Best Bankruptcy & Debt Lawyers in Dubai

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Dubai, United Arab Emirates

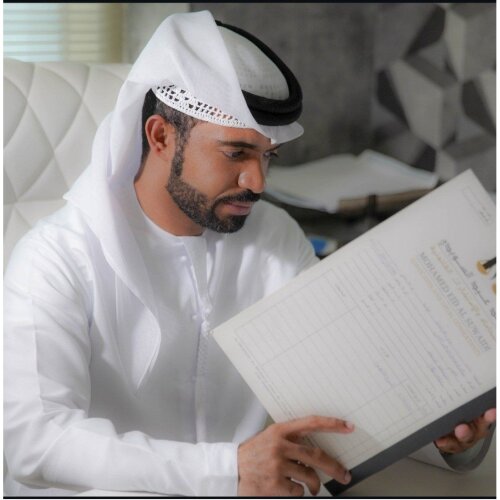

Mohamed Eid Al Suwaidi Advocates & Legal Consultants

30 minutes Free ConsultationUnited Arab Emirates Bankruptcy & Debt Legal Articles

Browse our 2 legal articles about Bankruptcy & Debt in United Arab Emirates written by expert lawyers.

- Debt Collectors in UAE: How to Stop Harassment & Verify Debt

- In the UAE, banks and their collection agents must follow Central Bank Consumer Protection rules that prohibit harassment, threats, and disclosure of your debt to third parties without a legal basis or your consent. You can require collectors to verify the debt and their authority. Ask for an itemized statement,... Read more →

- Understanding the UAE's New Bankruptcy Law

- Table of ContentsIntroduction: Demystifying the New LawA Paradigm Shift in UAE Insolvency LawThe Core Objective of the New LegislationWho Does the New Law Apply To? Navigating JurisdictionsOnshore vs. Financial Free Zone ApplicabilityCommercial vs. Personal InsolvencyThe New Judicial FrameworkThe Specialized Bankruptcy CourtSupporting Administrative BodiesPathways to Rescue: Options for Debt ReliefThe Preventive... Read more →

About Bankruptcy & Debt Law in Dubai, United Arab Emirates:

The Bankruptcy and Debt law in Dubai, part of the United Arab Emirates, is a fairly new piece of legislation, having been implemented in 2016. This law constitutes a modern framework that assists individuals and companies in financial distress, allowing them to reorganize their affairs or liquidate their assets in an orderly fashion. The law applies to companies established under the Commercial Companies Law, companies not regulated by this law, and civil companies. It does not apply to government-owned companies unless these companies declare their intent to be subject to the provisions of the law.

Why You May Need a Lawyer:

While you may be able to navigate bankruptcy and debt procedures on your own, it's often recommended to consult with a lawyer due to the complexity of the process and the law itself. Situations may arise where you're facing legal actions by creditors, negotiating settlements, or preparing to file for bankruptcy. You might also require assistance in understanding how to restructure your debts effectively. Lawyers can guide you, offering legal strategies tailored to your situation and assisting you in paperwork and legal proceedings, so you are compliant with all laws and regulations.

Local Laws Overview:

The central aspect of the 2016 Bankruptcy Law is that it provides debtors with the opportunity to reschedule their debts, allowing businesses to continue operating while repaying their debts over a period of three years. It also provides a mechanism for dealing with insolvency situations, with a significant aim of it being to assist struggling businesses. The law also includes penal provisions criminalizing actions like hiding assets or funds during bankruptcy procedures, escaping from the country with the intention to evade bankruptcy proceedings, or carrying out fraudulent acts affecting creditors’ rights.

Frequently Asked Questions:

Can I file for bankruptcy as an individual in Dubai, UAE?

As of 2020, a new law was introduced allowing individuals, as well as companies, to file for bankruptcy, particularly offering relief to those with personal loans they're unable to repay.

How does the bankruptcy process begin in Dubai, UAE?

The debtor themselves, the creditor, or the public prosecutor can initiate the bankruptcy proceedings by filing a request before the concerned court.

What are the consequences of filing for bankruptcy in Dubai, UAE?

Declaring bankruptcy does not mean you are freed from all debts. Some debts, such as court fines or penalties, may still need to be paid. Additionally, the debtor may face certain restrictions, such as being prohibited from practicing a profession or trade unless they regain their financial standing.

Can I start a new business after bankruptcy in Dubai, UAE?

Yes, you can start a new business after bankruptcy, but the debtor may face certain restrictions until they have completed their bankruptcy proceedings and regained their financial standing.

What happens to my employees if I file for bankruptcy?

By law, your employees' rights are protected and must be part of the restructuring plan or liquidation process. The court may appoint a trustee to oversee this.

Additional Resources:

You may find it useful to connect with organizations such as the Dubai Chamber of Commerce and Industry, or UAE's Ministry of Finance for further information and resources. Many legal firms also offer free initial consultations, which can provide tailored advice to your situation.

Next Steps:

If you are considering filing for bankruptcy or need assistance with debt management in Dubai, UAE, it's crucial to consult with a legal expert specialized in bankruptcy and financial law. They can assess your financial situation, explain your rights and options, and guide you through the relevant legal process. Make sure you gather all relevant documents related to your financial standing to facilitate your discussion with your lawyer.

Lawzana helps you find the best lawyers and law firms in Dubai through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Bankruptcy & Debt, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Dubai, United Arab Emirates — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse bankruptcy & debt law firms by service in Dubai, United Arab Emirates

Dubai, United Arab Emirates Attorneys in related practice areas.