (except for very small firms) |

| Physical Office | Mandatory in Labuan | Mandatory in Malaysia |

A mainland Sdn Bhd is better if you plan to sell products or services to the 33 million residents of Malaysia. However, if your goal is to manage a global supply chain or provide consulting services to clients in Europe or the US, the Labuan structure offers superior tax efficiency and ease of capital movement.

Annual Maintenance Costs and Licensing Fees for International Hubs

Operating a Labuan trading hub involves recurring costs that must be factored into your annual budget. These costs include government fees, trust company service fees, and the expenses required to meet substance requirements.

The primary government fee for a Labuan company is approximately 2,600 MYR (600 USD) per year, paid to the Labuan FSA. Additionally, you must pay an annual fee to your licensed trust company, which typically ranges from 1,500 USD to 3,000 USD, covering their services as your company secretary and registered office provider.

| Expense Category | Estimated Annual Cost (USD) |

|---|---|

| FSA Annual Fee | $600 |

| Trust Company / Secretarial | $1,500 - $3,000 |

| Audit & Tax Filing | $1,000 - $2,500 |

| Office Rental (Substance) | $2,000 - $4,000 |

| Local Staff Salaries | $12,000 - $20,000 |

| Total Estimated Base Cost | $17,100 - $30,100 |

While these costs are higher than a simple shell company, they are necessary to maintain the 3% tax status. Compared to the tax savings on multi-million dollar trading volumes, these maintenance costs remain highly competitive.

Alternatives: Using Singapore or Hong Kong for Regional Trading

Singapore and Hong Kong are the primary competitors to Labuan for setting up a regional trading hub. Both offer high prestige and sophisticated banking systems, but they come with higher operational costs and different tax structures.

Singapore uses a territorial tax system where the corporate tax rate is 17%. While there are many incentives for start-ups, the cost of labor and office space in Singapore is among the highest in the world. Singapore is often preferred for businesses that require high levels of venture capital or a presence in a top-tier global financial center.

Hong Kong also offers a territorial tax system, meaning income earned outside of Hong Kong is generally not taxed. The first 2 million HKD of profits are taxed at only 8.25%. However, Hong Kong has faced increased geopolitical scrutiny in recent years. Labuan remains a "best of both worlds" option, providing the cost-benefit of a developing nation with the tax framework of a major financial hub, all while being part of a stable ASEAN economy.

Common Misconceptions About Labuan Business Setup

Misconception 1: Labuan is an "Offshore Tax Haven" for Locals

Many believe that Malaysian residents can use Labuan to avoid all taxes. In reality, Labuan is designed for international business. While Malaysians can own Labuan companies, the tax laws are strictly enforced to prevent domestic tax leakage. If a Labuan company does business with mainland Malaysia, those specific transactions are often subject to mainland tax rates and withholding taxes.

Misconception 2: You Do Not Need a Physical Presence

With the introduction of Economic Substance Requirements, the "letterbox company" model is dead in Labuan. You cannot simply register a company and leave it idle if you want to claim the 3% tax rate. You must have an actual office and actual employees physically located on Labuan island to satisfy the regulators and the tax authorities.

FAQ

Can a Labuan company trade in Malaysian Ringgit?

Generally, no. Labuan companies are expected to conduct their business in foreign currencies. Dealing in Malaysian Ringgit is restricted and usually requires specific permission or is limited to certain administrative expenses.

How long does it take to incorporate a Labuan company?

The incorporation process is relatively fast. Once all KYC documents are submitted to the trust company, the Labuan FSA usually approves the incorporation within 5 to 10 business days.

Do I need a physical office in Labuan if I have one in Kuala Lumpur?

Yes. To meet the economic substance requirements for the preferential tax rate, the physical office and the employees must be located in Labuan, not in mainland Malaysia.

When to Hire a Lawyer

You should consult a lawyer when your international trading hub involves complex intellectual property licensing, multi-jurisdictional contracts, or specific financial licensing requirements. While a trust company handles the administrative registration, a legal expert is necessary to draft robust shareholder agreements and ensure your corporate structure complies with both Malaysian law and the laws of the countries where your clients are located.

Next Steps

- Conduct a Feasibility Study: Determine if your projected trading volume justifies the annual maintenance costs of a Labuan entity.

- Consult a Tax Advisor: Confirm that your specific business activity qualifies for the 3% trading tax rate under current Malaysian law.

- Select a Trust Company: Interview at least two licensed Labuan trust companies to compare their service levels and fee structures.

- Gather KYC Documents: Start collecting notarized copies of passports and professional reference letters to avoid delays in the registration process.