Best Debt Capital Markets Lawyers in Tallinn

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Tallinn, Estonia

About Debt Capital Markets Law in Tallinn, Estonia

Debt Capital Markets (DCM) involve the issuance, trading, and regulation of debt securities, such as bonds and notes, which are vital mechanisms for raising capital. In Tallinn, Estonia, the DCM sector operates within the broader context of the Estonian and European Union financial frameworks. Tallinn serves as Estonia's economic and financial hub, with a growing capital markets ecosystem that is aligned with international standards. DCM transactions are significant for both public entities and private companies looking to finance expansion, restructure current obligations, or optimize their capital structures.

Why You May Need a Lawyer

Engaging a lawyer with expertise in Debt Capital Markets can be essential in various scenarios, including:

- Structuring and issuing bonds or other debt instruments

- Navigating complex regulatory requirements from Estonian and EU bodies

- Drafting or reviewing legal documents such as prospectuses, offering memorandums, and indentures

- Advising on compliance, disclosure obligations, and listing requirements for Nasdaq Tallinn

- Handling disputes or litigation resulting from DCM transactions

- Advising on cross-border transactions and EU passporting rules

- Assisting with due diligence and risk assessments before undertaking DCM operations

- Guiding through private placements or syndicated lending

- Ensuring adherence to anti-money laundering and financial crime laws

Local Laws Overview

Debt Capital Markets in Tallinn are regulated under a combination of national legislation and EU directives. Key legal frameworks include the Securities Market Act, the Estonian Commercial Code, the Credit Institutions Act, and applicable EU regulations such as the Prospectus Regulation and the Market Abuse Regulation. Issuers must closely follow the listing requirements set by Nasdaq Tallinn and the rules of the Estonian Financial Supervision Authority (Finantsinspektsioon).

Estonian DCM participants are generally subject to rigorous transparency obligations, investor protection rules, and anti-fraud measures. Legal processes for public or private offerings vary depending on the size and nature of the issue, and certain exemptions may apply for smaller offerings. Due diligence and disclosure play a crucial role in every transaction, with additional scrutiny for cross-border deals involving multiple jurisdictions.

Frequently Asked Questions

What is a debt security?

A debt security is a financial instrument representing a loan made by an investor to an entity, often issued in the form of bonds or notes, which must be repaid under agreed terms.

Are there restrictions on who can issue debt securities in Estonia?

Yes, only certain legal entities such as public companies, financial institutions, and occasionally public authorities are permitted to issue debt securities, and they must comply with both national laws and EU regulations.

What are the main regulatory authorities overseeing DCM in Tallinn?

The Estonian Financial Supervision Authority (Finantsinspektsioon) is the main regulatory body, while Nasdaq Tallinn acts as the operator for exchange-listed securities.

Is a prospectus always required for offering bonds to the public?

Generally, a prospectus is required unless a specific exemption applies, such as for small offerings below certain thresholds or private placements to qualified investors.

Are there specific disclosure requirements for DCM transactions?

Yes, issuers must provide clear and truthful information regarding the terms of the securities, risks involved, and the financial status of the issuing entity, following both Estonian laws and EU directives.

How can international issuers access the Estonian DCM?

International issuers can access the Estonian market by complying with local and EU regulations, and may benefit from EU passporting rights which streamline the process for offerings across member states.

What are the typical costs involved in issuing debt securities?

Costs may include regulatory and exchange fees, legal and advisory fees, costs of preparing disclosure documents, and, if applicable, ratings agency charges.

What risks should investors consider in the Estonian DCM?

Investors should be aware of credit risk, market risk, liquidity risk, and the possibility of regulatory or tax changes impacting their investments.

How are disputes in DCM transactions typically resolved?

Many disputes are resolved via negotiation or commercial arbitration, but some matters may require court proceedings under Estonian law.

Can individuals or only institutions participate in the Estonian DCM?

While institutions are the primary participants, informed individuals can also invest in listed debt securities, subject to relevant regulatory requirements and their own risk tolerance.

Additional Resources

If you need more information or official guidance on Debt Capital Markets in Tallinn, consider contacting these organizations and resources:

- Estonian Financial Supervision Authority (Finantsinspektsioon) - oversees compliance and licensing

- Nasdaq Tallinn - operator of the local securities exchange

- Estonian Banking Association - provides industry insights and contacts

- Chamber of Notaries or the Bar Association for lawyer referrals

- Estonian Ministry of Finance - for policy and legislative updates

- Legal libraries and public access legal databases of Estonia

Next Steps

If you believe you need legal assistance with a Debt Capital Markets matter in Tallinn:

- Identify whether your need is related to structuring, compliance, dispute resolution, or another area

- Prepare documents detailing your goals, the nature of the transaction, and any relevant correspondence

- Research and select a qualified lawyer or law firm with expertise in DCM and financial regulations

- Arrange a consultation to discuss your situation, the potential risks, and the expected outcomes

- Request a clear explanation of legal fees and timelines before engaging services

- Stay informed of changes in laws and regulations that might affect your activities

Legal processes in Debt Capital Markets can be intricate, so early expert advice can help protect your interests and ensure compliance with all applicable laws and market standards.

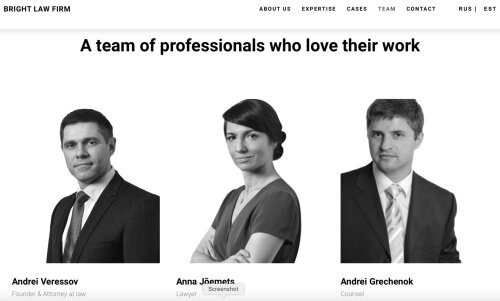

Lawzana helps you find the best lawyers and law firms in Tallinn through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Debt Capital Markets, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Tallinn, Estonia — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.