Best Mortgage Lawyers in Larnaca

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Free Guide to Hiring a Real Estate Lawyer

List of the best lawyers in Larnaca, Cyprus

About Mortgage Law in Larnaca, Cyprus

The mortgage system in Larnaca, Cyprus, is a critical aspect of the property purchasing and financing process. Mortgages serve as a security interest in property, usually granted to a lender as collateral for a loan. The law governing mortgages in Cyprus ensures that both the lender and borrower’s rights are protected. The process involves various legal formalities, from the initial loan agreement to the final payment and release of the mortgage.

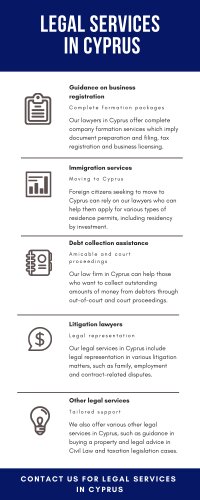

Why You May Need a Lawyer

There are several situations where legal guidance is essential when dealing with mortgages in Larnaca, Cyprus:

1. Property Purchase: Purchasing a property often requires taking a mortgage, and legal advice is crucial to ensure that the terms of the mortgage are fair and clear.

2. Refinancing: Legal assistance can help in understanding the new terms, penalties, and potential benefits of refinancing a mortgage.

3. Foreclosure: If there's a risk of foreclosure, legal help can provide options for mediation or renegotiation of terms to avoid losing the property.

4. Disputes: Lawyers can assist in resolving disputes related to mortgage terms, interest rates, or payment defaults.

5. Legal Documentation: A lawyer ensures all legal documents are correctly drafted and registered to avoid any future legal complications.

Local Laws Overview

The local laws in Larnaca, Cyprus, that pertain to mortgages are influenced by both national legislation and European Union directives. Key aspects include:

1. Loan Agreements: These must comply with local regulations to be valid and enforceable.

2. Registration: Mortgages must be registered with the Department of Lands and Surveys to be legally recognized.

3. Consumer Protection: Laws are in place to protect consumers from unfair lending practices, including transparency in terms and conditions.

4. Foreclosure Process: This process is regulated to ensure fairness and legal compliance during the repossession of a property.

5. Interest Rates: Limits and regulations on interest rates to avoid usury.

Frequently Asked Questions

1. What is a mortgage?

A mortgage is a loan secured by the property you own or are purchasing. It serves as collateral for the loan, which is repaid over a fixed term with interest.

2. How do I apply for a mortgage in Larnaca?

Contact local banks or financial institutions. You'll need to provide financial statements, proof of income, and details of the property you're purchasing.

3. What are the typical mortgage terms available?

Mortgage terms can range from 5 to 30 years, with fixed or variable interest rates, depending on the agreement with the lender.

4. Can foreigners apply for a mortgage in Cyprus?

Yes, non-residents can apply for a mortgage in Cyprus, although they might face stricter lending criteria and higher down payments.

5. What happens if I default on my mortgage?

Defaulting on a mortgage can lead to foreclosure, where the lender seeks to repossess the property to recover the owed amount.

6. Can I refinance my mortgage?

Yes, refinancing options are available, which can allow you to negotiate better terms or interest rates.

7. What is a variable interest rate mortgage?

It is a mortgage with an interest rate that can fluctuate based on market conditions, as opposed to a fixed rate, which remains constant.

8. What legal documents are required for a mortgage?

Documents typically include the mortgage deed, loan agreement, proof of property ownership, and personal identification.

9. Are there any tax benefits for having a mortgage in Cyprus?

Yes, interest payments on a mortgage may be tax-deductible, subject to specific conditions.

10. How can I find a reliable mortgage lawyer in Larnaca?

Research local law firms specializing in property law, check reviews, and seek recommendations from trusted sources.

Additional Resources

Helpful resources for those seeking legal advice on mortgages in Larnaca, Cyprus, include:

1. Department of Lands and Surveys: Provides information on property registration and transfer.

2. Central Bank of Cyprus: Offers insights into financial regulations and consumer protection guidelines.

3. Cyprus Bar Association: Can help locate qualified lawyers specializing in mortgage and property law.

4. Consumer Protection Service: Offers assistance and information on consumers' rights in financial transactions.

Next Steps

If you need legal assistance with a mortgage in Larnaca, consider the following steps:

1. Research: Gather information on your specific mortgage situation and understand your needs.

2. Consult: Schedule a consultation with a lawyer experienced in mortgage law to discuss your case in detail.

3. Documentation: Prepare all necessary documents and financial records for review by your legal advisor.

4. Negotiate: Work with your lawyer to negotiate terms with lenders or resolve disputes.

5. Stay Informed: Keep abreast of any changes in local laws that might impact your mortgage and financial obligations.

Lawzana helps you find the best lawyers and law firms in Larnaca through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Mortgage, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Larnaca, Cyprus — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.