Best Tax Increment Financing Lawyers in Tallinn

Share your needs with us, get contacted by law firms.

Free. Takes 2 min.

List of the best lawyers in Tallinn, Estonia

About Tax Increment Financing Law in Tallinn, Estonia

Tax Increment Financing (TIF) is a public financing method used globally to subsidize community improvements, infrastructure developments, and urban renewal projects. In Tallinn, Estonia, TIF is increasingly becoming a strategic tool for urban planners and local governments striving to foster economic development within designated districts. By earmarking future tax revenues to finance immediate projects, TIF helps stimulate growth and invigorate underdeveloped areas without raising local taxes. While historically not widely utilized in Estonia as in some Western countries, its implementation is gaining traction, particularly in Tallin, where urban expansion is prominent.

Why You May Need a Lawyer

Seeking legal advice in the field of Tax Increment Financing in Tallinn can be essential for several reasons:

- Understanding Complex Legislation: TIF involves intricate legal and financial frameworks that require expert interpretation to ensure compliance and proper utilization.

- Project Structuring: Legal guidance is vital for structuring TIF projects to meet both regulatory requirements and financial objectives effectively.

- Risk Mitigation: Legal professionals can help identify and mitigate potential risks, ensuring that projects remain viable and legally sound.

- Negotiations and Agreements: Lawyers assist in negotiating and drafting agreements between public bodies and private developers, ensuring all parties' interests are protected.

- Resolving Disputes: In the event of conflicts or disputes, legal representation can facilitate resolution or litigation if necessary.

Local Laws Overview

Tax Increment Financing in Tallinn is governed by a blend of national and local regulations designed to oversee the creation and management of TIF districts. Key aspects include:

- Legal Frameworks: Estonian law provides the guidelines for establishing TIF districts, outlining processes for approval, management, and funding mechanisms.

- Approval and Governance: Local governments play a crucial role in designating TIF districts and approving projects. Pertinent municipal bodies are responsible for oversight and compliance.

- Revenue Allocation: Regulations specify how future tax increments are captured and allocated to fund TIF projects, ensuring transparency and accountability.

- Environmental Considerations: Projects must comply with local environment impact assessment requirements to guarantee sustainable development practices are maintained.

- Public Involvement: Legal provisions often require public consultations and stakeholder engagement to ensure community needs are addressed in TIF project planning.

Frequently Asked Questions

What is the purpose of Tax Increment Financing?

The purpose of TIF is to subsidize developments in underdeveloped areas by using future tax gains from increased property values to fund improvements now.

How does the TIF process begin?

The TIF process typically starts with identifying a potential district, followed by feasibility studies, public consultations, and legal approvals.

Who benefits from TIF projects?

TIF projects often benefit both the community, through improved infrastructure and services, and private developers, through financial incentives for development.

Can TIF be used for residential developments?

Yes, TIF can be used for residential developments, particularly those that contribute to urban renewal and affordable housing initiatives.

How long do TIF districts last?

The duration of TIF districts can vary, but they often last until the project pays off its financial obligations, typically ranging from 15 to 30 years.

What risks are associated with TIF?

Potential risks include inadequate revenue generation, economic downturns impacting tax bases, and project mismanagement.

Are there alternatives to TIF for financing projects?

Yes, alternatives include municipal bonds, public-private partnerships, and government grants, among other financing mechanisms.

How is public transparency upheld in TIF projects?

Through legal frameworks mandating disclosures, public consultations, and regular audits, transparency is maintained in TIF projects.

Can existing businesses in a TIF district be adversely affected?

While the goal is improvement, disruptions during construction or shifts in economic landscapes can pose challenges, but support measures are often available.

Where can I find more detailed legal standing on TIF?

Consulting legal texts, municipal bylaws, or seeking advice from a TIF law expert are viable ways to gain deeper insights.

Additional Resources

For more information on Tax Increment Financing in Tallinn, Estonia, consider the following resources:

- Estonian Ministry of Finance: Provides regulatory guidelines and financial policies related to TIF.

- Tallinn City Council: Offers access to local laws and ordinances governing TIF projects within Tallinn.

- Urban Development Institutes: Research organizations that provide studies and publications on urban financing and TIF.

- Legal and Financial Consulting Firms: Many offer specialized services in navigating the complexities of TIF law and financial planning.

Next Steps

If you require legal assistance in navigating TIF in Tallinn, follow these steps:

- Identify Your Needs: Determine the specific legal help you require, whether it is for tax guidance, project management, or dispute resolution.

- Research Professionals: Look for lawyers or firms with expertise in Estonian tax law and urban development financing.

- Consultation: Schedule initial consultations to discuss your situation, project objectives, and potential legal strategies.

- Engage Legal Services: Choose the legal professional or firm that best fits your needs and formally engage their services.

- Stay Informed: Remain actively involved in your project's legal and financial planning to ensure successful outcomes.

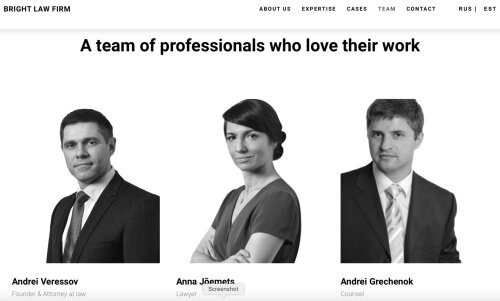

Lawzana helps you find the best lawyers and law firms in Tallinn through a curated and pre-screened list of qualified legal professionals. Our platform offers rankings and detailed profiles of attorneys and law firms, allowing you to compare based on practice areas, including Tax Increment Financing, experience, and client feedback.

Each profile includes a description of the firm's areas of practice, client reviews, team members and partners, year of establishment, spoken languages, office locations, contact information, social media presence, and any published articles or resources. Most firms on our platform speak English and are experienced in both local and international legal matters.

Get a quote from top-rated law firms in Tallinn, Estonia — quickly, securely, and without unnecessary hassle.

Disclaimer:

The information provided on this page is for general informational purposes only and does not constitute legal advice. While we strive to ensure the accuracy and relevance of the content, legal information may change over time, and interpretations of the law can vary. You should always consult with a qualified legal professional for advice specific to your situation.

We disclaim all liability for actions taken or not taken based on the content of this page. If you believe any information is incorrect or outdated, please contact us, and we will review and update it where appropriate.