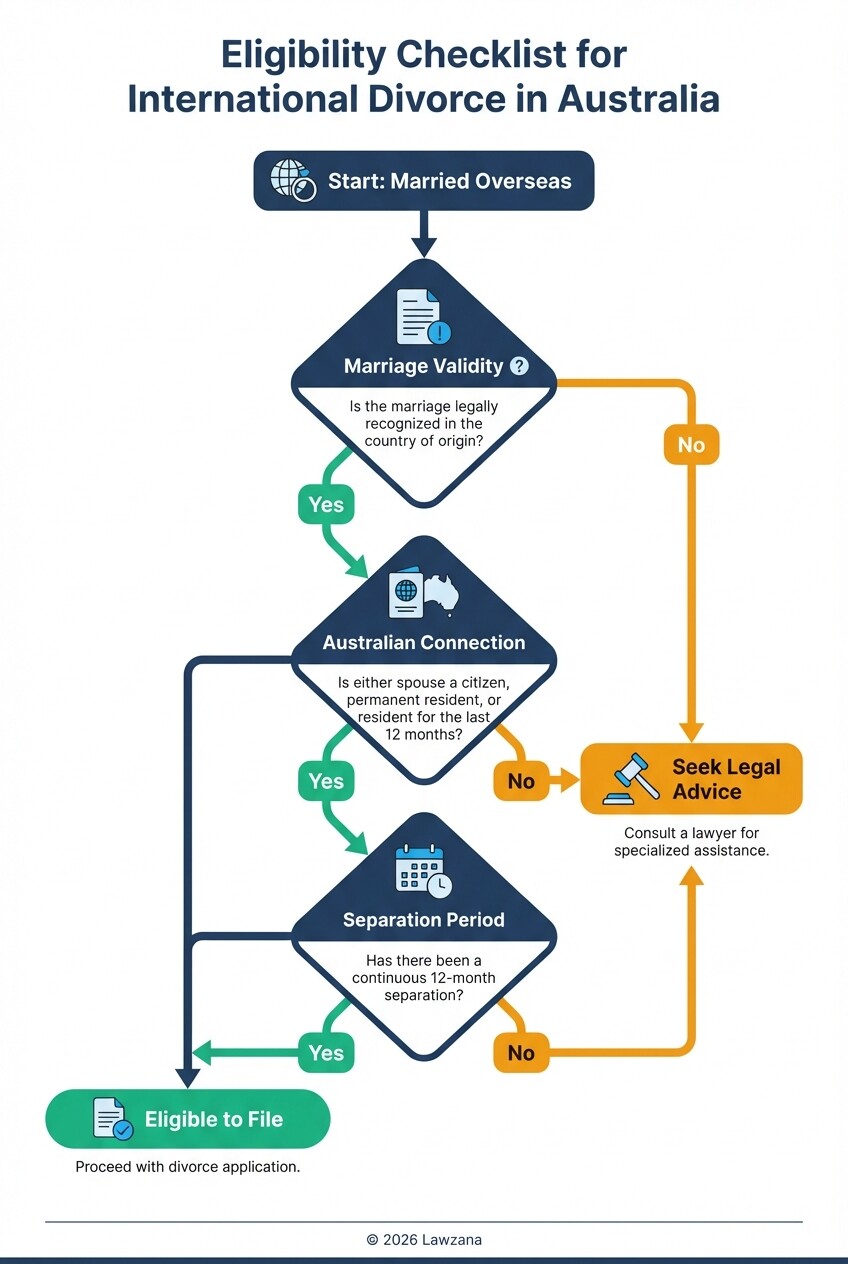

- You can divorce in Australia even if you married overseas, provided at least one spouse is an Australian citizen, a permanent resident, or has lived in Australia for the preceding 12 months.

- Australian law requires a strict 12-month separation period before a divorce application can be filed, regardless of where the marriage took place.

- The Federal Circuit and Family Court of Australia (FCFCOA) has the power to make orders regarding global assets, including real estate, bank accounts, and trusts located in other countries.

- Australia is a signatory to the Hague Convention, which provides a legal framework for the return of children in cases of international parental abduction.

- Foreign prenuptial agreements are not automatically binding in Australia and must generally meet specific criteria under the Family Law Act 1975 to be enforceable.

Can You File for Divorce in Australia if You Married Overseas?

You can apply for a divorce in Australia if you married in another country, as long as you can prove the marriage is legally recognized in that jurisdiction. To file, you or your spouse must also meet residency requirements: being an Australian citizen, living in Australia permanently, or having lived in Australia for at least one year immediately before filing.

The Australian legal system operates on a "no-fault" basis. This means the court does not consider why the marriage ended, only that the relationship has broken down irretrievably. This breakdown is proven by a continuous 12-month separation period. If you have been married for less than two years, you are generally required to attend counseling before applying for divorce, unless specific exemptions apply.

The 12-Month Separation Requirement for Foreign-Married Couples

The 12-month separation rule is a non-negotiable prerequisite for divorce under the Family Law Act 1975. This period begins when at least one party communicates their intention to end the marriage and acts upon it, even if both parties continue to live under the same roof for financial or logistical reasons.

For expats or those who married abroad, this timeline can become complicated if the separation began while living in different countries. You must be able to provide evidence of the date of separation, such as:

- Changes in shared bank accounts or utility bills.

- Official correspondence (emails or letters) stating the intent to separate.

- Statutory declarations from third parties who can verify the separation date.

International Divorce and Asset Division Checklist

When a divorce involves multiple countries, identifying and valuing the "marital pool" becomes significantly more complex. Use this checklist to ensure all international interests are accounted for during the property settlement process.

| Category | Item to Verify | Documentation Needed |

|---|---|---|

| Real Estate | Foreign residential or commercial property | Current market appraisal from a local agent; Title deeds |

| Financial Accounts | International bank accounts, stocks, and bonds | Last 12 months of statements; Proof of current balance |

| Business Interests | Shares in foreign companies or partnerships | Business tax returns; Shareholder agreements; Valuation reports |

| Retirement Funds | Foreign pensions, 401(k)s, or superannuation | Latest member statement; Summary of vesting rules |

| Trusts | Beneficiary status in international trusts | The Trust Deed; Financial statements of the trust |

| Liabilities | Foreign mortgages, personal loans, or tax debts | Loan statements; Official correspondence from foreign tax authorities |

Disclosure Rules for Global Assets and International Trusts

Australia follows a "full and frank disclosure" policy, which mandates that both parties reveal all financial resources, regardless of where they are located in the world. This obligation covers everything from a small savings account in London to a complex family trust structure in the Cayman Islands.

If a party fails to disclose an international asset, the court has the power to set aside existing orders or impose "costs orders," requiring the non-disclosing party to pay the other's legal fees. In extreme cases, the court may make an adjustment in favor of the "innocent" party to compensate for the hidden assets. For international trusts, the court will examine whether the spouse has "control" over the trust. If the spouse is the appointor or the sole trustee, the court may treat the trust assets as marital property rather than a mere financial resource.

Enforcing Australian Parenting Orders Across International Borders

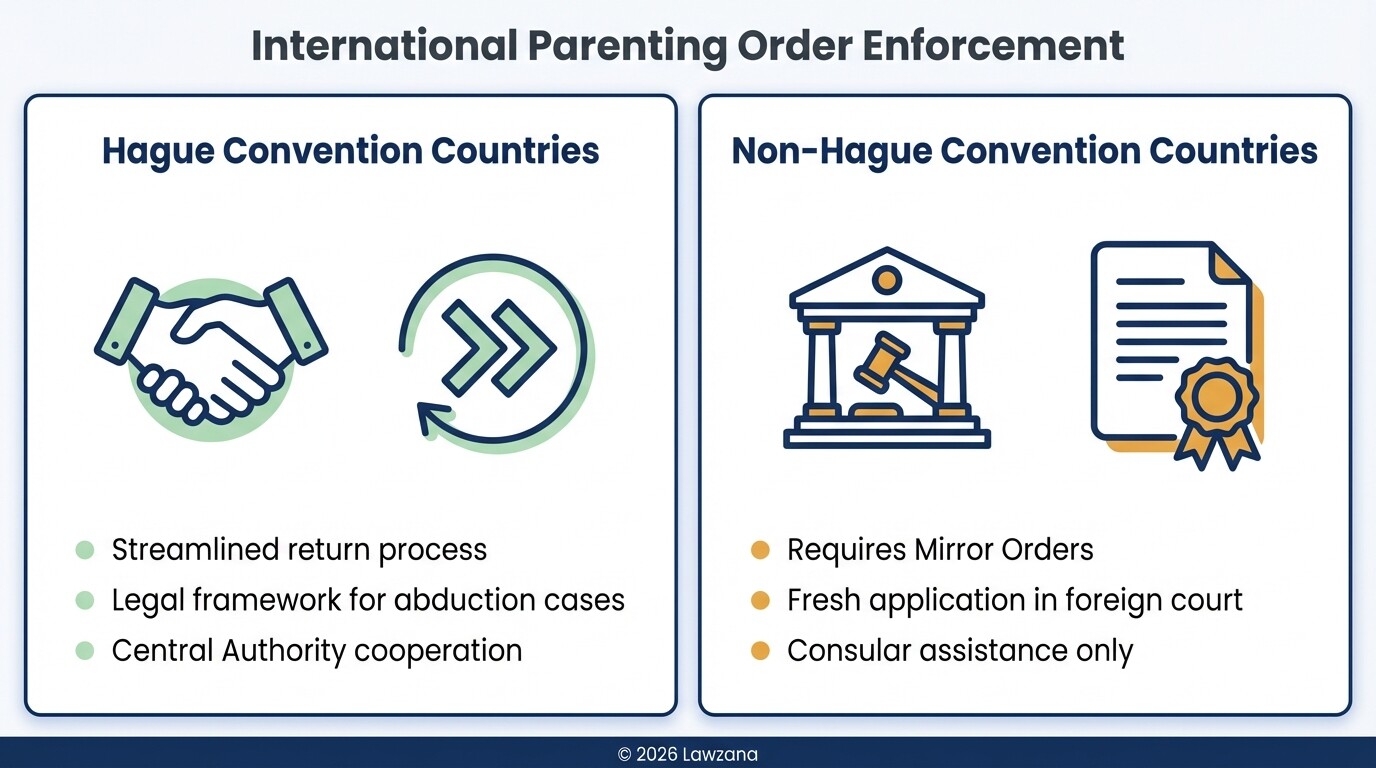

Enforcing parenting orders internationally depends largely on whether the other country is a member of the Hague Convention on the Civil Aspects of International Child Abduction. This international treaty ensures that children who are wrongfully removed from their home country are returned as quickly as possible to their place of habitual residence.

If you have an Australian parenting order and the other parent moves the child to a non-Hague Convention country, enforcement becomes significantly more difficult. In these cases, you may need to:

- Initiate Local Proceedings: File a fresh application in the foreign country's court system.

- Mirror Orders: Seek "mirror orders" in the foreign jurisdiction that replicate the terms of the Australian order.

- Department of Foreign Affairs and Trade (DFAT): Seek consular assistance, though their power to intervene in private legal disputes is limited.

For more information on international child abduction, visit the Attorney-General's Department.

How the Court Handles Foreign Prenuptial and Postnuptial Agreements

Foreign prenuptial and postnuptial agreements are not automatically enforceable in Australia. To be recognized as a "Binding Financial Agreement" (BFA) under Section 90 of the Family Law Act, the document must meet strict Australian legal standards, including the requirement that both parties received independent Australian legal advice.

If your foreign agreement does not meet these criteria, the court may still consider it under its discretionary powers. The court will look at the agreement as evidence of the parties' intentions at the time it was signed. However, if the agreement is deemed "unfair" or if circumstances have changed significantly (such as the birth of children), the Australian court may choose to override the foreign agreement and apply the standard principles of Australian property law to ensure an equitable distribution.

Strategies for Avoiding Double Litigation in Multiple Jurisdictions

"Forum shopping" occurs when both parties start legal proceedings in different countries to find a more favorable legal outcome. To avoid the massive expense of double litigation, you must determine which country is the "clearly appropriate forum" for the dispute.

If proceedings have started in two countries, an Australian court may issue a "stay" (a temporary or permanent halt) on its own proceedings if it believes the foreign court is better suited to handle the case. Factors the court considers include:

- The location of the marital assets.

- Where the parties and children primarily reside.

- Which country's laws are most applicable to the dispute.

- The relative cost and convenience of litigating in each jurisdiction.

To protect yourself, it is often advisable to file first in the jurisdiction that is most favorable to your circumstances, provided you meet the residency requirements.

Common Misconceptions About International Divorce

Myth: If I move back to my home country, I don't have to follow Australian property orders. Fact: Australia has reciprocal enforcement arrangements with many countries. Debts and property transfers ordered by an Australian court can often be enforced by foreign courts, especially regarding child support and alimony.

Myth: My overseas assets are "safe" from my Australian spouse. Fact: The FCFCOA requires global disclosure. Even if the court cannot directly seize a house in another country, it can "offset" the value by giving the other spouse a larger share of the assets located within Australia.

Myth: You must divorce in the country where you were married. Fact: The location of the wedding ceremony is largely irrelevant for the divorce itself. What matters is where you are currently living and your status as a citizen or resident.

Timeline and Cost Overview for International Divorce

| Action | Estimated Timeline | Estimated Cost (AUD) |

|---|---|---|

| Initial Filing | 1-2 months | $1,060 (Court Filing Fee) |

| Service of Documents (Overseas) | 2-4 months | $300 - $1,000 (Process Servers) |

| Property Discovery (International) | 6-12 months | $5,000 - $20,000+ (Legal/Valuation) |

| Final Hearing (If Contested) | 18-36 months | $30,000 - $100,000+ |

FAQ

What happens if my spouse lives overseas and won't sign the divorce papers?

In Australia, you can apply for a "sole application." You must prove that you have served the papers to your spouse. If they cannot be found or refuse to sign, you can apply to the court for a "substitutional service" or a "dispensation of service," allowing the divorce to proceed without their signature.

Can the Australian court divide my foreign pension?

The court can take the value of a foreign pension into account when dividing the total asset pool. While the court might not be able to issue a "splitting order" directly to a foreign pension fund, it can award you a larger share of Australian assets to balance the value of that pension.

Will my Australian divorce be recognized in my home country?

Most countries recognize foreign divorces if they were granted according to the laws of that country and if at least one party had a real connection (residency or citizenship) to that country. You may need to provide a certified copy of your Divorce Certificate to your local embassy.

When to Hire a Lawyer

Navigating an international divorce is significantly more complex than a domestic one. You should consult a lawyer immediately if:

- Your spouse has already started legal proceedings in another country.

- You own significant assets, businesses, or trusts outside of Australia.

- There is a risk that your spouse might move children to another country without your consent.

- You are unsure if your foreign prenuptial agreement is valid under Australian law.

Next Steps

- Gather Documentation: Collect marriage certificates (translated if necessary), foreign property deeds, and international bank statements.

- Verify Residency: Ensure you or your spouse meet the Australian residency or citizenship requirements for filing.

- Consult the Court Portal: Review the Federal Circuit and Family Court of Australia website for the latest filing fees and forms.

- Seek Specialist Advice: Contact a family lawyer who specializes in "Conflict of Laws" or international jurisdictions to discuss a strategy for your specific assets.