Best Private Client Lawyers in Denmark

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in Denmark

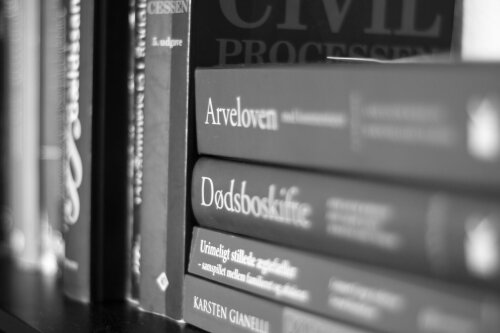

About Private Client Law in Denmark

Private Client law in Denmark encompasses all legal matters affecting individuals and families in relation to their personal wealth, assets, inheritance, estate planning, and family relationships. This area of law provides guidance and protection for matters such as wills, trusts, probate, tax planning, matrimonial agreements, powers of attorney, and guardianship. The Danish legal system is rooted in both statutory law and case law, ensuring that the rights and wishes of individuals and families are honored, while also complying with national regulations.

Why You May Need a Lawyer

Securing a lawyer specializing in Private Client law can help you navigate complex personal and financial situations smoothly. Here are common scenarios where legal assistance may be beneficial:

- Drafting or updating a will to ensure your wishes are respected after your death

- Setting up trusts or family foundations for asset protection or philanthropic goals

- Inheritance and succession planning to ensure smooth transfer of assets

- Resolving disputes between heirs or beneficiaries

- Advising on family law matters such as divorce settlements or pre-nuptial agreements

- Managing cross-border estates or international family matters

- Planning for incapacity through powers of attorney or guardianship arrangements

- Minimizing tax liability on estates and gifts through lawful planning

Given the complexity and potential for costly mistakes, consulting a qualified lawyer ensures compliance with local laws and helps safeguard your interests.

Local Laws Overview

Danish Private Client law is shaped by several statutes and regulations. Some of the key aspects include:

- Laws of succession - Denmark follows the Danish Inheritance Act, stipulating how assets are distributed among heirs and allowing for limited testamentary freedom. Certain family members, such as children and spouses, are protected by law and must receive a portion of the estate.

- Wills - Individuals over 18 with full legal capacity can create wills to specify the distribution of their estate. Legal requirements must be followed for a will’s validity, including witness signatures.

- Probate process - The Danish probate system manages the administration of estates. The process is often handled by the Probate Court (“Skifteretten”), especially where real property or significant assets are involved.

- Taxation - Inheritance and gift taxes apply depending on the relationship between the giver and recipient and the value of the assets. There are also rules for international inheritance.

- Matrimonial property - Assets acquired during marriage can be subject to division upon divorce or death unless agreements (such as prenuptial contracts) are in place.

- Powers of attorney and guardianship - Danish law allows individuals to appoint representatives through advance directives to make financial or personal decisions if they become incapacitated.

- International considerations - Those with assets or family abroad must consider Danish and foreign laws, as international treaties and EU regulations may impact inheritance, taxation, or matrimonial matters.

Frequently Asked Questions

What is the purpose of making a will in Denmark?

A will ensures your assets are distributed according to your wishes, within the limits of Danish inheritance laws. It can also address specific bequests or appoint guardians for minor children.

Can I leave my entire estate to someone outside my family?

Danish law protects certain heirs, including children and spouses, by granting them a reserved share of your estate. While you may distribute portions freely, the law restricts complete exclusion of these protected heirs.

How high is the inheritance tax in Denmark?

Inheritance tax rates vary depending on your relationship to the deceased. Close relatives (children and spouses) may benefit from lower rates or exemptions, while distant relatives or unrelated individuals may be subject to higher taxation.

How do I set up a power of attorney?

You must draft a legal document specifying your chosen representative and the scope of their authority. The document must be registered and, in certain situations, activated by the Probate Court if you become incapacitated.

What happens if I die without a will?

If you die intestate (without a will), your estate will be distributed according to the Danish Inheritance Act. The law prioritizes spouses, children, and descendants as inheritors.

Are foreign wills recognized in Denmark?

Under certain conditions, Denmark recognizes foreign wills, especially if they comply with the Hague Convention on the Conflicts of Laws Relating to the Form of Testamentary Dispositions. However, some limitations apply regarding reserved shares for close relatives.

Is it necessary to involve a lawyer in estate administration?

While not mandatory, engaging a lawyer is advisable for larger or complex estates, to ensure compliance with all legal and tax obligations, and to avoid disputes among heirs.

Can I disinherit a family member?

You can reduce a family member’s inheritance to the minimum allowed by law, but you cannot completely disinherit protected heirs, such as children and spouses, due to the reserved share rules.

How are family businesses handled in succession planning?

Succession of family businesses requires special planning to address both inheritance law and tax issues. Legal guidance ensures smooth transition and aligns business continuity with family interests.

What are the main steps in the Danish probate process?

The process generally involves notifying the Probate Court, valuing the estate, settling outstanding debts and taxes, and distributing assets to heirs according to the will or law.

Additional Resources

If you need further information or support regarding Private Client matters in Denmark, consider consulting these resources:

- Civilstyrelsen (The Danish Civil Affairs Agency) - provides information on wills, inheritance, and guardianship

- Skifteretten (Probate Court) - manages estate administration and probate matters

- Advokatsamfundet (The Danish Bar and Law Society) - offers help finding qualified lawyers

- SKAT (The Danish Customs and Tax Administration) - provides guidance on inheritance and gift taxation

- Local municipal family and legal advisory centers

Next Steps

If you believe you require legal advice in relation to Private Client matters in Denmark, follow these steps:

- Assess your situation and gather relevant documents such as existing wills, asset lists, and family information

- Consider the complexity of your case and whether it involves cross-border issues or high-value assets

- Contact a qualified lawyer specializing in Private Client law for an initial consultation

- Be clear about your objectives and ask questions to understand your rights and obligations

- Prepare to discuss your plans for succession, family arrangements, business interests, or other concerns openly with your lawyer

Seeking professional legal advice helps protect your interests and can prevent costly disputes or mistakes. Lawyers in Denmark are bound by confidentiality and are experienced in guiding clients through sensitive and significant personal legal matters.

Lawzana helps you find the best lawyers and law firms in Denmark through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Private Client, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Denmark — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse private client law firms by service in Denmark

Denmark Attorneys in related practice areas.

Browse private client law firms by city in Denmark

Refine your search by selecting a city.