Best Credit Repair Lawyers in Linz

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Linz, Austria

About Credit Repair Law in Linz, Austria

Credit repair in Linz, Austria involves a process in which individuals or businesses endeavor to improve their credit scores through the removal of inaccurate, obsolete, or otherwise incorrect information on their credit reports. The legal framework governing credit repair is influenced by national and EU regulations that aim to protect consumers’ rights and ensure fair credit reporting and lending practices. In Austria, credit reporting agencies must comply with strict data protection and privacy standards, providing individuals with tools to challenge and correct errors in their financial records.

Why You May Need a Lawyer

Legal assistance in credit repair becomes essential in complex situations such as disputing inaccurate credit information, defending against unfair credit reporting, negotiating settlements, and navigating bankruptcy. Lawyers can aid in understanding intricate financial laws and are instrumental when dealing with more severe financial reconciliation or litigation. They can provide expert representation in complex cases where the stakes are higher, ensuring that individuals' legal rights are protected.

Local Laws Overview

Key legislative measures related to credit repair in Linz include the Austrian Data Protection Act and Credit Reporting Act, which dovetail with broader EU regulations like the General Data Protection Regulation (GDPR). These laws grant individuals the right to access their credit information, demand correction of inaccuracies, and assert their privacy rights. They also outline the responsibilities of credit reporting agencies regarding the fair and accurate recording of credit-related data.

Frequently Asked Questions

What rights do I have if I find an error on my credit report?

You have the right to dispute any inaccuracies in your credit report. Under Austrian and EU laws, credit reporting agencies are required to investigate and correct errors within a specified time frame.

How can a lawyer help with credit repair?

A lawyer can assist you in drafting and submitting dispute letters, represent you in negotiations or litigation against creditors, and guide you through the legal processes involved in credit repair.

What is the process to dispute inaccurate information on my credit report?

The process typically involves requesting a copy of your credit report, identifying inaccuracies, submitting a formal dispute to the credit reporting agency, and following up to ensure the correction is made.

Can I repair my credit myself?

Yes, individuals can take steps to repair their credit themselves, primarily by monitoring their credit reports, disputing errors, and adopting sound financial practices. However, legal assistance may be beneficial for more complex issues.

Is hiring a credit repair company in Linz advisable?

While credit repair companies can offer services to improve your credit score, it is important to verify their legitimacy and ensure they comply with local regulations before engaging their services. Legal advice can also provide clarity on such commercial offerings.

What if my dispute is not resolved satisfactorily?

If your dispute is not resolved to your satisfaction, you may need to seek legal assistance to escalate the matter, possibly involving regulatory bodies or pursuing legal action against the agency or creditor.

How long does it take to repair credit?

The time required to repair credit can vary significantly based on the complexity of the case and the responsiveness of the involved agencies and creditors. It may range from a few months to over a year.

Are there any penalties for providing incorrect information in a credit report?

Yes, if a credit reporting agency or a creditor is found to have negligently provided incorrect information on a credit report, they may face penalties under Austrian law, which could include fines or sanctions.

Who enforces credit reporting laws in Austria?

The Austrian Data Protection Authority is responsible for enforcing data protection laws, which include credit reporting regulations. They ensure compliance and address complaints related to credit information handling.

Can I negotiate directly with creditors to remove negative entries?

Yes, negotiating directly with creditors to remove negative entries through settlements or payment arrangements can be effective. Legal advice may help in formulating a negotiation strategy.

Additional Resources

For individuals seeking more information or assistance with credit repair, the following resources may be helpful:

- The Austrian Data Protection Authority for privacy-related issues.

- Consumer associations like the Verbraucherzentrale Österreich for guidance and advocacy.

- Financial counseling agencies offering advice on debt management and financial planning.

Next Steps

If you find yourself needing legal assistance in credit repair, consider the following steps:

- Review your credit reports for errors and gather supporting documentation.

- Consult with a lawyer specializing in credit or consumer law to discuss the specifics of your situation.

- Explore dispute resolution options provided by credit reporting agencies or seek legal intervention if necessary.

- Engage with consumer protection bodies for guidance and support in your credit repair journey.

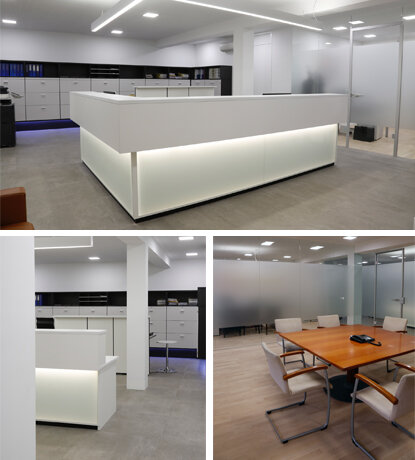

Lawzana helps you find the best lawyers and law firms in Linz through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Credit Repair, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Linz, Austria — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.