- The Out-of-Court Workout (OCW) is a purely digital process conducted through a specialized platform to settle debts with banks, the State, and social security funds.

- Successful applications grant a 90-day suspension of enforcement measures, including asset seizures and property auctions.

- Debt repayment can be extended up to 240 installments for State debts and 420 installments for financial institutions, often including significant "haircuts" on the principal or interest.

- The mechanism is based on a standardized algorithm that removes human bias, ensuring that the proposed settlement is based strictly on the debtor's financial capacity.

What is the Greek Out-of-Court Workout Mechanism?

The Greek Out-of-Court Workout (OCW) is a digital framework established under Law 4738/2020 that allows distressed businesses to restructure their debts through an automated electronic platform. It serves as a pre-insolvency tool designed to prevent bankruptcy by creating a sustainable repayment plan agreed upon by the debtor and a majority of their creditors.

By centralizing all debt information-including taxes, social security contributions, and bank loans-the platform generates a proposal that aims to balance the debtor's ability to pay with the creditors' right to recover funds. This process is particularly valuable for B2B entities because it avoids the lengthy delays and high costs of traditional litigation, providing a "second chance" for viable businesses to remain operational while satisfying their financial obligations.

Who is eligible for the OCW platform in Greece?

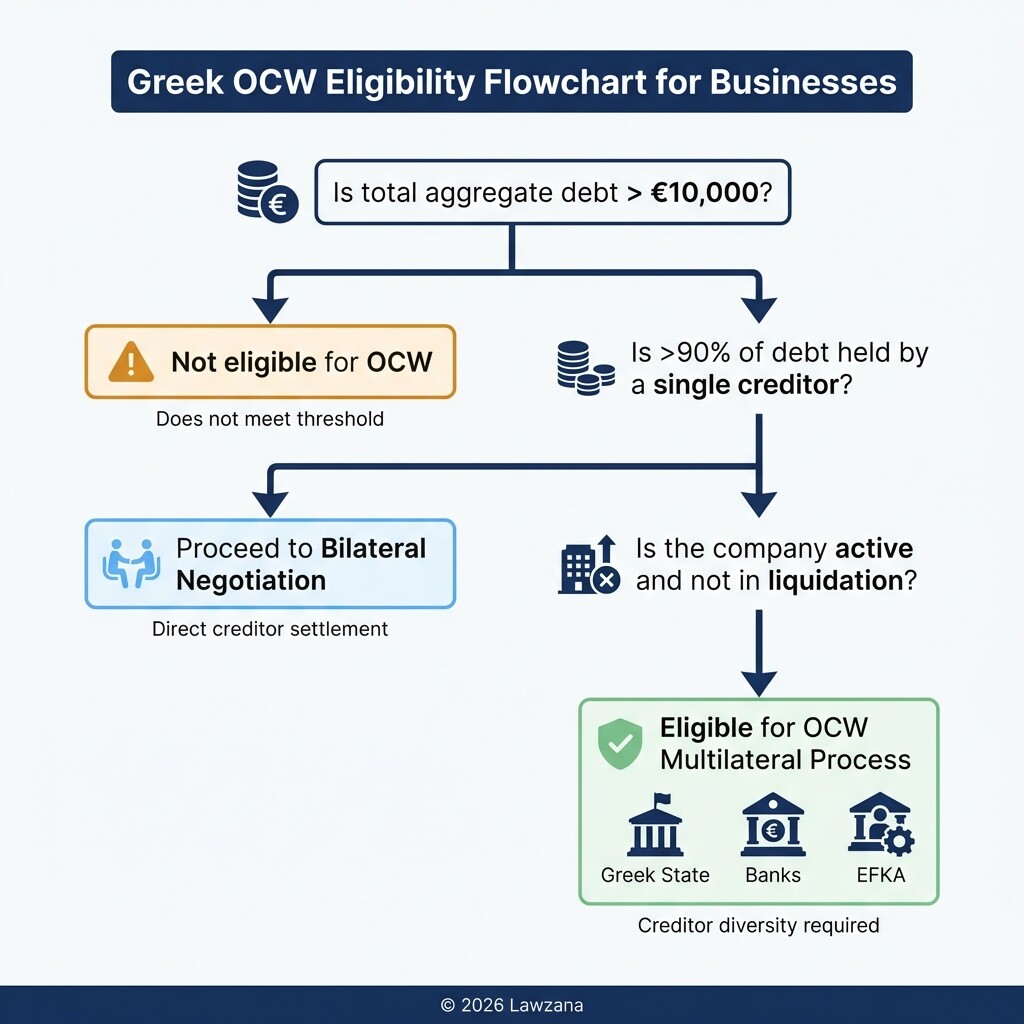

To be eligible for the OCW platform, a legal entity must have total debts exceeding €10,000 toward financial institutions, the Greek State, or Social Security Funds (EFKA). The business must not be in a state of liquidation or have a pending bankruptcy petition unless the OCW process is used as a means to reach a preventive restructuring agreement.

Eligibility is also restricted by the concentration of debt. If 90% or more of the total debt is held by a single financial institution, or if the total debt belongs to only one creditor, the multilateral OCW process is generally not applicable. In such cases, the debtor must pursue a bilateral negotiation. Additionally, the business must demonstrate that its financial situation has deteriorated, but it remains potentially viable if a restructuring is granted.

Eligibility Checklist for Legal Entities

- Debt Threshold: Minimum of €10,000 in total aggregate debt.

- Creditor Diversity: Debt must not be concentrated (90%+) with a single creditor.

- Legal Status: The company must be active and not already declared bankrupt.

- Compliance: All financial statements and tax records for the last five years must be uploaded or accessible via the platform.

How does the automated algorithm calculate debt haircuts and repayment installments?

The OCW platform utilizes a standardized mathematical algorithm to determine the "repayment capacity" of the debtor and the "liquidation value" of their assets. This algorithm compares what creditors would receive in a hypothetical bankruptcy auction versus what they can receive through a structured repayment plan, ensuring that the settlement is never less favorable to creditors than a forced liquidation.

If the debtor's total assets and projected income are insufficient to cover the full debt, the algorithm may propose a "haircut," which is the partial cancellation of the debt principal, interest, or penalties. For debts toward the State (Tax Office and EFKA), the plan can extend to 240 monthly installments. For debts toward banks and service providers, the term can reach up to 420 installments, depending on the age of the business owners and the nature of the collateral.

| Feature | State Debts (Tax/EFKA) | Financial Institutions (Banks/Funds) |

|---|---|---|

| Max Installments | 240 months | 420 months |

| Minimum Installment | €50 | €50 |

| Debt Haircut | Possible on surcharges/interest | Possible on principal and interest |

| Basis of Calculation | Disposable income & asset value | Asset value & future cash flows |

Does applying for the OCW stop enforcement and seizures?

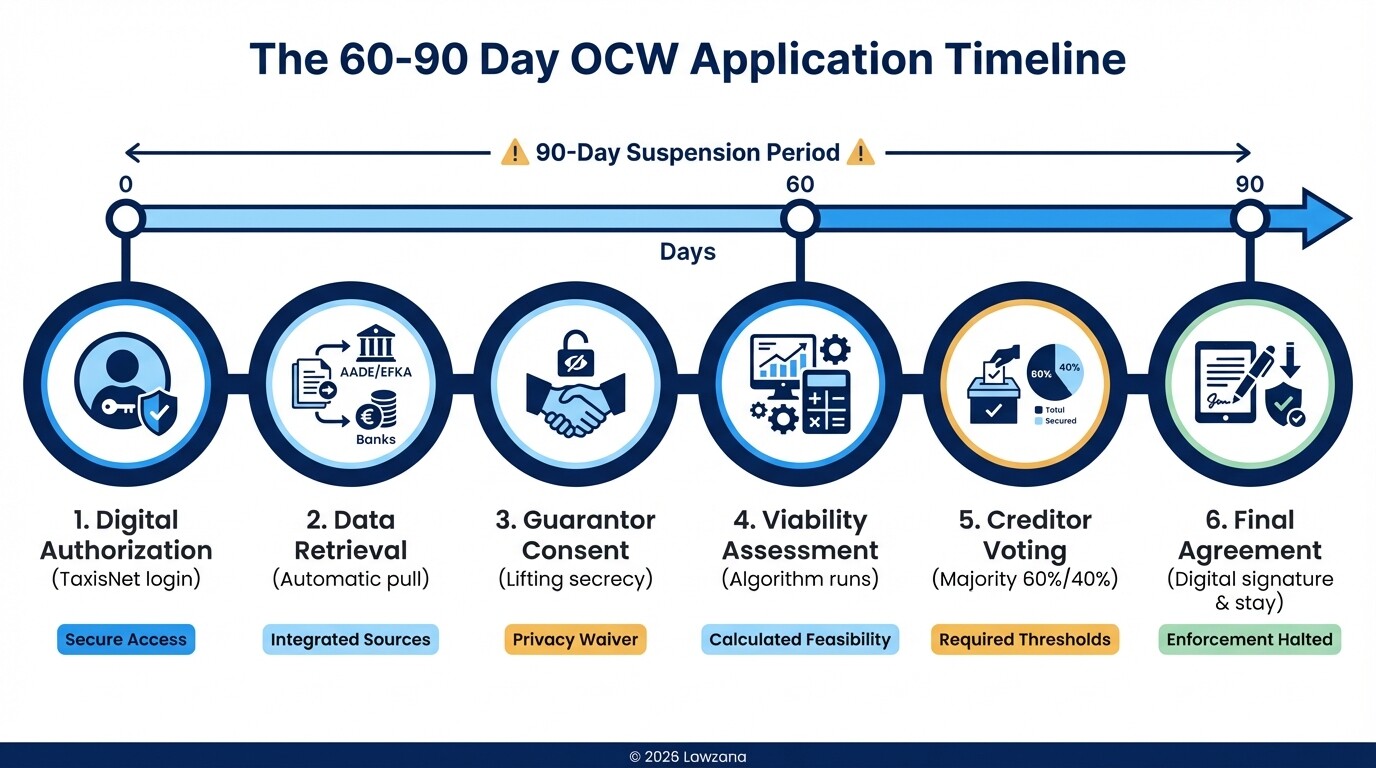

The submission of a completed application through the OCW platform triggers a mandatory suspension of all individual and collective enforcement measures against the debtor. This "standstill" period typically lasts for 90 days or until the procedure is finalized, providing the business with critical breathing room to negotiate without the threat of imminent bank account seizures or property auctions.

This suspension is not absolute and can be lifted if the application is rejected for bad faith or if the debtor fails to provide required documentation. It is important to note that the suspension only applies once the application is "finalized" in the system, meaning all co-debtors and guarantors have also provided their consent and data. If a business waits until a day before an auction to apply, the legal window to stop the sale becomes extremely narrow, making early application vital.

How does the multilateral agreement between creditors function?

The multilateral agreement is governed by a majority rule where a settlement proposal becomes binding if it is accepted by creditors representing at least 60% of the total debt, including 40% of those with special security (such as mortgages). Once this threshold is met, the minority of dissenting creditors is legally forced to accept the terms of the restructuring.

This "cram-down" mechanism is essential for complex business structures with multiple lenders. It prevents a single small creditor from blocking a rescue plan that the majority deems viable. The agreement is processed entirely through the Secretariat for Private Debt Management platform, and once the majority approves, the contract is digitally signed, and the new repayment schedule begins immediately.

What are the common pitfalls that lead to application rejection?

One of the most frequent reasons for rejection is the "Incompleteness of Data," where the debtor fails to disclose all secondary assets or fails to include information regarding a guarantor. The platform is linked to various Greek authorities (AADE, EFKA, Cadastre), and any discrepancy between the declared data and the official records can lead to an automatic disqualification for lack of transparency.

Another common pitfall is the failure to meet the "Viability Test" performed by the algorithm. If the algorithm determines that the business is fundamentally non-viable-meaning even with a maximum haircut and maximum installments, it cannot meet its obligations-the application will be rejected. In such cases, the business may be directed toward the "Second Chance" (Bankruptcy) framework instead of restructuring.

Top Reasons for OCW Rejection

- Unreported Assets: Omitting real estate or bank accounts held in Greece or abroad.

- Guarantor Refusal: If a guarantor refuses to join the application, the banks may reject the restructuring proposal.

- Strategic Default: If the creditors believe the debtor has the liquidity to pay but is choosing not to, the proposal will be declined.

- Timing Issues: Filing the application too close to an auction date without allowing the 90-day window to take effect.

Common Misconceptions about Greek OCW

"The debt haircut is guaranteed for everyone."

Many business owners believe that entering the platform automatically results in a 50% or higher debt reduction. In reality, the haircut is only granted if the debtor's liquidation value is lower than the total debt. If you have significant real estate equity, the algorithm will likely require you to pay the debt in full, albeit over a longer period.

"I can choose which debts to include in the settlement."

The OCW is an "all-in" mechanism. You cannot choose to settle your bank loans while ignoring your tax debts. To benefit from the legal protections and the automated proposal, all institutional debt must be disclosed and included in the multilateral negotiation.

Step-by-Step OCW Application Process

- Digital Authorization: Log in to the electronic platform using TaxisNet credentials.

- Data Retrieval: The system automatically pulls data from the Tax Office, Social Security, and Banks. You must manually add any missing data.

- Guarantor Consent: All guarantors must log in and consent to the lifting of their bank and tax secrecy.

- Viability Assessment: The algorithm analyzes the data and generates a restructuring proposal.

- Creditor Voting: Financial institutions and the State have a specific window to vote on the proposal.

- Final Agreement: If approved by the majority, the debtor signs the agreement digitally, and the stay on enforcement becomes permanent as long as payments are made.

FAQ

How much does it cost to apply for the OCW?

The platform itself is free to use. However, businesses should budget for professional fees for accountants and legal advisors to ensure the complex financial data and legal documentation are submitted correctly to avoid rejection.

How long does the entire process take?

By law, the process should be completed within two months from the final submission of the application. However, if there are issues with data verification, it can extend slightly beyond 90 days.

Can I apply if I have already lost a court case against a bank?

Yes. The OCW is designed to settle debts regardless of prior litigation, provided an auction has not already been concluded.

What happens if I miss a payment in the new plan?

If you miss more than three installments or the total amount of arrears exceeds three months of payments, the agreement is terminated. Creditors regain the right to pursue all original debts and resume enforcement measures.

When to Hire a Lawyer

While the OCW platform is digital, the stakes are exceptionally high for a business. You should consult a lawyer if:

- You have complex corporate structures with multiple subsidiaries.

- You are facing an imminent auction and need to ensure the "standstill" period is legally enforced.

- Your application was rejected, and you need to negotiate a bilateral agreement outside the platform.

- You need to verify that the "haircut" proposed by the algorithm is legally compliant and protects your remaining assets.

Next Steps

- Gather Documentation: Collect your most recent balance sheets, E1/E3 tax forms, and a list of all current creditors.

- Consult an Expert: Meet with a legal and financial advisor to run a "pre-check" on your viability and see if the OCW is the right path compared to other insolvency tools.

- Access the Platform: Visit the official Greek government portal to initiate the application process and check for any outstanding data requirements from the Secretariat for Private Debt Management.