Best Tax Increment Financing Lawyers in Bahamas

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

Or refine your search by selecting a city:

List of the best lawyers in Bahamas

About Tax Increment Financing Law in Bahamas

Tax Increment Financing (TIF) is a financial tool used by municipalities to encourage economic development and redevelopment in a designated area. In the Bahamas, TIF helps in funding public infrastructure and community improvement projects by capturing future increases in property tax revenues. The incremental tax revenue, generated as property values rise, is used to finance bonds or pay directly for the development improvements within the TIF district.

Why You May Need a Lawyer

Engaging a lawyer for Tax Increment Financing in the Bahamas can be beneficial for several reasons. It can be complex to navigate the regulatory requirements and legal specifications of a TIF district. You might require legal assistance if you are a developer seeking to initiate a TIF project, a property owner affected by a TIF district, or a government entity enforcing TIF laws. Lawyers can help interpret complex municipal ordinances, negotiate contracts, ensure compliance, and advise on the legal implications of TIF programs and agreements.

Local Laws Overview

The key aspects of local laws related to Tax Increment Financing in the Bahamas include the establishment of TIF districts, criteria for project approval, and the administration of TIF funds. Typically, a district is designated based on criteria like blight, underdevelopment, or the potential to enhance public welfare. It’s crucial to understand the statutory requirements for public hearings, notifications, and the renegotiation of existing financial obligations. Detailed knowledge of these regulations is necessary to ensure compliance and to leverage TIF effectively for community development.

Frequently Asked Questions

What is the primary purpose of Tax Increment Financing?

Tax Increment Financing is primarily used to stimulate economic growth in underdeveloped or blighted areas by leveraging future tax revenues for current improvements.

Who can establish a TIF district?

Typically, local governments or municipalities have the authority to establish a TIF district after fulfilling certain statutory requirements, such as holding public hearings and consultations.

Can TIF funds be used for any type of project?

No, TIF funds are generally restricted to specific public infrastructure and community improvement projects within the designated district, such as roadwork, sewer improvements, and public facilities.

What are the risks associated with TIF?

The risks may include over-reliance on projected tax revenues that may not materialize, which could lead to financial shortfalls and increased debt burdens on the municipality.

Can property owners within a TIF district object?

Yes, property owners may object during public hearings or through any prescribed legal channels if they believe the TIF designation adversely affects them or is not in their best interest.

How long does a TIF district last?

The lifespan of a TIF district varies, but it generally lasts long enough to pay off the incurred debt or fund the planned improvements, commonly ranging from 15 to 30 years.

Is the increase in property tax rates subject to approval?

The property tax increase in a TIF district comes from the rise in property values due to successful development, not through a hike in tax rates.

Do TIF funds affect existing tax revenues?

Existing tax revenues are unaffected since TIF funds comprise only the additional revenue generated from the rise in property values within the district.

How is accountability ensured in TIF projects?

Regular audits, financial reporting, and compliance reviews help ensure accountability and transparency in the administration of TIF funds and projects.

Can TIF be used in combination with other development incentives?

Yes, TIF can be complemented with other financial incentives or grants to maximize development impact and align with broader economic goals.

Additional Resources

For further guidance on Tax Increment Financing, consider consulting governmental bodies such as the Ministry of Finance or local municipal offices. Organizations focused on economic development in the Bahamas can also provide valuable insights and support. Furthermore, industry publications and legal firms specializing in financial or municipal law may offer additional perspective and expertise.

Next Steps

If you require legal assistance with Tax Increment Financing, it’s advisable to consult with a lawyer experienced in municipal finance or real estate law. Begin by gathering all relevant documents and details about your project or concern. Schedule a consultation to discuss your specific needs and objectives, and follow the legal advice provided to navigate the TIF process efficiently and in compliance with all applicable regulations.

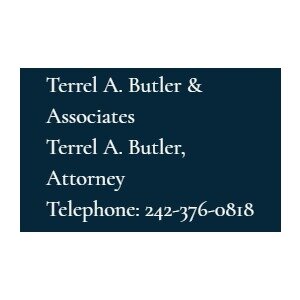

Lawzana helps you find the best lawyers and law firms in Bahamas through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Tax Increment Financing, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Bahamas — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.

Browse tax increment financing law firms by city in Bahamas

Refine your search by selecting a city.